- Search

- Top FAQs

-

I'm considering investing with InvestSMART

-

I'm Invested in a PMA

- Retirement FAQ

- Cashback FAQ

-

InvestSMART Fundlater

-

Bootcamp

-

Referral Program

-

Investment Process & Philosophy

- Portfolio Manager

-

Managing My Account Details

Can't find your answer? Use our chat function on the bottom right and one of our team will help you out.

Investing with Us

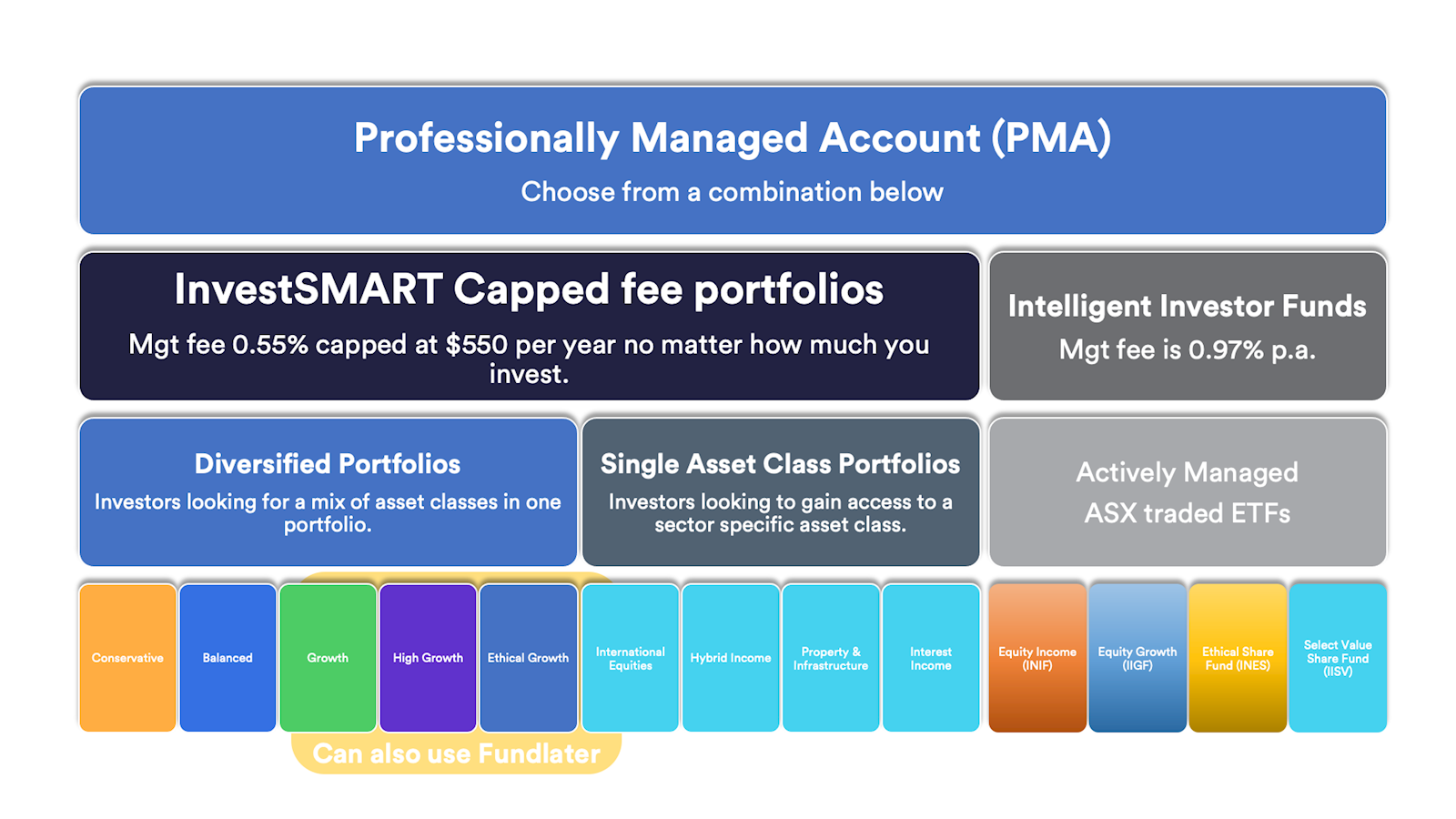

What is a Professionally Managed Account (PMA)?

Under our Professionally Managed Accounts, you will gain the following benefits:

1. Professionally managed investment portfolio: An investment portfolio managed by InvestSMART's investment team.

2. You own the securities: The investor holds legal ownership and the underlying securities are registered under your name.

3. Reporting: Complete end of year Accounting and tax reporting is provided on your investment.

4. Transparency: Investors are provided full visibility of all stocks held in your portfolio.

5. Tailored & Unique Portfolio: Under a PMA, we offer multiple model portfolios to choose from so that you can create a customised and diversified portfolio to suit your individual needs. Our model portfolios will differ in the levels of risk and return, and each model offers a different investment emphasis (such as Australian & international equities, property securities, international ETFs, etc).

6. Account Management: The paperwork and administration is taken care of, reducing the administrative burden on investors.

7. Tax effective: You only pay tax on gains & income you received.

8. Inflows & outflows: Your investment will not be impacted by the decisions of other model portfolio investors. An example of this is when a pooled investment like a managed fund receives redemption requests at the bottom of the market and is a forced seller at the worst time.

9. Flexibility with income/distributions: Choose to receive the dividends directly into an account of your choice or set up a regular payment or request drawdowns on an adhoc basis.

How long does it take for my cash to be invested?

Once the funds have cleared in the InvestSMART Applications Account they will be transferred over night into your investment account. Once settled in the investment account our team will buy the holdings in the model/s you have selected.

Investing in hybrids

Hybrid securities can be an attractive investment proposition, offering relatively stable income streams and lower levels of volatility when compared to equities. However, many hybrids are often more complicated than they seem and identifying which are appropriately priced is not always a simple task.

What are hybrids?

Hybrid securities are financial instruments that have both equity and debt features, and have been a key part of the Australian stock market retail product offering for many years.

The term ‘hybrids’ effectively covers any interest-bearing security that has both debt-like and equity-like features embedded in it. Some hybrids (like those issued by the banks) take this dual nature all the way to the possibility of conversion into the ordinary shares: others (like some corporate hybrids) only have equity-style features, such as the ability to defer interest payments without triggering a default.

Repayment of the investor’s principal can be in the form of cash or ordinary shares of the issuer. Although they are part of the Australian Securities Exchange’s (ASX’s) listed interest-bearing security – or listed credit – sector, the hybrids are a discrete group of investments because of their equity-like features.

Hybrid securities’ distributions (or dividends) can be franked or unfranked. They are typically unsecured, ranking just above ordinary equity. Hybrids are technically perpetual securities, meaning that they may never be redeemed, and an investor may never have their invested capital returned.

Key Features of Hybrids

When a hybrid is issued, investors know the following:

- the face value – the price at which the security is issued and the amount the investor will receive at maturity/redemption by the issuer;

- the coupon – the distribution/dividend return investors receive each year for holding the security, paid either quarterly or semi-annually;

- the maturity/redemption date – the date at which holders will be repaid the face value of the security in cash; and

- the conversion date – the date when a preference share or other convertible security will convert into ordinary shares in the issuer (assuming the required conversion conditions are met).

Why invest in hybrids?

For investors, hybrids promise regular interest payments at rates usually several percentage points higher than those paid on bank term deposits or ‘vanilla’ corporate bonds; while the potential equity convertibility is a more conservative way of holding exposure to a company.

What is the InvestSMART Hybrid Income Portfolio?

The InvestSMART Hybrid Income Portfolio is a professionally managed portfolio that gives you access to a hand-picked selection of 5 to 15 hybrids to diversify your income stream, with the added benefit of minimised portfolio risk.

Our Hybrid Income Portfolio has been designed to deliver a regular income stream with lower levels of volatility.

The Portfolio’s objective is to to achieve a return of 3% (including franking credits) above the RBA Cash rate per annum over three year rolling periods.

The main benefits of the InvestSMART Hybrid Income Portfolio include:

- Lower risk than ordinary shares and a higher return than cash and cash like investments

- Diversification across 5 – 15 securities to minimise portfolio risk

- Professionally managed by our investment team, with active monitoring and rebalancing

- Low trading costs for rebalances (<0.05%)

More information on investing in hybrids:

InvestSMART Hybrid Income Portfolio

Launching InvestSMART's Hybrid Income

Investing in Hybrids for Income

An investor's guide to hybrid securities

What are InvestSMART's investing principles?

Diversification

We recognise that over the long term not one asset class is guaranteed to deliver substantial outperformance on a consistent basis and that attempting to time the turning points across the various asset classes is near impossible.

Lower Fees

Compounded over time, even a small difference in fees can result in substantial differences to your return and a higher management fee is no guarantee of better performance.

Transparency

We believe in absolute transparency. This directly impacts how we manage conflicts and report our performance. We take disclosure, conflicts and transparency extremely seriously.

Am I guaranteed returns?

All forms of investing, regardless of what you are investing in, carry some kind of risk. These risks relate to factors outside of our control and include, but not limited to, market conditions. Using past performance is also not a reliable indicator of future performance. As such, InvestSMART does not guarantee returns on our investment products. If you are looking to make an investment, we strongly advise you to consider whether or not this investment is suitable for your circumstances and is in keeping with your investment goals.

What is the Standard Risk Measure?

The Standard Risk Measure (SRM) is a guide developed by the Financial Services Council (FSC) and The Association of Superannuation Funds of Australia (ASFA) that outlines the likely number of negative annual returns expected over any 20 year period.

The purpose of the SRM is to provide a standardised labelling system to assist investors in comparing investment options across providers, as shown below in Figure 1, FSC/ASFA Standard Risk Measure Classifications.

| Risk Label | Estimated number of negative annual returns over any 20 year period |

|---|---|

| Very Low | Less than 0.5 |

| Low | 0.5 to less than 1 |

| Low to Medium | 1 to less than 2 |

| Medium | 2 to less than 3 |

| Medium to High | 3 to less than 4 |

| High | 4 to less than 6 |

| Very High | 6 or greater |

Source: FSC/ASFA Standard Risk Measure Guidance Paper for Trustees, July 2011

It should be noted, however, that the SRM is not a complete assessment of all forms of investment risk. For instance, it does not detail what the size of a negative return could be or the potential for a positive return to be less than a member may require to meet their objectives. As such, it should be used as a guide and as with any investment, investors should ensure they are comfortable with the risks and potential losses associated with their chosen investment option(s). Any information should be considered general in nature and before making any investment decisions, please ensure that you read all relevant disclosure documents related to that product.

How do I know which Portfolio is suitable for me?

When considering an investment, core to your decision-making process should be your investment objective, time horizon and risk tolerance.

We have created an online statement of advice quiz to assist you in selecting the best portfolio for your needs.

How do I see my portfolio?

You can view and manage your InvestSMART PMA online.

If you are already invested, visit the Dashboard section of the website.

Find out more in the Help Centre.

What do the portfolios invest in?

The InvestSMART Capped Fee Diversified Portfolio range invests in exchange traded funds (ETFs) across a range of different asset classes including Australian shares, international shares, cash, fixed interest, property and infrastructure.

Depending on the goal of the portfolio it will hold a mixture of ETFs, each weighted depending on the risk profile of the portfolio.

InvestSMART's core belief is to focus on what you can control. Investors can control the diversification of their portfolio and the fees they pay but they cannot control the movements of investment markets.

By focusing on keeping investment costs to a minimum and diversification in line with your investment goal and timeframe the InvestSMART Diversified Portfolios help investors reach their investment goals sooner.

What is a Professionally Managed Account?

The InvestSMART Professionally Managed Account (PMA) is established and offered within the registered managed investment scheme known as the Professionally Managed Accounts.

Each investor has a separate account to which their investments are allocated. You will require a different PMA for each investment entity you have e.g. individual, joint, SMSF etc.

A client will open an InvestSMART PMA and can then choose between the various InvestSMART Diversified Portfolios. An account can hold one or more models but can only hold one diversified portfolio. The management fee is charged at the account level, not per portfolio.

Once you decide which model portfolio(s) are best suited to your investment needs and objectives, we will purchase the investment to be included in your account to reflect the model portfolio or combination of model portfolios that you have selected.

Investing in small companies

What are small companies?

The definition of what constitutes a “small company” differs within the industry, but in general terms, they are companies with a market value between $300 million and $2 billion.

Why invest in small companies?

Small caps offer an interesting opportunity in the market due to the lack of analyst coverage, subsequent potential for mispricing and long-term growth prospects.

What is the Intelligent Investor Australian Small Companies Fund?

Using Intelligent Investor’s value-based investing philosophy, the Australian Small Companies Fund is a managed fund that seeks to deliver moderate to high total portfolio returns over the long term across 10-25 listed small companies, often overlooked by the broader market. These are companies smaller than the largest in the Small Ordinaries Index (curr A2 Milk, worth $3.2B).

The ‘Small Ords’ are the smallest 300 companies in the All Ords index (e.g. company 201-500).

The fund is managed by our equities team at Intelligent Investor, and will use the same long-term, value investing philosophy that has provided the team's track performance to date.

The main benefits of the Intelligent Investor Australian Small Companies Fund include:

- Good potential for generating capital growth

- Lower fee structure than most fund managers

- Benefit from a unique opportunity - less liquidity means larger funds struggle to invest in small companies.

- Good potential for above average returns from active management by the experience team at Intelligent Investor

- Limited contributions to ensure that performance is not impacted by the size of the fund, and to maximise the possibility of delivering a better return.

More information on investing in small companies:

- Our Australian Small Companies Fund page

- Highlights from our webinar, 'investing in small companies'

- 'The rewards of small cap investing' article

- 'Top 5 small caps for 2017' article

Can I set up a regular contribution plan or easily add to my portfolio when I want?

Yes you can. You are able to set up a regular contribution plan or add funds at any point for your InvestSMART PMA.

When setting up your account you can elect to have a monthly direct debit from your bank account into your InvestSMART PMA. The minimum monthly direct debit amount is $100.

If you are already invested click on Investment Preferences to set up or amend the regular contribution plan in the Quick Links section or the My Account section when you are logged in.

To add funds whenever you wish click on the Add Funds link in the Quick Links section or in My Account.

Can I switch between investment models & can I hold more than one?

Yes, you can easily switch between investment models and yes you can hold more than one investment model in the same account however you can only hold one diversified portfolio per account. If you wish to invest in multiple diversified portfolios you will need to hold multiple accounts.

To switch between investment models simply click on Modify Allocations via the Quick Links section or within My Account. There are no administration fees for changing between models. The only costs associated would be the brokerage charges for selling and buying the new holdings.

Do I own the shares/ETFs?

Yes. Investors have legal ownership of the shares and they are held on a HIN (Holder Identification Number) registered with CHESS in the investors name.

Should you wish to withdraw your investment with InvestSMART you can transfer your shares out to a brokerage account of your choice.

Find out more in the Help Centre.

Do I receive dividends and where do they go?

Yes, your InvestSMART PMA will receive dividends from the holdings. InvestSMART does not participate in dividend reinvestment plans. As the dividends from your holdings are paid they will go into the cash component of your account. You will see these via the Dividends & Interest tab and Deposits & Withdrawals tab within the My Account or quick links section.

Clients can elect to have the dividends paid out in a monthly income sweep. At the end of each month all dividends and interest received by your account will be tallied and paid out to the bank account you nominated in your application form.

If you do not have an income sweep in place the dividends will remain as cash and invested when your portfolios cash percentage exceeds the investment models.

If I need to withdraw funds how long will it take?

This depends on cash available in your account. If shares need to be sold down you will need to allow time for settlement (transaction day plus two days). After this the requested amount will be transferred to your nominated bank account. Depending who you bank with you will need to allow a further one to two business days.

Can I set up a regular contribution plan?

Yes, when setting up an investment or at any point during your investment you are able to set up a direct debit regular contribution plan for a minimum of $100 per month. This can be altered at any point. Existing investors can access and edit their Regular Contribution Plan under the Investment Preferences area of their online account.

When is my regular contribution deducted from my bank account?

The direct debit will take place on the 15th of each month or the closest following business day. If you have insufficient funds our administration team will contact you to help facilitate the transfer at another date or you can just skip the payment for the month.

How can I add to my portfolio?

There are three ways you can add funds to your portfolio:

- One off contribution: Simply use the BPAY biller code and reference number you used to fund your investment

- One off contribution with investment model allocation: If you have more than one investment model and would like to specify how the additional funds are split or would like to add a different model all together with the new funds you will need to use the Add Funds feature in your online account.

- Set up a regular contribution plan: When you establish your account you can nominate a set amount to be drawn from your bank account into the portfolio each month. This takes place on the 15th of the month (or closest following business day). The minimum amount is $100. If you already have a portfolio set up you can start a regular contribution plan by updating your preferences in the Investment Preferences section of your online account.

Do I receive franking credits and do I get a tax statement?

Yes. You will receive a comprehensive tax statement at the end of financial year and you will receive the franking you're entitled to once you submit your tax return.

Why does my portfolio not have exactly the same weightings as the model?

You may notice your portfolio will not hold the stocks to the exact same weight as the model. Holdings may be marginally out for example a stock may be 4.2% rather than 4.6%. This is due to the practicality of buying a stock. We cannot buy a fraction of a stock and depending on the dollar size of your portfolio this could lead to it not being 100% on the model.

What are the requirements for non-Australian Residents?

To invest in any of our InvestSMART products, you are required to have a bank account domiciled in Australia, in the name of the entity you wish to invest through e.g individual name or company name. If you reside overseas, there are AML/CTF requirements that will have to be met and we will be more than happy to help you through the process. If you leave Australia, you can keep your investments active as long as you keep your Australian bank account remains open.

What are the fees?

We know even the smallest difference in fees can result in substantial differences to your return. Through ongoing technology advances, our goal is to continue to reduce the cost of investing.

On launching our Professionally Managed Account (PMA) service, we have reduced our investment fees and updated our investment fee structure*.

To better diversify your portfolio or get you on the path to building your first investment portfolio, we offer the choice of the following investment strategies - Active Asset Allocation & Active Stock Selection range.

Investment Fees - Active Asset Allocation range

Professionally managed by our Portfolio Manager, our Active Asset Allocation Portfolio objective is to provide investors returns in line with the benchmark minus our fees by investing in blend of our preferred Exchange Traded Funds (ETFs).

| Investment Amount | Fees* |

|---|---|

| $0 - $100000 | 0.55% p.a. |

| From $100,000 | $550 p.a. capped |

Brokerage: The greater of $4.40 per trade or 0.088% of the value of the trade

Indirect Cost: Between 0.18 - 0.31% p.a. depending on model portfolio selected (this is a cost associated with ETF providers and not marked up by InvestSMART).

Our capped fee structure is across our InvestSMART Portfolios (no matter if you invest in one or several models and applies to the following Models:

Do you charge performance fees?

If you invest in a Professionally Managed Account (PMA), there are no performance fees charged.

Do you charge exit fees or establishment fees?

No. The only expense is the brokerage costs when we purchase or when we sell down the portfolio.

Do you charge brokerage?

Yes, only on the sell side. The cost of brokerage is the greater of $4.40 per trade or 0.088% of the value of the transaction value.

Related topics

What is an Exchange Traded Fund?

An Exchange Traded Fund, or ETF, is a type of managed fund where the underlying securities comprising this fund mimic an Index. Indices are created by ratings agencies to represent a subset of the stock market e.g. the largest companies trading on the Australian Stock Exchange is represented by the All Ordinaries Index. An ETF aims to invest directly in those companies making up a particular Index. As the companies/stocks/securities have already been determined in the Index an ETF is aiming to replicate, the level of funds management required is minimal compared to other types of managed funds where active investment decisions are required. Investing in ETFs are a form of passive investing and generally incur cheaper management fees, as fewer investment decisions are required in terms of managing an ETF.

How can I invest in Exchange Traded Funds through InvestSMART Group?

We offer Professionally Managed Accounts (PMAs) through InvestSMART Group which are portfolios of securities that are managed professionally and cater for a number of investment objectives. These portfolios can comprise of ETFs or direct shares. We recommend that you understand your financial objectives and investment timeframe before committing to an investment. Further information may obtained through our website and we also urge to read all disclosure documents in relation to the PMAs.

Is my investment safe? What would happen to my investments if InvestSMART went bankrupt?

Your shares will be held in your name in a CHESS sponsored broking account, therefore, in the event where we could not manage your shares anymore, you would continue to hold your shares in your name.

Why isn't the Intelligent Investor Australian Small Companies Fund listed on an exchange?

The underlying securities of the fund are small companies which may be too illiquid to invest in through an exchange on a frequent basis.

Can I do an in-specie transfer?

Yes. Any existing holdings of CHESS eligible Australian securities or other Eligible Investments may be transferred into your Account. Any investments being transferred into your Account must be in the same name that you are applying for an Account under. Eligible investments transferred into the PMA will be sold if they do not form part of the selected Model Portfolio(s).