Your guide to next steps

Dealing with a struggling fund? What to Do and Look For

We’re here to help you achieve your financial goals

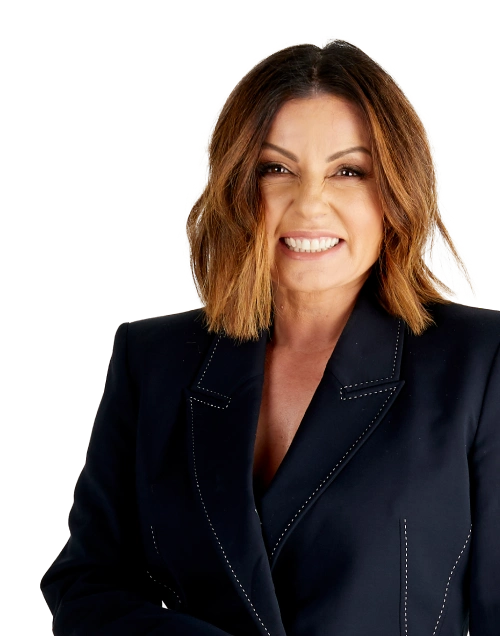

Effie Zahos

Effie is one of Australia’s leading personal finance commentators with more than two decades of experience helping Australians make the most of their money. A regular money expert on Channel 9’s Today Show and on radio around Australia, Effie is also the author of The Great $20 Adventure and A Real Girl’s Guide to Money and Ditch the Debt and Get Rich.

Wealth creator

Entrepreneur

Money expert

Paul Clitheroe, AM

Paul has 37 years of investment experience and is regarded one of Australia's leading "money" experts. From 1993 to 2002, Paul hosted the popular Channel 9 program Money and now currently writes for newspapers across Australia, is a frequent guest expert on Australia's major television networks and radio.

Paul is Chairman of The Australian Government Financial Literacy Board and Money Magazine. He also holds the Chair of Financial Literacy at Macquarie University.

Chairman

Alan Kohler, AM

Alan has been covering business and markets as a financial journalist for 48 years, including two stints as the Financial Review’s Chanticleer columnist and periods as editor of The Age and the AFR. He also started Eureka Report in 2005 and Business Spectator in 2007.

As well as being Editor-in-Chief of InvestSMART Group, Alan is currently finance presenter on ABC News, Business Editor at Large of The Australian, presenter of the Talking Business channel on Qantas radio and an adjunct professor in the business faculty at Victoria University.

Founder-Eureka Report

Disclaimer

Analysis based on data sourced from Morningstar, as at June 2023. Funds that had a 10-year track record were analysed against the standard industry benchmarks. Whilst InvestSMART has taken care in producing these numbers, guarantees cannot be made around the complete accuracy of these figures.

Disclaimer

Unique to InvestSMART, our management fees start from $44 p.a. and are capped at $880 p.a. for investments over $200,000. This does not include the admin fee (0.11%) nor the fees charged indirectly by the underlying holdings. For more information about fees and costs, please see the Product Disclosure Statement or click here.

Please check the following:

×

{{ successMessage }}

FREE membership

FREE membership

Join InvestSMART today

{{ twilioFailed ? 'SMS Code Failed to Send…' : 'Enter verification code' }}

Please enter the 5 digit verification code sent to "{{user.DayPhone}}" Change number

We cannot send you a verification code via SMS to "{{user.DayPhone}}" Change number

{{ completedStep1 ? 'Start your free 15 day trial now' : content.trialHeading.replace('{0}', user.FirstName) }}

Please enter your mobile number and press send to receive a text message with a verification code.

{{ content.upgradeHeading.replace('{0}', user.FirstName) }}

The email address you entered is registered with InvestSMART

Please login to continue

Thank you

We have sent you an email with the details of your registration.

Purchase order

Sign up

OR

Sign up with

Login with

By continuing, you agree to our

Log in

Your account has been locked.

Please contact our {{ isPMAUser ? 'Portfolio Services' : 'Customer Service' }} Team:

- Call 1300 880 160

Looks you are already a member. Please enter your password to proceed

OR

Sign up with

Login with

By continuing, you agree to our

{{ upgradeCTAText }}

Updating information

Please wait ...

Your membership to InvestSMART Group recently failed to renew.

Please make sure your payment details are up to date to continue your membership.

Having trouble renewing?

Please contact Member Services on support@investsmart.com.au or 1300 880 160

You've recently updated your payment details.

It may take a few minutes to update your subscription details, during this time you will not be able to view locked content.

If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in.

Still having trouble viewing content?

Please contact Member Services on support@investsmart.com.au or 1300 880 160

Please click on the ACTIVATE button to activate your Intelligent Investor 15-day free trial

Please click on the ACTIVATE button to finalise your membership

Log in

Your account has been locked.

Please contact our {{ isPMAUser ? 'Portfolio Services' : 'Customer Service' }} Team:

- Call 1300 880 160

OR

Sign up with

Login with

By continuing, you agree to our

Upgrade Today

Compare our membership packages.

Unsuccessful registration

Registration for this event is available only to Eureka Report members. View our membership page for more information.

Registration for this event is available only to Intelligent Investor members. View our membership page for more information.

{{eventFunction.Name}}

{{eventFunction.EventTypeName}}

{{eventFunction.StartDate}}

{{eventFunction.EventTimings}}

{{eventFunction.VenueName}}

{{ t.Cost === 0 ? "FREE" : "$" + t.Cost.toFixed(2) }}

Quantity *

- You are already registered for this event.

- This event is already full.

- Please select a quantity for at least one ticket.

- {{ i }}

Forgotten password

Please enter your email address below to request a new password

Check your inbox

- Verify your email address by clicking on the link we sent to {{user.Email}}

- You now have free access, we look forward to helping you on your financial journey.

Proudly

We're here to help