- Search

- Top FAQs

-

I'm considering investing with InvestSMART

-

I'm Invested in a PMA

- Retirement FAQ

- Cashback FAQ

-

InvestSMART Fundlater

-

Bootcamp

-

Referral Program

-

Investment Process & Philosophy

- Portfolio Manager

-

Managing My Account Details

Can't find your answer? Use our chat function on the bottom right and one of our team will help you out.

Can you provide advice on...

What portfolio should I invest in?

We can't tell you what portfolio to choose as we can provide general financial product advice only about the products that InvestSMART offers.

We cannot provide any personal financial advice and you should consider your own financial objectives, financial situation and needs before making an investment decision and submitting an application.

We have a number of tools you can use at InvestSMART including the Portfolio Manager and online calculators.

You will notice a common thread throughout the guides, the investment time-frame. We recommend investors look at the suggested time-frame associated with each portfolio to see if it aligns with their investment goal.

Here is a list of tools and guides to help select the right portfolio:

- InvestSMART's statement of advice

- InvestSMART's guide to growing your wealth

- InvestSMART's guide to investing in retirement

- InvestSMART's investor pack

- Wealth savings calculator

- Saving to buy a property calculator

- Saving for kids education calculator

- Saving for retirement calculator

- Target Market Determination for the InvestSMART Professionally Managed Accounts

Additionally, we have InvestSMART Bootcamp which is a comprehenisve investment course designed to get you started on the right foot. Click here for further details.

How does InvestSMART handle market volatility?

We understand it will happen, but it’s unpleasant when it does. So, here’s what to do when your account balance goes the wrong way.

Volatility

The securities markets are often associated with big swings in prices. For example, when the stock market rises and falls more than one per cent over a sustained period, it is called a “volatile” market. See Nuts and Bolts: What is Volatility.

Reasons behind volatility will vary, and seeing headlines detailing consecutive down days in markets and then seeing the flow-on effect on your investment portfolio tends to induce concern.

We invest knowing down days will occur, and it’s how we react to them that will determine your long-term investment success. Here’s how you and InvestSMART help to manage volatile times and keep your investments on track:

- Diversification is the key to lowering volatility over time. InvestSMART rebalances your portfolio from time to time, ensuring your portfolio maintains a blend of assets in line with the mandate of each portfolio. In short, we make sure a balanced portfolio remains balanced. It gives you confidence your portfolio blend and risk is in line with your expectations.

- Make sure your investment portfolio is in line with your investment time horizon. The length of the timeframe directly correlates to the breakdown of growth and defensive assets each portfolio invests in. The longer the timeframe, the higher the growth assets and the greater the volatility. That timeframe allows for market downturns and provides time to recover. InvestSMART makes this easy for investors by clearly indicating the recommended timeframe for each portfolio.

- What you can do to help. Focus on your timeframe. You know downturns happen. It’s par for the course when it comes to investing. Stick to your timeframe, continue your regular contributions and add more funds if you can.

I’d recommend this excellent piece by my colleague John Addis on How to Worry Better for further reading.

Finally, we’re here to help. Use the chat function, email or call on 1300 880 160. We cannot provide personal/specific advice, but we can talk about investing generally and account management.

How much should I contribute?

We can't tell you how much to contribute as we can provide general financial product advice only about the products that InvestSMART offers.

We cannot provide any personal financial advice and you should consider your own financial objectives, financial situation and needs before making an investment decision and submitting an application.

We have a number of tools you can use at InvestSMART including the Portfolio Manager and online calculators.

These links will take you to our various calculators:

Does InvestSMART provide personal advice?

No, InvestSMART does not provide personal financial advice. We can provide general financial product advice only about the products that InvestSMART offers.

We cannot provide any personal financial advice, and you should consider your own financial objectives, financial situation and needs before making an investment decision and submitting an application.

InvestSMART offers several tools that can help you learn and understand investing. These include:

| Name | Description | Link |

|---|---|---|

| Bootcamp | An online course that teaches you how to invest in shares, property, fixed interest, and cash. | Visit here |

| Portfolio Manager | A tool that helps you create, manage, and track your investment portfolio. | Visit here |

| SOA | A Statement of Advice (SOA) is a document that outlines your financial situation, goals, and recommendations for investing. | Visit here |

| Calculators - Savings Calculator | InvestSMART provides several calculators that can help you plan your investments. This calculator helps you calculate how much money you will save over time. | Visit here |

| Kids Education Planning | InvestSMART offers a tool that helps you plan for your child's education expenses. | Visit here |

| Wealth Planning | InvestSMART offers a tool that helps you plan your wealth management strategy. | Visit here |

| Retirement Planning | InvestSMART offers a tool that helps you plan for retirement. | Visit here |

How can InvestSMART portfolios help with income and retirement?

InvestSMART cannot provide personal or specific financial advice.

Here is a list of tools and guides on InvestSMART which may assist:

Interactive online tools

- InvestSMART's statement of advice

- Our Statement of Advice will provide you with an Investment Plan detailing a number of steps for you to implement in stages to achieve your financial goal.

- Wealth savings calculator

- We have created a great way to help you achieve your goal by developing a calculator that shows you how much you need to invest and the monthly contributions needed to reach your goal.

- Saving for retirement calculator

- We have created a great way to help you achieve your goal by developing a calculator that shows you how much you need to invest and the monthly contributions needed to reach your goal.

PDFs for further reading

- Guide to investing in retirement

- How InvestSMART can help you secure your wealth.

- Growing your wealth

- How InvestSMART can help you to build long-term wealth.

- Investor guide

What is the Difference Between General Product Advice and Personal Financial Advice?

When it comes to seeking financial advice in Australia, it's important to differentiate between general product advice and personal financial advice. As a new investor, understanding these terms will help you navigate the financial services landscape and ensure you receive the appropriate guidance.

General Product Advice

General product advice refers to information about financial products or strategies that is not tailored to an individual's specific circumstances. This type of advice is often provided by financial professionals, including investment companies like InvestSMART, to educate clients about various investment options, their potential benefits, and associated risks. It is important to note that general advice does not take into account your personal financial situation, goals, or needs.

Examples of general product advice include:

Requesting product information: "What are the key features and benefits of this particular managed portfolio?"

Comparing investment options: "How do index funds compare to actively managed funds in terms of fees, historical performance, and potential risks?"

Seeking clarification on investment terms: "What is the difference between a growth and an income-focused investment strategy?"

Requesting market insights: "What are the current trends in the Australian share market, and how might they affect investment opportunities?"

Asking about regulatory considerations: "What are the general tax implications of investing in a particular type of financial product?"

Personal Financial Advice

In contrast, personal financial advice is customised to suit your unique circumstances, factoring in your financial situation, objectives, and risk tolerance. This type of advice takes into account elements such as your income, expenses, assets, liabilities, and investment goals to offer tailored recommendations that can assist you in reaching your financial targets. Personal financial advice typically involves spending time with a financial adviser to gain a comprehensive understanding of your individual situation. Owing to the time invested, financial advisers are remunerated by charging fees for their expert guidance.

Examples of personal financial advice include:

Seeking specific recommendations: "Which investment product would be best for me to achieve my goal of buying a house in 10 years?"

Requesting advice on asset allocation: "How should I distribute my investment funds across different asset classes to ensure a comfortable retirement?"

Asking for guidance on tax implications: "What investment options should I consider to minimise my tax liability?"

Inquiring about debt repayment strategies: "Which of my loans should I prioritise for repayment, given my current financial situation?"

Asking for risk management guidance: "How can I best manage the risks in my investment portfolio to protect my family's financial future?"

Due to regulatory restrictions in the Australian financial services industry, investment companies like InvestSMART can only provide general product advice. We cannot offer personal financial advice or specific recommendations based on your unique situation.

If you require personal financial advice, it is recommended that you consult a qualified financial adviser who can assess your individual needs and provide tailored guidance to help you make informed decisions about your investments.

To find a qualified financial adviser in Australia, you can visit the following websites:

ASIC's MoneySmart website (https://www.moneysmart.gov.au/investing/financial-advice)

The Financial Planning Association of Australia (FPA) (https://fpa.com.au/)

The Association of Financial Advisers (AFA) (https://www.afa.asn.au/)

These websites offer tools to help you locate qualified financial advisers in your area. Before engaging a financial adviser, ensure they hold an Australian Financial Services (AFS) Licence or are an authorised representative of a licenced financial services provider.

In conclusion, understanding the difference between general product advice and personal financial advice is crucial for new investors in Australia. While we can provide you with valuable information about various investment products and strategies, it is essential to seek personalised advice from a qualified professional to ensure your financial decisions align with your specific circumstances and goals.

How can InvestSMART portfolios help to grow my wealth?

Please see this information here.

What's the difference between Intelligent Investor Ethical Share Fund (INES) and InvestSMART Ethical Growth Portfolio?

Intelligent Investor Ethical Share Fund (INES)

INES is a managed fund listed on the ASX. This managed fund follows the Intelligent Investor analyst team's research to invest in a portfolio of 20 - 30 ASX-listed companies using an ESG filter. The fund only invests in ASX-listed companies and holds cash. To invest, you will use the code INES to purchase units via your brokerage account, through an InvestSMART PMA, or during secondary offer periods.

InvestSMART Ethical Growth Portfolio

Ethical Growth is a managed portfolio offered via InvestSMART's Professionally Managed Account (PMA) service. As the PMA is a managed account, investors own the direct investments which make up the investment portfolio. The InvestSMART Ethical Growth Portfolio holds exchange-traded funds (ETFs) with an ESG overlay. These ETFs range across multiple asset classes, e.g. Australian shares, international shares, cash etc.

Here are some key differences:

|

|

InvestSMART Ethical Growth Portfolio |

Intelligent Investor Ethical Share Fund (INES) |

|---|---|---|

|

Investing Strategy |

Passive |

Active |

|

Are the management fees capped? |

Yes (see Capped Fees) |

|

|

How do you invest in this? |

You can only invest through a PMA online. |

You can buy through your share broker on the ASX (INES) or invest through a PMA. |

|

Is there a minimum investment amount? |

From $500 with your share broker. |

|

|

Diversified? |

Yes |

Only Australian Equities |

| Can be used with Fundlater? | Yes | No |

|

More information |

See Product Page |

See Product Page |

What's the difference between the InvestSMART Growth and Intelligent Investor Growth Fund (IIGF)?

Are the InvestSMART Growth and Intelligent Investor Growth the same?

Although the InvestSMART Growth portfolio and Intelligent Investor Equity Growth Fund might sound similar, they are two different investments.

Here are some key differences:

|

| InvestSMART Growth portfolio | Intelligent Investor Equity Growth Fund |

|---|---|---|

| Investing Strategy | Passive | Active |

| Are the management fees capped? | Yes (see Capped Fees) | |

| How do you invest in this? | You can only invest through a PMA online. | You can buy through your share broker on the ASX (IIGF) or invest through a PMA. |

| Is there a minimum investment amount? | From $500 with your share broker. | |

| Diversified? | Yes | Only Australian Equities |

| Can be used with Fundlater? | Yes | No |

| More information | See Product Page | See Product Page |

Understanding the Reasons for Significant Allocation to Australian Equities in InvestSMART's Diversified Portfolios

For InvestSMART's capped-fee diversified portfolios, we endeavour to create portfolios that accurately reflect the risk profiles that investors seek by diversifying across various asset classes. These portfolios range from Conservative, Balanced, Growth, Ethical Growth, to High Growth, with each portfolio designed to achieve the optimal balance between risk and return for its clients. It might seem counterintuitive for InvestSMART to allocate a significant portion of the portfolio to Australian equities; however, there are several justifications for this decision:

Home bias

Home bias is a tendency for investors to prefer investing in domestic assets, as they may have better familiarity and understanding of the local market. This home bias is not unique to Australian investors; it is a phenomenon observed across many countries. By having a significant allocation to Australian equities, InvestSMART caters to its client base's preferences.

Tax benefits

Australian investors may benefit from favourable tax treatments for investing in domestic equities. The dividend imputation system, for example, allows Australian shareholders to receive tax credits on dividends, effectively reducing the tax burden on these investments. These tax benefits can make Australian equities more attractive compared to international equities, leading to a more significant allocation in the portfolio.

Currency risk

By investing in domestic assets, investors can mitigate the currency risk associated with international investments. Fluctuations in exchange rates can impact the returns on international assets. By having a significant portion of the portfolio in Australian equities, InvestSMART helps its clients manage this risk.

Diversification within Australian equities

The Australian stock market encompasses many companies operating across diverse sectors, including finance, resources, and healthcare. Investing in a broad array of Australian equities, such as the entire ASX200 Index through an ETF like ASX: IOZ, InvestSMART can attain a considerable degree of diversification within this asset class. Consequently, this approach helps safeguard the portfolio against sector-specific risks.

A broad range of investment portfolios

InvestSMART acknowledges that clients have varying investment goals, timeframes, and risk profiles. To accommodate these diverse requirements, the firm provides an array of investment portfolios and strategies for clients to choose from based on their own understanding of their preferences and needs. InvestSMART does not offer personalised financial advice but empowers clients with a selection of investment options, allowing them to make informed decisions on which portfolio best aligns with their circumstances. This approach ensures that InvestSMART caters to a wide variety of client requirements without providing tailored financial advice.

In summary

While it might seem unusual for InvestSMART to have a significant allocation to Australian equities within their diversified investment portfolios, there are valid reasons for this decision. These include home bias, tax benefits, currency risk management, diversification within the asset class, and an extensive range of investment portfolios. However, it is essential for investors to understand their own risk tolerance and investment objectives and to carefully consider their options when selecting a portfolio to ensure appropriate diversification.

Related topics

Do I receive franking credits and do I get a tax statement?

Yes. You will receive a comprehensive tax statement at the end of financial year and you will receive the franking you're entitled to once you submit your tax return.

What portfolio should I invest in?

Choosing the right portfolio depends on your investment goals, time frame, and risk tolerance. To help you decide, consider the following:

1. Investment Time Frame: Each portfolio has a suggested time frame. Ensure it aligns with your financial goals:

2. Target Market Determination (TMD): Review the PMA Target Market Determination to understand the intended investor profile for each portfolio.

3. Tools & eBook Guides: InvestSMART provides several resources to help you choose the right portfolio.

Here is a list of tools and guides to help select the right portfolio:

- InvestSMART's Statement of Advice – A tailored Investment Plan with step-by-step guidance.

- Guide to Growing Wealth – Strategies to build your portfolio.

- Guide to Investing in Retirement – Insights for managing your investments during retirement.

- Investor Pack – A comprehensive overview of InvestSMART’s offerings.

Calculators:

- Wealth Savings Calculator

- Property Savings Calculator

- Education Savings Calculator

- Retirement Savings Calculator

For a deeper dive into investing, explore InvestSMART Bootcamp, a complete investment course designed to help you get started.

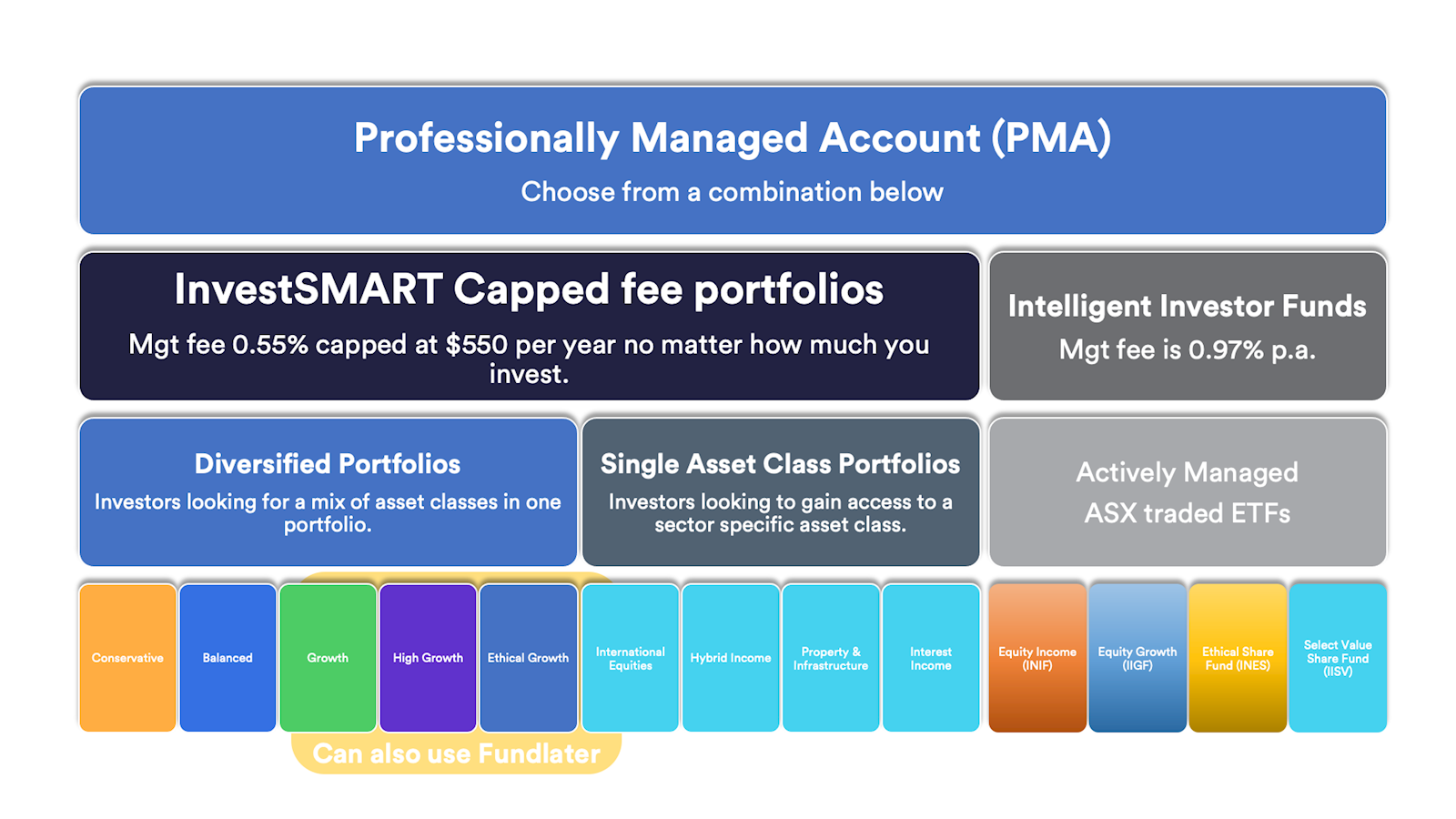

What is a Professionally Managed Account?

The InvestSMART Professionally Managed Account (PMA) is established and offered within the registered managed investment scheme known as the Professionally Managed Accounts.

Each investor has a separate account to which their investments are allocated. You will require a different PMA for each investment entity you have e.g. individual, joint, SMSF etc.

A client will open an InvestSMART PMA and can then choose between the various InvestSMART Diversified Portfolios. An account can hold one or more models but can only hold one diversified portfolio. The management fee is charged at the account level, not per portfolio.

Once you decide which model portfolio(s) are best suited to your investment needs and objectives, we will purchase the investment to be included in your account to reflect the model portfolio or combination of model portfolios that you have selected.

What does InvestSMART invest in?

When you open an InvestSMART Professionally Managed Account (PMA), you choose from InvestSMART's range of Diversified Portfolios to invest in.

A list of the portfolios can be found here.

These managed portfolios comprise of Exchange Traded Funds (ETFs) or, in some cases direct shares. In particular, the InvestSMART Hybrid Income Portfolio invests in Australian listed hybrids and listed debt securities.

What is an Exchange Traded Fund?

An Exchange Traded Fund, or ETF, is a managed fund that trades on the stock market.

There are different types of ETFs, each with its own purpose, but most commonly, they will track or follow a particular index.

For example, if you want to follow or track the S&P ASX 200 (the top 200 Australian shares by market capitalisation), you could either buy each individual share (200 shares) or one ETF. The one ETF wraps up the 200 shares into one holding. By holding this one ETF, you get exposure to the movements of the ASX 200, less any fees.

Investing in ETFs is a form of passive investing, and they generally incur cheaper management fees, as fewer investment decisions are required to manage an ETF. They are also quite liquid and traded easily on an exchange.

You can see the holdings of each InvestSMART managed portfolio by navigating to its product page and scrolling to Key Facts > Holdings.

Do I own the shares/ETFs?

Yes, all investments held within your InvestSMART PMA are held in your name (or chosen entity e.g. SMSF) in a CHESS sponsored broking account.

You are the registered legal and beneficial owner of a portfolio of securities. You can log into the investor website at any time to view the individual securities that make up your Account.

.png)