Your managed fund switching checklist. Is fear of capital gains tax holding you back?

No one likes to pay additional tax but according to Financial Advisor Bruce Brammall, you might be in for a surprise.

“One of the first things I say for clients is to get the lay of the land when it comes to your CGT position. I find people are often surprised, they expect to see a large CGT bill that would make them hesitant to change investments but, if they’ve been in a poor performing fund, it might not be that bad. Especially when you look at it in the context of opportunity cost of what they could be getting elsewhere.”

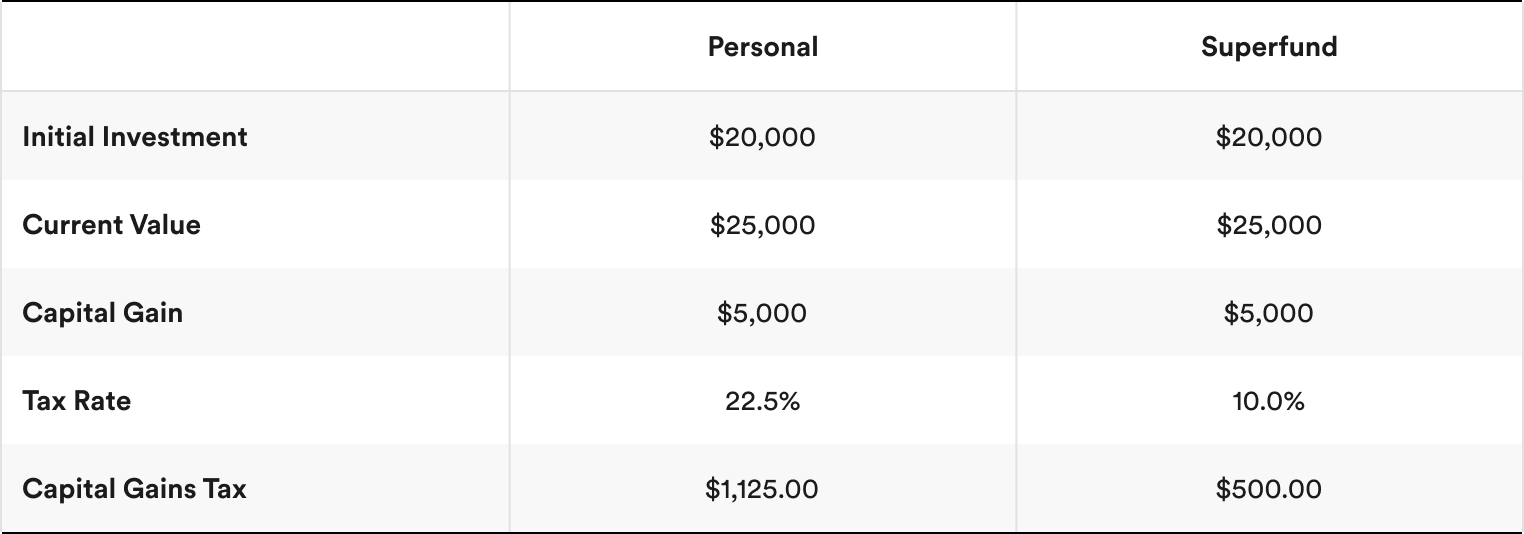

How to calculate your capital gains tax bill

- Subtract the sale price from the purchase price, if it is a positive number you have to pay CGT.

- How long did you hold it for? If you held for 12 months or less you will have to pay the full effective tax rate, over 12 months you will get a 50% discount on that rate.

- Multiply your capital gain by your tax rate.

It’s this last line that’s important. You need to calculate if the capital gains hit you take now will be more or less than the fees you pay in the next 5 years. Over the long term it may be worth the CGT pain now for greater returns in the future.

For your convenience this link will take you to the ATO’s guide on CGT.

Compare like for like funds

When looking at alternative investment options make sure you are comparing apples with apples. Here are a few questions to ask yourself:

- Does the new fund replace the asset class I will be exiting? If your total portfolio is well diversified, you hold investments in multiple asset classes. If you are exiting a fund that holds international equities, does the new fund you are looking at also hold international equities? If not, this will leave you with a hole in your diversification and an unbalanced portfolio.

- Compare performance over the same period. Ensure you are comparing across the same period e.g., end of month for the same length of time and compare over the longest period available.

- Make sure you are looking at total returns net of fees. Look at the fine print when it comes to performance reporting, you’d be surprised how often fund managers will show returns before expenses have been deducted.

- Question excessive returns. "Past returns are no indication of future returns” may sound like a compliance cliché these days but it is a warning to be heeded. Every year for the last twenty years, S&P have released their SPIVA report. This report provides analysis on the percentage of managed funds that outperform the industry standard benchmarks. To summarise the 20 years of reporting, it is more likely that the top performing funds this year will end up as the bottom performing funds in the following year. Why? Because different market conditions favour different investment strategies but also, specific asset classes can boom and bust. For example, funds highly exposed to high growth technology companies coming out of COVID raced ahead with astronomical returns only to come crashing down the following year, leaving investors who invested at the top, carried away after seeing the lofty numbers, to be burnt badly by dramatic negative returns.

Compare the fees. A high fee does not = better performance.

We’ve touched on fees above but they’re so important, a higher fee does not ensure better performance. In fact data shows it points overwhelmingly to the opposite.

- Over the past 10 years over 74% of funds underperform their industry benchmark.*

- The average underperformance is -2.53%

- And the average fee charged is 1.53%

It begs the question, "what exactly are you paying for?".

As Alan Kohler highlights of managed funds, “The “product” you buy is an investment return, and the amount you pay for assistance in achieving it reduces the return. The higher the price, the more it reduces the “product”. The problem, to state the obvious, is that the service you are buying (with a fee that is deducted from the product itself) resides in the future, and the future is unknowable.”

You cannot be certain your fund will outperform, you can be certain of the fee it will charge. What we know is, the less coming out of your investment, the more goes towards your capital growth and income.

*Data sourced from Morningstar.

Frequently Asked Questions about this Article…

To calculate your capital gains tax (CGT), subtract the purchase price from the sale price of your investment. If the result is positive, you have a capital gain. If you held the investment for more than 12 months, you can apply a 50% discount to your CGT. Finally, multiply your capital gain by your tax rate to determine the amount owed.

While no one likes paying extra tax, it might be worth the CGT hit now for potentially greater returns in the future. Consider the opportunity cost of staying in a poor-performing fund versus the potential gains from a better-performing one.

When comparing managed funds, ensure you're comparing similar asset classes, check performance over the same period, and look at total returns net of fees. Be cautious of funds showing excessive past returns, as they may not indicate future performance.

Comparing fees is crucial because higher fees do not guarantee better performance. In fact, data shows that over 74% of funds underperform their industry benchmark, and high fees can significantly reduce your investment returns.

High fees reduce the investment return you receive from a managed fund. The more you pay in fees, the less you have contributing to your capital growth and income, which can negatively impact your overall returns.

The SPIVA report, released annually by S&P, analyzes the percentage of managed funds that outperform industry benchmarks. It highlights that top-performing funds one year may underperform the next, emphasizing the importance of not relying solely on past returns when choosing investments.

Funds with high past returns may not continue to perform well in the future. Different market conditions favor different strategies, and specific asset classes can experience boom and bust cycles, leading to potential losses if you invest based on past performance alone.

Diversification is crucial when switching managed funds to ensure your portfolio remains balanced. If you're exiting a fund that holds international equities, for example, make sure the new fund also includes similar asset classes to maintain diversification.