Readings & Viewings: August 10, 2018

Welcome to this week’s Readings & Viewings, a collection of news, analysis and other interesting snippets we’ve spotted from around the world during the latest week for your reading pleasure.

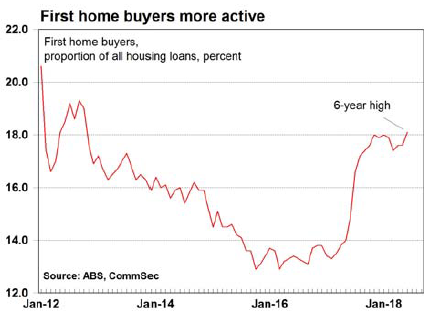

Last week, we gave a rundown of a report studying the changing nature of the Australian property market, which outlined how millennials are likely to define the market over the next decade. As Eureka Report property expert and REA Group chief economist Nerida Conisbee detailed, sections of the property market are starting to cool off, particularly in Melbourne and Sydney. As the below chart shows, these lower property prices are providing a more accommodating environment for first home buyers.

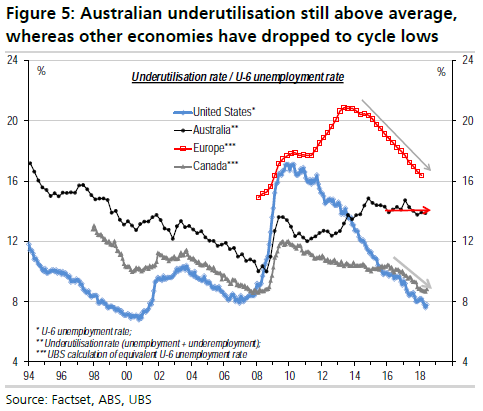

Staying in Australia, we hear plenty about the unemployment rate, but what often slips under the radar is the underutilisation rate, which takes into account unemployment and underemployment. The below chart shows that compared to the US and Canada, Australia is experiencing a higher incidence of labour underutilisation, and has done for some time. What would be of concern to Australians however, is that the European rate, along with the US and Canadian rates, have been declining sharply over a reasonable period of time, whereas that of Australia has remained fairly constant.

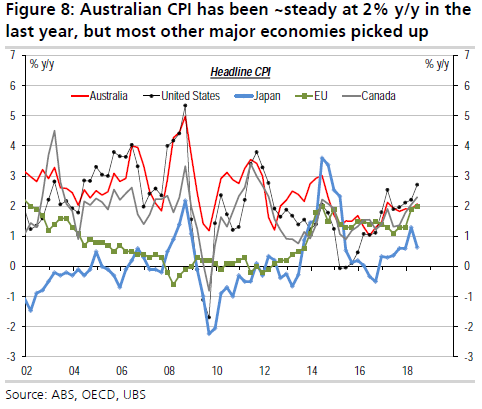

While we’re comparing the Australian economy to other developed economies around the world, let’s take a look at how we stack up in terms of inflation. Firstly, as the below chart indicates, we should note that inflation rates are quite low among these countries, with the US leading the way at just under 3 per cent. As we know, the Australian inflation rate has remained fairly stagnant in recent times, which contrasts with those of the US, Canada and the European Union, which have risen over the last year as global economic growth has also started to take off.

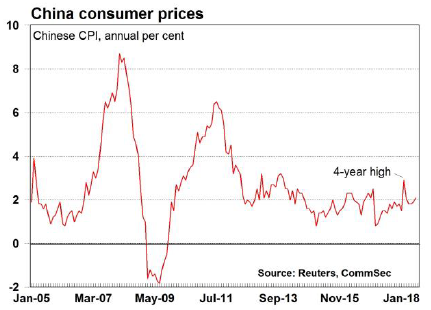

On the subject of inflation, Chinese inflation figures were released during the week. Looking at the chart below, are you noticing a trend? Like many of the developed economies outlined above, inflation in China has been reasonably low, but is starting to trend upwards – albeit remaining quite low overall.

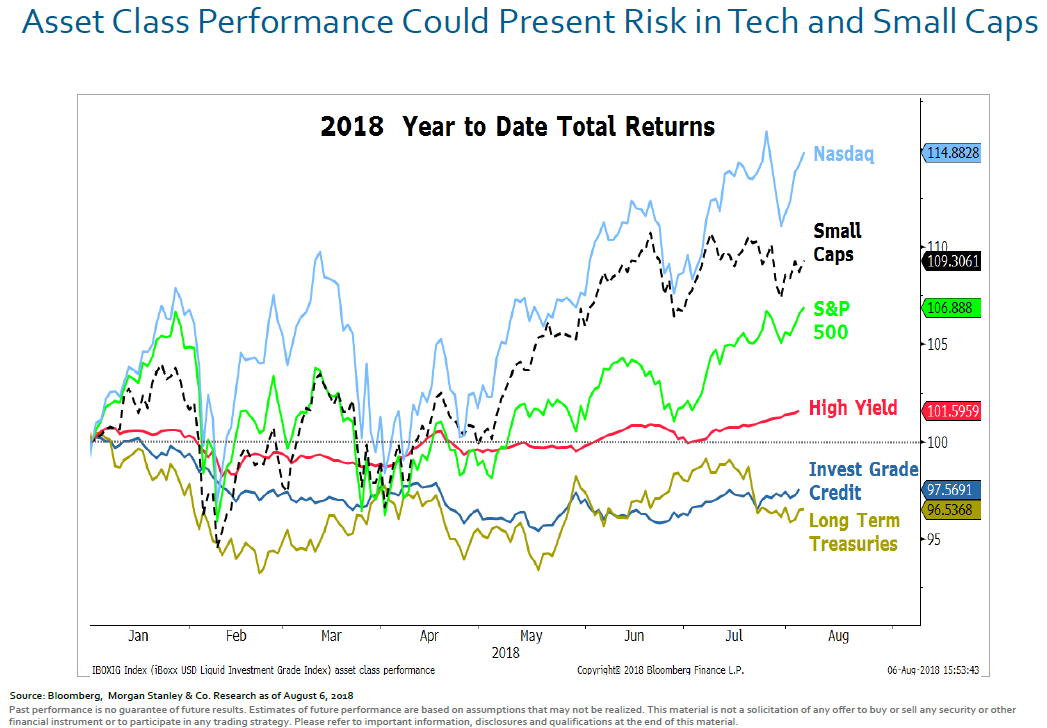

It’s certainly been a positive year thus far for stocks in the US, as you can see in the below chart. The accommodating economic environment in the US has meant the Nasdaq, S&P 500 and small caps are far outperforming fixed interest assets.

S&P 500 earnings surprises. Investment bank Citi is somewhat surprised about how good the numbers have been.

“Bumping up numbers a little belatedly can be a touch embarrassing, but 2Q18 results have been just outstanding.”

Citi admits that “extraordinarily low tax payments” allowed for “better beats”, and understandably, some investors believe the strength wasn’t exactly that clean.

What else helped? Higher than originally anticipated oil prices certainly did, with energy by far the best performing S&P 500 sector. As a sector, energy companies have performed 125 per cent better in second-quarter 2018 than second-quarter 2017.

This level of outperformance isn’t exactly out of the ordinary. It’s just that analysts are shocked it has come at this stage in the market cycle.

“[In the US] we continue to favour Banks, Insurance, Energy and Capital Goods as well as Heath Care which may be able to offset IT weakness but we also underweight some of the bond proxy areas including Telecoms, Utilities and Food & Staples Retailing," the Citi analysts remarked in the report.

As investors celebrated milestones during US earnings season, like Apple reaching a $US1 trillion market capitalisation, TechCrunch was inclined to point out the greedy ways Apple got there. After the jubilation of last week, the tech giant has been brought back to Earth this week, as it has emerged that music streaming service Spotify is gunning for Apple, as well as Amazon and Google. Here is Spotify’s playlist for global domination. If all that wasn't enough, Apple has also been forced to deny allegations that smartphone microphones are listening to our conversations.

When technology isn't spying on us, it's starting to play a much larger role in our payments system, and here is a look at how the different investment banks around the world view cryptocurrencies. However, one thing’s for sure, not everyone is lining up to be involved in the financial revolution.

One section of the Australian economy could be worth as much as $34 billion, but you may be surprised to hear which one.

$34 billion is a lot of money, but it doesn’t even equate to half of the net worth of Bill Gates, who has weighed in on the trade war between the US and China.

Could Jeff Bezos – the man who recently overtook Bill Gates as the richest person on the planet – be the world's next style icon?

We leave you with reasons why your company might need to get with the program, and why 'find your passion' is terrible advice.

That's enough from us, enjoy your weekend.