Prices are falling, but not everywhere

Summary: Certain parts of Australia are experiencing falling property prices, but some areas are still performing well.

Key take-out: There are plenty of factors to consider when evaluating property price changes in certain regions.

Property prices are falling around Australia, but not everywhere. In fact, while Sydney's falls dominate the headlines, places like Geelong and Hobart are seeing double digit growth. What can be said is that many areas which did very well in 2016 are most likely not doing that well now.

Sydney is leading the way with price declines, and is likely at the beginning of its property market downturn. Across in Perth however, prices are still decreasing, but it appears things are about to turn at the tail end of what has been a period of poor property market performance.

.png)

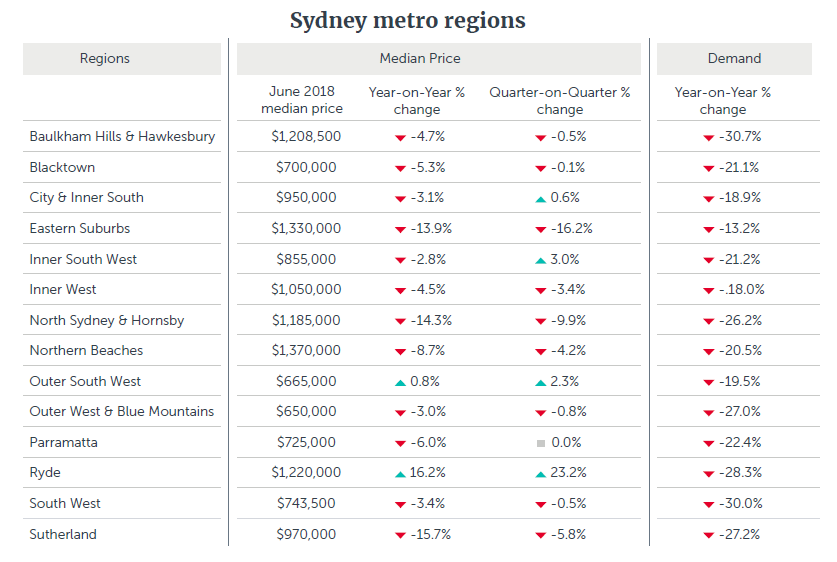

The national view that not everywhere is struggling holds true within cities. Even in Sydney, where prices are going down fastest, not all areas are doing badly. Many parts of the Central Coast are still performing well, with suburbs like Killcare Heights seeing price increases of more than 30 per cent. The falls are also not particularly consistent. Outer South Western Sydney has seen a small price increase over the past 12 months, while prices in Inner South Western Sydney have dropped by almost 3 per cent. The Inner East of Sydney has seen its prices drop by 14 per cent over the past 12 months, and yet prices in Bronte have jumped by more than 20 per cent. It may be that it takes a while for the market to adjust enough to show consistent behaviour.

Table 1: Sydney price declines have been the most dramatic

Another difficulty in judging what is happening is that many suburbs which did well last year are quickly pulling back. It appears that prices overshot, so suburbs which look great on a 12-month basis are looking less impressive on a three-month basis. A good example is Dover Heights, which is one of the best performers in Sydney over the past year, but prices have fallen by 2 per cent over the last quarter. It's a similar story in Melbourne, with Parkville prices increasing by 30 per cent over the past 12 months, but falling 24 per cent in the past three months.

Misreporting, or difficulty in interpreting data, is also a problem. Houses in Inner Brisbane are doing very well, however apartment prices aren't holding up quite as well due to high levels of supply. The figures show Inner Brisbane prices going backwards, even though house prices in many suburbs are doing very well.

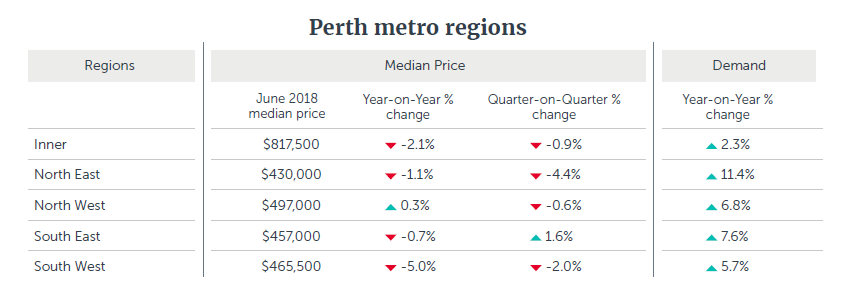

Understanding where we are in the cycle is also important. While prices are dropping in Sydney and demand is falling back, Perth seems to be turning a corner. Price falls aren't as severe this year as they have been in the past few years. More people are now looking to buy and there even appears to be some modest jobs growth.

Table 2: Perth prices are still falling but more people are looking to buy

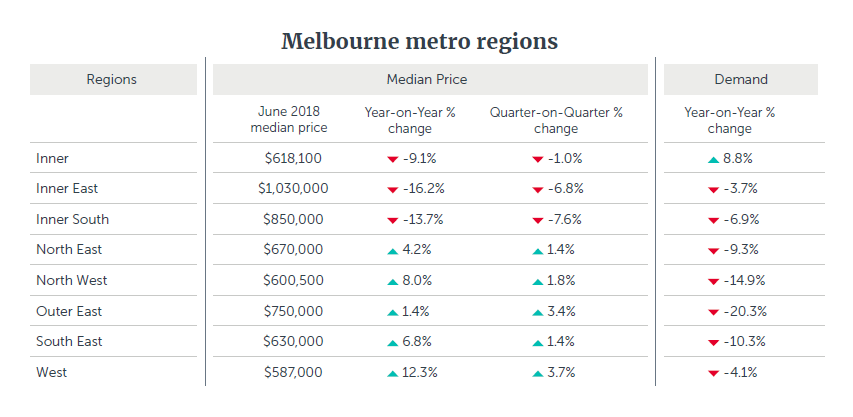

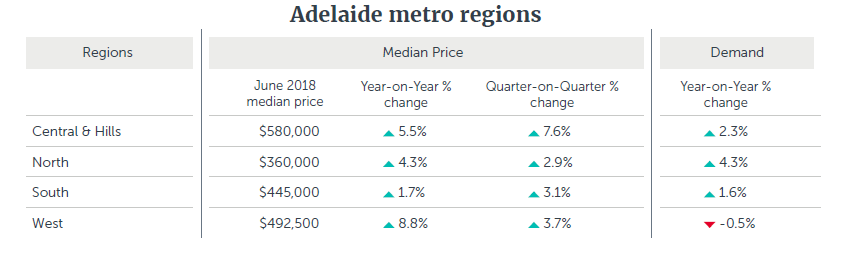

Assuming different markets are the same is also a danger. Melbourne prices have dropped in some places, but out west, increases continue. Although demand has pulled back, it is relatively minor at this stage. The Adelaide market is very stable and both prices and demand are up. So, depending on your definition of a ‘crash', there are actually very few places in Australia in which a ‘crash' is occurring.

To understand which areas may increase in value, looking at who is buying can help. Investors and foreign buyers are increasingly out of the market, but first home buyers are more active. Any areas or property types with high levels of investor activity are unlikely to be great locations to buy in the short-term. Meanwhile Ballarat, the Central Coast and Geelong are areas attracting a lot of first home buyers, and prices are rising accordingly.

Table 3: Melbourne is holding up better than Sydney

Table 4: Adelaide prices and demand continue to hold up

With so much confusing data out there, what can you do to ensure you invest in the right property?

- Get used to longer hold periods – the days of buying and selling at a profit within two years are behind us, at least for a while.

- Look to better rental yields – with price growth less assured, now is the time to look at areas where you can achieve a better rental yield.

- Make sure you educate yourself with the local area in which you plan to buy. Study sales results and speak to local agents.

- Always understand the fundamentals driving price growth – cities that create jobs tend to be home to properties which maintain their value.

- Look closely at the asset you are buying – even in poorly performing suburbs, there are some properties that will increase in price.

Finally, it is important to put price falls into perspective. In Sydney, even a 10 per cent decline will only take us to where we were at the end of 2016. For most property investors, the strong run-up in prices prior to 2016 would mean very little value has been lost from their asset.