Readings & Viewings: August 3, 2018

Welcome to this week's Readings & Viewings, a collection of news, analysis and other interesting snippets we've spotted from around the world during the latest week for your reading pleasure.

We start this week with the findings of a BIS Oxford Economics report regarding the changing demand for property over the next decade.

The major takeaway: it seems that the ‘Great Australian Dream' of owning and living in a house with a big backyard may fall by the wayside, with higher density living taking on greater prominence.

The report notes that as people move into their late 30s and 40s, they are traditionally more likely to be living as a family in a separate house they have purchased.

However, as Generation Y (currently aged between 20 and 34) moves into that older age bracket over the next decade, we may begin to see a change in those generational trends. According to BIS Oxford Economics, high housing prices mean millennials will likely find themselves needing to make a choice between a more family-friendly house in the expanding outer suburbs and a smaller residence (townhouses or even apartments) closer to the city centre.

Therefore, depending on the choices made by Gen Y, we will see an increase in demand for separate houses in outer suburbs, or a higher likelihood of – and greater demand for – apartment living. As you can see in the chart below, things are already starting to change across the five major Australian cities.

Source: Australian Bureau of Statistics, BIS Oxford Economics

Regardless of which way they decide to go, it's clear that Generation Y will have the power to change the course of the Australian property market.

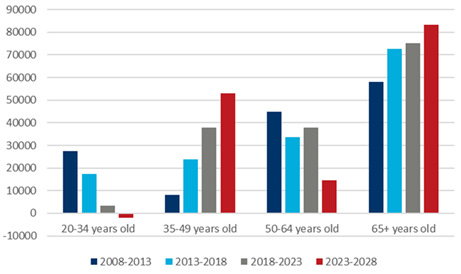

The report also found that the incidence of retirees ‘downsizing' – that is, moving from a separate house into a unit, townhouse or apartment – is not as common as we may have expected, given our ageing population. BIS Oxford Economics still expects this to occur in the future however, as the number of households in which the occupants are aged 65 and above continues to grow, as outlined in the chart below.

This phenomenon, the report notes, combined with the likely increase in demand from Generation Y families, is expected to push up the prices of these smaller homes even further.

The changing composition of Australian households: Average annual growth in the number of households by age

Source: Australian Bureau of Statistics, BIS Oxford Economics

The big week in Australia continues, and this time the ‘Big Four' banks are firmly in the firing line after the release of the Productivity Commission's report examining the level of competition in the Australian financial system on Friday.

The results are quite scathing, with a major finding being that the CBA, NAB, ANZ and Westpac have punished loyal customers by charging them higher prices to ultimately lift profits. That may or may not be news to you, but the market has certainly reacted, with the share prices of all four banks having fallen on Friday as of this writing.

The report's overview can be found here, but if you find yourself with a few spare minutes, the full 686 page report awaits.

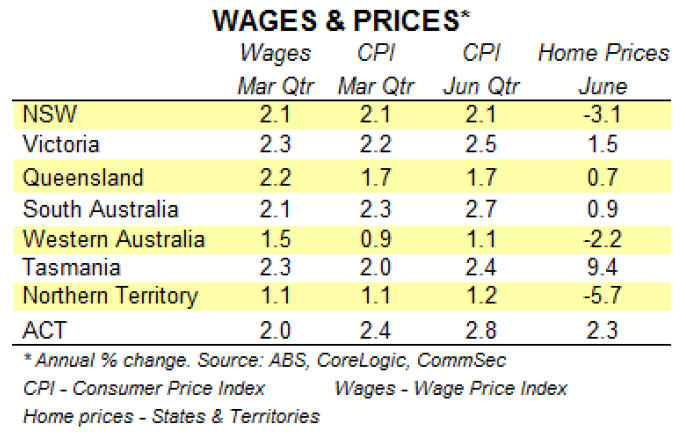

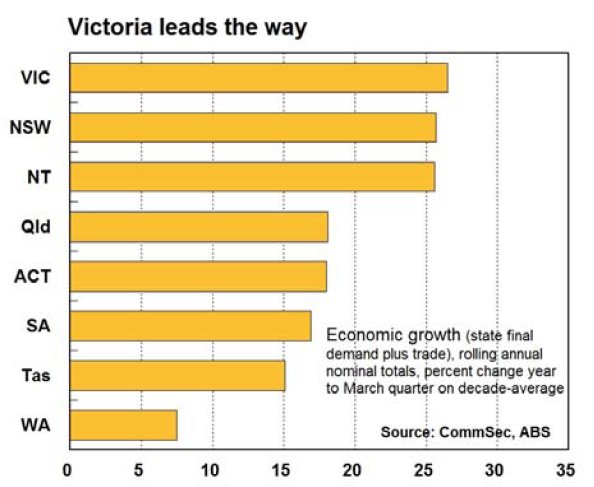

Continuing the theme of Australian economic data, CommSec released its ‘State of the States' report earlier in the week, which compares a range of figures across the states and territories. We've dug up the most interesting morsels for you, as shown in the following graphics.

Firstly, a look at wage growth compared to inflation, and it's a grim sight for workers. Growth in wages for the March quarter is barely outpacing the CPI over the March and June quarters across the board, and in some cases, wages aren't even keeping up with prices (we're looking at you South Australia and the ACT). Let's hope the June quarter wage figures paint a rosier picture when they are released in the near future.

However, it's not all bad for the ACT and South Australia, with both ranking in the top three job markets in the country. New South Wales is out in front, with Victoria and Tasmania also posting positive results. Things aren't looking too good in Queensland and the Northern Territory, and Western Australia is lagging well behind.

It only gets worse for Western Australia, which also finds itself at the bottom of the economic growth pecking order. Growth is quite healthy across the country however, particularly in Victoria, New South Wales and the Northern Territory.

Speaking of Western Australia, we all know iron ore has been the lifeblood of its economy over the last decade, and this week, Eureka Report commodities commentator Tim Treadgold outlined a potential threat to Australian iron ore miners: iron ore processing. As the below chart shows, different prices are paid for different grades of iron ore, depending on the level of processing.

The news might be slightly better for another Aussie export, with drought in Australia sending local wheat prices into a flurry, or a world-beating rally.

Moving away from home, Apple achieved another significant milestone when it became the first American company to reach a market capitalisation of $US1 trillion overnight. Just down the road from Apple's Silicon Valley Headquarters, San Fransisco airport is home to a vending machine for down vests, the unofficial venture capitalist uniform. It makes $US10,000 per month.

He certainly knows how to turn a trick. Elon Musk has bought his company more time by releasing limited edition Tesla surfboards that sold out within 24 hours. We will leave you to decide whether it's a sharky sales tactic or a suave move (Fast Company calls it 'dumb').

That might have been smooth, but this takes the cake as the best summer marketing campaign. Italian beverage maker Campari boosted sales of its beloved Aperol by 48 per cent since the middle of last year thanks to a concerted push.

Where the young and rich go to learn. Adult children of the wealthiest clients of investment banks are working on ways to personally build wealth and give back through dedicated sessions in global cities. Impact philanthropy, not chequebook charity, is becoming a big theme.

You will find most of them in these parts of the world. Investment management company JLL has pinpointed 30 cities best positioned for long-term success.

From a story of success to a cautionary tale of how the former billionaire known as 'Catwoman' went bankrupt. She's now living on social security benefits for $US600 a month. She should have gleaned the wisdom of Hetty Green, the richest woman in Wall Street history.

As financial services technology evolves, the customer experience is becoming not less, but more, complicated. Paying for a coffee, once a simple transaction, can now be complicated beyond belief.

It's all a little too complex. Harvard Business Review gives a rundown on how to think deeply about complex problems.

Here's a complex question for you: is the race between 'growth' versus 'value' over? Maybe a winner is becoming clearer, and maybe it isn't what you initially tipped. The leaderboard of the S&P 500 has turned decidedly 'defensive' since the middle of June, as investors shift out of growth stocks and move into more value plays.

The coming correction “will be [the] biggest since February” says Morgan Stanley on US stocks. That said, all in all, February only saw the S&P 500 lose 3.9 per cent and other US indices even less.

“However, [this correction] could very well have a greater negative impact on the average portfolio if it's centered on Tech, Consumer Discretionary and small caps, as we expect," noted Morgan Stanley.

Giving a recap of the quarterly reporting season, albeit mid-way through: “Companies experiencing relatively large drawdowns appear often in Discretionary while Financials have been relatively insulated from large drawdowns". As we head into our reporting season, let's see if Australia follows suit.

Finally, the most expensive property to ever list has just come on the market. Can you guess where it is?

Have a good weekend.