The new Big Five in investing

When all is said and done, having an adviser still adds significant value to the average portfolio. Russell Investments did the numbers.

According to Russell Investments, financial advisers can generate extra value of more than 4.4 per cent every year.

Managing director for Russell Investments Australia, Jodie Hampshire, equates this to an extra $550,000 over the course of a lifetime for a 40-year-old with a modest amount of savings.

However, what you should now be looking for in a financial adviser may not be the same as you sought out yesteryear.

Putting you into one fund over another won't generate this level of return, and we’ve seen what happens to any adviser who does. Rather, these returns are generated, according to the latest piece of research, by behaviour coaches first, who are financial advisers second.

But that’s just the starting point. There’s a lot more to this financial advice story.

Rebalancing still the goal

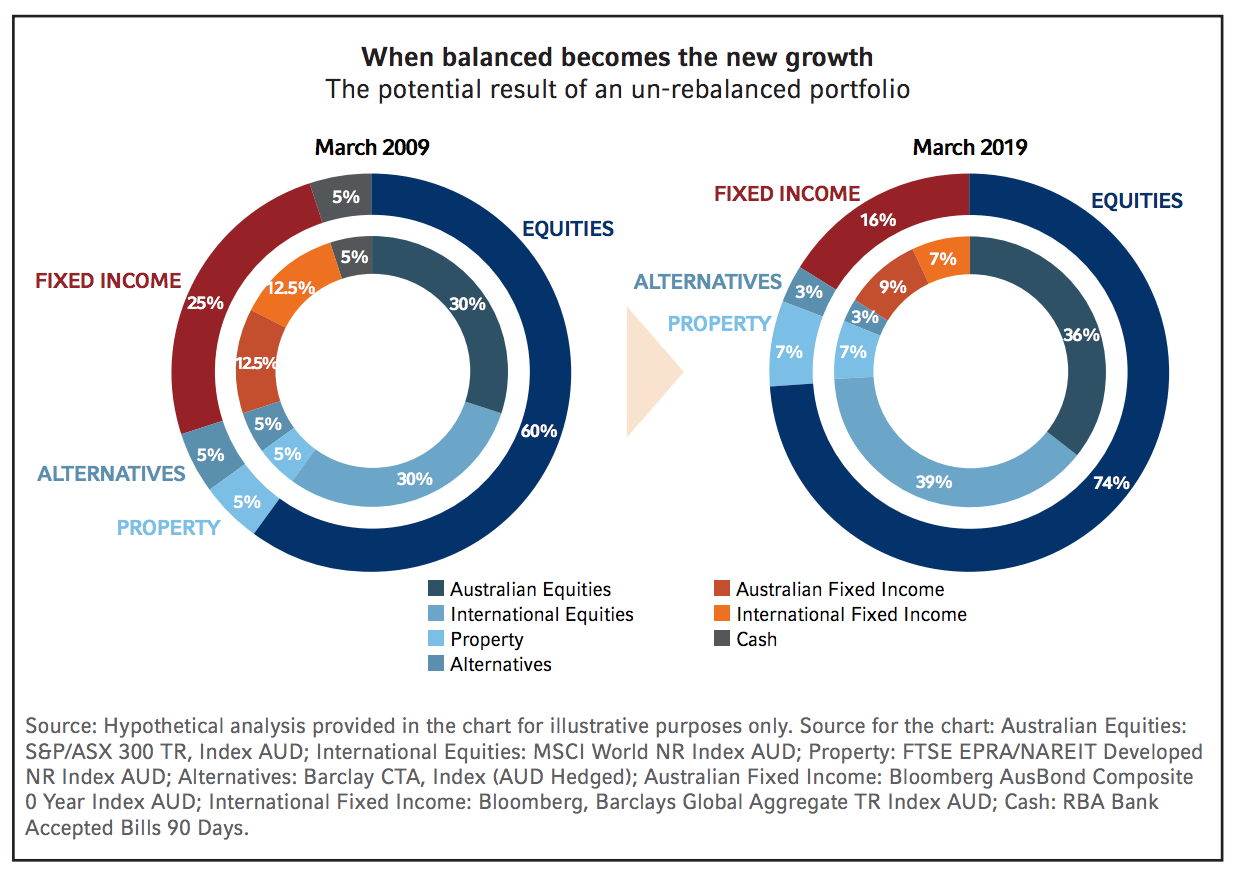

It may not always help in the short term, though in the long term, rebalancing is key to returns.

When a certain asset class is performing strongly, it can be tempting to hold an overweight position. However, what goes up must ultimately come down, and the investor who refuses to rebalance may find their hands are tied.

On the right, Russell Investments draws on real-world markets to show what happens when a balanced portfolio is left unchecked. Balanced can easily become growth, and despite the positive connotation of the word growth, this transition isn’t necessarily a good thing.

Investors will often opt for annual rebalancing.

The diversification reminder

Healthy or not, too much of anything is not a good thing.

Russell Investments, naturally, focused on the Russell 3000 in the US for the next part of their study, but claims these results are transferrable.

From December 2007 to December 2018, investors withdrew more money from US mutual funds than they put in. All the while, $100 constantly invested in the Russell 3000 more than doubled in value. And those that chose to stay in cash during that period missed a cumulative return experienced by investors in the Russell 3000 of more than 200 per cent.

Despite what this may seem, this isn’t a lesson in staying the course, and instead ties back to diversification.

A good adviser keeps you in check so you don’t not panic sell and move all the cash under the bed when the market inevitably corrects.

Reasons why some investors panic while others hold their nerve include risk tolerance sand beliefs about market cycles. Online tools can help you figure out where you stand as an investor, so you can better understand how you are likely to react or retreat in certain situations.

Five big cognitive biases

Before calling up the first financial adviser claiming to be a behaviour coach in Google search, however, it’s important to know what you’re trying to avoid. For starters, that’s becoming a sucker for patterns in stock markets.

Advisers can arrest your cognitive biases, to prevent behavioural mistakes. Specifically avoiding behavioural mistakes can generate an additional return as high as 1.9 per cent per annum, according to the latest from Russell Investments. More specifically, that’s by reining in these five big behavioural biases:

- Overconfidence

- Loss aversion

- Mental accounting

- Herding

- Familiarity

Beyond the self-explanatory, mental accounting is the tendency to attach different values to money, when all the money (of the same currency) is really created equal. An inheritance may feel like it’s worth more than savings from a salary, for example.

Herding often results in buying high and selling low. Russell Investments gives more weight to this bias, especially in an Australian context, though not because we’re all sheep following the herd. Speaking of that Australian context, familiarity stems back to home country bias, which is another open struggle of ours.

Of these, Jodie Hampshire, the managing director of Russell Investments Australia, tells Eureka Report she has the biggest problem with herding, otherwise known as “the fear of missing out (FOMO) or the fear of not getting out (FONGO)”.

“It’s what we have observed in the US data, and we don’t have long enough or robust enough data from Australia to really make a call,” says Hampshire.

“But we think the effects of herding are probably stronger in Australia because momentum generally does better, and that’s because our market is so concentrated. So as people pile into a particular stock, more people are hearing about it, and there is probably more momentum.

“In Australia, with fewer large-cap and mid-cap stocks, it’s more of an issue.”

Hampshire references the ASX tech rally. Some of these stocks are commanding multiples nearly 100-times their earnings, outstripping even the toppiest US leaders.

In 2019, could a digital nudge take the place of a real adviser?

It’s a work in progress. As Russell Investments will remind, there’s not yet a digital tool that can deliver hyper-specialised advice, such as, recommending trauma insurance the very moment an investor is diagnosed with cancer.

But we also didn’t expect to see something like Elon Musk’s brain-reading Neuralink debuted so soon, even if it’s not yet approved for human use.

For now, it seems having greater awareness of the tricks your brain may play, coupled with access to great advice, is the best investment plan.