Home country bias

Home country bias is an investment phrase that refers to our tendency to invest more money in our own country’s sharemarket while building an investment portfolio, compared to investing money in global portfolios.

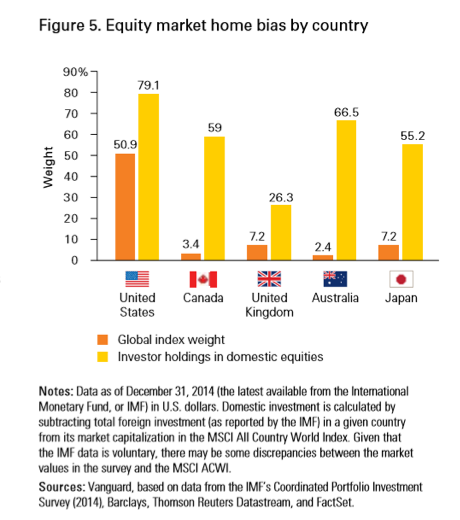

It is important for us here in Australia because we are world leaders in ‘home country’ bias. A Vanguard report from 2017 titled ‘The Global Case for Strategic Asset Allocation and an Examination of Home Bias’ used the following graph to demonstrate this:

Despite Australia accounting for 2.4 per cent of the MSCI All Country World Index, Australian investors are, on average, prepared to put 66.5 per cent of their share-based investments in Australian shares.

It is interesting to consider the extent of Australian home country bias by looking at the asset allocation of Self Managed Super Funds (SMSF).

The ATO’s March 2019 report looks at the way $715 billion of net superannuation assets are invested. A total of $7.7 billion is invested in overseas shares and overseas managed investments, which is just over 1 per cent of the value of assets.

While there are some other investment categories that may include overseas shares, such as listed trusts that might hold international shares, the SMSF data would seem to support the notion that Australian investors love Australian shares at the expense of overseas shares.

Not all portfolios, however, take this approach. According to the Future Fund’s 2019 update, it holds Australian shares at a weighting of 6.5 per cent, while holding 17.4 per cent of the portfolio in developed markets shares and a further 9 per cent in emerging market shares.

Other fund managers have a similar preference for overseas shares over Australian shares. For example, Q Super, the Queensland Government's Superannuation Fund’s balanced option (at 31st of March) has 6.4 per cent of the portfolio in Australian shares and 21.1 per cent in overseas shares.

Large industry super fund Australian Super’s balanced fund option has 22.2 per cent of the fund invested in Australian shares, with 30.9 per cent invested in overseas shares.

The good results from investing in Australian shares

A challenge in talking about ‘home country bias’ is that up until now investors have been well rewarded by being overweight in Australian shares.

The Credit Suisse Global Investment Returns Yearbook (2018) shows that over the period of 1900 to the end of 2018, Australian shares have provided an after inflation total annual return (capital gains and dividends) of 6.75 per cent, well above the after inflation return from ‘world markets’ of 5 per cent per year.

Add to this the fact that Australian shares continue to provide an additional tax benefit from franking credits, equal to around 1.3 per cent per annum (assuming a market average 4 per cent dividend yield and 75 per cent franking level across the market), and Australian investors have actually been rewarded for their home country bias.

Indeed, add these two reasons (historical outperformance and the value of franking credits) to the fact that investing in Australian shares sees investors investing in their own currency, in a sharemarket that is well developed and reliable, and that pays a high dividend yield, and you have a pretty strong set of reasons for sticking to Australians shares.

Arguments for overseas shares in your portfolio

However, it is important to at least consider the case for holding overseas share investments.

The first element we should keep in mind is the homogeneous financial services warning that ‘past returns are not indicative of future returns’. Indeed, we can see ‘reversion to the mean’ in some instances of performance, meaning, there is at least the chance that Australian shares could provide a period of underperforming the world average return.

In this case, diversification into overseas shares will increase the returns from a portfolio.

In a more severe case of economic shock in Australia, for example, one that might see significant falls in the Australian currency and local investment values, overseas shares potentially provide a crucial source of diversification to other economies and currencies.

Another element that overseas shares potentially mitigate against is the fact that the Australian sharemarket is very concentrated. At the end of March 2019, the Australian market (ASX300) was dominated by two market sectors, financials (31.5 per cent of the market) and materials (18.5 per cent of the market). Just over half the market was in these two sectors. By contrast, the first 50 per cent of global markets have four sectors that are all proportionally less that than Australia’s biggest two, including information technology (16.4 per cent), financials (15.3 per cent), healthcare (12.7 per cent) and industrials (11.2 per cent). The top 10 companies in the ASX 300 account for 42.8 per cent of the market overall.

The top 10 holdings in the global index (MSCI Index) account for 13.5 per cent of the total index.

Overseas markets also provide access to innovation, markets and trends not available in Australia. For example, the biggest market sector in global shares is information technology. However, in Australia, we only have limited exposure to this sector, with 2.4 per cent of our market being information technology.

A key question might be; do we want our portfolios to be exposed to the economic success of just one country (Australia), or to a broader slice of global capitalism as well?

A comment on hedging

When looking at overseas shares in a portfolio, a key question is whether or not to have currency hedging for the assets in the overseas part of the portfolio (or a mix of hedged and unhedged).

The main reason I hold overseas assets is as an insurance against an extended period of underperformance by the Australian market. On this basis, my preference is to hold the majority of overseas assets in an unhedged form, so that this part of my portfolio helps preserve the overseas purchasing power of my assets (for example for the odd overseas holiday).

There are more subtle reasons that I also prefer unhedged overseas assets, including that they tend to be slightly cheaper to hold and slightly more tax efficient.

Benefits of global shares

It has never been easier or cheaper to hold overseas shares in portfolios, from directly owned shares, to ETF’s and LIC’s through to managed funds.

Australian investors, however, have continued to strongly favour local shares and so far have benefited from strong historical performance, strong dividends and the benefit of franking credits. Going forward, none of these are guaranteed.

The benefits of global shares in a portfolio in terms of diversification, exposure to a different range of assets and as a protective mechanism in terms of a local market downturn require a thoughtful approach when considering the issue of exposure to global assets. After all, the cost is very low. For example, even if Australian shares outperformed global shares by 1.5 per cent per year for some time (including in this the value of franking credits), a decision to allocate 20 per cent of a portfolio to global shares will only decrease the overall portfolio return by 0.3 per cent per year.

However, if Australian shares underperform then a global allocation will increase the overall portfolio return. And, either way, a portfolio with global shares will be in much better shape if there is a long period of Australian market underperformance or a significant local economic shock that impacts local markets and the local currency.

Frequently Asked Questions about this Article…

Home country bias refers to the tendency of investors to allocate a larger portion of their investment portfolio to their own country's share market, rather than diversifying globally. This is particularly prevalent in Australia, where investors often favor Australian shares over international ones.

Australian investors often prefer local shares due to historical outperformance, the benefit of franking credits, and the familiarity and perceived stability of investing in their own currency and market. These factors have traditionally rewarded investors for their home country bias.

Including global shares in a portfolio offers diversification, exposure to different markets and sectors, and protection against local economic downturns. It also provides access to innovation and trends not available in the Australian market, such as the technology sector.

The Australian share market is heavily concentrated in the financial and materials sectors, which can limit diversification. By investing in global markets, investors can access a broader range of sectors, reducing the risk associated with sector concentration.

Franking credits provide a tax benefit to Australian investors, effectively increasing the after-tax return on dividends. This has been a significant factor in the preference for Australian shares, as it enhances the overall return compared to unfranked international dividends.

Currency hedging can protect against currency fluctuations, but it may also reduce the benefits of diversification. Some investors prefer unhedged global assets to preserve purchasing power and for potential cost and tax efficiencies.

Global shares provide diversification across different economies and currencies, which can mitigate the impact of local economic shocks. If the Australian market underperforms or the currency weakens, global investments can help stabilize the overall portfolio.

Investing in global shares has become more accessible and cost-effective through options like ETFs, LICs, and managed funds. The cost of diversifying globally is relatively low, and the potential benefits in terms of risk reduction and exposure to growth opportunities can outweigh these costs.