Square's Afterpay Play Signals Music About to Stop for BNPL Stocks

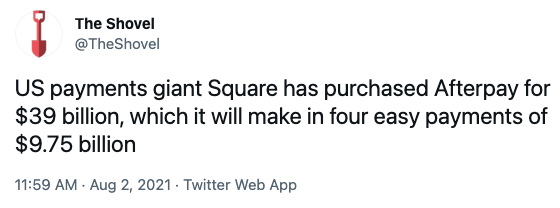

The buy now, pay later (BNPL) sector has been a darling of the Australian share market as online shopping boomed during the pandemic. Since its pandemic lows of around $12 per share in March 2020 Afterpay has risen more than tenfold, to reach a final acquisition price of $126.21.

To be clear, I agree with the Afterpay board who have unanimously recommended shareholders accept the offer. Shareholders of other local BNPL stocks – there are no less than 13 trading on the ASX currently – should be crossing their fingers and toes that they too, get acquired. The music is about to stop.

FinTech Chicanery

While the founders of Afterpay have pointed to the sale as overdue recognition of innovation within the Australian technology sector, the BNPL sector seems more to me to be more like financial and regulatory engineering than pure-play technology. Of course, none of this is to disparage the company built by Messrs. Eisen and Molnar who have created extraordinary shareholder wealth for their investors.

Technology companies now have a revered and profitable history of using language to redefine the markets they disrupt. And while it sounds like a small thing, language has extraordinary power in allowing firms to skirt regulation that potential competitors and legacy firms must navigate. Language is an even more powerful tool when the products in the market exist in the metaverse. It’s a case of old idea, new words. These methods obfuscate what they really do, and create a path to new revenue models within old sectors.

The domination of big technology firms in the social media space – we’d include Alphabet, Facebook, Twitter – is, in part, due to their ability to claim they are not responsible for the content their platforms publish. They can do this as providers of internet infrastructure – legally they are not seen as publishers. They are afforded this protection in most countries, most notably by section 230 of the United States Communications Decency Act.

The BNPL sector has used a similar tactic. Afterpay (and BNPL generally) reinvents the age-old idea of ‘Lay-Buy’ and disguises interest payments as fees when, in real terms, they are the same thing, just worse. The fees Afterpay customers pay of $68 for late payment are up to 25 per cent, which is much higher than most credit card interest rates. Another trick they are able to do because they are “not a credit facility” is to separate their transactions. In this case, the buyer doesn’t see an aggregate debt balance across their individual and, often many, purchases.

This ability to skirt traditional credit law has allowed the sector to grow quickly and unencumbered by pesky regulation. The fact Australian financial regulators didn’t respond earlier to the BNPL sector requiring more thorough credit checks and tighter definitions has been a boon for early investors.

Competitive Pressure

The impending regulatory reality of the sector, the fact that the accepted price of $126.21 was well below the stock’s high of $159.50, and that the founders took $250 million off the table at their last capital raise should send a message to sector investors. It seems the founders know that the upward rise is likely to stall as reality hits. It does make one wonder what Square have actually acquired. As far as I can tell it is a large multi-market customer base and brand. Quite clearly it can’t be profitability or bespoke technology, neither of which Afterpay has.

The competitive arrivals in the sector are also notable. Apple has announced it will soon launch Apple Pay Later. Paypal are entering the segment, as are the CBA locally with StepPay – despite their holdings in Klarna. It would also be wise of investors to consider the potential entry from marketplace providers such as Amazon, Facebook, Shopify and Ebay as highly likely. While the barriers to entry are low, the regulatory pressures are only set to increase, and these firms have the financial robustness to deal with likely upheavals which could disrupt the current simplicity of the BNPL business model.

While Afterpay had the strongest distribution and consumer position in the sector, other players locally will find it difficult to compete with the likes of Apple (and other technology firms entering the space), Mastercard, Visa and local banks who already have financial relationships with every Australian consumer and retailer.

In addition, the margins BNPL currently demand from their retailers seem unsustainable. With their merchant rates at 3.9 per cent, they are much higher than credit card fees of 1 to 2 per cent on major players. Merchant fees are currently 60 to 80 per cent of revenue for the sector – something investors ought be wary of. If you feel like any bank could flick a switch and offer BNPL as a feature, you should trust your instincts.

While Afterpay stockholders have had stellar returns, it’s a classic case of paying attention to Porter’s 5 Forces for those still trading. The odds are starting to stack up against BNPL stocks. In short, they are starting to look more like product features than solo companies.

Frequently Asked Questions about this Article…

Afterpay's stock price surged more than tenfold from its pandemic lows due to the boom in online shopping and the popularity of the buy now, pay later (BNPL) model. This growth was further fueled by the company's innovative approach and the lack of stringent regulatory oversight in the sector.

The acquisition of Afterpay by Square is significant because it signals a potential peak in the BNPL sector's growth. The acquisition price was below Afterpay's previous high, suggesting that the market may be adjusting its expectations. This move also highlights the increasing competitive and regulatory pressures facing BNPL companies.

Afterpay's business model differs from traditional credit facilities by disguising interest payments as fees and avoiding aggregate debt balances for consumers. This allows them to operate outside traditional credit laws, which has contributed to their rapid growth but also raises concerns about sustainability and regulatory scrutiny.

BNPL companies are facing challenges such as increasing regulatory scrutiny, competitive pressure from major tech and financial firms entering the space, and unsustainable merchant fees. These factors are making it difficult for BNPL companies to maintain their growth and profitability.

Investors should consider the increasing competition from established tech and financial companies, potential regulatory changes, and the sustainability of current business models. It's important to assess whether BNPL companies can continue to thrive as standalone entities or if they are becoming more like product features within larger ecosystems.