Rethinking Retirement for the 21st Century

When the Australian Government introduced the old age pension for retirement back in 1908, the pension kicked in at age 65. However, life expectancy was then under the age of 60. Clearly, this was a great decision for the Government. No doubt it was popular and easy to make the numbers work. The majority of people simply wouldn’t make it. Fast forward to today – 2021 – and life expectancy in Australia now is 84 years.

It’s clear that what was great policy just over a century ago is problematic today. While the government has moved to increase the age when benefits kick in, it’s been a paltry two-year shift. To receive a pension in July 2023, the recipient will need to be 67 years of age.

Early decisions made by organisations, including governments, are often what sets them up for long-term success. The problem is when we plan based on assumptions that were made a long time ago. If people retire at age 65 or even 67, people’s life in retirement could be half as long as their working life. Retirees would need to be able to fund an almost additional 50 per cent of their adult life from savings and investments, or become a government pension recipient. The numbers just don’t stack up anymore – and it seems today’s governments are reticent to make what would be a very unpopular change. Yet if the Australian Government had to make the same decision today, I doubt that they’d come up with the same age to receive a pension.

Old – Then and Now

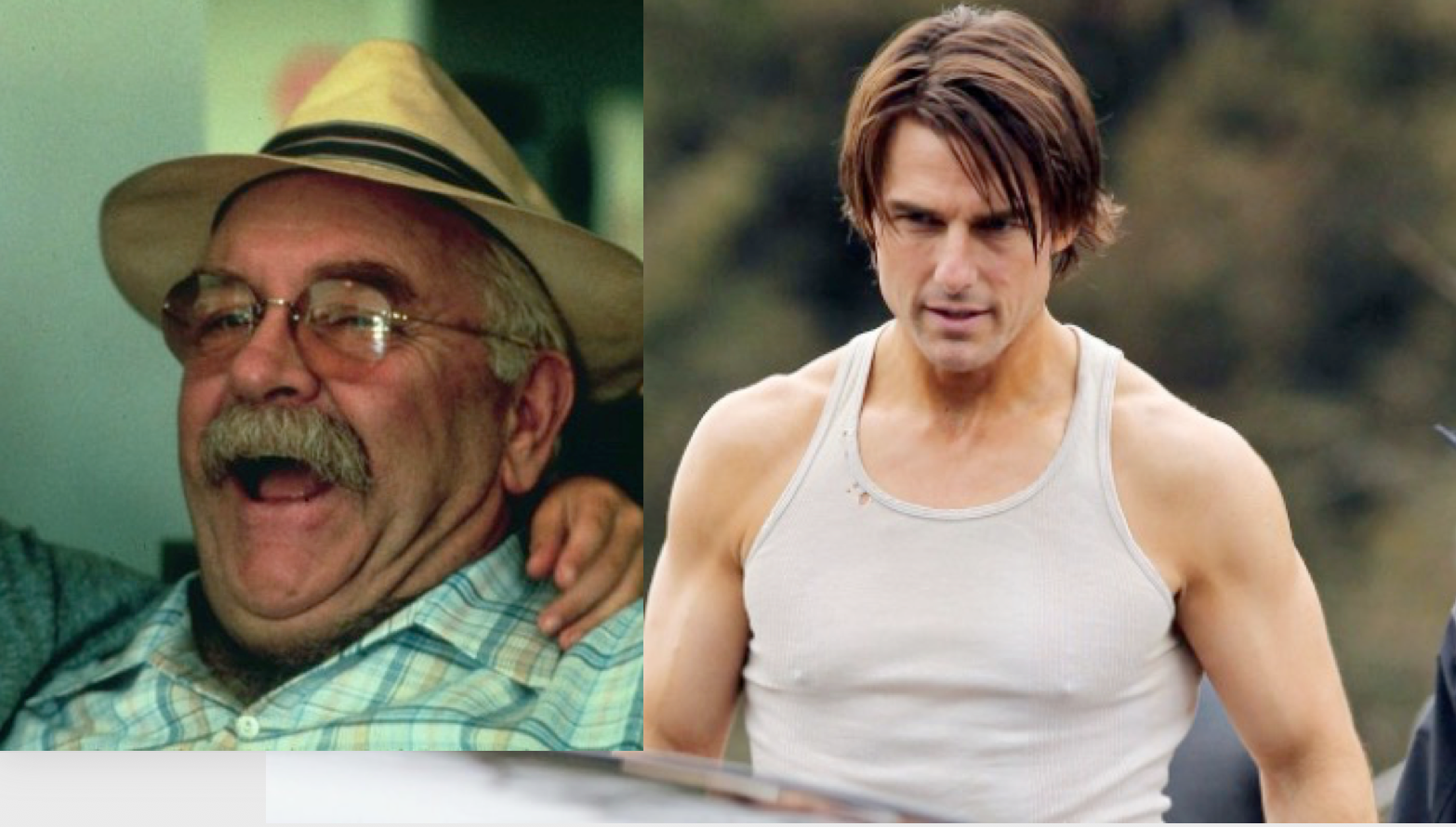

The problem isn’t just the number. It’s the reality that we are ageing far more gracefully. What was seen as old in years gone by has changed radically. Backed by radical improvements in medicine, disease prevention and life science, we are a much healthier bunch when we reach the age of 50. My favourite example is exemplified in the picture below. Compare the age of 50, as represented in the mid 1980s, to a mere three decades later.

On the left, we have Wilfred Brimley from the 1985 movie Cocoon, portraying a 51-year-old grandfather of a 12 year old. On the right, we have Tom Cruise – who is 50 years old in this Mission Impossible film set photograph – and he was then the father of a six year old. The difference is noteworthy, even if we go beyond the physical reality and limit it to society’s perception.

Innovation — Reducing the Burden

As I’ve written many times – disruption isn’t limited to corporations. It can happen to governments too. They also need to use policy and technology to keep up. If we don’t create new incentives beyond retirement age, then a significant economic burden will fall on an already struggling younger generation. What we need are ways to keep people healthy, replace the mid-life crisis with mid-life skill generation and institute financial incentives for corporations to maintain an older workforce, most of which will pay for themselves. The longer people stay in work, the more money they have to spend and the more the economy benefits.

So, here are a few policy ideas to reframe our future:

No tax beyond 65: When people reach retirement age, we should radically reduce the personal tax rate – as low as 10 per cent or perhaps even zero. Of course, this would need to be means-tested, but it could create a massive flip in what people decide to do with their time. From a government perspective, the downside is limited. It could mean the difference between a handout and having someone contributing to the economy and having more money to stimulate the economy. This is before we take into account the type of community-based work older people could engage in. Once the tax burden is removed, all sorts of work becomes financially worth it to them.

Corporate Aged Workforce Incentives: We should create incentives for corporations to continue retraining and retaining older workers. We could remove payroll taxes and provide other offsets based on their age ratio employment mix. Wage subsidies at the back end of people’s careers could be effective in the same way that apprenticeship training programmes are.

Government Funded Retraining: We would also need to make available retraining at no cost to the trainee. The government should offer targeted industry training at TAFE and university level for people at or close to retirement age. There is a strong potential for a hybrid week where half a person’s time is spent learning and the other half earning. Areas that spring to mind that do not impose a hefty physical burden are Data Security & Privacy, Augmented Reality, Digital Twinning, Customer Experience, Digital Interface and User Experience. Most of these areas are far more human than technological in their output and we are severely under-supplied in these areas in our workforce.

Technological Incentives: On top of this, we should be trying to find ways to enhance worker morale and productivity as they age. As robotics become commonplace, there is a further opportunity to not replace physical labour but to augment it instead. The addition of Exo Labour to augment physical work and pre-emptive healthcare with Crispr could not only solve the ageing population issue, but also provide export opportunities for local corporations to sell their processes overseas. This is something Big Tech have done extraordinarily well – solving their own problems becomes their next market.

What Would We Do if We Started Today? The question we should ask ourselves is this: how would we design our business – or government policy, for that matter – if we started today? If there were no legacy policies, what would we decide? Once we do this, the answers become self-evident. If we have the courage to do it, the investment upside for the economy would be enormous.

Frequently Asked Questions about this Article…

The traditional retirement age of 65 is outdated because life expectancy has significantly increased since the policy was first introduced. People are living healthier and longer lives, meaning they need to fund a longer retirement period, which the current system doesn't adequately support.

Governments and corporations can support an ageing workforce by implementing policies such as reducing taxes for retirees, offering corporate incentives to retain older workers, and providing government-funded retraining programs. These measures can help keep older individuals in the workforce longer, benefiting both the economy and the individuals.

Innovative policy ideas include eliminating or significantly reducing taxes for those over 65, creating corporate incentives to retain older workers, and offering government-funded retraining programs. These initiatives aim to keep older individuals engaged in the workforce and reduce the economic burden on younger generations.

Technology can help by enhancing worker productivity and morale through innovations like robotics and Exo Labour, which augment physical work. Additionally, advancements in healthcare technology, such as Crispr, can improve the health and longevity of older workers, allowing them to remain active contributors to the economy.

Retraining plays a crucial role by equipping older workers with new skills that are in demand, such as data security and digital interface design. Government-funded retraining programs can help older individuals transition into less physically demanding roles, ensuring they remain valuable members of the workforce.