Research Roundup: M&A, interest rates and wages

In this week’s Research Roundup, we dive into Australian mergers and acquisitions activity, examine a contrarian interest rate opinion, and also take a look at domestic wage growth and world GDP growth.

Pitcher Partners and Mergermarket: M&A going strong in Australia

Two weeks ago, we took a look at Australian merger and acquisition (M&A) activity, which showed that M&A activity in Australia had taken off in the last 12 months, particularly when compared to the rest of the world.

This week, prominent accounting and advisory firm Pitcher Partners and M&A tracker Mergermarket have released a report which provides a further examination of Australian M&A activity so far in 2018.

According to the report, 903 M&A agreements were reached throughout the first nine months of 2018, up from 805 in the corresponding period last year. In valuation terms, M&A activity grew to just under $118 billion from $67.8 billion in the same period of time, representing an increase of almost 74 per cent over last year.

With only 17 of these deals thought to be worth over $1 billion, the majority of Australian M&A activity in the first three quarters of 2018 – 72 per cent of total deals to be precise – occurred in the mid-market range, which consists of transactions worth between $10 million and $250 million.

The report also found that Australia has been an attractive destination for international investors, with foreign buyers responsible for 36 per cent of M&A transactions representing 44 per cent of total M&A value over the first nine months of 2018.

Foreign investment has also been prominent in private equity and venture capital transactions, making up almost half of these deals. Overall, the number of private equity and venture capital M&A transactions has fallen significantly, but the collective value of these deals has increased by 18 per cent compared to the opening three quarters of 2017.

Quay Global Investors: Rate cut on the horizon?

Record-high levels of household debt in Australia will prompt the Reserve Bank to lower interest rates, a prominent portfolio manager says.

With the Australian economy seemingly in the midst of an expansionary phase – as economic growth and employment start to pick up – the expectation among the general market is that the RBA’s next interest rate movement will be an increase.

However, in what represents a conflicting opinion to this view, Quay Global Investors portfolio manager Chris Bedingfield says the declining property market will have a negative effect on the economy.

“As Australian household debt relative to income has steadily increased, there is now meaningful downside risk to the economy as the housing cycle unwinds,” he says.

“This is specifically due to very high levels of household debt, tight credit conditions, potential downside to jobs and economic activity from the construction sector, and the almost inevitable rise in household savings impacting 60 per cent of GDP via household consumption.”

Bedingfield says the state of the property market will give the RBA no choice but to lower the cash rate against its will.

“While the RBA will be reluctant to cut given the current governors’ preference for financial stability over inflation, as far as financial stability is concerned, we fear that horse has already bolted,” he says.

“If the housing market continues to weaken, we believe the risk is that the RBA will face a sharply weaker economy in 2019 and will be forced to consider an official rate cut before the end of the decade.”

CommSec: Aussie wages growing

Australian wage data has been released this week, and the figures represent a positive result for workers. As CommSec notes, wages (as measured by the wage price index) grew at a rate of 0.6 per cent in the three months from July to September. The chart below shows that on a yearly basis, wages have grown by 2.3 per cent, which as CommSec identifies, is as high as it has been for three-and-a-half years.

In addition, wages are clearly growing at a faster rate than underlying inflation, meaning real wages, and therefore employees’ purchasing power, are growing. When it comes to wage growth by industry, CommSec outlines that workers in the healthcare, education and utilities industries have experienced the highest growth in wages, while mining, retail, communications and construction workers haven’t been as fortunate.

CommSec also notes that Tasmania is setting the standard among the states in terms of annual nominal wage growth, at a rate of 2.6 per cent, while Queensland is the best-performing state when it comes to real wage growth. At the other end of the spectrum, the ACT is experiencing negative real wage growth. CommSec expects that wages growth will continue to grow into the future.

.png)

UBS: Examining world growth possibilities

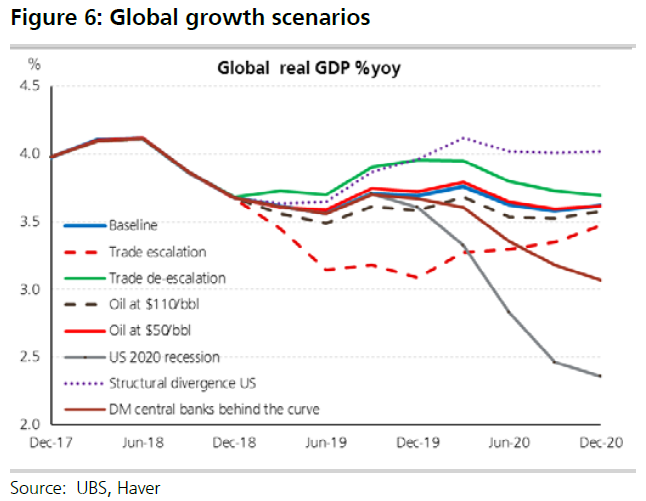

Investment bank UBS has published a chart outlining its projections for world GDP growth over the next two years under different sets of circumstances. The chart below outlines eight different scenarios which UBS believes will have a material impact on world GDP growth. As the chart shows, UBS’ base case has world growth – currently expected to be 3.9 per cent for this year – hovering between 3.5 per cent and 4 per cent over the next two years, eventually settling at 3.6 per cent next year, and 3.7 per cent in two years’ time.

The investment bank believes this will be led by falling growth figures in China, the US and Europe in this timeframe. UBS outlines that changes in the oil price to $50 or $110 a barrel would create small divergences from the base scenario, while any heightening of or reduction in global trade tensions would also cause world GDP growth to deviate from its base path.

As one may expect, a US recession in two years’ time would cause world growth to plummet, while UBS believes that structural growth increases in the US would lift world GDP growth to around 4 per cent in the next 24 months.

International Energy Agency: The end is nigh for thermal coal

A recently released report has predicted that the use of thermal coal in power generation worldwide will fall by 80 per cent in the next two decades.

The International Energy Agency’s (IEA) World Energy Outlook 2018 – which examines a range of different energy demand outcomes under differing sets of circumstances – has found that demand for thermal coal will fall dramatically by the year 2040. In fact, the report downwardly revised its initial projection of thermal coal demand in 2040 by 3.5 per cent.

Institute for Energy Economics and Financial Analysis director of energy finance studies Tim Buckley says alternative sources of energy will continue to become more prominent, as coal will be left behind by society.

“We don’t believe global coal consumption will ever regain the 2014 peak, and given relative pricing trends, we can expect to see more coal forecast downgrades in the WEO 2019 report,” he says.

“Technology and relative costs have moved on, as has the global community’s willingness to tolerate coal pollution externalities.

“Meanwhile, global financial institutions are increasingly reluctant to fund likely stranded assets.”

Under one IEA scenario, the use of gas and solar energy generation will be far more prevalent than that of coal leading up to 2040.