Research Roundup: The US economy and national wealth

This edition of the research roundup features plenty about the US economy, particularly regarding how its feud with China may impact emerging markets, and a few reasons why the US economy may encounter tough times ahead. We also delve into mergers and acquisitions data, commodity prices and take a look at our staggering collective wealth as a nation.

Nikko Asset Management: US/China tension affecting emerging markets

In its quarterly report focusing on emerging markets, Nikko Asset Management has taken a look at the potential impact of the simmering conflict between China and the US on the global economy, particularly as it pertains to emerging markets. The asset manager notes that even though once near-shambolic economies such as Turkey and Argentina are beginning to stabilise, emerging markets in general still have plenty of obstacles to navigate, with the coming months to be instructive as to how these markets are affected. Nikko has outlined three areas it believes to be crucial to the outlook for emerging markets going forward. These are: the possibility of the US and China reaching a deal to repeal or lower proposed tariffs and other protectionist policies; China’s credit stance; and the Federal Reserve’s future interest rate movements.

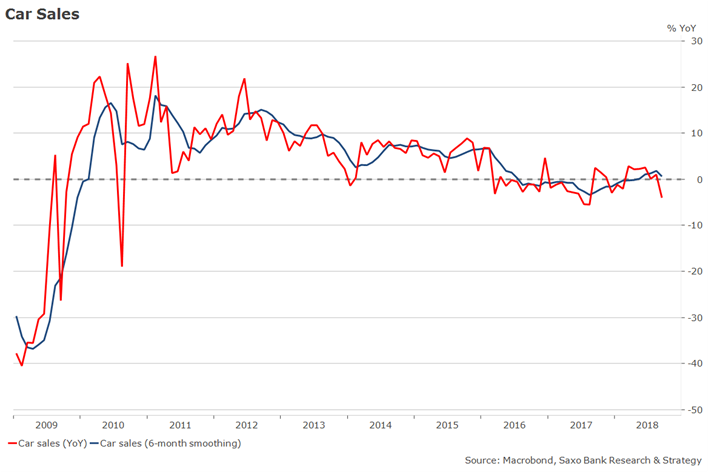

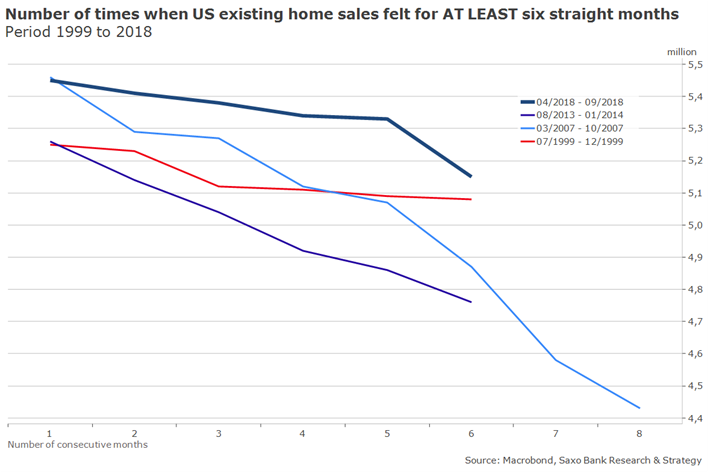

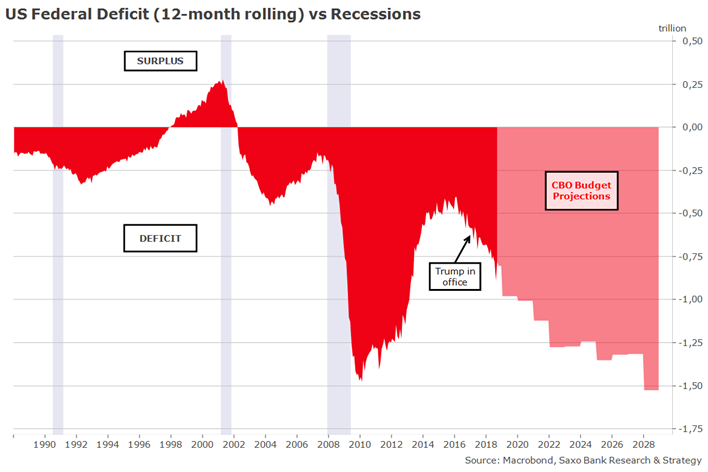

Saxo Bank: Not quite a party in the USA

We’ve heard plenty about the strength of the US economy under President Donald Trump, but in its latest Monthly Macro Outlook, Danish investment house Saxo Group has highlighted that things may not be as rosy as they seem, pointing out some causes for concern now and into the future. As the first two charts below outline, car sales in the US are on the slide, as is the property market, with sales of existing houses now having fallen for six straight months, a phenomenon which Saxo Group notes has arisen only three times in the last two decades. The first instance preceded the ‘dot-com’ crisis before the turn of the century, and the second was followed the GFC. Saxo Group’s final concern revolves around the size of the budget deficit, which is nearing $1 trillion on a rolling one-year basis – representing uncharted territory during times of economic prosperity.

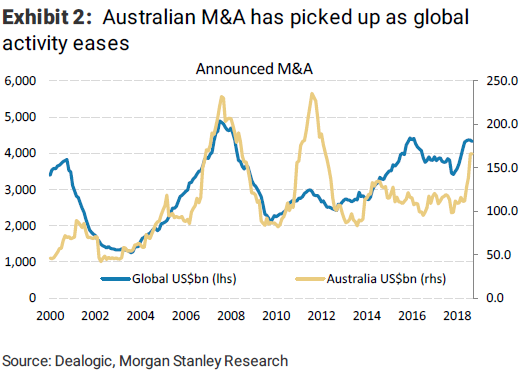

Morgan Stanley: Australia leading the M&A charge

Investment bank Morgan Stanley has examined trends in mergers and acquisitions (M&A), comparing M&A activity between Australia and the world. As the below chart clearly outlines, Australian M&A activity has soared in recent times, with Morgan Stanley noting that world M&A activity was 3 per cent lower in the most recent quarter when compared to the corresponding quarter in 2017. The investment bank is of the opinion that lower interest rates in Australia compared to the US make for a more accommodating (i.e. lower cost) M&A environment, thus stimulating domestic M&A activity. Morgan Stanley also notes that the weak Aussie dollar is playing a role in lifting local M&A.

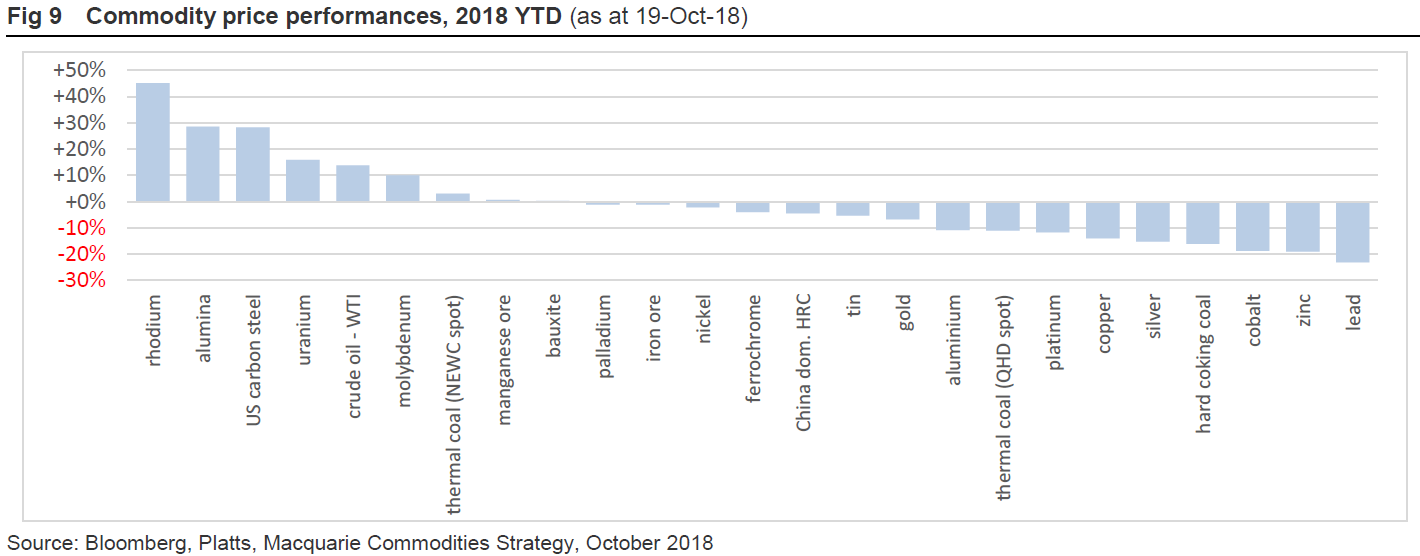

Macquarie: Taking stock of commodity prices

A few weeks ago, we provided an update on how commodity prices have performed so far in 2018. Alumina was far and away leading the pack at that point in time, having increased in price by around 60 per cent. About one month later, the below chart shows that alumina is still a positive performer, but that positive performance has more than halved – Macquarie noting that the commodity has now increased in price by just under 30 per cent since the turn of the calendar. Rhodium is the new clubhouse leader, having risen in price by over 40 per cent, a rate similar to that of last time. At the other end of the spectrum, Macquarie illustrates that zinc and lead remain the worst performers so far in 2018 – the only difference being that they have switched places. Zinc had fallen in value by more than 20 per cent about a month ago – that figure is now just under 20 per cent, while lead has claimed the ‘worst performer’ mantle with a price decrease of above 20 per cent in 2018. The Macquarie chart outlines that the tough year for precious metals is continuing, with each of the four metals still experiencing negative price growth.

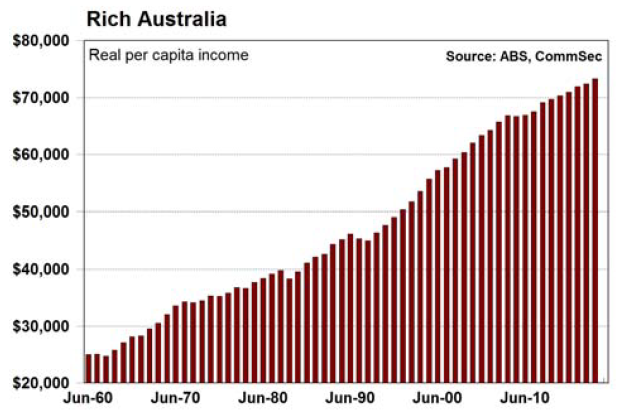

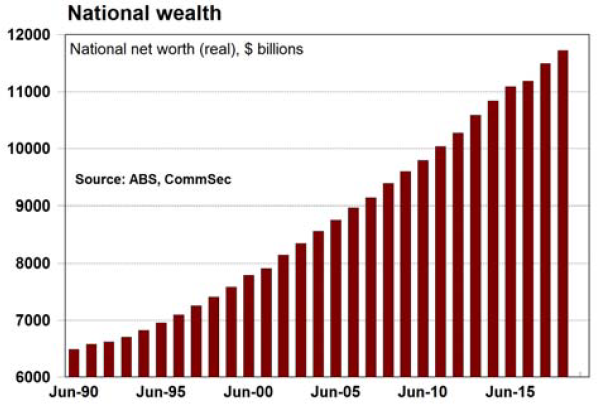

CommSec: The ‘Lucky Country’ strikes again

We’ll end on a positive note, as CommSec has published data showing that we’re richer than ever! Our household budgets may or may not agree, but as the charts below indicate, we have reached all-time highs in terms of income and wealth in this country. The first chart illustrates real per capita income – which CommSec notes is higher than it has ever been, checking in at just over $73,000 per person, reflecting a growth rate for the year of 1.2 per cent. The fun doesn’t stop there, with the second chart below conveying a 2 per cent increase in national net wealth to $11.72 trillion – also a record, according to CommSec.