Intelligent Investor Equity Growth Portfolio - December 2018

‘The dogmas of the quiet past are inadequate to the stormy present. The occasion is piled high with difficulty, and we must rise with the occasion. As our case is new, so we must think anew and act anew.’ – Abraham Lincoln.

‘Faced with the choice between changing one's mind and proving there is no need to do so, almost everyone gets busy on the proof.’ – John Kenneth Galbraith.

‘The stock market is a device for transferring money from the impatient to the patient.’ – Warren Buffett.

This quarterly is much longer than usual, as we wanted to answer the question that fund managers get asked most i.e. What is your edge?

We’ll always explain our investment process, as that’s what drives our performance. But if you’re more interested in what’s happening with the portfolio then skip to Part II where we also explain why we’re long term bulls on the US housing market and why it matters to Australian investors.

Note: Part 1 is an abbreviated version of last November’s webinar: How to find value, where you can also download the presentation slides.

Part I – What is our edge?

Funds management is fiercely competitive. The first question a potential investor will ask is why they should invest with you given so many alternatives. Trust plays an important role, which is why Intelligent Investor was launched 20 years ago.

The aim was to demystify an industry that regularly drowned potential investors in unnecessary complexity to charge high fees. Intelligent Investor offered those with independent and curious minds the ability to take control of their investments.

Trust isn’t sufficient on its own. It’s also necessary to outperform, otherwise you can save money and time buying an index fund. There’s a reason Warren Buffett recommends this approach for most people. It takes little time or understanding, it’s cheap, and it acknowledges the well-proven fact that the vast majority of investors are not emotionally equipped to succeed.

Research into the individual returns of investors in Peter Lynch’s famous Fidelity Magellan Fund suggested the average investor lost money. How is this possible when Lynch compounded returns at an astounding 29% per year from 1977-1990? A mix of short-term investment horizons and trying to time the markets ups and downs no doubt.

Our job is not to outperform all the time. Such consistency is usually reserved for fraudsters like Bernie Madoff. Our job is to consistently follow an investment process that trades criticism and frustration in the short run for higher returns in the long run. That is the price for superior returns that very few are prepared to pay. If you’re not doing something different to the market, then why should you expect to beat it?

The two pillars of our process are finding value in excellent businesses suffering temporary issues, preferably with high insider-ownership, and special situations that consistently produce mis-pricings. Let’s analyse some examples.

Quality at a discount

There are hundreds of recommendations you can see in Intelligent Investor’s audited recommendations report showing high quality businesses bought at a discount due to a plethora of temporary issues.

CSL is widely regarded as Australia’s best business. Yet it’s share price went nowhere from 2007-2012 due at one point to concerns that a plasma supply glut would once again hurt industry profitability despite a much more concentrated industry structure. You could’ve paid the highest price at the peak of the 2007 bull market and still made an 18% annualised return since.

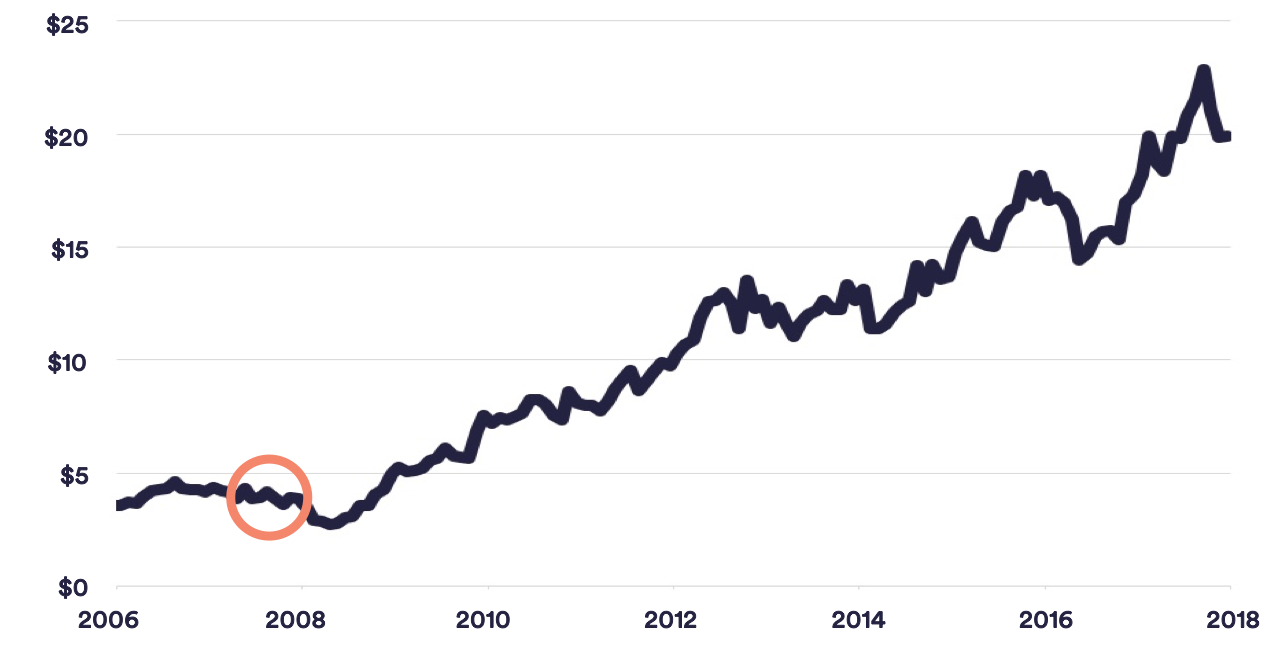

But let’s focus on four-wheel drive accessories manufacturer ARB Corporation, which, again, you could’ve paid the highest price at the peak of the 2007 bull market and still made a 19% annualised return up until last October.

Chart 1: ARB Corporation Share Price

Although ARB was a smaller business, it was well known. It boasted return on equity (ROE) of 24% despite having net cash on the balance sheet; large insider ownership due to the founding Brown brothers’ shareholding; it dominated its market; and it paid regular fully franked dividends and special dividends. This company’s virtues were no secret.

So why could you buy it at the peak of a bull market that eventually created the GFC at a price that allowed you to earn twice the market average despite the company being a far better than average business?

There were fears that the high oil price would strangle demand for four-wheel drives and SUVs. This was a classic case of letting temporary, macroeconomic considerations blind investors from the company’s promising future.

As John Huber of Sabre Capital notes, ‘there is no informational edge in most large-cap stocks, but there absolutely is a time-horizon edge for those who are willing to thoughtfully analyze what most people want to avoid out of fear of what the next year might look like.’

That’s why, with the market falling, we’ve recently been selectively adding excellent businesses to the portfolio.

High Insider-Ownership

High insider-ownership, where management owns a material stake in the business (as is still the case with ARB Corporation), is also a reliable indicator of outperformance.

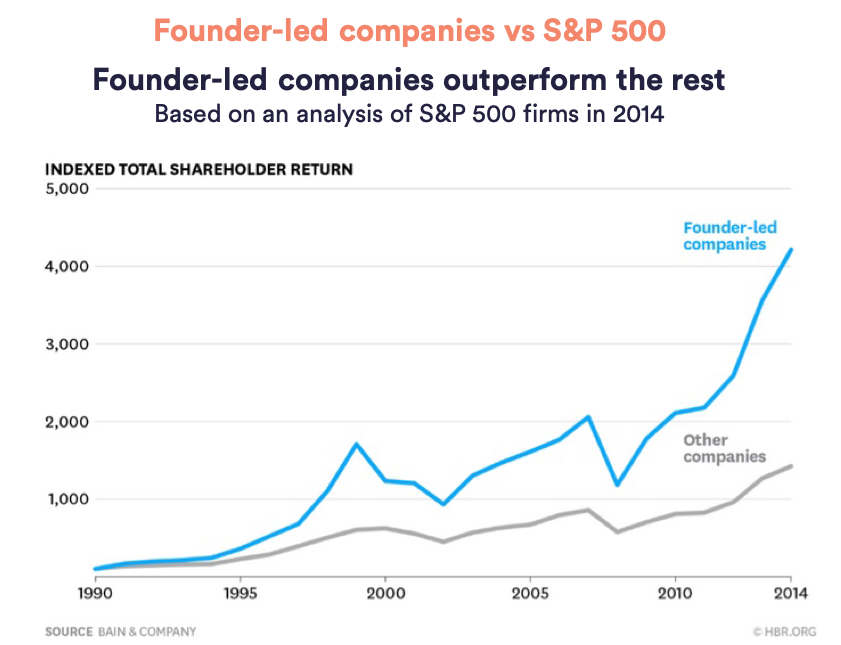

Chart 2: Founder-led companies vs S&P 500

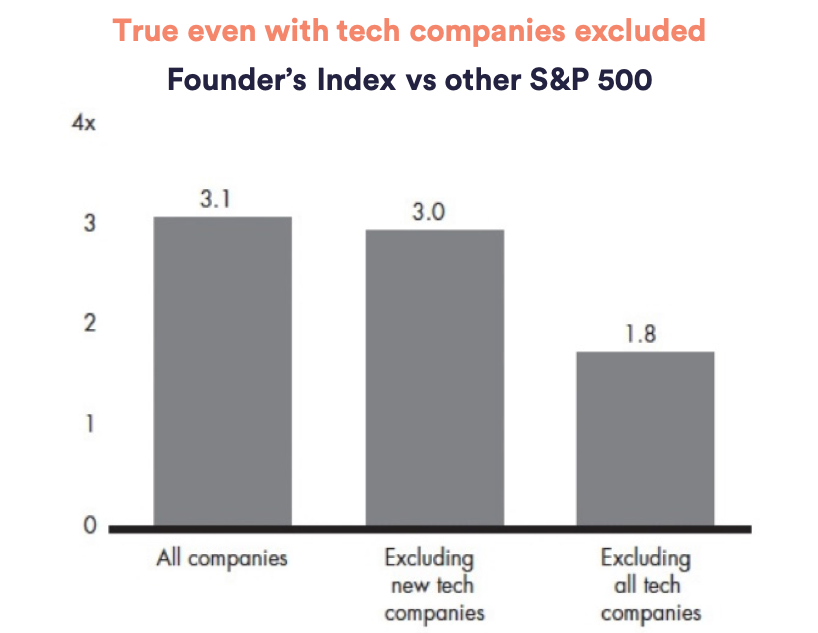

Chart 3: Tech companies excluded

Source: Consultancy.UK

Chart 2 shows just how much insider-owner companies have outperformed in the US since 1990. Unfortunately, the chart only goes to 2014, so you can imagine what it would look like if you included the US technology stocks with large insider-ownership, such as Amazon, Netflix and Google, up until 2018.

This phenomenon isn’t restricted to globally dominant technology stocks. Chart 3 shows this phenomenon exists across all industries. Nor is it just an American experience. Studies in Europe show that family-controlled companies also outperform.

We’ve got plenty of insider-ownership in the portfolio through Reece, Reliance Worldwide, 360 Capital (see review below), Flight Centre, ResMed, Seek, Frontier Digital Ventures (see review below) and Platinum Asset Management.

In increasingly short-term focused markets, it’s important that we partner with CEOs that are prepared to sacrifice short-term profits for higher and more sustainable long-term profits. As the Hayne Inquiry has shown, CEOs prepared to sacrifice their own compensation, even when it’s in the best interest of all stakeholders, are very rare.

Special situations

This group includes spin offs, a change of CEO, capital raisings, and uncovering hidden assets amongst others.

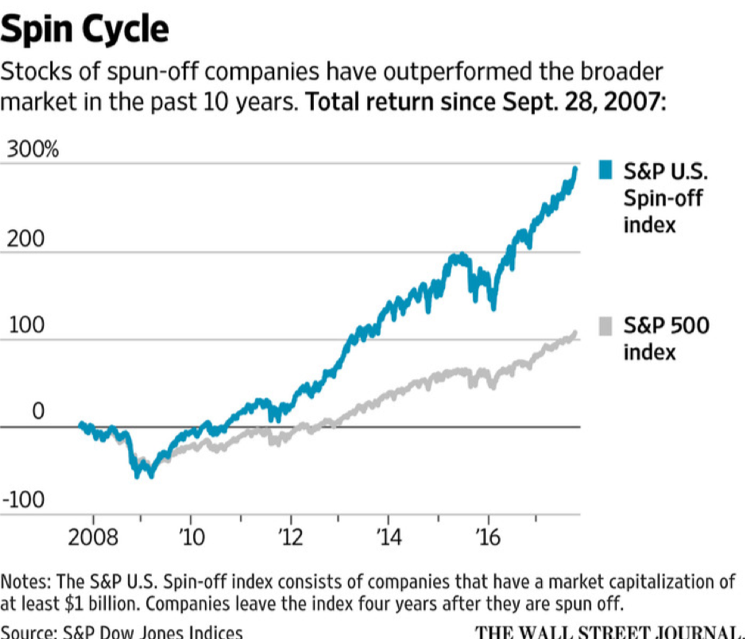

Spin offs are usually where a large business separately lists one of its smaller divisions. It happens more regularly in the US, but it’s been increasing in Australia. Think Trade Me being spun off from Fairfax; South 32 from BHP; and Coles from Wesfarmers, just to name a few.

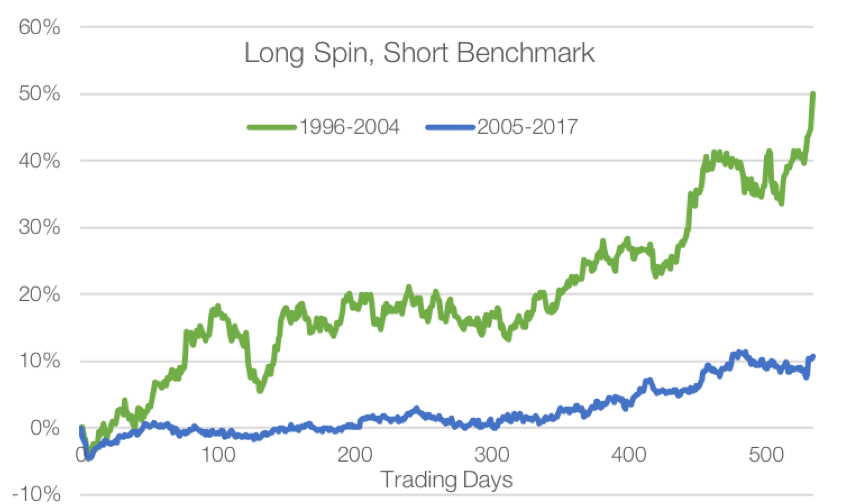

Chart 4: Spin offs Chart 4 shows spin offs have been another reliable indicator of outperformance. Despite Joel Greenblatt popularizing the concept in his 1997 book You can be a stockmarket genius, it still works. Just slightly differently.

Chart 4 shows spin offs have been another reliable indicator of outperformance. Despite Joel Greenblatt popularizing the concept in his 1997 book You can be a stockmarket genius, it still works. Just slightly differently.

Chart 5: Excess performance of spinoffs by vintage

Source: factorinvestor.com via Greenwood Investors

As Greenwood Investors’ research shows in Chart 5, more recently the market has been valuing spin-offs more accurately overall. But it masks highly varied individual results.

No longer can you buy every spin-off and do well. While six out of ten spin offs are providing very high returns, the remainder aren’t. Our job is to pick the six.

In contrast to the Coles spin-off, many spin offs aren’t well understood by the market at the time of listing. This could be due to unfamiliar management or a lack of historical financial information. It’s vital we investigate the information gap given the large potential rewards.

New CEOs and capital raisings

Often these two events go hand in hand, like they did with Service Stream in 2014 (the company has never been owned or recommended by Intelligent Investor). Capital raisings are often done at a large discount while company performance is weak, which is also when many investors are most frustrated and willing to sell their shares at any cost.

Chart 6: New CEO and re-capitalisation - Service Stream share price

While it looks obvious now, it wasn’t obvious in 2014 that new, internally appointed CEO Leigh Mackender, would morph into one of Australia’s most successful managers after presiding over a ten-fold increase in the company’s share price.

While it can be very difficult to handicap a new chief executive, we aim to identify talent as early as possible given the huge potential returns. Particularly at the smaller end of the market, where the inefficiencies and rewards are largest.

Lastly, Intelligent Investor has a history of finding hidden assets, like the unappreciated long-term rent increases slowly coming due for ALE Property Group (a long time holding in the Income portfolios). We’ve laid out the investment case for 360 Capital below, which has a potentially valuable hidden asset, or option, that we’re not currently paying anything for.

Highly valuable hidden assets are rare, but by putting all these special situations together in an investment process it provides a lasting edge in a market that, while becoming increasingly competitive, is also becoming increasingly short-term.

While we haven’t distinguished ourselves with our recent results, remember thinking long-term is our greatest advantage of all.

Fund size and Mr Macro

In addition to our time-tested process that has prospered through several cycles, we have two other distinct advantages.

First, we stick to fundamentals and don’t let the macroeconomic environment stop us from investing when we’re being compensated for the risks. Bearish market commentators can be very convincing, despite the fact that most of the time the market is going up.

In our view it’s better to take a leaf out of Peter Lynch’s book, who said, ‘Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.’

Second, but most importantly, we’re not aiming to manage the largest fund possible. Once a fund focused on Australian equities approaches $1bn the chances of materially outperforming drop considerably.

Our ability to buy and hold smaller businesses as they grow into large businesses is a tremendous way to compound returns at high rates while minimising tax. Nanosonics, 360 Capital, Frontier Digital Ventures and Audinate are some current examples in the portfolio, while ARB Corporation is the perfect example of a historical core Intelligent Investor holding and long-time recommendation.

This is a bigger advantage for our growth funds, as smaller companies tend to distribute smaller dividends, if any at all.

Just a one or two percent advantage after costs earned safely over decades can mean life changing wealth for those armed with the necessary patience. In a world of abundance, patience is in short supply. Yet you can’t earn high returns for long periods without it.

Simple but not easy

Our strategy is simple, and we’ve shown over two decades that it works. But it’s not easy. Our process is only as good as your patience to stick with us through the inevitable periods of underperformance. Remember that’s the price we must pay for superior long-term returns.

Buffett once said that he’d rather earn a lumpy 15% return than a smooth 12% return. You can see a similar pattern in the performance of the fund, which has done satisfactorily since inception but has left more recent investors asking, ‘what have you done for me lately?’

We expect to continue to outperform by a satisfactory margin over the long term, just as we have done historically, but without adopting Bernie Madoff-like schemes, we don’t know how to outperform all of the time.

There are no shortcuts to riches and no free lunches in the sharemarket, which is why fund managers should be judged through a full cycle. There is a time to play offense and defence.

As you embark on a new year and discuss financial challenges and opportunities with friends and family, we hope this letter will help you explain why you invest with us, as you help them seek trusted partners to help them save for a house, university or a stress-free retirement.

Part II – A testing quarter for short-term investors

One study showed that sharemarket returns had more in common with US rainfall than economic growth measured by GDP. The December quarter suggests why.

Despite good economic growth, particularly in the US, the ASX200 Index dropped 8% as concerns about slowing global growth and higher US interest rates grew. The portfolio fell slightly more; by 12%. Short-term performance means little, if anything, and given how different the portfolio is from the index you should expect the performance to vary.

We’re focused on the individual merits of each company in the portfolio and getting the weightings right. Over time the overall returns will take care of themselves based on skill rather than random short-term price movements.

While we’re expecting falling price-to-earnings ratios to provide more opportunities in 2019, we explained in Don’t sweat a downturn why we’re not expecting an imminent US recession. With many high-quality stocks down by more than 30% we’ve been nibbling at opportunities.

Before we examine those, let’s deal with the bad. For more detail on certain positions please read the October and November.

Clydesdale Bank has fallen over a third based on our average purchase price after announcing lower expected profits in 2019. The chief culprits were intense competitive pressure for homeloans as the UK property market slows and lower interest rate expectations on its recently acquired Virgin credit card business.

At a price-to-tangible equity of just 0.7 for a business that should be capable of producing a double-digit return on tangible equity in the years to come and paying a dividend yield beyond 5%, we’re holding on and eager to hear the company’s next three-year plan in June.

Management must prove it can do more than cut costs to get the stock out of purgatory, and we believe it can. Unfortunately, a messy Brexit may delay the high returns we believe are possible.

The share price of SMSF software provider Class also fell by a third since we added it to the portfolio. There are several things weighing on the share price. The surprise exit of the CEO; high PER stocks falling generally; fears of pricing pressure from BGL; Labor's post electoral changes that make SMSFs less attractive.

Class is well known for its cheap and functional SMSF software, where it should keep taking market share from rivals. The market should also keep growing as more people use professional software instead of their own paper or excel based processes.

At 24x earnings based on our purchase price, the share price is factoring in this growth. But not the potential of its cheap portfolio software designed to help individuals and financial planners manage their investments.

Class is aiming to be a smaller and cheaper version of Netwealth and HUB24 by offering a range of investment options to retail investors at low cost. Netwealth and HUB24 are two market darlings trading on very high multiples due to their rapid growth of funds under administration, as investors flee the high cost of complicated incumbent fund platforms.

Once the software is developed, profit margins increase very quickly as investment funds flow in without requiring much extra cost. This high operating leverage business model is similar to what's driven REA Group's success, except as the investments from clients get larger their fees get capped. Capping fees is another advantage that will hurt much larger incumbents with business models based on high fees.

Even if Class can repeat the success it had with its SMSF product with its portfolio product, it's going to take many years to play out. The company is clearly having growing pains, but we’re more likely to judge further share price weakness as a buying opportunity.

Although it had a negligible impact on the portfolio, we sold a subscale position in radio advertising business GTN Network. We’d slowly been building a stake when right before Christmas it announced its 2019 interim operating profit would fall 10-15% due to falling revenue and higher costs in its highly profitable Australian business.

The share price reaction was savage, with the stock falling 38% despite an increasingly profitable overseas business and the resumption of dividends. The steep fall didn’t just reflect the expected 15% fall in operating profits, but the contempt management (who own few shares) showed for shareholders by delaying a full explanation until February.

Radio advertising has historically been highly resilient and GTN has long contracts with clients, but the lousy treatment of shareholders makes it hard to trust management and maintain a position.

Trade Me

The good news this quarter was the acceptance of a takeover bid for one of our largest holdings Trade Me. Takeovers like this are bittersweet. On one hand, the ~25% gain since the original announcement of a potential deal sounds great, and it justifies our large position.

On the other hand, there aren’t many companies of this quality trading at such attractive valuations, which makes it hard to replace.

On first blush, the premium fails to compensate for the expected profit growth over the next few years. Large investments in staff and growth in premium classified advertising were only just starting to increase profits.

Despite low or negligible growth in listings, revenue was growing more than 10%. The full exploitation of premium ads is partly why we expect UK private equity firm Apax Partners has bought the company.

On the flipside, the deal could be an admission by management that competition is increasing as the business matures and companies like Facebook offer cheaper ways to sell second hand goods and potentially offer competitive classified’s advertising of its own. Either way, we’ll hold on until the deal is completed in case a superior bid emerges.

Recent Additions

ResMed is an exceptional business with a long history of profitability run by Mick Farrell, the son of founder and chairman Peter Farrell. While ResMed's forecast 2020 PER of 25 based on our purchase price is high, the company has next to no net debt. That means it could easily take on 10% of its market value as debt and return the equivalent amount to shareholders, as fellow US companies typically would in similar circumstances (though we’re comfortable with the safety and flexibility of its current balance sheet).

ResMed is a leader in sleep apnoea treatment, where the market grows every year particularly due to increasing obesity. As most people go undiagnosed, a combination of new patients and increasing awareness and diagnosis means ResMed is one of the few companies of its size that still has the potential to grow profits by 10% per year for the foreseeable future regardless of economic fluctuations.

More recently Mick Farrell has been acquiring healthcare software businesses to capitalise on the shift to in-home medical treatment. It’s too early to judge these highly priced acquisitions but, due to their size and ResMed’s pristine balance sheet, failure won’t be catastrophic. Earnings should remain resilient in a downturn, which will balance the portfolio when recent additions such as Pinnacle and Flight Centre suffer from cyclical downturns.

We’ve started building a position in Pinnacle after its share price was almost cut in half after last year’s early upward momentum swung into reverse. Pinnacle has become the preferred choice for fund managers wishing to swap equity in their business for distribution, which allows the managers to focus on investing rather than sales and marketing.

Pinnacle has arguably the country's best distribution team spread throughout each state close to clients. While profits will fluctuate with equity markets in the short term, over time the company has the potential to dramatically increase funds under management.

While currently priced at 20x next year’s earnings, the PER will fall rapidly over time as new fund managers are brought under Pinnacle’s umbrella and new funds are launched. As earnings will swing with the market, we’ll build a larger position over time when the market becomes myopically focused with short-term earnings at the expense of the large, longer-term opportunity.

Flight Centre will be familiar if you’ve followed Intelligent Investor for a long time. We recently added it to the portfolio after a 35% fall in its share price increased the dividend yield to ~4%. We also expect more fully franked dividends in the short-term if Labor changes the franking rules.

Overseas profits are growing nicely and now constitute ~40% of profits, while the company is investing more in technology - the company has been heavily criticised historically for not investing enough to adapt to the internet.

Flight Centre's profits vary with the cycle, but its balance sheet is pristine, and the company's offshore expansion seems under-appreciated on a net cash forecast price-to-earnings ratio of ~15. Achieving a return on equity (ROE) near 20% in such a competitive industry and despite having large investments and plenty of cash on the balance sheet is extremely impressive, while management is one of Australia's best.

Management is entrepreneurial and the company's consistently high ROE over such a long history is testament to the company's ability to adapt to a more digital and competitive environment. While earnings are currently being weighed down by temporary factors, such as the restructuring of its consultant network, revenue per consultant is growing, which augurs well for future profitability.

Growth in travel is one of the world's most persistent and durable mega-trends, which is why in combination with excellent management, excess franking credits and potentially double-digit earnings growth, we’ve added Flight Centre to the income and growth portfolios.

360 Capital

Note: This and the following analysis of Frontier Digital Ventures are very lightly edited versions of articles we shared for Intelligent Investor’s Christmas special report i.e. they contain no new information if you’ve already read them.

In 2009, as I was sifting through the ruins of the commercial property sector, a friend urged me to look at a small A-REIT called Trafalgar. Like every A-REIT at the time, its portfolio of B-Grade office properties was trading at a large discount to its net tangible assets (NTA).

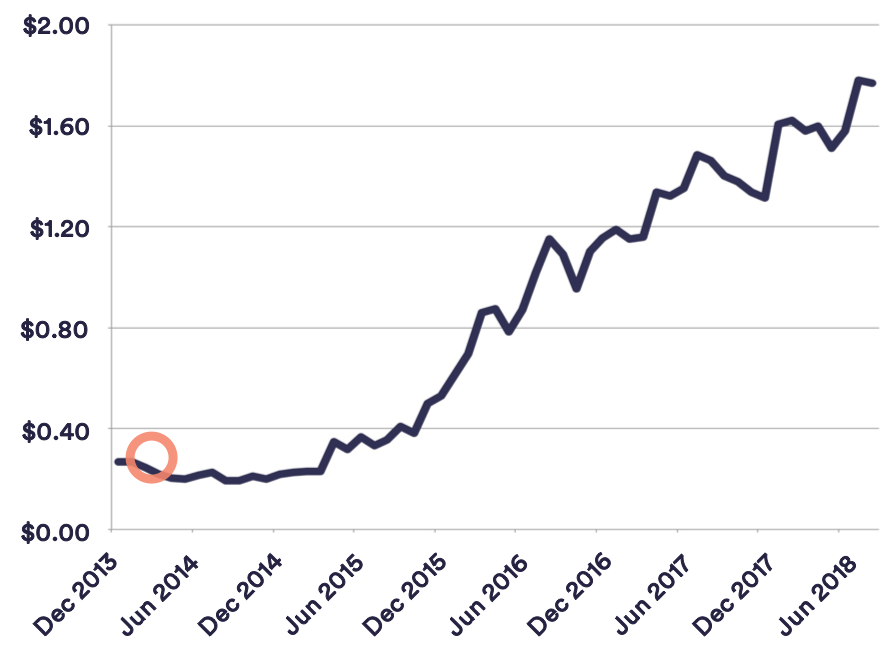

What distinguished Trafalgar was a man named Tony Pitt, who’d bought a major shareholding and planned to sell the assets one by one to eliminate the discount. Over a few years he delivered on his promise much to shareholders’ benefit (see chart below).

Chart 7: TPG total return

I then sold my shares, thanked my friend for the recommendation, paid my tax, and moved on to ‘better’ opportunities, missing the huge share price gains as Pitt reversed his strategy and began making acquisitions. Renaming the company 360 Capital, he kept buying undervalued property and rode the recovery in commercial property prices.

Clean slate

Now, Pitt is again starting with a clean slate. Having recently agreed to sell 360 Capital’s last major property to NextDC, which also happens to be the tenant, 360 Capital is flush with cash and a new strategy.

When emerging from downturns like the global financial crisis, owning equity maximises your returns as asset prices recover. At the opposite end of the business cycle, which is where we are now, Pitt wants the extra protection of supplying debt with covenants rather than equity. You don’t need to sacrifice returns too much, either.

Property development returns have increased due to the withdrawal of Australian banks, which have been forced to ration credit to satisfy regulators as they prepare for lower housing prices and higher bad debts.

Big opportunity

This market opportunity can be quite lucrative. Providing debt for a year or two on a small property development typically earns a 10–11% annual return. Not bad when interest rates are below 2%, if you get your money back.

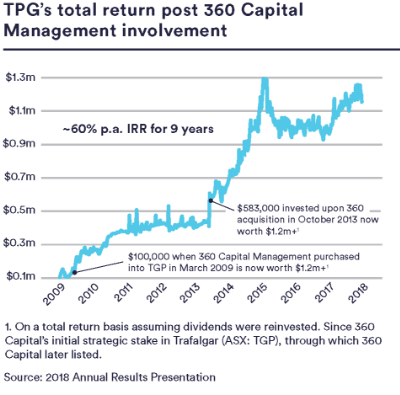

Anecdotally, we’ve learned those returns are more like 15% right now. The chart below, which shows the (expected) falling market share of Australia’s banks for property lending, is a visual description of the size of the opportunity. Let’s now look at how this might unfold in practice.

Chart 8: $30bn lending gap

A typical development for 360 Capital might be a $30m suburban doctor’s office. Because of the small size, in a worst-case scenario where the developer goes under, leaving the project unfinished, Pitt could take control and complete it. More capital might be required, either directly from 360 Capital’s balance sheet or by finding a new developer and/or investor, but that shouldn’t be a problem.

If the story ended here, we’d currently be paying net tangible assets (NTA) for 360 Capital. Given Pitt’s track record that could be very cheap indeed. Over time, we’d receive distributions as if owning an A-REIT. The value of 360 Capital, meanwhile, would grow as profits are banked from completed projects and reinvested in new ones.

That’s pretty good for a company where a shrewd, shareholder-friendly chief executive owns a quarter of the shares and which is orientated towards leaner times but has the potential to capitalise on higher development returns while they last.

Lending platform

But the story doesn’t end here. 360 Capital also owns a 50% stake in a property lending platform called AMF Finance, which earns fees from matching developments requiring capital with investors willing to supply it. Here’s how it works.

Let’s say you’re a high net worth individual with $25m to invest over the next few years in our theoretical suburban doctor’s office. You plug your details into the AMF Finance system, after which you get a list of projects in which to invest along with the associated terms. You pay a fee for being offered deals on a silver platter, without having to do any of the dirty work.

As projects mature, 360 Capital can then repackage or ‘securitise’ this debt for less risk tolerant investors willing to accept lower returns. This releases cash for 360 Capital’s next development. Sometimes, 360 Capital can turn over its capital more than once a year. With the right fee structure, this can be extraordinarily profitable.

These are early days. The platform has only completed $111m of deals in the eight months to 30 June, although the potential is substantial, if investors get the right outcomes. Potential 360 Capital shareholders aren’t currently paying anything for this potential. Last year, 360 Capital paid a 5.6% dividend yield based on our purchase price but it’s unclear what will be paid in future. That’s ok, as we can afford to let dividends grow slowly over time if necessary.

The bull case is clear. Tony Pitt is a canny operator with his own money on the line. In a blue-sky scenario, the AMF Finance business could one day be collecting fees on deals valued in the hundreds of millions of dollars.

Just as importantly, Pitt has prepared the business for leaner times. Even if AMF Finance is worthless, we’re not paying much, if anything, for it. At worst, we’ll own a well-run, entrepreneurial business that’s investing in a profitable niche. Pitt excelled during the global financial crisis. We expect nothing less from him during the next downturn.

Frontier Digital Ventures

When local online real estate classifieds business REA Group entered the Italian market in 2007 it looked unstoppable. After conquering Australia’s real estate market, attracting 89% of agents and gaining a handy lead over Domain, acquiring Italy’s biggest property website, Casa.it, should have been a breeze.

It wasn’t. After being overtaken by once distant competitor immobiliare.it, REA sold out of Italy in 2016. The loss of a seemingly insurmountable lead has been put down to the travails of corporate bureaucracy.

REA shareholders’ loss is Frontier Digital Ventures’ (FDV) gain. FDV acquires stakes in emerging online classifieds. By mimicking the successful parts of REA Group and dropping the mistakes – a classic second mover advantage – Frontier has a decent shot of hitting the big time. With the benefit of hindsight, REA’s failed Italian jaunt was the wet stone that honed its model.

Founded in 2014 by Shaun Di Gregorio, a general manager of REA’s Australian business for eight years and former iProperty chief executive, Frontier lacks the value sucking management contracts common in other investment vehicles, such as Macquarie Group’s former satellites.

Instead, Di Gregorio receives a market-based wage and upside via a large stake in the company – alongside renowned Asian classified investor, Catcha Group. It’s reassuring that both are aligned to the interests of minority shareholders.

There’s another difference between FDV’s and REA’s approaches to acquisitions. Instead of buying entire businesses, Frontier takes minority stakes in local market leaders, keeping founding entrepreneurs at the helm, suitably incentivised.

This means it keeps local expertise. If needed, though, Frontier will provide guidance to help the businesses entrench their leadership positions (which is often why an owner sells to Frontier in the first place); otherwise it stays out of the way. Again, it’s a better alignment of interests.

What about the markets in which Frontier operates? Well, the name says it all. ‘Frontier’ markets are even riskier than ‘emerging’ markets, but the opportunity for rapid growth is perhaps greater.

Countries like Pakistan and the Philippines have large populations – 197m and 105m respectively – and rates of internet and online advertising penetration are quickly catching up with more developed economies. The allure of Frontier is the potential of owning a market leader, protected from competitors by network effects, with decades of growth ahead of it.

Unfortunately, the comparison with owning, say, REA or US-based Zillow in its formative years is misplaced. Frontier operates in countries with less stable economies, governments and currencies. That means these businesses are exposed to greater risks than their western counterparts, which is why it’s a much smaller than average position for the fund so far.

To soften this risk, Frontier takes a portfolio approach. It currently has 15 investments, with most focusing on property in the Asian region. Of these 15 investments, we’d expect five to wind up worthless, more than that to muddle through and a small handful to be successful.

Given how profitable a dominant online classified business can be, one winner is all that Frontier might need to be a resounding success. An investment in Frontier is therefore much closer to venture capital investing than typical equity investing.

And, as luck would have it, Frontier might have stumbled upon a winner with its very first investment.

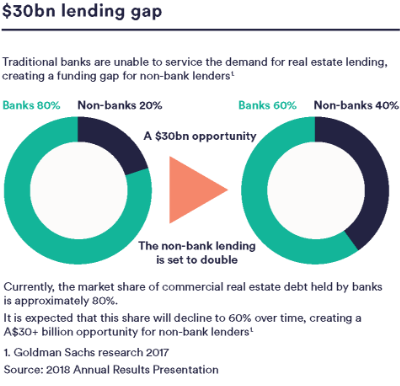

In 2014, Frontier acquired a 30% stake in Zameen, the leading property portal in Pakistan. At the time this valued the business at US$4m. After adopting Frontier’s suggestions, Zameen’s market leadership widened and its growth accelerated.

In May this year, Zameen was valued at US$220m. You read that correctly. Frontier’s stake is now valued at 55 times its purchase price. How can this be? Well, maybe it’s not. The valuation was conducted privately between two parties, both with an incentive to overstate the value to validate their business models.

Either way, Zameen’s revenue is almost doubling every year. And with the valuation representing a lower multiple of sales than many listed comparables, it may not be outlandish. There’s a chance that Frontier’s Zameen stake is worth more than its market capitalisation of $127m, meaning shareholders would get 14 free lottery tickets in the form of its other investments.

Zameen also has the potential to ‘get closer to the transaction’, which may increase its value further. In many frontier markets, websites garner a higher degree of trust than in the West. This may allow them to facilitate transactions rather than merely advertise them. Zameen could be even more important in Pakistan than REA Group is in Australia, but clipping the ticket on apartment sales, as Zameen does, makes earnings more cyclical.

Frontier’s currently burning cash at a rate of $7m each year. But with $20m in the bank it has a few years before passing around the hat. But with nine of its investments expected to breakeven by the end of calendar 2019, it may not need to.

One nagging concern is Gregorio’s frustration with the company’s share price, which prompted a recent presentation designed to encourage people to buy the stock. A low share price restricts Gregorio’s ability to raise cash, make new investments and offer business owners appealing incentives.

As frustrating as it may be, we’d prefer Gregorio to stay focused on delivering good numbers and the share price will eventually take care of itself.

US Residential Property Market

Stocks related to the slowing US residential property market have been some of the market’s worst performers over the past year or so. Although it only accounts for 4% of US GDP, the industry is a bellwether for the US economy.

It’s also an important sector for Australian investors, as numerous Australian companies, such as Boral, Reece and Reliance Worldwide, have recently made large acquisitions with varying exposure to the US housing market.

As we own the latter two names and would also like to own James Hardie at the right price, it’s an important sector for us as well. Note Reece and Reliance earn most of their profits from repairs and maintenance, which can provide more stable profits than other companies more directly exposed to new home building, such as homebuilders.

While the market has clearly slowed recently, and higher property prices and higher interest rates have sunk the sharemarket’s expectations, there are three reasons why we’re long term US housing bulls.

Weak recovery

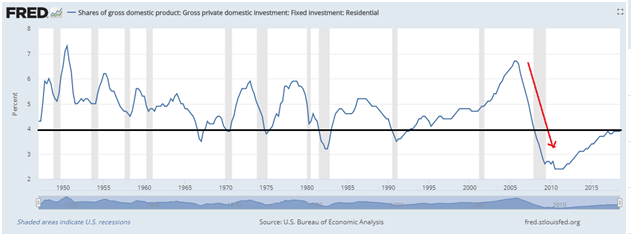

First, after being decimated during the GFC, annual new builds haven’t even recovered to the long-term average of ~1.4m. In fact, new starts have only recovered to a level consistent with historical lows (Chart 9). This suggests America will need plenty of new homes in future as the population grows.

Chart 9: Shares of gross domestic product: Gross private domestic investment: Fixed investment: Residental

Fears about higher interest rates, and therefore affordability, also seem over done in light of history, as Bill Smead of Smead Capital Management explains, ‘Stand-alone residences were the most affordable to buy in 2011 as in any year of my adult life. We built 320,000 in the year 2011. They were the least affordable in the 1970s and 1980s, and we built 1m homes many of those years with 65% of the existing population base. There is an inverse correlation between home building and affordability.’

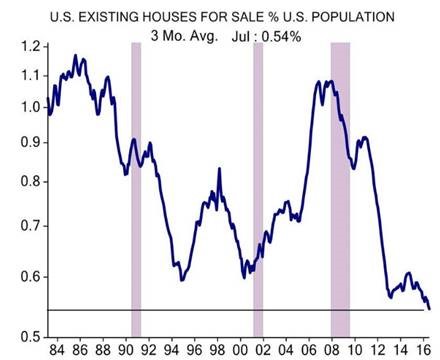

‘From 2009 to 2013, homes were the most affordable in my lifetime (60 years). As you can see from the chart below, the availability of homes for sale, coming off five years of negligible home building, was the lowest in 60 years:’

Chart 10: U.S. existing houses for sale % U.S. population

Source: ISI Group

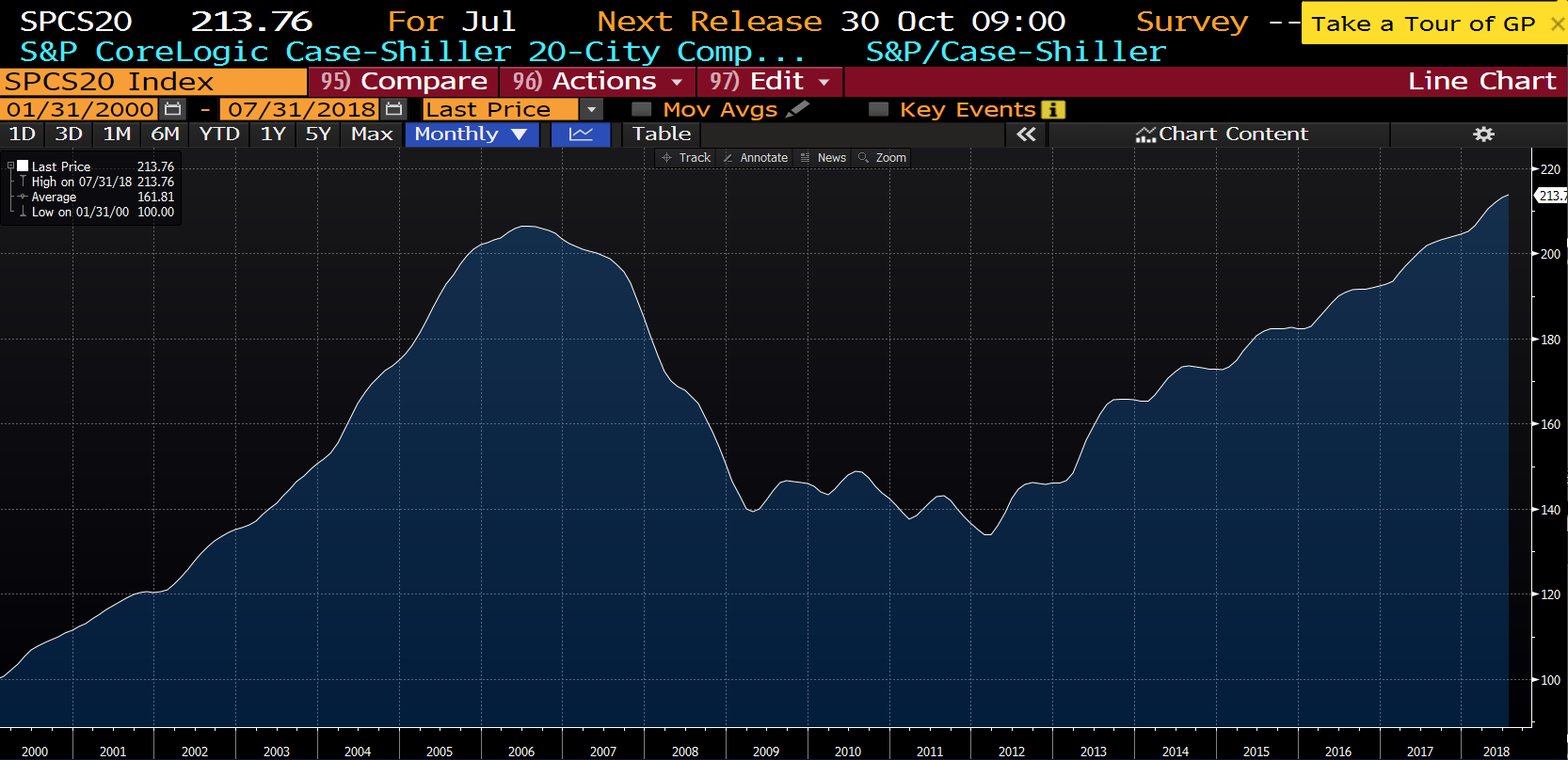

‘This chart shows that there is a severe lack of supply in homes and the owners (primarily boomers) are staying in their home much longer than prior generations. How would you have done if you bought home builders at the low points on this chart in 1994 and in 2000? The Case-Schiller chart below answers the question:’

Chart 11

Source: Bloomberg

Source: Bloomberg

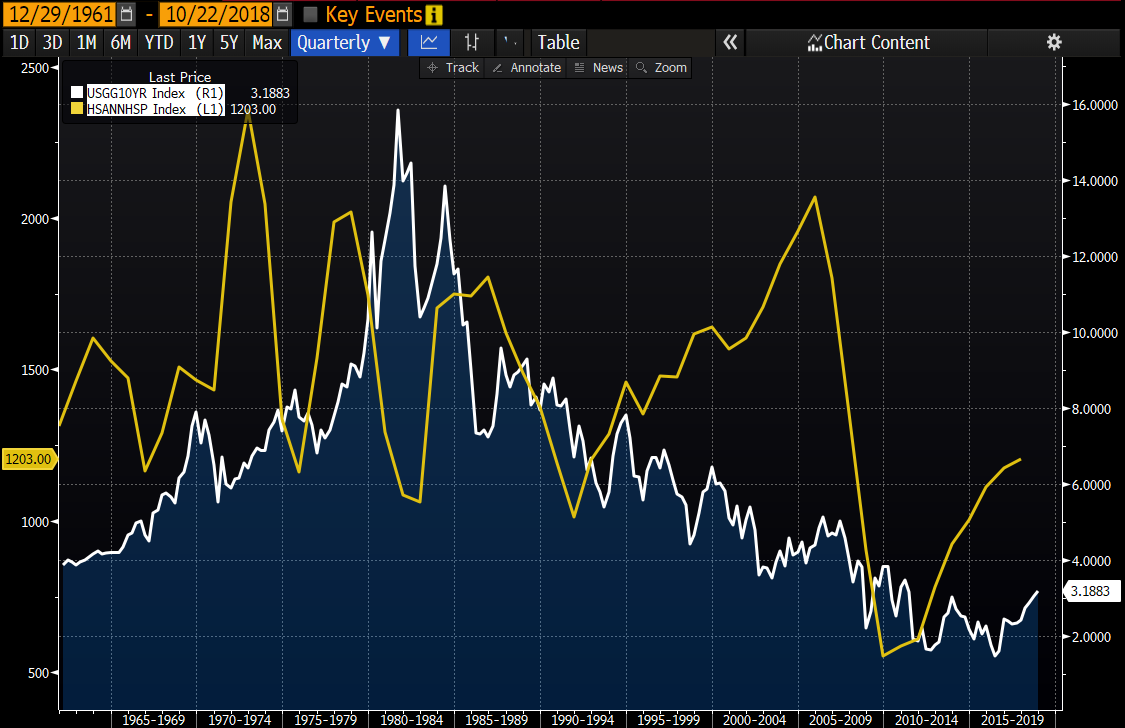

‘In fact, the biggest home building phases outside of the 2003-2006 mania were in the early 1970s, the late 1970s and the mid-1980s. Two of those intervals peaked at ten-year Treasury rates above 10% and everything on this chart happened at mortgage rates far higher than today’s rates. What was the cause of this huge demand in the face of high mortgage rates and very unaffordable homes? We had the largest population group hitting first-time home buyer status constantly from 1970 to 1986!’

Chart 12 Source: Bloomberg

Source: Bloomberg

‘The chart of housing starts versus Treasury interest rates is not population adjusted the way the prior chart was. There were 180m people in the U.S. in the early 1960s, 225m in the 1980s and America is approaching 330m residents now. Don’t 330m people need more homes than 225m did?’

Millennials

Lastly, unlike many aging nations, America’s millennial population is the country’s largest ever population cohort.

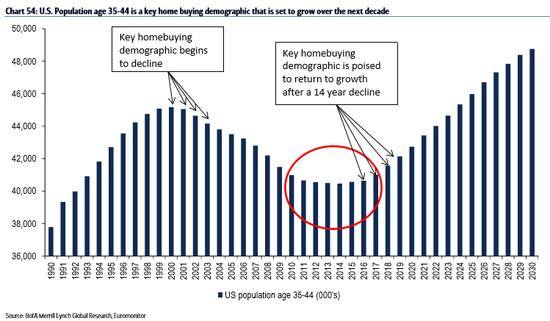

Chart 13: U.S. Population age 35 -44 is a key home buying demographic that is set to grow over the next decade

Handing back to Smead. ‘Among our 330m residents are 86m people between 24 and 42 years old, with their group peak population year at 27 years old, currently. They marry, on average, in their late twenties and early thirties and have their children between the ages of 28-40. Their full force is not yet into the housing start data.’

‘At 5% mortgage rates and with today’s level of affordability, history shows that there is nothing in the way from having a home building boom over the next ten years to satisfy this demographic demand.’

‘Some believe that a larger number of the millennial group will not do what prior groups did—buy houses, build families, etc. If that amounts to 5-10% of them, it means that there will still be between 17 to 23.5% more home and car buyers on average in the next ten years than the last ten years.’

Cash

A final note on cash. Over the long-term it’s not sensible to hold large amounts of cash. But at times it will be elevated due to sales outweighing satisfactory replacement opportunities. Sometimes those sales are forced, like the acquisition of Trade Me.

We don’t target specific levels of cash, but it makes sense that when the market is at or near peaks suitable opportunities may lag behind sales as more stocks are trading above fair value. The cheaper the market gets, the more likely we’ll be fully invested.

If the market gets really cheap, like March 2009, for example, then we’ll sell cheap stocks for even cheaper stocks to increase the potential return of the portfolio without materially increasing risk, as timing the market will never be our speciality.

In the spirit of the new year, we offer our 2019 forecast.

- There will be three or four excellent individual stock buying opportunities

- Dividends will remain fairly stable

- Stock prices will fluctuate far more than their intrinsic value

- Many investors will sell out in anticipation of the next crisis, only to regret it in the long-term

- We’ll acknowledge our mistakes as quickly as possible

- We’ll risk looking foolish to beat the market over the long term

We hope you had a happy and safe Christmas break, and please call us on 1300 880 160 or email us on support@investsmart.com.au if you have any questions about the funds. Next year promises to be full of opportunity, even if it doesn’t feel like it at the time.

To see more information on our Equity Growth Portfolio, click here.

Frequently Asked Questions about this Article…

The Intelligent Investor Equity Growth Portfolio focuses on finding value in excellent businesses facing temporary issues and special situations that produce mis-pricings. The strategy emphasizes long-term investment horizons and high insider-ownership to achieve superior returns.

High insider-ownership is a reliable indicator of outperformance because it aligns the interests of management with shareholders. Companies with significant insider stakes tend to perform better as management is more likely to make decisions that benefit long-term growth.

Intelligent Investor does not let macroeconomic conditions deter them from investing when compensated for risks. They focus on fundamentals and believe that long-term patience and strategic stock selection can lead to superior returns, even during market downturns.

Special situations refer to investment opportunities like spin-offs, changes in CEO, capital raisings, and uncovering hidden assets. These situations often lead to mis-pricings that can be exploited for higher returns.

Patience is crucial because the strategy involves enduring short-term underperformance for long-term gains. The approach relies on the belief that consistent adherence to a proven investment process will yield superior returns over time.

Intelligent Investor is bullish on the US housing market due to a weak recovery in new builds, historical affordability trends, and the demographic potential of the millennial population, which is expected to drive demand for housing.

Trust is fundamental to Intelligent Investor's approach as they aim to demystify the investment industry and empower investors with independent and clear insights. Trust, combined with a commitment to outperform, forms the basis of their relationship with investors.

This quote underscores Intelligent Investor's belief in the importance of patience and long-term thinking in investing. By focusing on enduring value and avoiding short-term market timing, investors can achieve superior returns over time.