2021: Edition 34 - Facts

Last Night's Markets

A Tech View

Changing Facts

China & The Colour Of The Cats

NFTs & The Price of Innovation

Research and Diversions

Ask Alan

Next Week

Last Week

Last Night's Markets

As at 5:00am EST:

| Name | Price | % Change |

|---|---|---|

| Dow Jones Industrial Average | 35,409.3 | - 0.1% |

| S&P 500 | 4,539.2 | 0.0% |

| Nasdaq Composite | 15,354.8 | 0.2% |

| The Global Dow USD | 4,098.3 | 0.1% |

| Gold | 1,833.2 | 1.2% |

| Crude Oil WTI | 69.51 | - 0.7% |

| Australian Dollar / US Dollar | 0.7460 | 0.8% |

| Bitcoin / US Dollar | 50,382 | 1.7% |

| U.S. 10-Year Bond Yield | 1.328% | 0.036 |

Also: The US economy added just 235,000 jobs in August, disappointing with a sharp drop from larger gains during early summer. Wage growth, though was strong, with earnings rising 0.6% in a single month; 4.3% on a year-over-year basis.

A Tech View

I’m honoured today to be actually writing what I regard as mandatory weekend reading. Every Saturday morning, I sit at the table with a homemade espresso and happily scroll through the Weekend Briefing. In Alan’s absence, I’m hoping I can hold the mantle as well as Maria and Evan have done so far.

As you may expect, there’ll be a technology bent, given that’s my bailiwick as Eureka Report’s Technology Commentator.

Changing Facts

Spring is here, and as our season changes, we’re reminded a lot can change in a week; especially during COVID times. With daily case numbers rising three-fold in Victoria and swelling to over 1,400 in NSW, the COVID-zero dream Australia has held onto so dearly, seems to be over.

It’s easy to forget that at the dawn of the pandemic 18 months ago, our official national strategy was suppression, rather than elimination, and either by stealth or luck, it became clear that a flat zero number of cases was the only number tolerable. As the Delta strain persists and spreads despite tough lockdowns, Government strategies are quickly being revised. As famed economist Paul Samuelson said:

- “When the facts change, I change my mind, what do you do sir?”

In the space of a week, the Andrews’ Government has gone from claiming we’ll beat the delta strain, as we have before – to allowing. New facts; changed minds.

In recent days, Victorians have been advised they’ll need to learn to live with the virus and vaccinate their way out of this. Our two biggest states of NSW and Victoria now are aligned strategically on the path out, though it seems we still have a way to go to get some form of national alignment.

This revelation got me thinking about the influence legacy thinking has on policy, technology, and even our investment decisions. I did a survey to my 15,000 followers across Twitter and LinkedIn and asked this simple question:

Q: Name some things you think would be outlawed if they were invented today?

The list was long and responses included: Alcohol (by far the most oft-cited), motorcycles, Teflon, single-use plastics, fossil fuels, Orthodox religions, trans-fats, and refined sugar, to name a few. Of course, all responses have the benefit of hindsight where they all know the long term social and environmental externalities, which we rarely, if ever know as new technologies and even diseases arrive.

Our culture, and what we collectively believe, is powerful. It has a far greater impact on technology and policy than we admit. It’s in times of global calamities (like COVID) and technological upheaval, that we can observe and discover what really matters. This brings us to China.

China & The Colour Of The Cats

During the opening of the Chinese economy then leader, Deng Xiaoping famously said, in reference to finding an economic system that works:

- “It doesn’t matter if the cat is black or white so long as it as long as it catches mice.”

This shift in thinking and policy (ultimately allowing private enterprise) brought upon the greatest economic miracle the world has ever seen. Since the first free trade economic zones opened in China in 1978, it has had an average economic growth rate of 10 per cent and lifted more than 800 million people out of poverty. But it goes well beyond poverty: China now has more than 1,000 billionaires, a third more than the USA.

And all of a sudden, China is starting to care about what colour the mouse is again.

China has done much to assert its power against its newly spawned elite. China’s richest man, and founder of Alibaba, Jack Ma, famously went missing for three months late last year. It seems Xi Jinping didn’t care for Ma’s flamboyance and commentary on financial governance. Actions via Beijing include the Ant Financial Float cancellation and continued tightening of controls on Hong Kong, despite some of the largest protests in human history in 2020.

In July, its biggest ride-hailing business Didi was blocked from App stores citing security concerns. Shares in Tencent declined more than 10 per cent after Beijing called video games opium for the mind. They’ve now put time limits on youth playing video games to 3 hours a week. China’s school curriculum was also overhauled to educate young children on Xi Jinping’s principles.

It seems the little red book is back – and the capitalist dream in China, like our COVID-zero dream, might be over.

In times of great economic upheaval, history can be a better guide than technological capability. My prediction: the PRC will take back control of all their public firms of significant size, and potentially even nationalise them entirely. We’ll all need to pay close attention to investments in the Middle Kingdom and those relying heavily on its supply chains. It seems some legacy decisions can be reversed when leaders have absolute power.

NFTs & The Price of Innovation

And just while most of us were trying to work out what NFTs (Non-Fungible Tokens) actually are, they have become a giant asset class. In the last week of August, total sales of NFTs topped US$1 billion. It seems that 2021 will be the year of NFTs as people and even corporations get on board to avoid FOMO.

Most notably, Visa purchased a Crypto Punk for approx. US$150,000 (or 49.5 ether) for their collection. While a Coca-Cola NFT auction fetched more than US$575,000 for digital collectibles. And a teenager from London collected $350,000 for his Weird Whales collection. And if you think this whole thing is weird, the largest art museum (The State Hermitage) in the world is about to Auction NFTs for actual Da Vincis and Monets. We are giving birth to the metaverse.

So, what do you actually get beyond the token? An exclusive NFT video featuring Mikhail Piotrovsky, a director of the museum, showing how he certifies copies of the artworks by signing them and indicating the exact time of each signature – all store on the blockchain. The auction is underway and you can bid here. Expect this bubble to have plenty of air in it!

Always wanting to practice what I preach – I auctioned my first NFT. It was a digital version of my tech TV show – The Rebound on Channel 9. The winning bidder paid just under 1-Ether for the crypto episode - around $4,000 AUD. The kicker was the smart contract which gives them the right to appear in 8 episodes of the show next season to be mentored, which will reach around 800,000 people. It was a pretty good deal given the cost of paid TV ads with this reach would be well over $100,000.

Research and Diversions

Here’s a mix of R&D reads from Steve, and from InvestSMART’s Mitchell Sneddon:

6 simple things you can do to prevent getting hacked.

Doctors claim to have found how to reverse cell ageing.

Apple claims it will be bringing emergency satellite capabilities to iPhones.

Can robots emerge into machines of loving grace?

It’s the 30th anniversary of Pearl Jam’s first album 10. The classic video for Even Flow – reminds us of mosh pits and how close human contact once was!

On Sept 4th 1947 the Ford Edsel was released – the car Industry’s most famous flop!

.png)

From Graham Witcomb at the Intelligent Investor, Warren Buffett’s sidekick, Ted Weschler tells us how to build a fortune: “Start early, maximise the employer match, invest 100% in equities, and ignore all other noise.”

Founder of Dicker Data, David Dicker with one of the best explanations for a director selling shares we’ve ever seen.

The average smartphone contains roughly 80% of the stable elements on the periodic table, here’s a cool image of all the metals that go into one device.

Mickey at the Intelligent Investor has been reading up on the origin of lizards.

Scientists from Osaka University 3D print wagyu beef.

The comedy wildlife photography awards are on again. I like the squirrel who appears to be playing a tiny flute, or it may have just rolled a spliff.

The Beatles' single "Help!" goes #1 – Appropriate given we lag the developed world in vax rollouts!

It’s spring so here’s some springtime feel-good bangers for you – thank you Zan Rowe on Double J Friday morning for the inspiration when putting this lineup together! 11am every Friday morning Zan does Desko, a disco at your desk and it’s always a highlight of my work from home week.

Minnie Riperton with Les Fleurs.

Eels with Mr. E’s Beautiful Blues.

Mr Blue Sky from ELO.

And finally, Earth, Wind & Fire with September.

Plus: 1998 on this day Google is formally incorporated by two Stanford graduate students – you can check out what it looked like then with the Internet Wayback Machine... and any other site too! It’s a pretty cool tool.

Ask Alan

Ask Alan will be back as soon as Alan's new knee is feeling fine! If you do have a question for Alan or SMSF Coach Olivia Long, you can submit it here and Alan or Olivia will get to it.

.jpg)

Next Week

By Ryan Felsman, Senior Economist, CommSec.

Australia: Taper tinkering from the Reserve Bank?

- In the coming week, the Reserve Bank (RBA) will be at the front-and-centre of investors’ minds with the Board to provide updates on its policy settings amid an escalating health crisis and worsening near-term economic outlook.

- The week kicks-off on Monday when the Melbourne Institute issues its monthly inflation gauge. In July, the headline and trimmed mean measures of inflation were both up 0.5 per cent.

- Also on Monday, ANZ releases its measure of job advertisements. Ads had lifted for a record 13 successive months through to June, but fell by 0.5 per cent in July from 12½-year highs. Extended lockdowns in NSW, Victoria and the ACT are expected to reduce recruitment activity in August.

- On Tuesday, ANZ and Roy Morgan jointly release the weekly consumer confidence survey. And credit and debit card lending data is scheduled for release by the RBA for July.

- Also on Tuesday, the RBA Board meets and hands down its policy decision at 2.30pm AEST. At the meeting, Commonwealth Bank (CBA) Group economists expect the Board to announce that they will not proceed with a previously announced tapering of bond purchases. The Board had advised that they planned to reduce the weekly rate of bond buying from $5 billion to $4 billion from September. But with the hit to the economy from Delta-induced lockdowns far more significant than anticipated, we expect the Board to stick with the current level of purchases through to November.

- On Wednesday, the Bureau of Statistics (ABS) releases the “Labour Account Australia” report, featuring key insights on the number of people working secondary or multiple jobs in the period to June.

- Also on Wednesday, Guy Debelle, Deputy Governor delivers an online speech at TradeTech FX 2021 at 6.10pm AEST. And Dr Debelle returns to the “podium” with another online address on Thursday, this time to ASIFMA Compliance Week at 6.35pm AEST.

- Also on Thursday, the ABS publishes its weekly payroll jobs and wages data for the fortnight to August 14.

Overseas: China data in focus in US holiday-shortened week

- Chinese inflation, international trade and credit growth data are key focuses this week with the US economic data docket light on tier-1 releases in a holiday shortened week.

- On Monday, US financial markets are closed in observance of the Labour Day public holiday.

- In China on Tuesday, the National Bureau of Statistics (NBS) is scheduled to release international trade data for August. China’s imports and exports rose at double-digit annual rates in July, but growth has slowed as global efforts to control the contagious Covid-19 Delta variant weigh on spending. In August, exports are tipped to lift by 18.8 per cent on a year ago with imports up 27.2 per cent over the year.

- On Wednesday in the US, the weekly data on US mortgage applications from the Mortgage Bankers Association is scheduled with the regular weekly Johnson Redbook chain store sales index. Consumer credit figures are also due. US consumer borrowing surged in June with total credit jumping US$37.7 billion – the most on record – due to large increases in credit card balances and non-revolving loans. Credit could lift by US$28.6 billion in July.

- Also on Wednesday, the US Federal Reserve’s 12 districts provide updates on economic conditions in the Beige Book. And influential New York Federal Reserve President John Williams discusses the economic outlook.

- On the data docket, the US Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) is released. US job openings surged in June to a fresh record high of 10.1 million available positions. And the IBD/TIPP economic optimism index is tipped to ease from 53.6 to 53.0 in September, rounding-out a busy day for investors.

- On Thursday in China, inflation data is scheduled for August. Prices diverged in July with business inflation pressures building, while consumer prices remained largely contained. The Producer Price Index (PPI) jumped 9.0 per cent from a year earlier in July, the strongest growth rate since late 2008. But the Consumer Price Index (CPI) rose 1.0 per cent in July when compared to last year with food prices easing 3.7 per cent. The transmission of higher materials costs into downstream sectors remains limited. And in August, consumer prices are expected to lift by 1.1 per cent on a year ago with producer prices up 8.9 per cent over the year.

- On Thursday in the US, the weekly claims for unemployment benefits (initial jobless claims) data dominates market attention.

- On Friday in the US, wholesale inventories and producer prices data are both scheduled. The advances in the annual July headline PPI ( 7.8 per cent) and core PPI (excluding food and energy, 6.2 per cent) were the largest annual gains since 2010. A lift in the monthly PPI of around 0.5 per cent is expected in August.

- In China over the week, August credit data – aggregate financing, loan growth and money supply – are scheduled.

Last Week

By Shane Oliver, Head of Investment Strategy and Chief Economist, AMP Capital.

Investment markets and key developments over the past week

- Global share markets saw continuing gains over the past week helped by expectations that the Delta outbreak won’t lead to lockdowns in major developed countries and that the Fed would be gradual in scaling back monetary stimulus. Helped by the positive global lead and rapidly rising vaccination rates, the Australian share market also rose despite rising local coronavirus cases, with the gains led by energy, property, industrial and IT stocks. Bond yields fell in the US but rose elsewhere. Oil prices rose but copper and iron ore prices fell. The $A rose back above $US0.74 as the $US slipped.

- From their March 2020 lows US shares are up 14 of the last 17 months and Australian shares are up 16 of the last 17 months. But while shares keep powering on month after month, the risk of a short-term correction remains – with threats from coronavirus, the approach of Fed tapering, the US debt ceiling and tax hikes and supply constraints and as the next six weeks is often rough for shares. However, the likely continuation of the economic recovery beyond near term interruptions, vaccines ultimately allowing a more sustained reopening and still low interest rates with tight monetary policy a long way off augurs well for shares over the next 12 months.

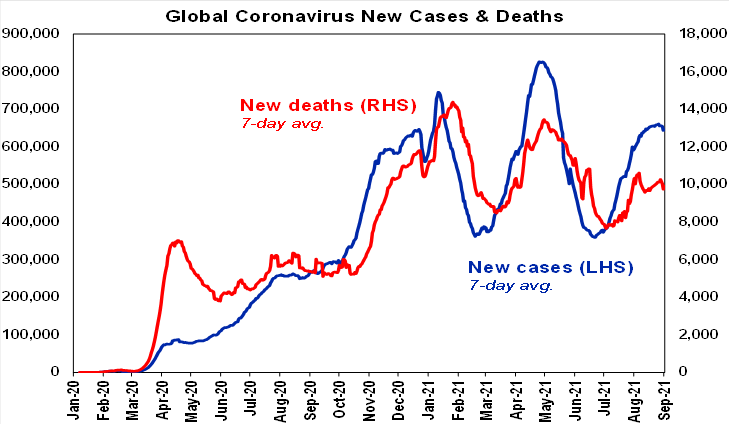

- New global coronavirus cases started to decline in the last week. South America continues to trend down, Asia is of its highs and the US and Europe are showing signs of stabilising.

Source: ourworldindata.org, AMP Capital

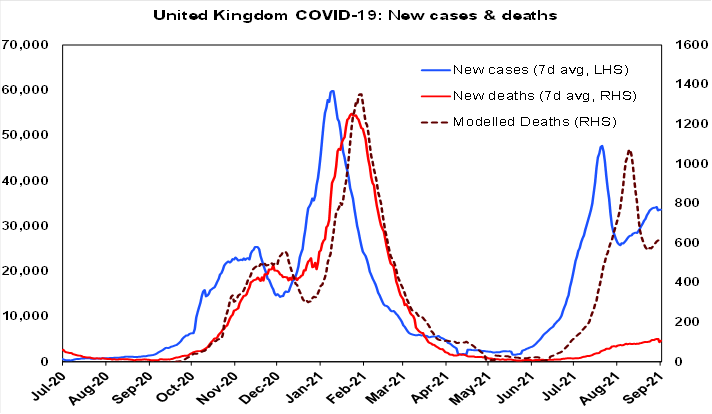

- The really good news is that despite the increase in cases from mid year lows the UK, Europe and Canada have continued to see hospitalisations and deaths remain relatively low – indicating that vaccines continue to work in heading off serious illness. For example, the next chart shows deaths in the UK (the red line) are running well below the level predicted on the basis of the previous wave (dashed line).

Source: ourworldindata.org, AMP Capital

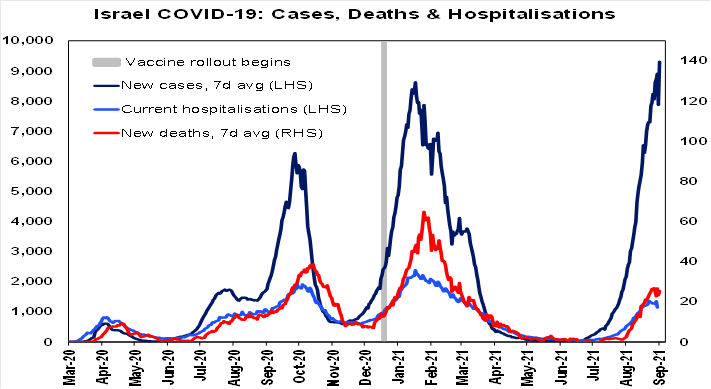

- Meanwhile, Israel’s less favourable experience highlights the need for booster shots. Israel was early to vaccinate but saw declining vaccine efficacy for those vaccinated early this year contribute to a surge in new cases. There is some evidence that efficacy against Delta infection declines faster for Pfizer than AstraZeneca and it may also reflect the shorter gap between Pfizer doses compared to AZ doses (both of which may have benefitted the UK). Israel is now rapidly rolling out booster shots (with 25% of the population boosted) - which may be helping to stabilise hospitalisations and deaths.

Source: ourworldindata.org, AMP Capital

- Early evidence from Israel indicates a 10-fold decline in the risk of infection for those with a booster compared to those with two doses. While there may be various differences, the Israeli experience warns that the US, UK, Canada and Europe need to rapidly ramp up booster shots ahead of winter. Australia will need to do the same by year end. Interestingly, some studies show Moderna’s vaccine provides even higher protection against infection & hospitalisation than Pfizer and AZ.

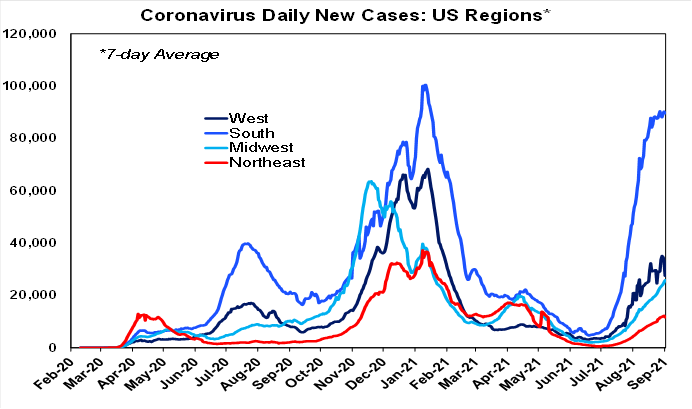

- The US is continuing to experience mostly a “pandemic of the unvaccinated” with the lowly vaccinated South faring the worst. However, there are some signs it may be slowing.

Source: ourworldindata.org, AMP Capital

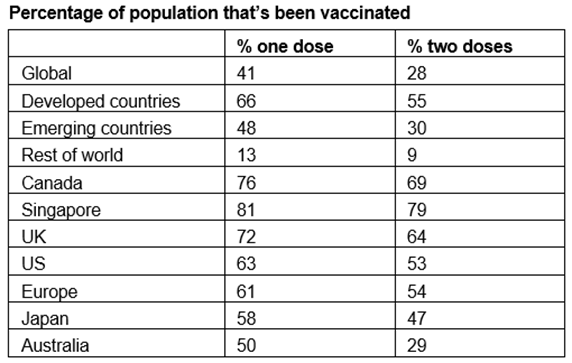

- Vaccination is continuing to ramp up globally. So far 41% of people globally and 66% in developed countries have now had at least one dose of vaccine.

Source: ourworldindata.org,AMP Capital

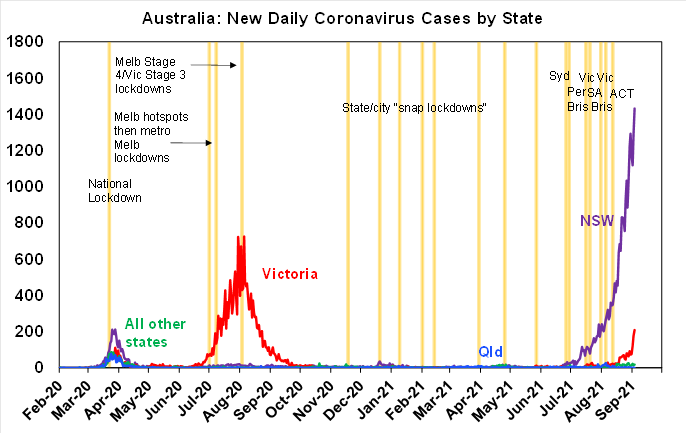

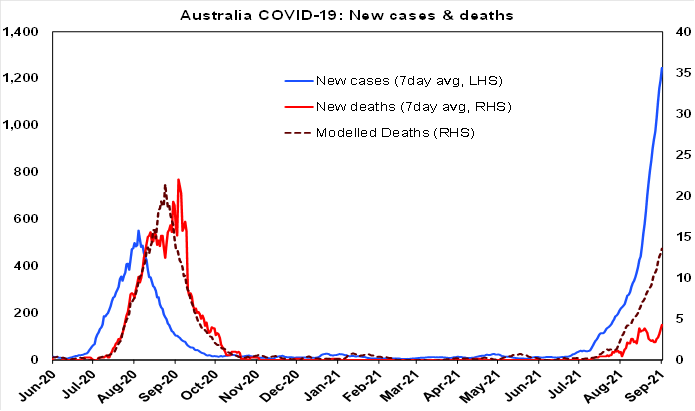

- Unfortunately, the bad news in Australia is that the number of new cases continues to surge in NSW and Victoria and there have been new covid scares in SA and Queensland.

Source: covid19data.com.au, AMP Capital

- The good news is that Australia now has around 50% of its whole population with one dose. The past week saw nearly 2 million people vaccinated with one jab (including me as I got my second AZ shot). At this rate, we will reach the national goal of 70% of adults being fully vaccinated around mid-October and 80% of adults in November. Of course, this will still leave 44% & then 36% of the whole population respectively unvaccinated and at risk. And combined with the higher transmissibility of the Delta variant, the reality that vaccinated people are not fully protected against infection and the higher number of cases in NSW and Victoria it’s unclear as to how much we can safely reopen at these targets. This is reflected in the understandable position of some Premiers in “covid zero” states. It may mean that some states still keep their borders closed once the targets are hit, that the reopening is mainly for the unvaccinated for a while at least and that some people remain wary about getting out from “under the doona”. However, the attainment of even higher vaccination targets is not that further away. If we keep going at the current rate of vaccination, helped along by vaccine passports (no jab/no entry requirements) to get the vaccine hesitant over the line along with the vaccination of 12–15-year-old children, then we will reach 80% of the whole population being vaccinated in December.

- There is also good news in that despite the surge in cases in Australia, hospitalisations and deaths are more subdued in this wave. The next chart shows deaths (the red line) are running well below the level predicted on the basis of the previous wave (dashed line). Unfortunately, the rise in new cases points to a big rise in deaths in the weeks ahead, but so far at least deaths are running about 30% of the level suggested by last years’ experience. So, the relatively high vaccination rate for older people already appears to be helping.

Source: ourworldindata.org, covid19data.com.au, AMP Capital

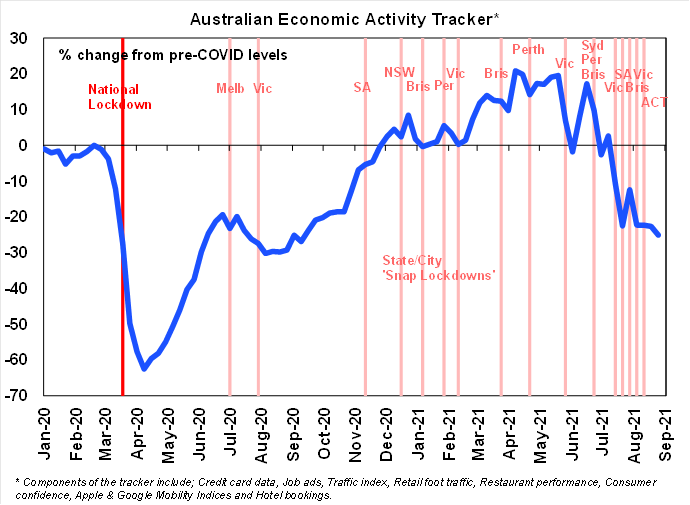

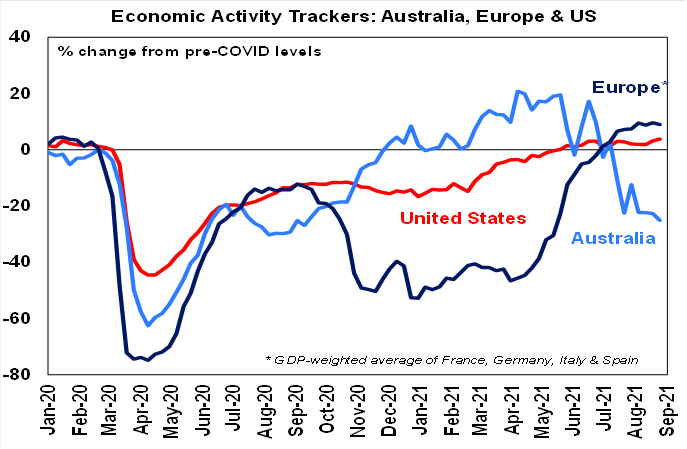

- Our Australian Economic Activity Tracker fell again over the last week reflecting the economic impact of the lockdowns. However, after its plunge since June we remain of the view that it’s likely at or close to the bottom as NSW and Victoria have probably hit bottom - providing of course that other states don’t enter extended hard lockdowns too.

Source: AMP Capital

- Fortunately, June quarter GDP rose a stronger than expected 0.7% in Australia indicating that demand growth was still solid prior to the latest lockdowns even though stocks and trade detracted from growth. And of the course the rise avoids, for now, headlines of a double dip recession.

- However, the hit to the economy in this half year from the lockdowns is escalating. Based on the extension of the Melbourne lockdown to at least around 23rd September and the ACT lockdown by another two weeks our estimate of the cost of the hit to economic activity from the lockdowns since May has now blown out to $28bn which will mean a big decline in GDP this quarter. We expect September quarter GDP to fall by at least -4%. And a likely constrained initial reopening even when the vaccine targets are hit points to only a weak recovery in GDP in the December quarter. Added to this is the risk that other states may have lockdowns too. The bottom line is that growth through this year could now come in around zero, which is well below the RBA’s assessment for 4% growth.

- That said while the near-term outlook is bleak there is good reason to expect a strong rebound in growth through next year as vaccination rates ramp up, we learn to live with covid as vaccines help keep hospitalisations and deaths down, pent up demand is ultimately unleashed, Australia benefits from strong growth globally and monetary policy is easier for longer. As a result, we see 6.5% or so growth through next year.

- However, we continue to see the RBA deciding to delay its decision to slow its bond buying at its September meeting and to continue at the rate of $5bn into early next year. This is because the bigger hit to near term growth now means that even with a strong rebound in the economy through next year the profile for GDP and unemployment in 2022 will be significantly weaker than the RBA was assuming a month ago.

- Our US Economic Activity Tracker rose over the past week as Delta fears receded a bit, but our European Tracker edged down slightly. The absence of lockdowns has headed off steep declines like we saw in last year’s outbreaks.

Based on weekly data for eg job ads, restaurant bookings, confidence, mobility, credit & debt card transactions, retail foot traffic, hotel bookings.

Source: AMP Capital

- On the fiscal policy front in the US, its looking increasingly clear that the Democrats plans for $US3.5trn in spending over eight years will be scaled back. To get Democrat Senators Manchin and Sinema (who both continue to say they won’t support $US3.5trn) on side and raise the debt ceiling its likely to be scaled back to maybe $US2trn, and with tax hikes (on high earners, corporates, capital gains and dividends) will mean net new spending of maybe $US1trn but that’s spread over 8 years. The process of trying to wrap this up in the next few months – and particularly raise the debt ceiling and the tax hikes – could cause some gyrations in shares.

- After the NBC Comeback Special in 1968, the return to live concerts in 1969 and That’s The Way It Is and touring in 1970, 1971 seemed like a bit of a quieter year for Elvis (although he did perform 156 concerts). However, he did make it back to Nashville for another marathon recording session and came up with several classic recordings including Its Only Love which was written by Mark James, who also wrote Suspicious Minds and Moody Blue, and I’m Leavin’.

Major global economic events and implications

- US data was mixed. The August ISM manufacturing condition index surprisingly rose to a very strong 59.9, albeit its down from its high a few months ago. Construction spending rose more than expected and home prices continue to surge. Jobs data was mixed with the ADP survey softer but jobless claims down. And consumer confidence fell. On the inflation front the prices paid component of the ISM survey fell but remains high.

- Eurozone unemployment fell in July as economic recovery resumed and inflation rose more than expected in August, albeit with core inflation only at 1.6%yoy (despite producer price inflation of 12.1%yoy). Partly in response hawkish ECB officials are talking of an ECB taper, although the ECB is likely to be even more patient than the Fed.

- Japanese industrial production fell back in June but by less than expected, consumer confidence fell less than expected and unemployment fell in July.

- Chinese business conditions PMIs fell in August mainly due to coronavirus restrictions weighing on services. Fortunately, with cases coming under control again restrictions are starting to be relaxed so some rebound is likely this month.

Australian economic events and implications

- Australian data was mostly strong – although given the lockdowns some of it is now a bit dated in some areas. As noted, GDP rose a stronger than expected 0.7% in the June quarter with strong growth in domestic demand – particularly for consumer spending and public demand - but detractions from trade and inventory and of course a big fall likely this quarter.

- Record current account and trade surpluses for the June quarter and June respectively are great news and indicate that Australia is not reliant on foreign capital. But the recent strength has been driven more by stronger export prices (notably for iron ore) rather than volumes and the 30% plunge in the iron ore price since July suggests that we have seen or come close to the peak in the current account and trade surpluses. That said the iron ore price still remains very high, so the surpluses are likely to remain at least for a while yet.

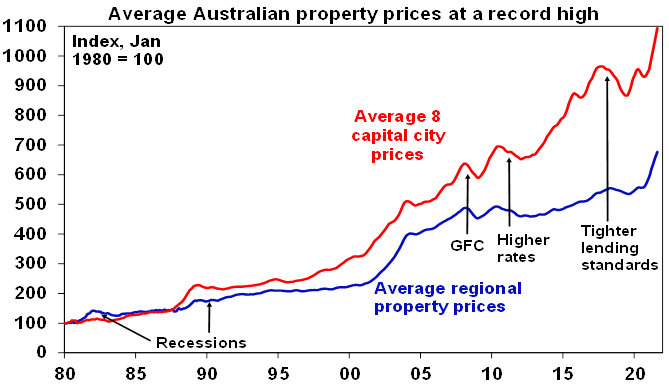

- Building approvals down, but housing finance and home prices up. While the ending of HomeBuilder and its pull forward of demand for new homes continues to weigh on building approvals which fell another 8.6% in July pointing to a fall in home building next year, housing finance edged up again in July as upgraders and investors offset weakness from first home buyers. The near record level of housing finance points to a likely further acceleration in housing credit growth and continued strength in home prices.

- Home price gains slowed a bit further in August according to CoreLogic but remained very strong at 1.5%mom and saw their strongest annual increase in more than 32 years. While worsening affordability and the lockdowns may have had some dampening impact on prices, monthly price growth remains stronger than we were assuming before the lockdowns. Listings have generally slowed more than demand suggesting that housing market participants are generally feeling far more confident about the outlook than was the case through last year’s lockdowns. We expect capital city average home prices to rise 20% this year, with Sydney likely to be the strongest at 25% growth, before slowing to 7% growth next year.

Source: ABS, AMP Capital

What to watch over the next week?

- In the US, it will be a relatively quiet week on the data front with job openings (Wednesday) & producer prices (Friday).

- The ECB (Wednesday) may slow its bond buying a bit but is likely to remain dovish. While some hawkish Eurozone central bankers are arguing for a reduction in ECB bond buying as a result of the improving outlook, this may just see a slowing in its “significantly higher” pandemic bond buying back to the levels seen earlier this year before the spike in bond yields, but with the ECB otherwise likely to remain patient given issues around Delta, Chinese growth and the Fed’s taper.

- Chinese August data is expected to show a further slight moderation in export and import growth (Tuesday) and flat CPI inflation (Thursday) at 1%yoy but a slight fall in producer price inflation to 8.9%yoy. Credit data may also be released.

- In Australia, the RBA (Tuesday) is expected to delay the tapering of its bond buying and continue it at the rate of $5bn a week until a review early next year. In fact there is a case to increase bond buying. At its last meeting it indicated that it “would be prepared to act in response to further bad news on the health front should that lead to a more significant setback for the economic recovery”. Since then the extension and/or addition of lockdowns in NSW, Victoria and the ACT constitute a “significant setback” which mean that GDP growth this year could now come in around zero which is well down from the RBA’s 4%. And the initial part of the recovery is likely to be more subdued against a backdrop of high numbers of coronavirus cases. So, the level of economic activity will be far lower and the level of unemployment far higher through 2022 than the RBA was assuming a month ago. Delaying the taper and maybe even increasing bond buying to say $6bn a week may not result in a big boost to 2022 growth and the heavy lifting will have to come from fiscal policy, but it will help. It also won’t look so good for the RBA to be reducing stimulus by proceeding with the taper at a time when the economic outlook has deteriorated significantly.

- On the data front in Australia, expect a fall in ANZ job ads (Monday) and further weakness in payroll jobs (Thursday).

Outlook for investment markets

- Shares remain vulnerable to a short-term correction with possible triggers being coronavirus, the inflation scare and US taper talk, likely US tax hikes and a debt ceiling standoff and geopolitical risks. But looking through the short-term noise, the combination of improving global growth and earnings helped by more fiscal stimulus, vaccines ultimately allowing a more sustained reopening and still low interest rates augurs well for shares over the next 12 months.

- Expect the rising trend in bond yields to resume as it becomes clear the global recovery is continuing resulting in capital losses and poor returns from bonds over the next 12 months.

- Unlisted commercial property may still see some weakness in retail and office returns but industrial is likely to be strong. Unlisted infrastructure is expected to see solid returns.

- Australian home prices look likely to rise by around 20% this year before slowing to around 7% next year, being boosted by ultra-low mortgage rates, economic recovery and FOMO, but expect a progressive slowing in the pace of gains as poor affordability impacts, government home buyer incentives are cut back, fixed mortgage rates rise, macro prudential tightening kicks in and immigration remains down relative to normal. The lockdowns have increased short term uncertainty though.

- Cash and bank deposits are likely to provide poor returns, given the ultra-low cash rate of 0.1%. The setback from coronavirus lockdowns could push the first rate hike back into 2024.

- Although the $A could pull back further in response to the latest coronavirus outbreaks, the threats posed to global and Australian growth and falling iron ore prices, a rising trend is likely over the next 12 months helped by strong commodity prices and a cyclical decline in the US dollar, probably taking the $A up to around $US0.80.

Frequently Asked Questions about this Article…

Global stock markets have been experiencing gains, driven by expectations that the Delta variant won't lead to lockdowns in major developed countries and that the Federal Reserve will be gradual in scaling back monetary stimulus. The Australian share market has also risen, with energy, property, industrial, and IT stocks leading the gains.

The COVID-19 situation, particularly the Delta variant, has led to lockdowns in major states like NSW and Victoria, impacting economic activity. However, vaccination rates are rising, and there is optimism for a strong economic rebound next year as vaccines help manage hospitalizations and deaths.

NFTs (Non-Fungible Tokens) have become a significant asset class in 2021, with total sales topping US$1 billion in the last week of August. Corporations and individuals are investing in NFTs to avoid missing out, with notable purchases like Visa's acquisition of a Crypto Punk for approximately US$150,000.

China's recent policy shifts, including increased control over major firms and regulatory actions against tech giants, are impacting global investments. Investors need to pay close attention to China's economic policies and their effects on supply chains and companies heavily reliant on the Chinese market.

The Reserve Bank of Australia is expected to delay its planned tapering of bond purchases due to the economic impact of COVID-19 lockdowns. The RBA is likely to maintain the current level of bond buying to support the economy, with a review expected early next year.