We're buying Hunter Hall

For the first time since I have been looking at LICs, I think Hunter Hall Global Value Limited (HHV) is a buy. After trading at a discount to net tangible assets for such a long time, I now see a catalyst for the share price to reflect the underlying performance of the fund – which has outperformed its benchmark by 2.4 per cent per annum since inception in 2004.

Peter Hall, the name on the door, is back in the country. For years Hall has operated out of the UK, managing the portfolio from London with a team of analysts across the globe, but mostly in Hunter Hall's Pitt Street office in Sydney. There is only so much you can do when you are across the other side of the world and getting out there and pressing the flesh isn't one of those things.

Now he is back living in Sydney, one of the first things the team organised was a series of investor briefings across the country and Hall is just as good at pressing the flesh as he is at picking stocks. Why is this important? Because it adds that intangible element of a strong message and confidence that LIC investors gravitate towards.

Currently the discount to NTA (post tax, which takes into consideration the sizeable capital gain from its biggest holding, St Barbara Limited) sits at 8.87 per cent and this has been closing since the start of the year (it was 10 per cent in March and 13 per cent in February). Peter Hall is engaging and with him out there meeting with advisers, shareholders and journalists spreading the Hunter Hall message, if the performance continues the gap will close.

Leadership aside, the Hunter Hall proposition is a unique one for two reasons. Firstly it is the only “ethical” LIC out there. More on this later. Secondly, it is one of the only global LICs to include Australia instead of excluding it.

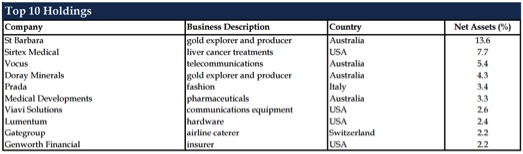

This second point is interesting because right now the portfolio is 30 per cent invested in Australian equities, dramatically overweight when compared to the portfolio's benchmark, the MSCI World Index. And when one of those Australian stocks is the ten bagger St Barbara Limited, why would you want to stop yourself from selecting stocks from all regions?

The portfolio is a real stock pickers' portfolio. Completely index unaware, the team go where the opportunity is – ethically of course – and the portfolio reflects this. When I spoke with Peter he let us in on some of the other Australian holdings, like his other play on gold Doray Minerals Limited (DRM) and pain management and asthma treatment device manufacturer Medical Developments International (MVP). For more on these companies and Hall's outlook check out the video below:

It is important to note the remainder of the fund is invested overseas. This gives investors the potential benefit from further declines in the Australian dollar, particularly against the US dollar, which 30 per cent of the fund is currently exposed to.

When it comes to the ethical aspect of Hunter Hall's investing, the team predominantly use what is known as a negative screening process. This filters out companies that manufacture things like weapons, tobacco and gambling related products, among others. Hunter Hall also use positive screening but on a smaller scale. Positive screening is looking for companies where the main business is helping to improve the environment (renewables) or making medical advances.

Ethical investing is a bit of a minefield and to see this you need to look no further than Hunter Hall's largest holding, St Barbara Ltd (SBM), a mining company. When I asked about this Hall had this to say: “Firstly all our funds are fossil fuel free and that means we do not invest in oil, gas or consumable fuels, or in uranium mining but we can invest in other mining. It does, however, require an extra level of diligence in our research around the management's policy on environmental remediation and workplace practices. Some mines are relatively limited in their environmental impact and can be effectively remediated and those are the ones we favour.”

Either way you slice it, ethical investing is not always going to please everyone and something will always be against someone's ethics.

There are a few risks investors need to be wary of. Market cap and liquidity will be an investor's main issue. It may be hard to buy. Additionally, being externally managed, you have to factor in performance fees going forward. Investors should hope performance fees get charged because that means the portfolio is heading in the right direction, but the performance fee will eat away at some of your returns.

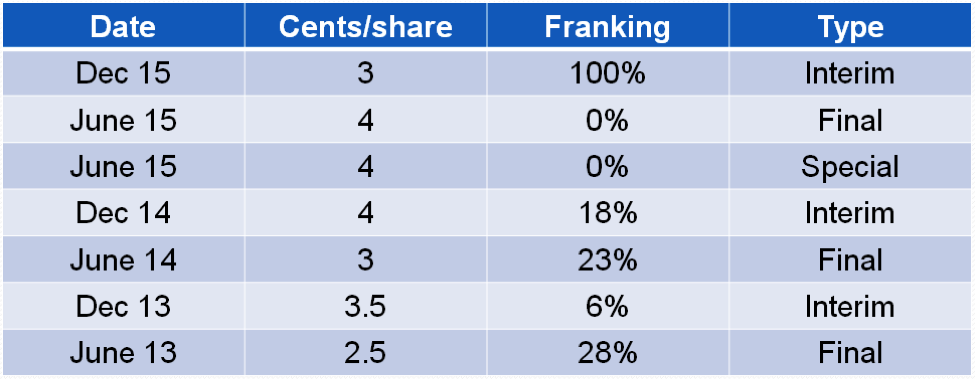

Dividends, like in a number of international LICs, are not always going to be 100 per cent fully franked. but in 2013 the board decided to pay half yearly dividends no matter the franking balance as it was decided some franking and a dividend was better than none.

There is also the potential the gap to NTA won't close. In the past HHV has conducted share buy backs to help close the gap. Approximately half the shares on issue were bought back with little to no effect. Hall says they are now trying new strategies focusing on the performance, steady dividend and effective communication of the message.

But say the team can close the gap to NTA, there may be the temptation to look to increase the size of the portfolio. There is no problem with this as long as it is done fairly to all shareholders. In the past it has been done via a placement to wholesale/institutional investors. This was to the detriment of the LIC's core shareholders - SMSF trustees. Hopefully the board have learnt from this, as once the placement had happened the share price never returned to the NTA. When speaking with Peter, he said there are no plans to raise capital, especially at a discount to NTA, in the foreseeable future.

The investment case is clear with HHV. You have a listed investment company that has flown under the radar due to the permanent discount it has traded at. That discount is still there and it compensates us for the management fees but the gap is starting to close. You have an international fund that goes where it finds opportunity and you have a 12 year track record that has outperformed the benchmark by 2.4 per cent pa.

For those still looking for international exposure at a significant discount, which I believe can be reduced now with Peter Hall back out on the beat, HHV is a buy. For those looking for a LIC that invests ethically than it is a buy every day of the week, because you have no other alternative!