Upgrading our valuation on Credit Corp

Credit Corp has only been covered for a short period of time here at Eureka, but has been a strong performer, delivering an upgrade to guidance for its acquisition rate of aged receivables in FY16. The company has a very strong management team in place and a defined, feasible strategy for growth. Further to this, upgrading guidance has become something of a habit, as we pointed out in our initial feature (click here).

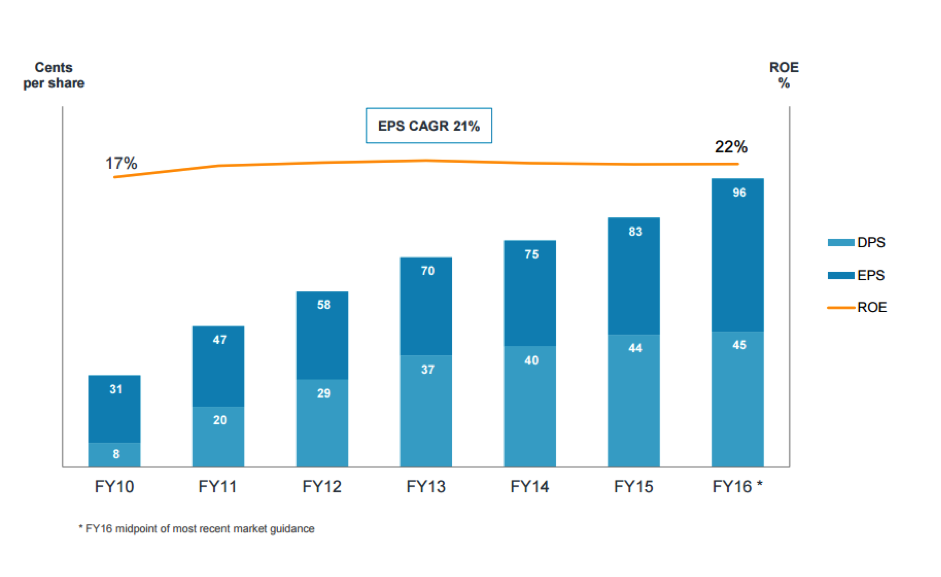

Following this strong track record of delivery on earnings guidance, CCP is a company that regularly under promises and over delivers. The balance sheet remains strong, despite the addition of some debt in recent years. In our view this level of gearing is well under control and the company is operating well within any lending covenants. Some debt has been taken onto the books, but this has been used to fund the consumer lending business growth. Here is a slide from CCP's most recent market update showing the strong track record of earnings per share (EPS) and dividends per share (DPS) growth:

Consumer lending - customer acquisition costs and SACCs

There has been a lot of press recently about payday lending, small amount credit contracts (SACCs) and other consumer leasing and credit card products. Pleasingly, CCP's collections and lending businesses fall outside of these areas of concern. Any changes to regulatory conditions may provide CCP with upside in terms of the contraction it could cause in the competitive landscape. Interestingly, the business competes with payday lenders in its advertising, through Google advertising and other means. In the US Google has announced that it will no longer allow ads for loans due within 60 days, or for loans with an interest rate over 36 per cent. This will become effective on July 13, and is at present US only. However, should this policy find its way to Australia, the cost of customer acquisitions through internet advertising might become more favourable for the likes of CCP – so this is definitely something to watch for investors.

Market opportunities

Credit Corp appears to have some strong opportunities to fuel growth. Some of the company's competitors are stumbling, and the entrance of US giant Encore Capital through the acquisition of a stake in ASX listed rival Baycorp has seemingly not pushed additional competition in the market. With CCP able to increase its market share in its core purchased debt ledger (PDL) business, the company appears to have a wealth of options at present. The key to this will be to manage the balance sheet, and take advantage of opportunities with considerations of risk.

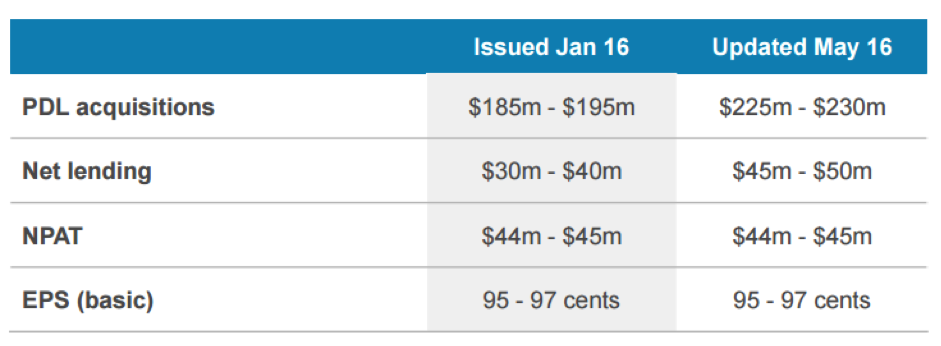

At present, these market conditions have seen CCP lift PDL acquisition guidance to a record range of $225m to $230m and net lending to a new range of $45m to $50m. While these upgrades won't necessarily see short term FY16 earnings gains, they do display that CCP is in a strong position to deliver double digit EPS growth in FY17 and beyond. With EPS guidance of 95 – 97 cents, we expect the dividend to come in around 48 cents for the full year payout amount. Here is CCP's guidance slide from its recent presentation:

Summary and valuation upgrade

In our view, the next 18 months should provide strong financial results in terms of the consumer lending division and our expectations are near the upper end of the guidance range for net profit when CCP provides FY16 numbers this coming August. Given our view that CCP is in a strong market position, we retain a buy recommendation and upgrade our valuation from $11.56 to $12.42. At our valuation, CCP is trading on an undemanding 12 month forward forecast PE (around 12x our FY17 earnings forecast). This $12.42 valuation is in our view conservative, and an upside case could see CCP rerate further. The key catalysts would be continuing strong performance in Australian PDL, profit growth in the loan book funded by cash flow generation, and some potential improvements in the US PDL market. The key risks that may offset this are largely within CCP's control at this point and relate to the business' ability to balance the need for capital (mostly expected to be debt) in order to take advantage of opportunities with the need to maintain a healthy balance sheet.