Sierra Wireless is wired for growth

Summary: The Internet of Things – where sensors and actuators are embedded in machines and other objects to bring them into the connected world – is not a new term. Manufacturers have been introducing such devices since the start of the century, but they didn't catch on. The advent of smartphones, however, has accelerated their development – and listed companies are beginning to reap the benefits. One such company is Sierra Wireless, which has quietly become the global leader in the embedded modular market for machine-to-machine cellular devices. |

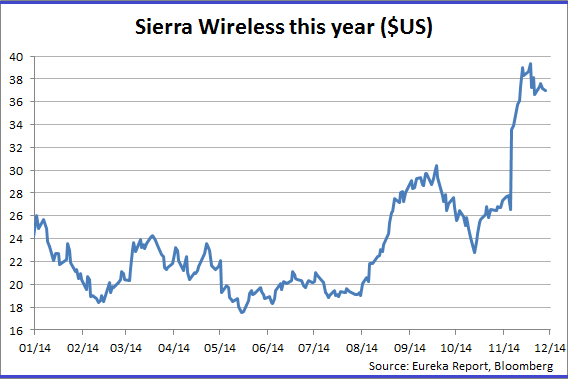

Key take-out: With real interest in the Internet of Things theme, stellar earnings growth and a positive outlook, I want to own Sierra in the long term, but I'm reluctant to buy it now after the stock has climbed 50% to $US38 this year. My advice would be to build a position if it retreats to around the $US30s. I have a target price of $US42 on the stock. |

Key beneficiaries: General investors. Category: International Shares. |

Recommendation: Speculative buy Price at call: $US36.99 Target price: $US42 Risk: High |

What is “the Internet of Things”? By most definitions it's embedding sensors and actuators in machines and other physical objects to bring them into the connected world.

Surprisingly, the term is not new but was coined by British technology pioneer Kevin Ashton in 1999 in an article for the RFID (Radio Frequency Identification Device) Journal. In 2000, LG introduced a refrigerator that could be connected to the internet but it didn't catch on. In spite of advances in RFID technology, the concept didn't really develop until recently with the advent of the smartphone and its “always on” connectivity. Now your fridge can send you a text saying “we're out of milk”!

The McKinsey Global Institute, in its influential report “Disruptive technologies: advances that will transform life, business, and the global economy”, puts a potential economic impact of between 2.7 and 6.2 trillion dollars per annum by 2025 as up to 1 trillion devices are connected in the public sector and businesses involved in manufacturing, health care, mining, retail, and transportation.

Practical applications in everyday life are endless. Our cars can be connected, and in our cities, sensors could provide smart parking, monitor the health of infrastructure (bridges, overpasses etc.), measure sound levels, and make our roads “smarter” aiding traffic flow. In the countryside, sensors could help detect forest fires, measure air pollution, flood levels etc. Utility infrastructure would benefit from smart grids, measurement of water flow, detection of hazardous materials and dangerous radiation levels.

One of the most beneficial applications would be in healthcare. Doctors and nurses could monitor vital signs of patients with chronic illnesses in real time, detect any problematic symptoms and advise patients what to do. Remote monitoring could reduce hospitalisations and the high costs of treating chronic diseases. Roughly 60% of overall health care costs are related to chronic disease.

It's obviously early days for the Internet of Things, but, as usual, I want to find a pure play as these sensors and devices are deployed around the wider world.

Sierra Wireless

Sierra Wireless, with a market cap of $US1.2 billion, is a Canadian company that trades on both Nasdaq and the TSE, has quietly become the global leader in the embedded modular market for machine-to-machine (M2M) cellular devices.

The M2M market continues to expand. In 2013 there were approximately 300 million embedded connected devices and that market is expected to grow to one billion by 2020. Sierra Wireless is the industry leader with 34% of the embedded module market. Their largest product line, AirPrime embedded wireless modules, are driving this growth. These devices are used in automotive, energy, sales and payments and mobile networking. Sierra Wireless is a clear pure play on 3G and 4G cellular technology within the M2M space.

The company's products feature cellular 3G and 4G connectivity solutions operating in over 80 networks globally. Their major clients include Cisco (with whom they have a close relationship), General Electric, Renault, Honeywell, Harman, Dell, Itron, Phillips and many more.

The company recently reported quarterly results which were well received in the market. Sierra reported record revenue of $US143.3 million and record earnings of US24 cents. Adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) doubled year over year to $US11.8 million.

On the conference call, chief executive Cohenour called the results "broad-based" and cited organic growth of 18.3% year over year. Their largest division, OEM solutions or AirPrime embedded products, reported revenue of $US127 million up 29.7% year-on-year with gross margins improving to 29%. Cohenour flagged several OEM design wins in energy, insurance, mobile computing verticals and also with automobile manufacturers in North America, Europe and Asia.

Sierra's products are aimed at delivering machine-to-machine connectivity in key areas such as mobile computing, sales and payment, energy, transportation, and automotive. Now, all these are growth verticals, and Sierra is achieving design wins in these areas.

The company's latest design wins include Itron, a pioneer in “smart metering”. Itron is interested in Sierra's AirPrime embedded modules for use in a smart grid solution for utility customers globally. In the Insurance Telematics division, Sierra inked a deal with Octo Telematics for providing wireless connectivity for user-based insurance solutions in Europe. In addition, Sierra has captured design wins in the connected car market in Asia, Europe, and North America.

This could be a key breakthrough for the company, as the connected car market is clearly a growth area with huge potential. Analysts have predicted the connected car market will reach total shipments of over 60 million units by 2018. That's an estimated compound annual growth rate (CAGR) of 41.2% over the next five years. That market could be worth up to $US100 billion by 2018 due to the growing usage of connected devices for such things as navigation, telematics and infotainment in vehicles.

The connectivity market is expected to grow globally in a number of applications. As a result, Sierra is focusing on improving and fine tuning its product line-up. For example, its new HL line-up is witnessing an increase in market demand since it is scalable and flexible. Moreover, Sierra's superior intelligent module product line-up, based on its Legato embedded software platform, is also a key driver behind the design wins. These two platforms combined are becoming popular with both small developers and big OEMs.

Through the acquisition of Motion Technology earlier this year, Sierra is expanding its enterprise business to help clients manage the connectivity network. Revenues from this business are not in analyst's estimates. This additional revenue stream, with margins exceeding 50%(hardware has 32% margins) gives Sierra a broader reach as both hardware and software contribute to future growth. Earnings power of in excess of $US2 per share is possible in the future.

Recommendation

After trading between $US20 and $US25 for most of 2014, Sierra's share price has seen very strong gains in the past two months on the back of a return to solid profitability. On top of earnings per share (EPS) rising 300% year-on-year, there is positive company guidance and real interest in the Internet of Things theme.

At $US38 it's up over 50% this year. I want to own some Sierra for the long term but I'm a bit reluctant to buy a full position at these levels. I would be a happy buyer in the low $US30s.

I can get a target price of $US42 based on 32 times 2015-16 EPS of $US1.30. You have to pay up for growth.

Risks

A significant portion of Sierra Wireless's revenues come from its business as an original equipment manufacturer (OEM) for the machine-to-machine market. In the fourth quarter of 2013, this segment accounted for 86% of total revenue. A material slowdown in this market would have an adverse effect on Sierra's revenues and could harm the company's earnings.

For Sierra Wireless's forecasts and financial summary, click here.