Sandfire makes the grade

Recently we have ceased coverage on most of our resource related stocks. When prices are down and stocks are volatile we want to ensure you have exceptional companies to diversity your portfolio without taking on excessive risk.

Sandfire is not immune to this and consensus forecasts for copper have been reduced in the short to medium term – this is the basis behind our valuation downgrade. However, Sandfire's low mining costs and growth potential mean it can still provide shareholder value during this difficult period and will be the first to benefit from any change in the copper market. We believe it is a current leader in the Australian resources market.

Since July when we last reported on Sandfire, we have seen high volatility in the share price with highs of around $6.70 in July and October, then falling below $5 in January, only to rally back to $6.80 in March due to positive investor sentiment over commodities and China stimulus.

With this in mind, the fundamentals that drive commodity prices have generally not changed and prices will most likely see volatility for some time to come. This should hopefully provide more buying opportunities.

Whilst the Monty deposit is the key to growth at Degrussa, Sandfire have been quietly branching out, taking on more exploration tenements in Australia and making a confirmed international presence.

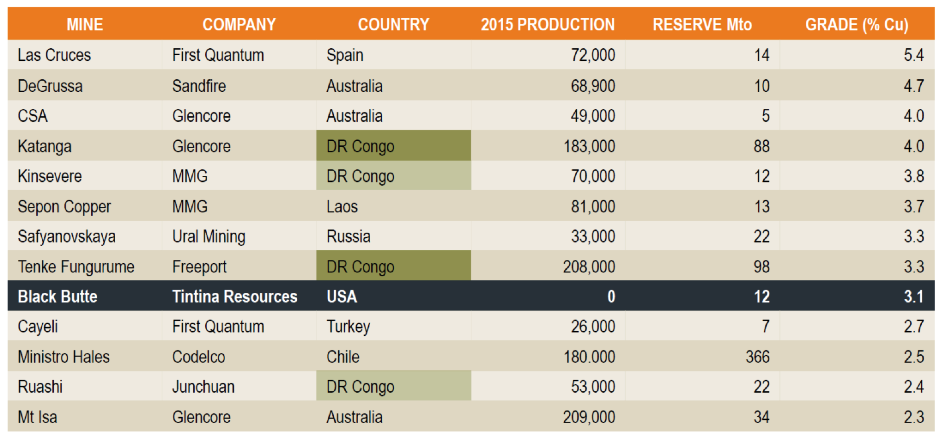

In December 2015, Sandfire purchased more common stock extending its controlling interest to 57 per cent in Tintina Resources (TSX-V TAU). Tintina owns 100 per cent of the advanced Black Butte Copper project located in the US state of Montana.

With mining permits submitted to governing bodies and a total resource (M&I) of 15.7 million tonnes at just over 3.4 per cent copper, it is currently the largest undeveloped high-grade copper deposit in the world.

There are still some hurdles to overcome, including significant environmental concerns, however Tintina feels its advanced mining and environmental methods should be more than suffice, and it expects to be producing by 2020 pending approvals.

Black Butte comparison of operating high grade copper mines (Tintina presentation March 2016)

HY results summary: Solid

Sandfire recently announced a net profit of $15.7 million, down from $30.6m when compared to the corresponding period last year. This can somewhat be attributed to the reduction in the value of copper and extra exploration expenses, however there is at least 4000 tonnes of contained metal in concentrate sitting in warehouses and ports which wasn't sold before reporting. This would have been worth around $26m in extra revenue at today's prices and should be picked up in 2H16.

With new milling and recovery efficiencies now seeming engrained, Sandfire can process over 100,000 tonnes more ore than the previous year with higher recoveries, we expect this to suitably offset lower grades and metal prices in the short term and provide extra revenue and profits into the future when high grade Monty ore comes into production.

Sandfire has continued to take steps to draw down debt and sure up its balance sheet by paying down $45m in debt and still has over $51m in cash on hand.

Figures show Sandfire is on track to meet upper FY16 targets of 65-68,000t copper and 35-40,000oz of gold. C1 cash Cost target is $US0.95-1.05 per pound of copper.

Exploration update: Monty is the key to future

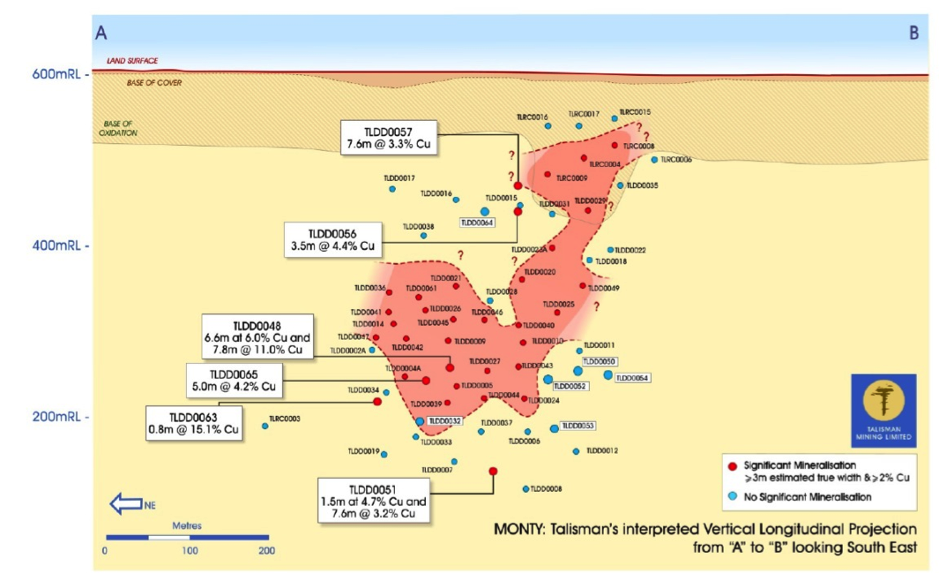

The success of the Volcanically Hosted (VHMS) Monty deposit has continued and underpins the growth and future value of Sandfire. Now with over 60 intersections, drilling has all but confirmed our previous expectations of around 1.5 million tonnes of ore, however the grades have been exceptional and should average closer to the 10 per cent mark.

Recent drilling has been targeting resource definition, and Sandfire now has the data to effectively calculate a maiden resource for Monty. This information is expected at the end of the March quarter and will provide the basis to the initial feasibility.

Sandfire has now met its obligations for 70 per cent ownership in Monty, with the other 30 per cent owned by their joint venture partner Talisman Mining (TLM). Talisman will now have the burden of 30 per cent of the ongoing costs of the project. In a recent capital raising its existing cornerstone investors, as well as new institutional investors, snapped up shares at 45c contributing an extra $16.7m in capital to meet this expense.

In conjunction with that announcement, Talisman indicated that mineralised zones outside the delineation of the current lenses had been intercepted. As mentioned previously, VHMS deposits are renowned for hosting multi-lens deposits, so although not a given, this highlights the excellent potential for further discovery in the surrounding host rocks.

Monty long section indicting new intercepts outside current lens delineation (source TLM presentation 9th March 2016)

Open areas lie mainly to the South-West, however an intriguing zone in the North-East hosts a thick and extremely high grade bornite zone. Bornite has a copper content of more than double chalcopyrite which is the other dominant copper mineral found within the deposit. This would account for those exceptional grades and may open up the potential for high margin direct shipping ore (DSO).

Five drill rigs are now working tirelessly to further define extents to Monty which is probably now the most exciting high grade copper discovery since Degrussa itself.

Recommendation: grade is king

Sandfire is meeting most of its production and resource targets assumed within out last valuation, however the consensus copper price forecasts have been downgraded as well as further ore depletion Degrussa. This has driven the current valuation down.

With the 1.5m tonne estimate at Monty already built into the previous valuation, the question is how much can it grow? The recent hits outlined by TLM may have jagged the edges of new lenses in a deposit style renowned for multi-lens morphology. This is a good indication of potential extensions, however it is hard to assume tonnage at this early stage.

The grade at Monty is the key and it adds flexibility for the future operations at Degrussa. If they decide to blend the high grade ore they could optimise the head grade in the mill and increase metal output. With grades at Monty set to average around 10 per cent, we have assumed head grades of 6 per cent from 2018.

Given this, the rest of the operational assumptions behind our valuation have not changed significantly. Currently there is little exploration upside added to the valuation, however the possibility of more exploration success, future growth from acquisitions and operational opportunities including the sale of high margin DSO ore coming into play. Our valuation of $6.80 is considered to be a conservative one.

Last Friday, Sandfire closed at $6.11, so we are maintaining our buy recommendation, however volatility in the commodities market may still provide better buying opportunities in the future for investors in a position to wait.