Ridley rides the agri boom

If you are looking for sectors with long-term supportive tailwinds, there are few greater opportunities than agriculture or agriproducts. The problem for Australian investors, however, is that there is a lack of listed opportunities. Ridley Corporation (RIC) is one way of doing so by gaining exposure to the positive Asian food export thematic.

The Australian-based agribusiness is focused on being the country's leading producer of premium quality, high performance animal nutrition solutions. This position can be maintained by a combination of organic growth and strategic acquisitions.

Ridley supplies livestock food producers mainly in dairy, poultry, pig and aquaculture. Management has also acquired two key rendering businesses in Victoria and NSW.

Rendering utilises surplus animal raw materials to create a commercial product. The process involves thermally treating animal tissues to produce sterilised products such as animal fat and protein that can be sold to pets and livestock.

Along with rendering, dairy is the other key growth opportunity with the very strong long-term outlook of Asian demand for milk products. The Australian dairy sector was in the headlines for much of 2013 due to takeover activity. More recently global milk prices have been weak presenting a short term risk for Ridley.

The company is diversified in its sector exposure balancing out the unpredictable nature of operating in agriculture. Some of these risks include weather, currency, commodity price, disease, and export markets.

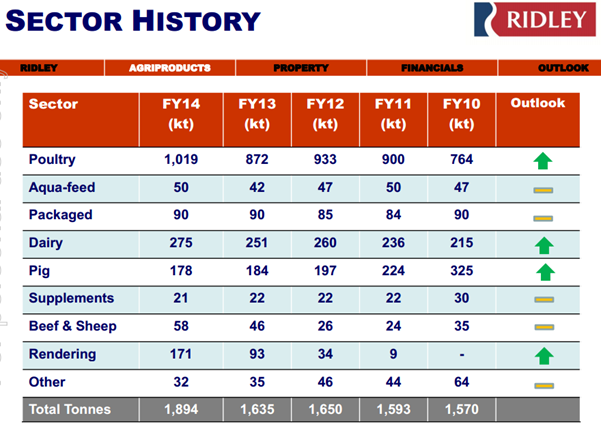

Sector exposure

Poultry volumes are likely to continue to grow organically at 2-3% per annum. It represents a lower margin exposure supported by long-term contracts.

As mentioned dairy has supportive long-term drivers, and management is focused on growing this business. Pasture is a large component of the feed in Australia, but there is room for Ridley to increase the supplement feed and try to increase the yield of milk per cow. The milk price to feed cost ratio is an important driver of demand and therefore Ridley will sell more volume of supplements when the farmers are doing well. A drought gives a short term lift in demand, but then is a negative in the long run after the farmers become cash constrained. Part of Ridley's service is for a technical expert to offer nutritional advice on how to maximise the yield of milk per cow.

Aquafeed is another high growth market due to domestic and export demand for seafood. The division recovered to grow in 2013-14 after a tough year in 2012-13 due to its main competitor (Skretting) dramatically increasing its capacity in Tasmania. There was strong volume growth in salmon and also recoveries in sales of prawn, Barrumundi and Kingfish aquafeed.

In rendering, 2013-14 was the first full result that included the BPL Melbourne acquisition, (Now CFS Proteins) which was acquired in December 2012 and is located in Laverton. Camilleri (NSW) was acquired in March 2011, and the outlook for both sites is promising. There was a record annual intake recorded at Maroota (Camilleri) for 2014. The increased intake volumes partially offset the weaker selling prices driven by the overseas market restrictions caused by the outbreak of avian influenza in Australia.

Whilst the influenza outbreak caused a hit to earnings, the impact was mitigated by the strength of the relationships with two pet food manufacturer customers in Thailand who successfully lobbied their government to continue to receive product throughout the period of market closure.

About half of the rendering protein based product is exported to Asia, and it is an important opportunity for Ridley given the huge demand that will continue from the region. There are organic opportunities through expanding existing sites, or acquisition opportunities given the fragmented nature of the sector.

Transition to agriproducts

The company has been in transition after the divestment of Cheetham Salt in February 2013, and then new management in place with Tim Hart commencing as chief executive in April 2013.

The proceeds from the Cheetham Salt sale were used to reduce debt and also allowed for a capital return to shareholders. The $150 million sale excluded the land at Dry Creek (South Australia), Bowen, Lara and Moolap. Bowen has since been sold and the remaining land assets present an opportunity to extract further value through development.

Dry Creek previously supplied salt to Penrice soda, but with the appointment of administrators an attempt to obtain compensation from the take-or-pay agreement has failed.

Land

Ridley has a number of opportunities to create value through its land assets. In 2013-14 there were opportunistic land sales generating $4.5 million of proceeds from some of the Dry Creek salt field in South Australia and also an agreement to sell the former feed mill site at Dalby in Qld.

In June 2014 the company announced the appointment of Sanctuary Living as the partner for the proposed land development project at Moolap near Geelong. With a focus on maximising value, it is more than likely that Ridley will look to sell this land once development approval has been achieved.

Feedmills

At the 2013 Annual General Meeting, management mentioned that it was reviewing its existing mill assets as a basis for modernisation, renewal, consolidation and expansion.

In August this year the company announced the acquisition of a strategic parcel of land on the North Eastern outskirts of Geelong. Assuming it gains approval there is long term plans to build a monogastric (poultry and pig) feedmill on the site. The site is ideally located with proximity to raw material grain supply, cost synergies from existing assets and strong customer demand.

There are other earnings accretive investment opportunities to upgrade existing mills. If successfully executed this investment will be a driver of earnings upgrades. A $50 million investment in the mills could net $10 million in additional earnings before interest and tax (EBIT).

Strategic shareholders

In April/May this year, the Ridley board board met with a number of representatives from the US feed millers, grain traders, vets, renderers and feedlot dairy farmers during a week-long visit to Omaha. This was arranged by AGR Partners who joined the register late last year. AGR Partners acquired the 19.5% stake in Ridley (RIC) from GPG Group.

AGR and their representative to the board have been very supportive to the business and have proactively introduced a number of overseas third parties to the company who have provided valuable benchmarking opportunities and ideas.

Valuation

Ridley provides a good combination of stable earnings growth and asset backing, with takeover appeal due to its exposure to the key food export markets.

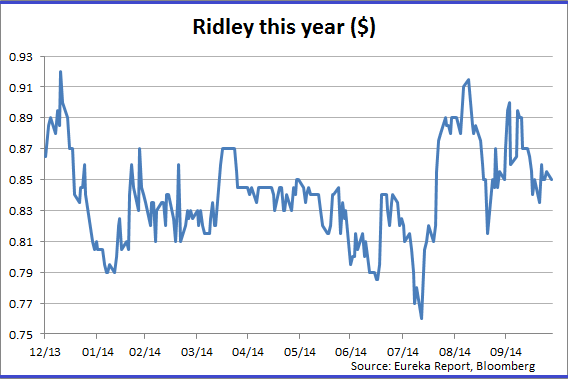

We have a $1.05 target price and valuation that doesn't factor in the efficiency gains from investing in the mills. It assumes an $18 million net present value (NPV) from the surplus property assets, and only modest volume growth. Our discounted cash flow valuation of $1.05 is very similar to the sum-of-parts of $1.03.

The diversified sector exposure reduces downside risks, but at the same time there is the risk that the stock tracks sideways until either a catalyst in the form of corporate activity, land sales, investment in feed mills or a significant acquisition occurs.

The number one positive long-term driver is the exposure to Asian export markets, and Ridley is well placed as Australia's largest processor of stockfeed products, with production mills and distribution facilities across Eastern and Southern Australia.