NetComm flies as Capitol slips

Two of our Growth First model portfolio stocks, NetComm Wireless (NTC) and Capitol Health (CAJ), held annual general meetings last week.

Investors' reactions to each AGM could scarcely have been more different. NetComm's share price growth has kicked into overdrive while Capitol's market capitalisation has extended its decline.

We view the price action in each stock as an overreaction compared to the risks that each company faces. With that in mind, today we trim three percentage points from our portfolio's holding in NTC, and reiterate our buy rating on CAJ.

NetComm Wireless (NTC)

NetComm's chairman Justin Milne struck a bullish tone at the firm's AGM on November 18. Milne opened his address describing NetComm's outlook as ‘extremely good', saying it has ‘never been stronger'.

NetComm's share price rose from 25c to $1.00 between mid-2013 and mid-2015, largely on the back of domestic wins and select partnerships in the global machine-to-machine (M2M) communications market. However, in the last three months investors have more than doubled the firm's value.

All the “cream” on the NTC share price north of $1.00 is predicated on NetComm making a significant announcement before the end of the year. With the value of a contract win now seemingly fully priced in, we grasp this opportunity to take some profits and trim NTC's weighting in the Growth First model portfolio.

Firing on all cylinders

Rollout of the domestic rural NBN continues apace, and NetComm provides the fixed wireless component. This is driving growth in volumes, revenue and earnings.

Having suspended its dividend in favour of reinvesting profit, NetComm plans to boost its engineering headcount by 40 per cent and bolster its sales capability.

The firm has secured M2M partnerships with Singtel in Asia, Deutsche Telekom in Germany and Kanematsu in Japan. Although further growth in its M2M business appears a reasonable expectation for NetComm, it's safe to say all investors' eyes are now on its opportunity in global rural broadband.

A $US80 billion market

NetComm understands that AT&T will soon choose a provider of fixed wireless rural broadband. As we outlined in our last update on NetComm (see NetComm surges ahead, September 21), this contract alone could represent as much as $360 million in gross profit. NetComm is down to the last three tenderers and is very confident that AT&T will choose the firm to deliver the project.

Boston Consulting Group views regional broadband provision as a $US80bn global opportunity. With NetComm's work on the NBN's rural component considered world-class, the firm remains confident of leveraging this success into even more valuable projects overseas.

Investors are already looking past NetComm's first overseas contract in rural fixed wireless broadband — which, we hasten to add, is not yet a done deal — and are considering the potential for this to deal to lead to several more new contracts.

Governments in Ireland, Mexico, Latin America and Japan are all considering similar rural NBN projects. They will be watching the outcome of the AT&T tender with great interest. We understand Ireland in particular to be the next cab off the rank, where potentially 750,000 households would call for the service that NetComm can help provide.

If NetComm wins the AT&T deal, it could solidify the first-mover advantage it seized with the NBN contract and establish the firm as the provider of choice to this market globally.

Time to take some profit

Depending on the commercial terms, the AT&T contract should add between $0.70 and $2.15 to NetComm's share price. At $2.44 per share, the market is already ascribing the midpoint of our estimates for the value of this contract, and is looking ahead to further wins.

We remain of the view that NetComm will win and execute this deal successfully and use it to launch into similar opportunities abroad. But with the share price having run hard ahead of any tangible news flow, it would be prudent to take some profits here and ease our exposure to anything less than the best case scenario investors currently expect.

NetComm has been a great driver of the Growth First model portfolio since inception. The stock initially had a five per cent weighting in the portfolio with a $0.74 entry price. Having taken a little profit at $1.37 per share, NTC at $2.44 now comprises approximately 11 per cent of our portfolio's value.

We want to retain some exposure to NetComm's growth prospects. At tomorrow's open, we will reduce NTC's weighting by three percentage points to eight per cent. This weighting retains NetComm as our biggest bet and strengthens our war chest to add new stocks to the portfolio.

The downturn in the stock market over the past three months has brought several strong growth stories closer to compelling value territory. We look forward to recommending some of these investments in the near future.

Capitol Health (CAJ)

Capitol Health's AGM confirmed several of the trends we identified three weeks ago in our last update on the stock (see Capitol Health hits an air pocket, November 2). The difficult trading conditions the company revealed in October seem to have continued unabated. However, Capitol's strategy should position the group as a relative winner when its industry dynamics improve.

We can read a few conclusions from investors shaving another eight per cent from the CAJ share price in the week following the AGM. Some are unimpressed by Capitol's remuneration policies — specifically, its plan to adopt a broad-ranging incentive program which might reward key managers with stock or options, and also the decision to boost non-executive directors' fees by $150,000 per year.

On the first matter, we are comfortable seeing Capitol rewarding valuable personnel with stock if doing so mitigates potential “flight risks” — as long as those grants are conditional on targets and timeframes which align with existing shareholders' interests.

On the second point, Capitol has made no secret of its desire to appoint at least one additional non-executive director. Shareholders would likely benefit from a board that operates more independently of management and has deeper expertise in the health sector. The firm is close to securing a preferred candidate who can bring that skillset to the board.

The industry headwinds that managing director John Conidi discussed at the AGM reinforce the need for a corporate strategy that adds value for general practitioners (GPs). Bulk-billing doctors in community settings refer most of CAJ's work and the company's prospects depend on keeping these GPs onside.

Under Canberra's thumb

Capitol has revealed that the weak revenue trends it disclosed at the end of October have not yet improved. Although revenue for the four months ending October 31 grew 51 per cent from a year earlier, it is still tracking around five per cent under the firm's prior expectations.

A small part of this is explainable through Victoria, Capitol's key market, having two fewer trading days relative to the prior comparable period. But most of the weakness stems from the simple fact that GPs are afraid to refer too many patients for diagnostic imaging (DI) scans.

Every item code on the Medicare Benefits Schedule is currently under review. The federal government has form in targeting and penalising radiologists for referring patients for DI scans it views as unnecessary and wasteful. As we discussed on our last Growth Portfolio interactive update, five years ago the government reined in growth in high-value DI scans by threatening to fine GPs who referred too many patients with lower back pain to radiology providers.

The government's scare campaign this time around relates again to lower back scans but also to knee MRI scans. Half of the MRIs that GPs typically refer for government rebates relate to knee afflictions. This explains why growth in MRI scans in Victoria slumped to less than four per cent in the first quarter of FY16 after having expanded at strong double digit percentage rates in prior comparable periods.

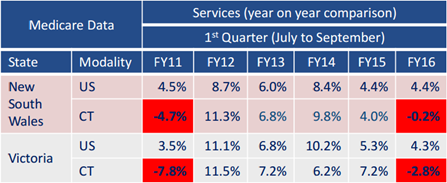

Capitol's most important services in terms of both revenue and profit are MRI and CT scans, and in the latter, the picture is grimmer. The number of CT scans that Victorian GPs referred to radiologists dropped by 2.8 per cent in the three months to September, after having expanded healthily in previous years.

The table below shows how dramatically government intervention has crimped growth in CT scans in Victoria and New South Wales. At the left end of the table, FY11 captures the previous scare campaign we mentioned earlier. We include ultrasound (US) scans for comparison — a lower-value test going untargeted by the government.

Source: Capitol Health Ltd

We continue to expect the new calendar year to act as a circuit breaker on GPs' referral patterns. It seems unlikely that a government in campaign mode with a new prime minister seeking his first win at the polls would burn through political capital by turning Medicare cuts into an election issue. On that basis, we expect a toning down of the rhetoric targeting radiologists, and a resumption of more typical referral patterns early in 2016.

We will be watching closely for evidence of this behaviour shift emerging — at first anecdotally, and later in the Medicare data. When that happens, we expect investors to regain an appreciation for Capitol's potential.

New technology investments are set to drive efficiency gains for the firm from early 2016, and we can see Capitol winning market share just as the DI industry headwinds subside. On that basis we reiterate our buy rating with valuation unchanged at $0.88.