LVMH: The masters of desire

Headquartered in Paris, LVMH Moët Hennessy Louis Vuitton S.A, better known as LVMH, is the world's largest luxury goods conglomerate.

Through its Louis Vuitton segment it makes and sells high-end leather goods, luggage, and accessories. It produces champagne under the brands Moet & Chandon, and Veuve Clicquot. LVMH also offers cognac through the Hennessy label. The Company manufactures perfumes, cosmetics, watches and jewellery, as well as haute couture through its Christian Dior, Marc Jacobs and Loewe brands.

The company controls over 60 brands. Recognizable names include Krug and Dom Perignon Champagnes; in apparel Loro Piano, Donna Karan, Thomas Pink, Australia's RM Williams; in watches and jewellery Tag Heuer, De Beers Diamond Jewellers and Zenith; and in perfume and cosmetics Guerlain, Pafums Givency, and Kenzo Parfums.

LVMH also owns DFS Group, which owns a network of duty free stores, Le Bon Marche (the iconic Paris department store) and apparel/cosmetics retailer Sephora.

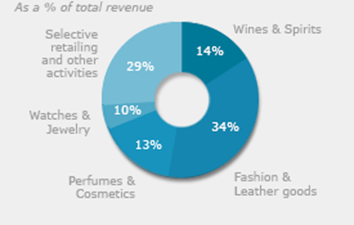

Company revenue breakdown by segment:

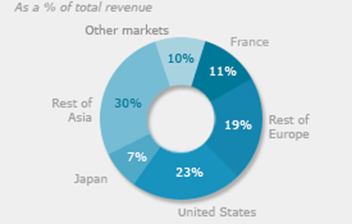

By geography:

I have been an investor in LVMH off and on for a number of years. I have also owned, at one time or another, Bulgari, Hermes (a portion of which LVMH just divested), Christian Dior, Richemont, and Tiffany.

Luxury goods has traditionally been a growth industry driven by the aspirational desires of consumers, globalisation, and increased world travel. It is also a category that can raise and maintain premium prices via strong brands and superior workmanship. I have always preferred it to general retail.

Given that I have flagged the necessity of broadening investor focus outside the US – where Eureka's international portfolio is over represented – I think LVMH is a good candidate for our first European selection.

LVMH is a true global player; it tends to absolutely dominate most of the categories that it operates in and generates some of the highest operating margins in the industry.

The depreciation of the euro is a huge tailwind – a 10 per cent depreciation in the euro increases earnings before interest and tax (EBIT) by around 5 per cent – and earnings guidance in the recent earnings release suggests confidence in the market for 2015. The shares are not expensive, trading at 16.5 times 2015 earnings per share (EPS).

Latest results and outlook

LVMH reported fourth quarter and full-year 2014 earnings on February 3, 2015. While EBIT was a bit soft in the second half – pressured by restructuring charges in watches and jewellery, rental inflation at DFS, and some non-recurring write downs in perfumes and cosmetics – fourth-quarter 2014 group revenue trends were surprisingly robust.

Sales in the last quarter were up sequentially 5 per cent in constant currency versus a consensus of 2 per cent. On a constant currency basis they showed an 18 per cent gain year-on-year.

At the segment level year-on-year, fashion and leather was a standout (up 4 per cent), perfumes and cosmetics lifted 9 per cent, watches and jewellery rose 3 per cent, and selective retailing climbed 8 per cent. This was substantially better than peers over the same period.

Fourth-quarter sales growth by region, on a constant currency basis, saw the US growing 13 per cent, more than double its 6 per cent in the previous quarter. The strength in the US for LVMH was broad-based across businesses.

Japan held up well with 7 per cent growth compared to 9 per cent in the third quarter, while the rest of Asia deteriorated, with sales falling 6 per cent when they rose 1 per cent in the earlier period, partly driven by Cognac weakness in China. It was down 1 per cent in FY14 but would have been up 4 per cent excluding the shortfall in wines & Spirits shortfall.

Growth in Europe was improving to the 5 per cent level, having been relatively flat in third quarter, with better local and tourist demand.

On the conference call, the tone was markedly confident for 2015. Management highlighted a “significant sales increase” at Vuitton in January, “rigorous” cost control, and tailwinds from a weak euro. They also flagged several important product initiatives at Vuitton and other brands, and an expected rebound in Cognac shipments to China towards the end of the second quarter of 2015.

Retail (even luxury retail) is a cyclical business. Fortunately, the most cyclical segments of LVMH are probably less than 30 per cent of total sales. They include champagnes, watches and DFS. Vuitton, on the other hand, is almost 50 per cent of sales and remains one of the industry's strongest and most profitable brands via the legacy of a long track record of innovation and a sophisticated supply chain.

Catalysts for the stock to continue to outperform in 2015 include a continuation of trends in the fourth-quarter 2014 earnings release (especially in Vuitton), improvement of the drinks business in China, the ongoing depreciation of the euro, and possibly the addition of even more valuable high-end brands into the mix.

Analysts have pointed out that while LVMH, Richemont, and Kering have acquired a plethora of luxury brands over the past decade and a half there are still a number of high quality privately held firms that may be pressured by the current global macroeconomic environment and subsequent currency fluctuations.

Brands such as Chanel, Versace, Ermenegildo Zegna, Rolex, Patek Philippe, Audemars Piguet, and Chopard could possibly be in the sights of larger acquirers such as LVMH in 2015. With a net debt/EBITDA multiple of less than 1 and fixed charge cover of 4 times, LVMH is lowly geared and could easily absorb further selective acquisitions.

Valuation

Conglomerates can be fiendishly difficult to value, particularly one that has as many brand units as LVMH. A “sum of the parts” (SOTP) method using implied or comparative multiples (from peers) would therefore be appropriate here. The EBIT and enterprise value (EV)/EBIT multiples are based on 2015 sales.

Segment Valuation | EV |

Fashion and leather goods | €498bn |

Wines and spirits | €20.2bn |

Selective retailing | €12.5bn |

Perfumes and cosmetics | €8.2bn |

Watches and jewellery | €7.3bn |

Total gross SOTP = | €97.2bn |

Less net debt | (€4bn) |

Less corporate costs €2bn | (€2bn) |

Divided by shares outstanding | 508m |

Implied SOTP = | € 180 |

The implied SOTP of €180 is 18.5 times 2017 EPS, which is not unreasonable given it's the equivalent of today's multiple.

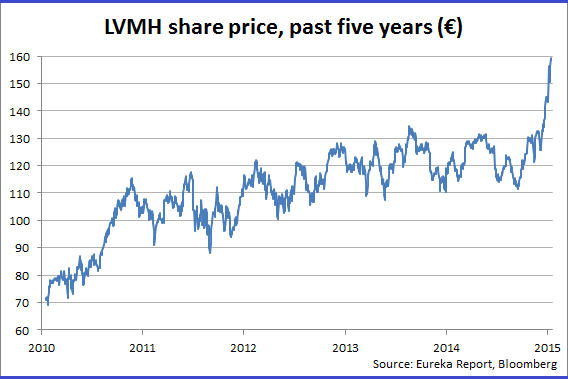

Over the past few years LVMH shares have “range traded” between €120 and €140, as shown in the chart below.

Following a significant underperformance in 2013, when the stock fell 5 per cent versus the wider sector's 15 per cent rise, LVMH shares have started to outperform again. In 2014 the stock climbed 11 per cent, higher than the sector's 4 per cent, and are nicely ahead so far this year with a 20 per cent boost versus its peers' 9 per cent lift.

The shares had a 9 per cent jump after the latest earnings report, breaking above the high end of the recent range to €156.25. I would be a buyer close to current levels and would use any market weakness to add to positions – ideally in mid to high €140s. That equates to a potential 15-25 per cent upside.

Risks

- Changes in demand for luxury goods are correlated to the macroeconomic environment and the health of consumer spending patterns. Any major change in the external political or economic scenario that may affect consumer confidence is a risk to LVMH's sales. A hard landing in China is an example.

- LVMH's businesses are highly dependent on sales to tourists and thus vulnerable to geopolitical developments such as terrorism.

- The group is an exporter of products sourced in Europe and therefore can suffer adverse pressures from currency.

- The key profit centre in the group and over 50 per cent of enterprise value (EV) is Louis Vuitton. Demand for Louis Vuitton products has grown at very positive rates. However, the product is overtly branded and the group would be vulnerable to changes in consumer taste in this area. (However it has been producing high demand leather goods since Louis XVI was on the throne of France!)

- Counterfeit goods remain a problem for luxury goods companies, notably for the Vuitton brand.

To see LVMH's forecasts and financial summary, click here.