Genera waits for ideal partner

Genera Biosystems (GBI) is a company that develops, manufactures and distributes advanced molecular diagnostic tests. The Melbourne-based company has a micro market capitalisation of approximately $20 million, and will need a larger partner to fast-track the commercialisation of its products.

Genera has been in discussions with a number of potential partners and initiated a formal process with a view to making an announcement prior to June 30. The company further guided, in an announcement to the ASX, that the process was likely to lead to a “capital injection but not limited to a material change in the current composition of Genera’s share register or otherwise potentially a change of control event.”

| It is important to point out that the company is currently loss-making with minimal revenues, and is largely dependent on a partner to take the next step to profitability. Therefore, the stock is clearly high risk, and our Buy recommendation is Speculative. |

AmpaSand and the diagnostic tests

The development of the molecular diagnostic tests is built upon Genera’s patent protected AmpaSand platform technology. The first product developed using this technology was PapType HPV, which tests for the variants of human papilloma virus (HPV) that can develop into cervical cancer.

Genera was ahead of its time in identifying that HPV testing would eventually replace the Pap smear test.

HPV testing currently comprises about $500 million of the global $5 billion molecular diagnostic market, with industry predictions of it increasing to $2 billion within five years.

Genera’s next major test is RTI-plex, which checks for the pathogens of the airways in acute respiratory tract infections (RTI). The challenge is that many different respiratory pathogens present with similar symptoms, making diagnosis difficult. The test can detect more pathogens than all but one test; however it has four times the throughput capacity. This greater throughput makes it attractive for a high throughput laboratory. RTI-Plex is not far away from Australian Therapeutic Goods Administration (TGA) approval, and CE (European) approval.

STI-plex, a test for five different common sexually transmitted diseases, is also completing development in the next 9-12 months.

The table below displays the US reimbursement prices and Genera’s assumed selling price for its test products.

ASR | LDT CPT Reimbursement | GBI Assumed selling price |

PapType | $US48 | $US13 |

RTI-plex | $US568 | $US40 |

STI-plex | $US235 | $US35 |

Earnings opportunity

In Australia, we are forecasting Genera to sell 520,000 tests in 2016, equal to a 40% market share. The tests are likely to be sold on average at $13, with a cost price of $4.50. This will deliver $6.8 million in revenue at a high profit margin.

In Germany, we are forecasting a 7% market share, comprising one-third of Sonic Healthcare’s sales. With the same sale price, this will produce $6.5 million of revenue.

In total, just assuming revenues in Australia and Germany from the HPV PapType test, we can see $13.3 million in revenue for 2016 at a high profit margin.

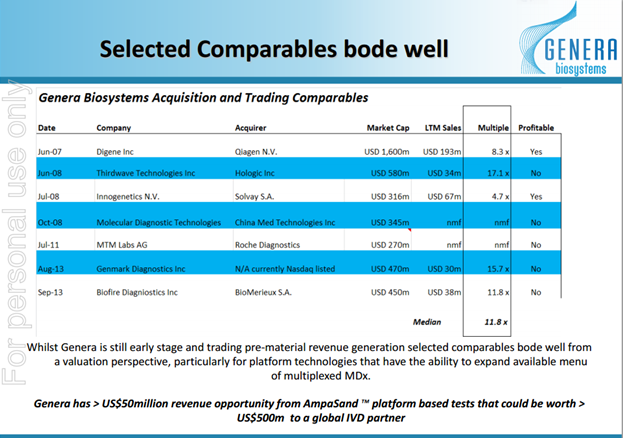

Given comparable partnering transactions are generally done on 6-10 times revenue, conservative 4 x revenue gives us a price of $0.54 per share. This value assumes no traction with its other products or expansion into other countries.

Partnering opportunity

Since listing, Genera has often been perceived as a company that only has the ability to manufacture HPV tests. But the real value is with the AmpaSand platform, which can automatically run a large menu of tests upon the same instrumentation hardware.

The company’s tests have been designed to meet the requirements of both clinicians and high volume pathology laboratories. Genera also has benefited from extensive assistance from Sonic Healthcare and Healthscope pathology during the development phase.

Executive chairman Lou Panaccio is a current board member of Sonic, after the company acquired Melbourne Pathology while he was CEO. Sonic is the world’s third-largest pathology company, and Healthscope is Australia’s second-largest.

Genera’s expertise is its ability to develop high-value multiplexed tests – that is, tests that can identify multiple viruses from a specimen in a single test. Whilst the supportive Sonic relationship may appear to be a good potential commercial partnership, the value of Genera’s technology with Sonic and other pathology clients will be maximised by combining the AmpaSand-based tests with another large IVD partner which already has existing relationships supplying pathology labs. That partner needs to be able to provide financial resources, and be capable of integrating Genera’s tests onto an existing or newly developed high throughput automated instrumentation platform.

Australia HPV Screening Program

In Australia there will be a significant market opportunity for Genera from 2016, thanks to the recent announcement from the federal Department of Health’s Medical Services Advisory Committee (MSAC). The proposal for the national Cervical Screening Program is that HPV testing be used as the primary screen. The details of the proposal mean that a couple of competitor tests will not be commercial.

Given Australia is one of the world leaders in cervical scanning and prevention there is potential for this screening program protocol to be rolled out in other countries, particularly Europe. This would obviously be positive for Genera.

US FDA Approval of Roche Cobas HPV

On April 24 the US Food and Drug Administration (FDA) approved the first HPV DNA test for woman 25 years and older that can be used alone to help a health care professional assess the need for a woman to undergo additional diagnostic testing for cervical cancer.

Competitor Roche’s Cobas HPV test can only simultaneously genotype two high-risk types of HPV that cause 70% of the cases that develop into cervical cancer. Genera’s genotyping test can identify all 14 of the high-risk types that cause 99.7% of cervical cancer in women.

The incorporation of simultaneous genotyping is a key differentiator for Genera, particularly when used within a long-term screening program.

This factor, and a positive independent assessment from the Wolfson Institute in London, may promote an opportunity for Genera to enter the US with a credible global IVD partner.

Back on the radar

Genera has been developing its patent protected technology for 10 years, and was listed in 2008 at $0.50.

The share price high of approximately $0.90 in 2009 was due to the potential of a partnering deal with a large Japanese IVD company that didn’t come to fruition. This was due to issues relating to the potential partner’s instrumentation and other aspects of its approach to market. While the Paptype product gained TGA approval, it was not efficient enough in terms of workflow for the pathology labs at the time.

While waiting for the HPV screening industry opportunity to develop and materialise, Genera has been running like a private company for the last few years. Its average annual $1 million of operating costs have been drip funded by existing holders participating in capital raisings as required. The board and management team hold material shareholding stakes in the company, and all of the directors recently elected to take equity at market prices in lieu of salaries and directors’ fees.

A recent $845,000 capital raising was further evidence of the company’s internal confidence in its technology and its ability to gain support from a larger diagnostic partner. Despite having the ability to complete a larger raising, the company was mindful to avoid dilution and only raise the minimum required to see it through the current partnering process.

Sector Transactions

Earnings/Valuation

For valuation purposes, at this stage we have only included revenue for HPV in Australia and Germany for 2016. A 4x multiple of this revenue gives a valuation of 54 cents as per below. If a partnering agreement is successfully formed, there will be valuation upside through greater access to capital and the use of broader capabilities.

AUSTRALIA | |

Annual tests | 1,300,000 |

GBI market share | 40% |

GBI annual tests | 520,000 |

Average selling price | $13.00 |

GBI revenue | $ 6,760,000 |

GERMANY | |

Current Paps with annual screening | 18,000,000 |

Proposed 3 year HPV screening | 5,994,000 |

Uplift with HPV positive recall | 8,391,600 |

Sonic Germany HPV volume | 1,510,488 |

GBI % of Sonic Germany business | 33% |

GBI annual tests | 498,461 |

Average selling price | $13.00 |

GBI Revenue | $6,479,994 |

2016 Germany and Australia PapType Revenues | $13,239,994 |

Sales multiple | 4.0 x |

EV | $52,959,974 |

Total Shares on Issue (including convertible notes) | 98,033,093 |

Value per share | $0.54 |

Summary

We have a Speculative Buy recommendation with a high-risk rating, and a $0.54 valuation / target price. The upside opportunity from leveraging the value of its IP protected diagnostic technology is clear. However the major catalyst and requirement for the company to meet its potential is an agreement with a significant IVD partner.