Flexigroup: Credit where it's due

Following a recent drop in the share price, I am adding non-bank lending business Flexigroup Limited (FXL) to the Income First model portfolio and initiating coverage on the stock with a buy call. My valuation is $3.14 and I am forecasting that the company will pay a dividend yield of around 7 per cent based upon last week's closing price (which is 10 per cent including franking credit value). I will add the stock to the Income First portfolio using Tuesday's open price, but also note that the stock commences trading on an ex-dividend basis on Wednesday (September 9). For those unfamiliar with FXL, it is a business that provides credit arrangements to both the retail and corporate markets in the form of leasing, point of sale credit terms, credit cards and other products.

FXL listed in 2006, with its solitary product “Flexirent” sold largely through Harvey Norman stores. Over time, and largely through acquisition-led growth, earnings have been diversified to the extent that the Harvey Norman contract represents a significantly reduced portion of overall group earnings. Nowadays, much of FXL's lending occurs at the point of sale (particularly through the credit cards and Certegy businesses) or via leasing arrangements, with retailers and commercial vendors providing a key gateway for FXL in terms of acquiring customers.

The company has endured some significant changes in leadership of late with the departure of its CEO and two directors in the last few months. The business has also reported fairly flat FY15 financial performance and guidance for FY16. This has led to a sell-off in the share price, and provides a good opportunity to enter a quality business at an attractive level. I acknowledge that when the leadership of a business changes risks are introduced. However, FXL is a strong business, with a high quality established base of products. Additionally the company's scale allows it to securitise receivables and lower funding costs, resulting in a market leading level of return on equity for a non-bank lending business. In light of this, and in order to take advantage of the weak share price we are comfortable entering FXL in the Income First model portfolio with a 6 per cent weight.

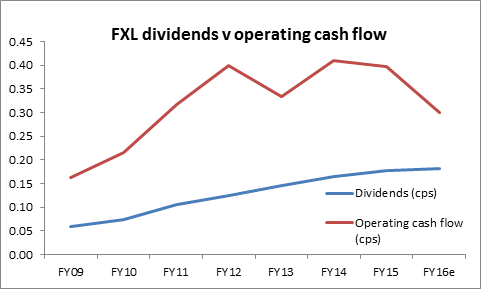

Strong dividends and cash flow

FXL's specialty is in leasing, technology plans, payment solutions and a range of interest free and no interest ever products. Being in this type of business creates strong cash flow from operations. There are some challenges inherent to this model including the management of credit risk but FXL has a stable track record for managing this risk and generating solid returns. The ability to produce cash from operations over recent years has resulted in a healthy and increasing flow of dividend payments. What's more is that the dividend payout ratio is in our view conservative when compared to peers in the financial sector, providing room for the business to invest cash in future growth. And that is exactly what FXL has done in the past. Growth has largely come through acquisitions over recent years and this is a trend we are comfortable to see continuing.

On the dividend more specifically, the FXL board has a policy to pay between 50 per cent and 60 per cent of cash net profit after tax as a dividend, though we note that recent dividends have been paid at the upper end of this range. As a result there is little room for dividend growth without growth in earnings. According to my expectations, FXL is likely to see stability in earnings with incremental growth possible as the company executes strategies to grow its credit cards business and to lift performance in lagging divisions (C&SME and Enterprise).

Strategy and leadership questions

At present David Stevens, FXL's CFO, and Peter Lirantzis, FXL's COO are acting co-CEOs of the business as the board progresses a search for new blood at the top. David has worked at FXL for over eight years and Peter four years, meaning that the operations of the business remain under competent supervision. While the absence of a current CEO is not an encouraging factor for investors, the presence of FXL's founding director Andrew Abercrombie as chairman will act as a steadying hand. Additionally, the timing is not the worst for the company, as a clear strategic path has been clearly laid until 2020. So the current search for a CEO is not a search for inspiration, it is a search for a leader to focus on executing the company's strategy in place. We note that the recent departure of two directors, Chris Beare and Anne Ward, has further rocked investor confidence, but that FXL remains in the process of looking to add to the board.

There is no doubt that the changes in leadership are unsettling. However, over the last couple of years, FXL has provided the market with clear communications on business strategy. Additionally we have spoken with the head of strategy and planning, Iain Lyle, who pointed out that the group's focus remains clearly set out for a period of investment in IT capability and digital solutions. With the heaviest year of lifting now behind FXL in terms of dollars of capex, and the potential for new leadership to breathe additional focus into the company, we have no reason to believe that there is something more sinister in these recent departures.

It is noted that questions of leadership currently remain unanswered at FXL, but I take comfort in the fact that the company is not willing to rush the process to please the market. At this stage I firmly believe the risks created by the change in both CEO and board members are well accounted for in the low share price.

Business operations overview

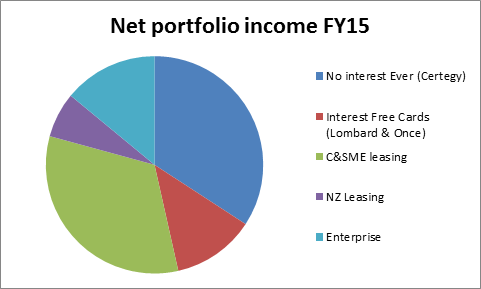

FXL is divided and reports its results largely by product type. Certegy Ezi-Pay is the company's retail based ‘no interest ever' product that provides consumers with payment plan options. Certegy takes the majority of its revenue as fees from the retailer but also charges customers establishment and ongoing transactional fees. This division accounted for over 34 per cent of net portfolio income in FY15, and with strong margins, produced over 38 per cent of cash NPAT.

The division has traditionally been involved in household solar power installations, assisting to fund 14 per cent of all solar installations in Australia in 2014. This may pose a risk to the division as government subsidies fall away; however performance in FY15 was stable despite this trend. Certegy is also involved in financing other home improvement segments and a wide range of retail categories. Additionally, the outlook for Certegy may be strengthened by a strategic focus on VIP customer offers (repeat business), where the cost of customer acquisitions appears lower and the market more readily identified.

FXL also offers interest free cards through the Lombard and Once brands. Similar to Certegy, the cards are used to finance purchases on interest free terms, taking a fee upon transaction initiation. However, as this division results in the issuance of a credit card (Visa), the focus is on encouraging consumers to use these cards in an ongoing way to produce interest revenue. Under the Lombard and Once brands, FXL now has around 103,000 active accounts on issue. The cards business contributed around 12 per cent of net portfolio income and over 13 per cent of cash NPAT in FY15. The division is a clear focus for potential growth in coming years, but subject to some competition via GE and HSBC. Recent investment into digital approvals and origination processes will assist with competitive edge here and any additional contract wins might provide upside for the FXL group. Pleasingly, FXL has agreements with many major retailers such as IKEA and offers a product that has a strong offering in the market.

Much of FXL's business is leasing and the company reports on consumer and Small Medium Enterprise leasing through a single division, C&SME. The focus here is technology leasing, as products that suffer obsolescence lend themselves to the leasing model more readily. In FY14 FXL purchased RentSmart Australian business from ASX-listed Thinksmart (TSM). The RentSmart business has shown a significant increase in penetration rates and volume with key customer JB Hi-Fi (JBH) under FXL management. This is a clear positive and I note that the former RentSmart business is operationally sound, free and clear of any previous issues that investors may have experienced with the listed TSM business. The RentSmart business has now been fully integrated into FXL.

Overall the C&SME division has produced mixed performance of late. Unfortunately, FXL does not split out the mix of portfolio income and cash profit within this division, however indications from management are that recent weakness in FY15 came from the SME side of things. The consumer business has enjoyed increasing volumes but this was offset by the fact SME volumes fell by 23 per cent in FY15 on the previous corresponding period. Much of this has been attributed to a lack of product differentiation and FXL is keen to focus on increasing product features, suitability and price points in order to arrest the recent declines.

The C&SME division accounted for just under 33 per cent of net portfolio income and a little under 30 per cent of cash net profit in FY15, indicating the slightly weaker margins in the division. Interestingly, the SME business that has suffered volume declines is considered a lower margin component of the division. Whether FXL can increase product relevance to reignite the SME business will be a contributor to future upside for the overall group.

FXL also offers leasing arrangements with a key focus on technology products in NZ through the NZ leasing division. While the division is small, FXL made an acquisition in May 2015 that will contribute a full 12 months in FY16, providing some potential earnings uplift. In FY15 the division only accounted for around 6.7 per cent of net portfolio income and 7.7 per cent of cash net profit but the acquisition of Telecom Rentals from Spark New Zealand is the key catalyst for growth here.

Finally, FXL's Enterprise division suffered a 30 per cent decline in volumes in FY15. The division focuses on commercial leasing through OEMs and vendors. Unfortunately, this decline has been a result of an inability to retain staff members who build the sales pipelines. This has been attributed to the listing and competitive pressure from Fleet Partners (now Eclipx). That said, and acknowledging that FXL's volumes have been down in Enterprise, cash NPAT was higher by 1 per cent, and the company has defended existing market share well. Overall, this division's performance has been somewhat lacklustre, but offers a key area for improvement in FY16 and beyond.

Share price underperformance offers value and a strong yield

As discussed FXL's share price has been sold down heavily on the back of leadership changes. I think it is important for me to acknowledge again that this change in leadership does create some uncertainty and poses some questions. However the price has reacted and FXL is trading on a forward price to earnings ratio of under 8 times, offering a forecast dividend yield near 7 per cent (around 10 per cent if I include the value of franking credits).

Notably, FXL's recent report and guidance indicated limited expectations for near-term growth, and was perhaps even behind expectations from some analysts. However, our view is that the company will provide a solid exposure to non-bank financial services and a healthy dividend with the potential for upside should the company's strategy for both investment in Certegy and the cards business, and improvement in the C&SME and Enterprise segments, deliver in coming years. FXL produced cash NPAT of $90.1m in FY15, guiding for a tepid level of growth to a range between $92 million and $94m in FY16. It should be noted that our assumptions are for the lower end of this range at present.

Acknowledging the existence of risks

As mentioned, FXL's ongoing leadership changes raise an eyebrow and seem to be the key contributor to market scepticism. That said, an investment in FXL does carry other, in my opinion more relevant, risks. The company's operations necessitate continually adding to the receivables balance much like a contracting business needs to constantly fill its order book, (ie receiveables are always being depleted and need replacing). In light of this, it doesn't take much to erode growth, or even set challenges for the business to achieve the same in future years. Thus we don't describe FXL's earnings as defensive. Investors should consider the exposure to consumer focused and business focused markets in a pretty benign economy, and the challenges that lay ahead when considering an investment in FXL. For me, I am comfortable that the business has a strong enough position and product diversification to weather the current environment, but concede that the next six to 12 months may prove crucial.

Compelling opportunity leads to 6 per cent weight

FXL's operations are by their nature producing strong recurring cash inflows that can form the basis of a strong dividend payout. At between 50 per cent and 60 per cent of cash net profit, this level leaves plenty of cash for reinvestment in the business' future. FXL's market position focuses not on the highest rung of credit quality, nor the lowest. Thus its offer is focused somewhere between that of the big banks, and that provided by sub-prime lenders like TGA or CCP. With larger banks focused on regulatory capital requirements, and these lower rung lenders seeing tightening regulations, FXL is in a position to benefit.

Within this target market I believe FXL has a strong competitive advantage in its ability to generate returns through a low cost of funds (the use of securitised bond issues). Thus in the long term, the company has the opportunity to further lever its current position and grow into a consumer and business lending market that is in an overall growth phase. The share price has been beaten up, and the stock is currently unloved. But for long-term investors happy to take a strong dividend through the more difficult times, FXL offers a compelling opportunity. Thus I initiate coverage of FXL with a valuation of $3.14 and will include the stock in my Income First model portfolio as of Tuesday's opening share price with a 6 per cent target weighting.

To see Flexigroup's forecasts and financial summary, click here.