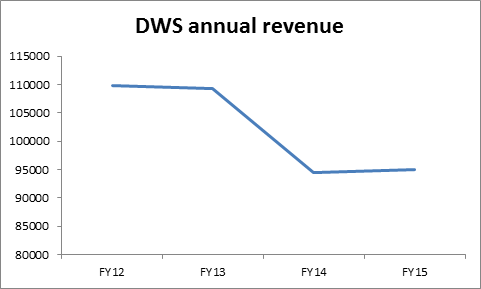

DWS: Servicing a turnaround

Following a strong full-year financial result and what appears to be green shoots of growth in the IT services sector, I am initiating coverage on IT services and consulting business DWS Limited (DWS) with a buy call and a valuation of $1.19. In addition to this, I am adding DWS to the Income First model portfolio with a 5 per cent weight.

The underlying investment thesis here relies on the fact that DWS paid 7.5 cents in dividends in FY15, and with a target 90 per cent payout ratio is expected to pay a higher level in FY15 (my forecast at this stage is for around 9 cents). This places DWS on a dividend yield near 9 per cent (in the vicinity of 13 per cent if we include franking credits).

Currently, the reason for the incredible dividend yield is that this is a turnaround story. The market is yet to fully embrace this. But following on from the most recent reporting season, IT services investment appears to be seeing positive trends. The sector as a whole reported well in August, with positive demand drivers likely to continue as financial institutions and government customers enter a renewed phase of investment. DWS is well placed to benefit from these demand tailwinds, and in my view is a business that offers value to investors as well as the benefits of an outstanding dividend payout.

Dividends and cash flow

As mentioned, it is DWS policy to pay 90 per cent of adjusted net profit as dividends to shareholders. Unfortunately, this has led to a bit of volatility in recent times as the industry has seen pressures and disruption. That said, the company reported a strong fourth quarter to FY15 and has made two key acquisitions that will contribute to earnings growth in FY16. Thus we are forecasting a sharp lift in dividends assuming that the current turnaround and the 90 per cent payout ratio continue to develop.

DWS is in a decent position in terms of cash flow. The company's cash balance was a shade over the $10 million mark at year end, with very limited borrowings. That said, DWS will take on some gearing this year as it funds the 75 per cent acquisition of Phoenix, an established consultancy firm. Following the acquisition completion, it is estimated that DWS is in a net debt position of around $15m.

In all, DWS has a strong balance sheet and is in a business that has shown strong cash generation from operations. Historically gross operating cash flow has far exceeded EBITDA, which is a trend we expect will continue despite the increased interest costs associated with a net debt position. In light of the strong cash generation we believe DWS is well equipped to fund its 90 per cent payout ratio without compromising growth.

Overview of operations

DWS was established in 1991 and provides IT and consultancy services to an Australian client base. Operations are currently focused in Victoria with almost 60 per cent of staff in the southern state. Additionally, the company's headcount overall, which can be a driver and predictor of revenue performance, appears to have turned a corner after three years of consecutive declines, sitting at 517 (in terms of billable staff). Much of the focus of DWS in recent years has been to increase efficiency by lowering administrative costs and increasing the proportion of staff in the organisation that are providing billable services.

The company's expertise is focused on three main areas: specialised practices, managed services and consulting services. Unfortunately, DWS's reporting on these business lines is somewhat opaque as the company does not split its financial results out by any defined segment (product nor geography). Fair to say, DWS is a traditional IT services provider, with a well spread client base. In its FY15 results presentation, DWS provided the revenue breakdown by industry sector, showing that banking and financial services are the largest revenue contributor followed by government and defence, and then daylight.

Source: DWS FY15 results presentation

In our view, the exposure of DWS to banking and financial services is a positive. In particular we note that there has generally been an underinvestment in technology in the Australian banking sector in the last five years and this will necessitate additional investment in coming years. The fact that DWS has some exposure to eight different sectors is a further positive. While financial services and government may currently be the major drivers of revenue at present, the opportunity for expansion into these additional sectors remains a positive.

Risks and operating leverage

DWS is an IT services business that functions with low operating leverage, strong margins and a healthy level of flexibility. I note again that the consultancy model means it is largely a people business (and indeed the company's largest cost is staffing). The old IT consulting model has suffered through significant demand-driven turmoil as both the government and private sector contracted spending over the last five years. This has led to the volatility in both profits and dividends mentioned above. However, DWS has been reasonably placed to endure this downturn, as its balance sheet strength and low level of fixed costs have provided a cushion to lower revenue. It is this same level of flexibility in the company's operations that leads us to believe that the model's ability to grow as demand recovers is significant.

Outlook and forecasting

DWS had a poor first nine months in FY15 and the sector was really continuing to struggle. However, it appears that demand is beginning to pick back up in the sector, with DWS posting a fourth quarter EBITDA that grew $837k when compared to the previous corresponding period.

The company also updated the market suggesting that the stronger conditions had continued into the first quarter of FY16. If this trend continues, and the company's acquisitions perform to expectations, EBITDA in the vicinity of $23m is likely. This equates to more than 50 per cent growth on that achieved in FY15. I should note that this relies on assumptions that the market continues to strengthen at the rate witnessed in the fourth quarter. However, even if this side of things disappoints slightly, the company is well placed for strong earnings growth.

During FY15, DWS acquired Simplicit which contributed one month of earnings to FY15, some $172k in EBITDA. Additionally, the company has purchased 75 per cent of Phoenix, which is an IT consultancy business with blue chip clients. DWS purchased this stake for around $25m, on a multiple of 5.2 times EBITDA, which implies that a 10 month ownership would have the potential to contribute around $3m in additional earnings to the group in FY16.

The company's earnings are expected to grow significantly in FY16 through some potential recovery in market demand as well as the contribution of both the Simplicit and Phoenix acquisitions. Given this, and despite some of the upside being mitigated by the costs of financing associated with higher debt levels, we believe that there is upside to the dividend paid during FY15 when we forecast FY16. Thus we are expecting a dividend above 9 cents in FY16. This alone is a very compelling potential yield for investors. Additionally, DWS is trading on a forward PE of around 9x.

Income first addition

I have decided to add DWS to the Income First model portfolio with a weight of 5 per cent. The ex-date for DWS has passed recently, so there will be some waiting involved in terms of seeing the income produced from this investment. Nonetheless, I feel it provides exposure to a sector that appears to be turning a corner at a good price, with the potential to see growth in both capital and dividends. My valuation is $1.19.

To see DWS's forecasts and financial summary, click here.