Cummins: A proxy for US growth

Cummins Inc. designs, manufactures, distributes and services diesel and natural gas engines, electric power generation systems and engine-related component products, including filtration, exhaust after treatment, fuel systems, controls and air handling systems.

These products are marketed to original equipment manufacturers (OEMs), distributors and other customers worldwide.

Cummins is the world's largest diesel engine manufacturer. The Cummins brand is synonymous with heavy duty diesel engines worldwide. The majority of heavy trucks on US roads today are powered by Cummins.

The company has a commanding 40 per cent share of the market. Competitors include Detroit Diesel (23 per cent share), Daimler (26 per cent share), Volvo (17 per cent share), and new entrant PACCAR (2 per cent share).

The company has long-standing relationships with leading global truck manufacturers such as PACCAR, Daimler, Chrysler, Volvo, Ford, Komatsu, MAN, Dongfeng Motor, and Tata Motors. Cummins has built out a network of some 600 company-owned and independent distributor locations and approximately 6,500 dealer locations in more than 190 countries and territories.

Reasons to invest in Cummins

There are a number of general reasons why I like Cummins.

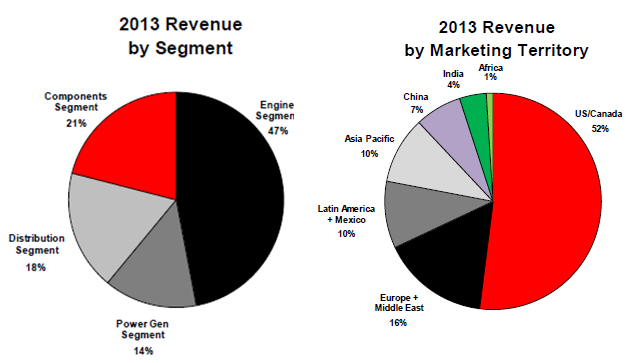

Cummins' geographic exposure is one of the best in its peer group with over 50 per cent of sales in North America, some 30 per cent of sales from emerging markets (especially India, a market that I like) and low relative exposure to Western Europe.

Cummins' power generation sub-segment is well positioned for the longer-term growth opportunities afforded by inadequate (and in some regions, inaccessible) electricity infrastructure in many emerging economies. Power Generation had $US2.9 billion of sales in 2014.

The power generation business serves three primary end markets:

- 50-55 per cent for the standby market (back-up power);

- 35 per cent prime power (main power supply); and

- 10-15 per cent is mobile.

The standby market serves municipalities, pump stations, firehouses and other critical back-up power needs (50 per cent), with data centres making up 15 per cent and the remainder being mission critical applications (i.e., hospitals) and commercial/manufacturing.

Prime power is used in a number of markets, particularly in the developing world, as the main power generation source (rather than as back-up power).

Cummins is also well positioned to benefit from a global focus on energy/engine efficiency, as it is the lone provider of diesel engines with a fully-integrated components offering. The more sophisticated engine technology that is required under new regulations provides an opportunity for Cummins to raise prices at the OE level.

Cummins should also benefit from tougher standards on heavy-duty trucks in most markets. Through heavy spending in R&D, Cummins has developed an efficient selective catalytic reduction (SCR) technology and a unique subsystem capability that would allow integration of the needed efficiency improvements.

Fortunately, unlike many of Cummins' peers such as Caterpillar and Terex, exposure to oil & gas is marginal. Cummins total revenue exposure to upstream oil and gas is one per cent. Falling energy prices are a positive for the trucking industry in general.

Cummins reported earnings on February 5, 2015, slightly beating consensus estimates for earnings per share and revenues. It also lowered its full-year guidance for 2015 sales growth to 2-4 per cent citing soft international markets and currency headwinds. This change in guidance overshadowed a solid ( 11.2 per cent) gain in fourth-quarter revenue driven by strong demand for trucks in North America.

More specifically, I believe North American heavy truck fundamentals will go from strength to strength in an improving US economy and replacement demand.

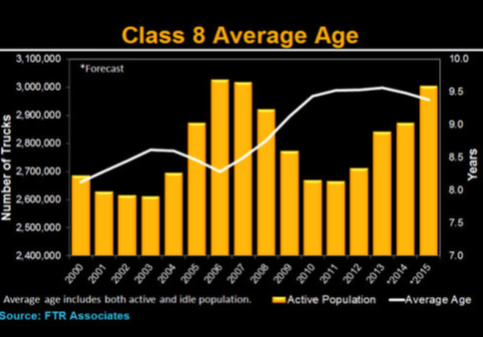

Aging vehicles and rising maintenance costs may continue to support new equipment buying; North American truck retail sales have been below estimated replacement demand of 250,000 units in six of the past seven years.

The average age of the heavy truck population is projected to remain near record levels in 2015, at 9.38 years vs.9.56 in 2013, according to FTR Associates. Cummins, of course, has strong relationships with Daimler, Paccar, Navistar and Volvo, the largest North American truck makers.

While most other geographic regions are at least holding their own, I expect some recovery in European and Asian markets (including China) in 2015.

In China (7 per cent of total sales), the new emission standards are a major factor in industry truck production (1m trucks are produced each year), with adoption of the new NS4 standard expected to double from 30-40 per cent in 2014 to 70 per cent this year.

Analysts have forecast the China truck market will decline 6 per cent year-on-year but Cummins volumes should increase some 10 per cent due to the increased penetration of the emission rules and the ramp in production of the ISG engine.

Cummins has about a 20 per cent share of the after-treatment components and 40-50 per cent of turbochargers for compliant engines in China.

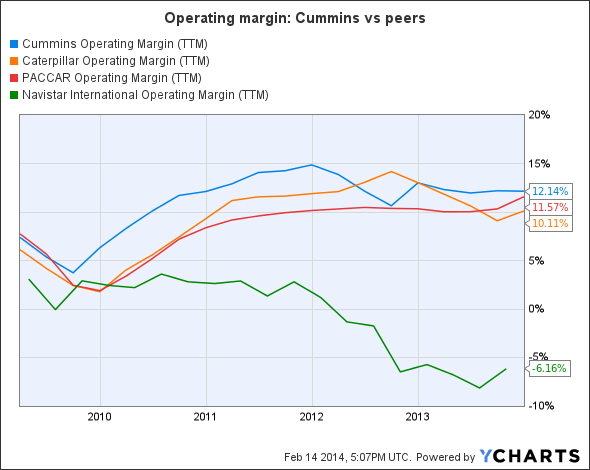

Cummins still boasts the best operating margin in the industry, as evidenced by the chart below. Operating efficiencies and significant declines in commodity inputs (Cummins uses significant amounts of copper, iron and steel, as well as platinum and palladium in the components business) should see a return to the 15 per cent area over the medium term.

Valuation

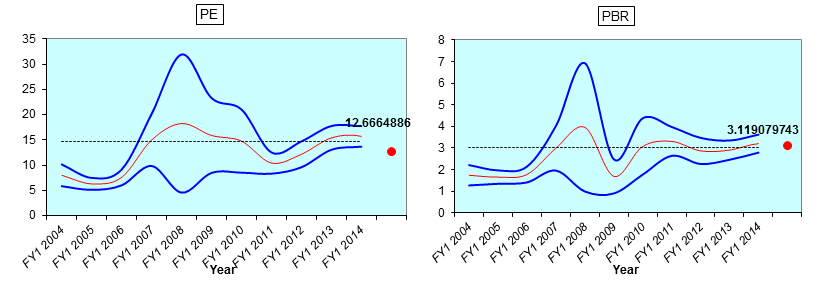

Cummins is statistically cheap, trading at 13.4 times 2015 earnings per share (EPS) and 12.2 times 2016 EPS.

That is substantially below its historical range in terms of price-earnings multiples and price to book value.

Cummins has underperformed the S&P 500 year to date (the stock is down 4 per cent) and up only 1.5 per cent year-on-year. It is currently trading 14 per cent below its 52-week high of $US161.00.

33 analysts cover the company; 20 have a buy (with a recent upgrade from Macquarie USA) and 13 have a hold.

We have a world class company, benefitting from a solid economic recovery in North America, that is well placed for new emission standards in China and elsewhere, and is leveraged into a potential recovery in Emerging markets.

I would be a buyer here at current price levels ($US140).

My price target is 16 times 2015 EPS of 10.32 or $US165.

Risks

The North American truck industry has historically used externally sourced engines from independent engine makers like Cummins. Customers' brand loyalty and the high residual value provided by these independent engines maintained strong market shares despite attempts by some manufacturers to increase vertical integration.

Recently, however, North American manufacturers are starting to migrate towards the European model of backward integration. For example, Navistar and PACCAR decided to build their own engines in the US and install them in North American heavy-duty trucks.

Another risk is that the primary end-markets that Cummins sells to are cyclical. The company has a high degree of fixed cost leverage so a marked downturn in one of these larger end-markets could result in sharp decline in sales and profitability.