Credit Corp: Result 2016

Credit Corp has once again underpromised and overdelivered.

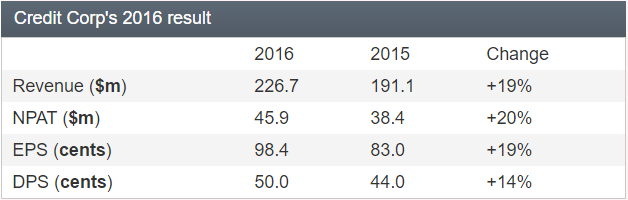

In its 2016 result, the company posted a 20 per cent increase in net profit, to $45.9 million, on revenues that rose 19 per cent to $226.7m. Earnings per share (EPS) increased by 19 per cent, to 98.4c, which was above the top end of guidance.

Key points

- Seventh consecutive year of earnings growth

- Net assets growing but so is debt

- Consumer lending to fuel growth

Credit Corp has now achieved seven consecutive years of EPS growth, averaging 22 per cent per year.

As the biggest player in the debt collection industry Credit Corp enjoys economies of scale in a number of important areas. Top of this list is its analytical capability, which benefits from enormous quantities of collection statistics that it continually uses to fine-tune its analytics. As a result, the company can boast a long history of pricing accuracy. Credit Corp's size also gives it the resources to develop sophisticated technology, including enhanced collection capabilities and automated systems to ensure compliance to policies.

The larger financial institutions, such as banks, also prefer to work with debt collection agencies that have the size and sophistication to meet their requirements.

Credit Corp chief executive Thomas Beregi understands that when a bank sells debt to a debt collection agency, it's putting its reputation on the line. Credit Corp has therefore worked hard to develop an excellent compliance record and reputation, and this is illustrated by the company having one of the lowest complaint rates in the industry.

The company is split between two main businesses: its core Debt Buying business and a fast-growing Consumer Lending business.

Debt purchasing

Credit Corp's debt buying business involves purchasing ‘written off' debt from large institutions such as banks. This debt is aggregated by the banks into Purchased Debt Ledgers (PDLs) and sold to collection agencies. The debt typically contains credit card and unsecured personal loan debt and is purchased for a price that is in the range of 15-25c in the dollar.

Credit Corp's objective is to not only collect more than what it paid for the debt but enough to cover its expenses, pay tax and make a profit. Typically, collection rates are around two times the purchase price when viewed over a six-year collection horizon.

In 2016, the Debt Buying operation increased net profit by 6 per cent, to $40m, on revenues that rose 12 per cent to $173m.

The Debt Buying business currently has PDL assets valued at $253m with a face value of $5.3 billion. The company has established payment arrangements with customers on 147,000 accounts with a face value of almost $1.2bn. The more payment arrangements, the better, as once a payment arrangement has been established with the customer, the likely collection rate of that debt soars to just over 50 per cent of the debt's face value.

The company also has a nascent US debt purchasing business, which is expected to reach breakeven in the second half of the 2017 financial year.

Consumer lending

The Consumer Lending business sits in a unique position between the mainstream lenders and payday lenders. The interest charged on these products is high (to account for the higher risk), but is still well below legislated caps, making its products an attractive alternative to payday lenders.

Demand is growing, with around 3 million Australians excluded from mainstream lending due to their poor credit profiles. The high level of demand means Credit Corp can be fussy and so it approves only around one in five loan applications.

Even so, the business is growing quickly through brands such as Wallet Wizard and now has total loans of $135m. It contributed a net profit of $6.1m in 2016, up from only $1m in 2015. This strong growth should continue and is behind management's guidance for overall net profit growth of 13-18 per cent for the 2017 financial year.

Debt increasing

To help fund its increased purchases of PDLs and the expansion of its consumer loan book, Credit Corp increased its own net debt from $59m to $140m in the 2016 financial year. This gives it more opportunity to grow profits, but it does increase risk. As illustrated in 2008-2009 – when operating profits plunged to $26m, just 2.5 times its net interest bill, and its share price fell 95 per cent from its 2007 peak – too much debt combined with underperforming PDLs can cause existential problems.

There's no doubt that collection rates and profit would decrease sharply in a downturn. So long as it wasn't itself imperiled, however, a recession could provide Credit Corp with an opportunity to purchase debt ledgers on the cheap.

Any downturn would also shine a light on Credit Corp's analytics, the quality of which must be maintained as its growth continues. The risk of reputational damage also increases with size. Debt collection is a closely watched industry and any lapses in collection behavior by staff could negatively impact reputation, thereby affecting Credit Corp's ability to win new business.

This result confirms that Credit Corp is in great shape, and that explains why its share price has risen 35 per cent since we last reviewed it in May. However, this has pushed the price-earnings ratio up to 16, which doesn't leave enough margin of safety for a purchase, so we're downgrading to HOLD.