Arista disrupts the cloud

Cloud computing is computing in which large groups of remote servers are networked to allow centralised data storage and online access to computer services or resources.

The McKinsey Global Institute, in its influential study on disruptive technologies, estimates that by 2025 over 90 per cent of US businesses and public institutions will be hosting critical applications in the cloud. Recent surveys have found only 54 per cent are utilising this service. There is still a growth opportunity here, not only in the US, but globally as well.

The cloud has been around since the 1950s when businesses could rent time on mainframes. However, the concept really took off after the dot-com bubble burst in the early 2000s with the widespread availability of high-capacity networks and low-cost computers, together with the widespread adoption of virtualisation and service-oriented architecture.

But who plays in this space? The usual suspects of course: IBM, Cisco, Amazon, Google, Microsoft, Salesforce.com and VMware.

One of the main barriers to total adoption of the cloud is really network capacity given the related upgrade costs and the speed of implementation. That brings us to Santa Clara (California) based Arista Networks.

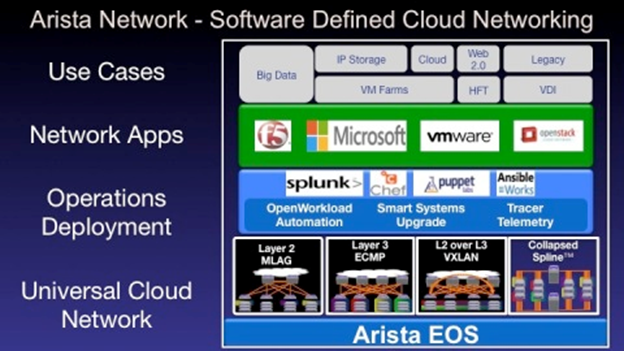

Arista Networks delivers software driven cloud networking solutions for large data centre and high-performance computing environments. There are more than two million cloud networking ports being deployed worldwide. Arista is addressing this market with a portfolio of 1/10/40 and 100GbE products that redefine network architectures, provide scalability to networking and dramatically change the price/performance of data centre networks.

Industry commentators are consistently referring to Arista's product line as “best of breed”.

Arista specialises in the data centres where internet traffic from websites and mobile apps is managed. Its main competitor is Cisco Systems, which has a 70 per cent market share in “legacy” network switches and software.

Arista (and many analysts) believes these older installations are inefficient and won't be able to carry the increased traffic load of data. Global internet traffic has increased fivefold over the last five years and is predicted to increase at least another three times to 2020.

Arista's Extensible Operating System (EOS) is programmable and modular, and is built on standard Linux, which allows customers to develop their own software applications as well as integrate with off-the-shelf Linux-based applications, a substantial departure from the closed-system approach of legacy networking equipment from providers such as Cisco. This is the reason you want to own Arista.

Latest results

In their latest earnings report (only the third as a public company) on February 19, 2014, Arista reported a strong fourth quarter, with revenue of $US173.5 million up 11.6 per cent compared to the previous quarter and 51.2 per cent compared to the same time last year, beating consensus of $US166m and previous guidance of $US160-165m.

Earnings per share (EPS) of $US0.53 topped the street's estimate of $US0.38, and nearly doubled the $US0.27 from Q4'13, Gross margin of 67.4 per cent was well above consensus of 64 per cent.

First-quarter guidance was also solid with revenue of $US164-172m above the market's estimate for $US162m, with a gross margin of 63-66 per cent versus forecasts for 64 per cent.

These were great results and the stock traded up over 6 per cent. However, investing in disrupters is never easy because there is a “fly in the ointment” here – a recent lawsuit (in December) involving 14 patents with its main competitor Cisco.

The lawsuit

Lawsuit risks are unquantifiable. Analysts can estimate potential damages but they are no more than educated guesses based on similar cases. Arista obviously does not believe they have infringed on Cisco's patents or intellectual property and the company has pointed out that the Arista EOS operating software was developed from scratch from a blank sheet. It is worth noting that the heart of ANET's differentiation from Cisco is in its Linux-based programming which is radically different to the Cisco programming.

It is also worth noting that Cisco claims that Arista is using technology invented when its founders, leaders, and employees worked at Cisco. Former Cisco employees include Arista's famous billionaire co-founder and Chairman Andy Bechtolsheim, who co-founded Sun Microsystems and later earned billions by angel investing in Google. Then there's Arista's chief executive, Jayshree Ullal, who prior to Arista was a 15-year Cisco alum. She led Cisco's core switching and networking division.

So is this suit just “sour grapes” on Cisco's part, reacting to the success of the new upstart, staffed mostly by ex-Cisco employees? Also, as Arista shipped its first product in 2008, why has Cisco waited until now? I have difficulty in believing that individuals of this calibre would even consider building a billion dollar business on someone else's technology.

Lawsuits in the US also take an incredible amount of time to get through the courts. A similar lawsuit involving Juniper and Palo Alto Networks took two and a half years. The company believes it will take two to three years for a resolution. Most patent infringements suits never get to court and usually lead to a settlement. Litigation expense will be a drag on cash flow, however.

Arista's outlook

Focusing on the business at hand, the main drivers for Arista going forward are the growth of infrastructure supporting Big Data/IaaS/Web 2.0, and strong capital expenditure spending, particularly from the top 10 Web 2.0/IaaS players (who have already increased capex 50 per cent in CY13). Out of necessity they are likely to increase spending 20-50 per cent annually over three to five years.

The private cloud/enterprise market has also discovered the Arista's Linux programmability enabling software-defined networking (SDN) virtualisation. This is a market that could grow 25 per cent per annum.

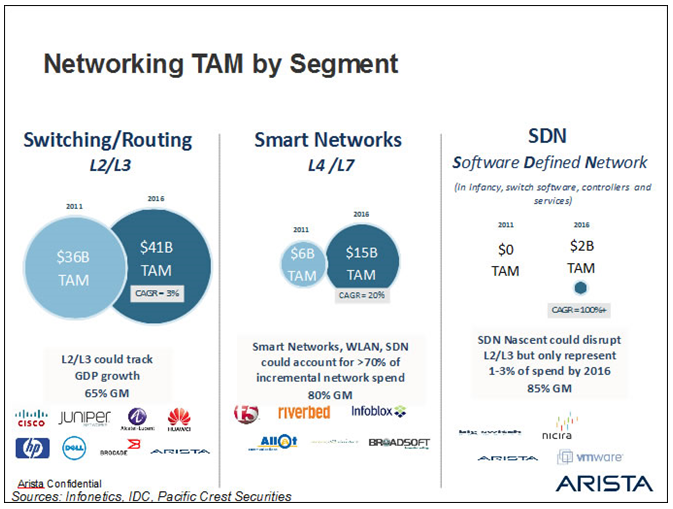

Shown below is Arista's strategy in targeting what are huge total addressable markets (TAMs). Note the numbers.

Valuation

Arista's stock price is currently down 25 per cent from its $US91 high reached in September of last year. The company went public in June of 2014 at $US43.

The stock popped 27 per cent on the first trading day and then went on to hit new highs. Since then the shares have given up most of those gains – not unusual in new high growth companies.

This year Arista is up 13 per cent. Of the 27 analysts who cover the company, 18 call it a “buy”, seven rate it a “hold”, and two have it as a “sell”. The average target price is $US84, or 21 per cent above the current price. Analysts have significantly raised earnings and revenue projections after each earnings release. I expect this to continue.

Arista is what I would call a “hyper growth” company. Since 2010 sales have grown at 70 per cent each year (from $US72m to $US584m) and next year will be in excess of $US1bn.

Revenues are forecast to grow 30 per cent a year from 2014 to 2017 and even that rate of growth could be understated given the size of the legacy installations in the addressable data centre/private cloud market and the extremely strong multi-year global data centre build out by the cloud providers (likened by one analyst to what the North American fibre builders did in 1995-2001).

Arista is a classic disrupter with a best-in-breed product chasing a vast and growing market.

And as for management? In a recent due diligence call, a Web 2.0 senior executive had this to say: “Arista's management are rock-stars. Our engineers were wowed by management.”

I think we can make money with this company. It's a “buy” at current prices, but only for investors who are comfortable with high-growth companies and can handle the volatility. Let the market and news flow provide more buying and position building opportunities.

We have a target price of $US90 based on 8 times enterprise value (EV) to revenues in 2015 of $US766m.

Enterprise value to revenue is a better valuation tool when dealing with relatively new public companies growing at a rapid rate. To put it into perspective, at $US69 Arista already trades at 8 times EV/2014 revenue and at its 2014 high was trading at 10 times.

Risks

- Cisco becomes more aggressive in the data centre switching segment, resulting in slower share gains than forecast and pressuring revenue growth and gross margins.

- Microsoft is a key customer. Any change in deployment plans or purchasing habits would be material to Arista's revenues.

- Broader adoption of white box switching alternatives than expected, resulting in slower revenue growth, and pressuring gross margins.

- Outcome of litigation is unfavourable to Arista, potentially disrupting its business and/or resulting in a cash settlement.

To see Arista Networks' forecasts and financial summary, click here.