AFIC: The fine art of being dependable

In the investment world, a story sells. It sells an IPO, a managed fund or an idea - anything that an investor will jump on and open their wallet for. They tantalise with the promise of something new, or an edge to beat the market.

A story about the next up and comer appeals on all levels, and in the LIC world there have been plenty of newcomers. They all have their own merits and stories to tell.

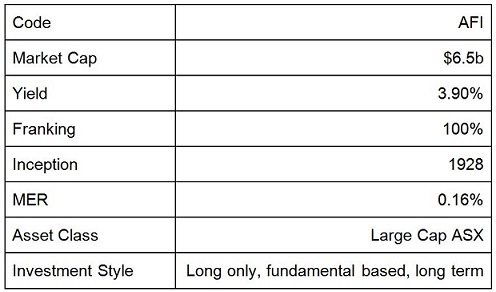

It is easy to get caught up in these new stories, but let's not forget the old ones. And they don't come any older than Australian Foundation Investment Company (AFI). Compared to the newcomers, it doesn't get any more beige than AFI. But don't be fooled - there's a reason why they are still around since 1928 when most of their contemporaties have vanished. To put this into perspective the Australian Stock Exchange was formed in 1987 and even predates the original Australian Associated Stock Exchanges which brought the individual city exchanges together in 1938. Records show Methuselah was even on the share registry.

The investment story

If you have a self-managed super fund, chances are you've had a look at AFI. Market participants and investors will tell you AFI is practically an ETF for the ASX 100. But that's not how AFI sees it. Geoff Driver from AFI sums up the process: “We are a very much a long-term investor. From that perspective we are looking at companies that are well placed within certain industries, clearly with a quality balance sheet, quality management and cash flow is an important element of that.”

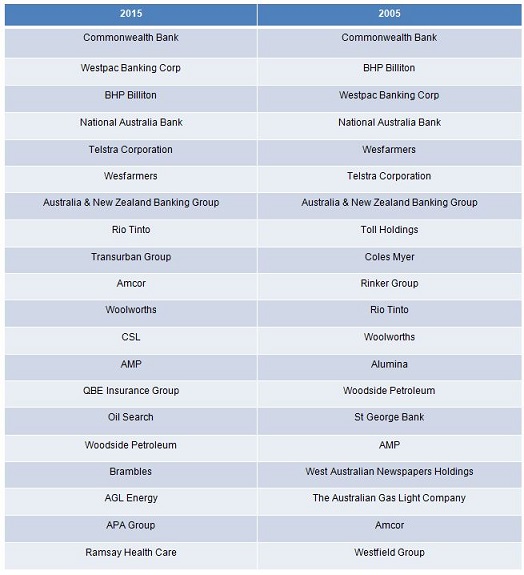

To get a sense of just how long term AFI are when it comes to investing here is their top holdings as of their last update to the market and 10 years ago:

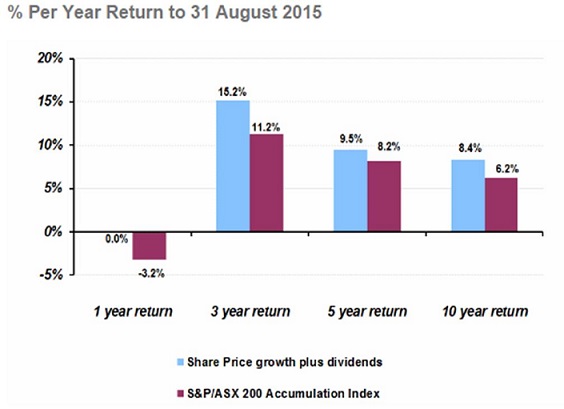

Why would market participants liken AFI to an index fund? Three reasons, firstly there is very low portfolio turnover as you can see. Secondly, the bulk of their portfolio comes from the top 50 companies in the index and finally their returns are very consistent with the market. They tend to beat the market by 1 to 2% each year.

How AFI works

How can a portfolio that is viewed as an index fund achieve this? It is more a case of what AFI doesn't do than what it does. They will hold stocks within the market but not to the weight, for example they have been underweight the banks and BHP. Also they don't hold all the stocks within the index. You could liken it to a John West approach, it's the ones AFI reject that makes it the best….or better than the market in this case.

Driver uses discretionary consumer as an example. “We are not a large investor in discretionary consumer as it tends to be too cyclical from our perspective, we tend to be more focused on those companies that are likely to generate ongoing long term returns and perhaps less volatility in earnings.”

AFI and high yielding stocks

As AFI tends to stick to the higher quality dividend-paying stocks they naturally hold fewer of the smaller, more speculative companies and those with higher levels of gearing. In times of market exuberance this will lead to slight under-performance. “Through the GFC when the market was hit substantially a lot of those speculative stocks were hit very hard and we didn't have any of those geared ones as well like Centro and Babcock & Brown and in that perspective we obviously outperformed even though the NTA still went down.”AFI also write covered call options as well to generate a little extra income. Additionally they have what they call a nursery of smaller stocks they believe will grow into industry leaders in time. A number of these come from the mid-cap LIC Mirrabooka Investments Limited (MIR). But the bulk of the returns are from the top 20 holdings.

As you might know I am not a fan of focusing on fees. I am a big believer in you get what you pay for and if someone charges higher fees and delivers higher performance, that's great. For those who do focus on fees and gravitate towards ETFs for their market exposure, have a gander at the table below comparing AFI's fees to several of the main ETFs out there. As you can see, with AFI you get an active manager, giving you market exposure for a fraction of what are generally perceived to be the low fee options.

AFI in the eye of the storm

Looking back through market corrections and crashes it is clear AFI will do something you won't. AFI will do nothing. It will not change course. It will not panic and sell. If it has cash on hand it will gradually deploy. Half the battle as an individual investor is the internal battle. Hands up if you thought of cashing in and going off the grid for a while in August.

Look through the ASX announcements in 2011, 07/08 and 2002 you will see very little movement in that portfolio. Overall AFI has an average annual portfolio turnover of approximately 4%.

The ability to be calm under pressure comes from decades of experience, and the knowledge that you have a portfolio of quality companies. We all know markets eventually rebound (picking when is the tricky part) and the quickest to recover are companies of superior quality. Look at CBA for example coming out of the GFC or the Greek stumble in 2011.

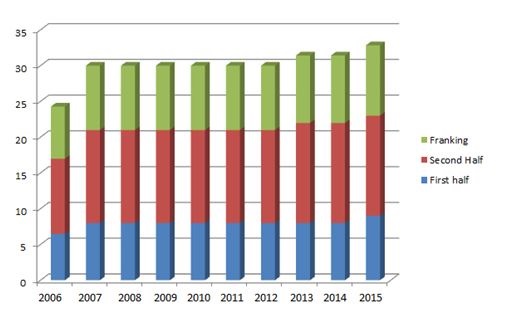

Notably, AFI continued to pay their dividend through the GFC period. When a number of the companies that made up the bulk of the portfolio cut their dividend significantly AFI still paid theirs in line with what they had historically been paying out. The same goes for 2002 when the market suffered from the dot com bubble during this period they even managed to pay a special dividend as well.

The dividend policy is plain and simple for AFI. Build a consistent increasing stream of fully franked dividends that shareholders can rely on.

Sentiment & NTA vs share price

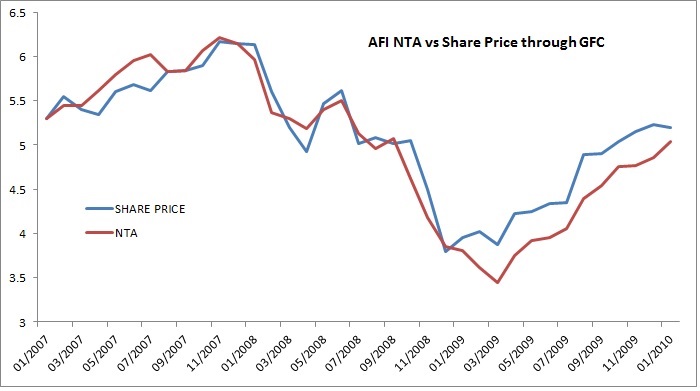

Looking back at the history of AFI's share price in relation to NTA makes for interesting reading, especially in times of market pessimism. The chart below shows that prior to the GFC AFI traded at a substantial discount to NTA. This might come as a surprise to some, thinking at a time of market exuberance people would be prepared to pay up for market exposure. But it was also a time when investors confidence was sky high. They could all do it themselves.

After the crash the inverse happened. AFI went from trading at a discount to trading at a significant premium. This was for two key reasons. Firstly, the board made the decision not to cut their dividend through the GFC. This was incredibly important as it gave investors much needed income. Secondly, AFI is viewed as safe and dependable. It has a quality portfolio that has stood the test of time. Investors were a little like children in their early twenties moving back in with mum and dad when the money ran out and so were willing to pay a premium for the rational thinking of the investment team and board at AFI.

How did you feel when the market dipped below 5000?

The investment case

There are a number of ways investors of different styles and life stages can use AFI in their portfolio. If you were one of those who bought a market ETF at 5700 or anywhere in between do you see value in the market now?

You could use AFI for your complete market exposure and sleep well at night. Some people out there may call it a lazy person's way of investing but if you can beat the market by a few per cent, year in year out, and get what you need to live off income-wise (not what you want but what you need, there's a big difference) than who cares about labels.

Another way you can use AFI is as a cornerstone for your portfolio. Buy a few parcels in it averaging down in these volatile times and use it as a backstop as you invest in specific companies and ideas. You will be comforted knowing AFI will be there rain, hail or shine paying you an income whilst you explore more interesting pursuits.

Why is it not in the model? I was able to get very similar market exposure through BKI and at the time I bought it I was able to get it at a slight discount to NTA whereas AFI was at a premium. It still is by the way, but buying this is taking a ten year or even decades long view or potentially generations long. AFI is one of the only LIC's I've seen with a section on their website dedicated to investing for children or grandchildren. A four per cent premium now is not going to make a great difference in twenty years' time.

AFI is boring. It is what it is. Saying this I am reminded of a George Soros quote: “If investing is entertaining, if you're having fun, you're probably not making any money. Good investing is boring.”

Portfolio update

Given BKI's material share price movement I am going to stick with my original statement and look to average down into the position. Tomorrow at market open I will be adding a further 5 per cent to BKI. More details on the LIC Model Portfolio are available here.