A closer look at Retail Food Group

Retail Food Group is one of Australia's largest multi-food franchise operators operating well-known brands such as Donut King, bb's café, Michel's Patisserie, Esquires Coffee, Pizza Capers, Crust Gourmet Pizza and The Coffee Guy.

The company was established in 1989, primarily to manage and develop the Donut King and bb's café brand systems, and since listing on the ASX in 2006 has been a consistent and successful acquirer of food-related franchise systems.

The acquisition path continued in 2014 with the company adding Café2U, Gloria Jean's Coffee and Di Bella Coffee to the stable. Together, these acquisitions significantly increase RFG's exposure to coffee along the supply chain.

Retail Food Group is run by Tony Alford, who has been involved with the company since 1994 and has been managing director since 1999. Colin Archer has been the independent chairman since 2006, broadly when the company listed on the ASX.

A recap on recent financial performance

Since listing in 2006, Retail Food Group has been a terrific success story, delivering significant share price appreciation and dividend growth for shareholders.

The last six years have seen significant acquisition activity and a six-fold increase in the share price so we thought it a worthy period of a closer look at the performance of the business.

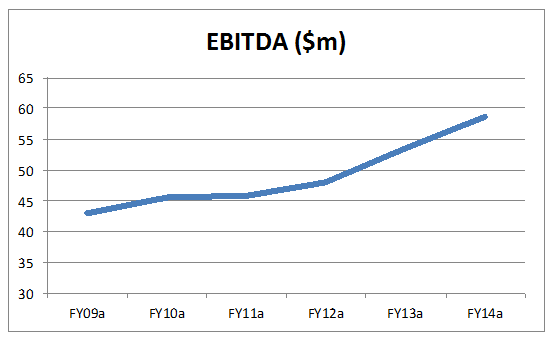

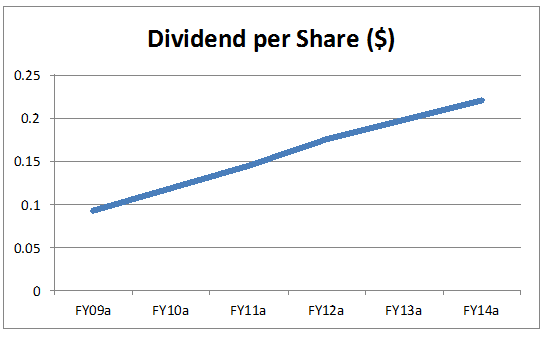

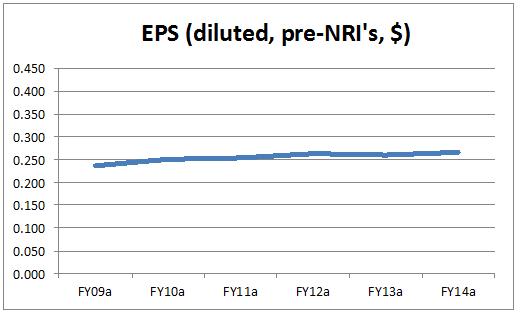

In the six years to 2014, RFG has managed to grow profitability by over 50% and more than double its dividend per share. This is a unique outcome for a domestic industrial business of this nature throughout this time period.

It is worth noting, however, that these strong headline numbers somewhat flatter the reality of the performance of the underlying business.

A closer look at profitability

The key driver of RFG's earnings growth in recent years has been the numerous acquisitions undertaken. Since listing, the company has acquired Brumby's Bakery, Michel's Patisserie Brand System, Esquires Coffee, Evolution Coffee Roasters, Crust Pizza and others.

In order to fund these acquisitions, RFG has consistently raised capital in the equity market. This has largely been done by underwriting the company's dividend reinvestment plan, a small capital raising in 2010, and raising in excess of $100m over FY13/FY14 and $55m in FY15 thus far.

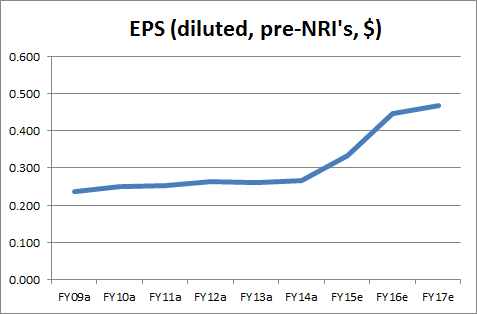

It goes without saying that raising additional equity capital reduces the proportional share of company earnings on a per share basis. As a result it is interesting to note that earnings, on a per share basis, have been broadly flat for the past six years despite the increase in gross operating profit.

The clear inference is that the share price appreciation in recent years has been a result of multiple expansion rather than earnings growth and it is likely that the share price is already discounting at least some of the potential benefits of the more recent acquisitions that we will discuss below.

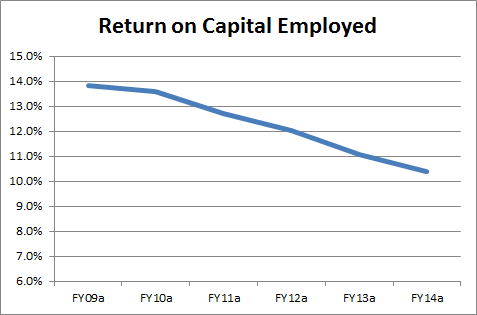

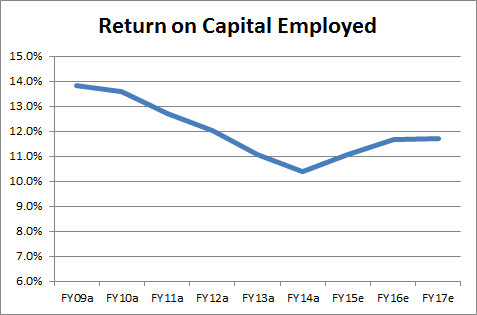

Equally as important, we note that RFG's return on capital has been consistently declining in recent years, raising some questions marks over the productivity of the group's legacy businesses.

A closer look at the dividend

Retail Food Group has had a strong track record of increasing its dividend in recent years. As outlined above, the company has more than doubled its dividend in the past six years. Any company with the ability to do this has been perceived favourably by domestic investors in recent years and by and large enjoyed robust share price appreciation. RFG is no different.

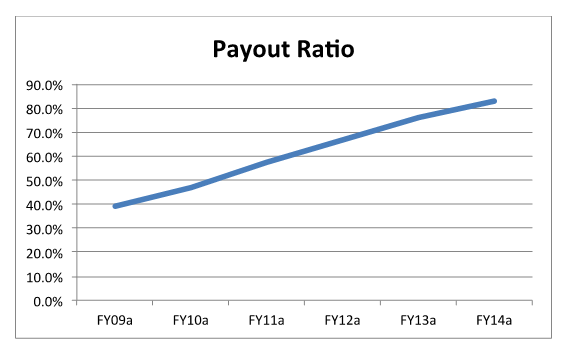

As outlined above, though, earnings on a per share basis have achieved limited growth, so it is important to note that the increase in dividend has been almost entirely driven by an increase in the company's payout ratio. It could be argued that this is an inefficient use of capital given the company is underwriting its DRP and has raised additional equity in recent years.

With a payout ratio in excess of 80%, it is important to understand that further increases in dividends will only be driven by increases in per share profitability.

Recent acquisitions: A coffee empire along the supply chain

In the second half of 2014, RFG announced three significant acquisitions in the coffee industry. In aggregate they encapsulate much of the coffee supply chain.

In August, the acquisition of Café2U was announced. This was followed by the $163.5m (plus up to $16.4m earn out) acquisition of Gloria Jean's Coffee in October and the $30m (plus up to $17.3m earn out) acquisition of Di Bella Coffee in November.

While the combined acquisitions will make little contribution in FY15, they should add in excess of $30m EBIT to the group's current earnings base from FY16.

These are clearly transformational acquisitions for the group.

The combined transactions significantly increase the group's upstream coffee roasting throughput from 1.5m kg pa to ~6m kg pa, as well as significantly increasing the group's downstream outlet network.

Accordingly we expect meaningful opportunities for both cost and revenue synergies as the acquisitions are integrated into the broader group. Management anticipate in excess of $15m restructuring benefits will be available to the group.

Importantly, we view these transactions as a catalyst to lift both the earnings per share and returns profile of the group. They key question is how much of this is already priced into the current share price.

Earnings and valuation

The key question facing investors in Retail Food Group is: What is the right price to pay for a business with two years of clearly defined acquisitions-based earnings growth that has some question marks around the growth outlook of a number of its legacy businesses?

On the basis that management achieve their integration and synergy targets, RFG is currently trading at ~13x FY16 earnings, broadly in line with the small cap industrials index. This suggests that the current share price is already discounting much of the potential success of the recent acquisitions. Considering that it would be unusual for an integration of this size to not have some stumbling blocks along the way, and that much of the success appears largely priced in, we adopt a Hold recommendation.

To see Retail Food Group's forecasts and financial summary, click here.