Will solar trade disputes hurt demand?

To understand the potential scope of the current trade disputes and barriers, it is useful to examine exactly how much future demand may be impacted by current restrictions and investigations.

While the broad impact of policies and disputes is well known throughout the industry, it is less clear just how far-reaching these actions could be in terms of impacting future PV market demand.

Figure 1: Top 30 PV market demand; cumulative 5-Year demand 2013-2017; 215 GW

Source: Adapted from NPD Solarbuzz Marketbuzz

This article discusses using a trade barrier index combined with the 5-year cumulative market demand projections for the top 30 markets (shown below). Each of these was recently featured in NPD Solarbuzz’s Marketbuzz report.

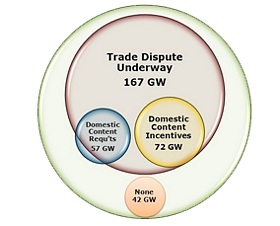

For this, we have introduced a Venn diagram visual, created to show how much future demand could be affected by trade barriers and investigations.

The figure shown has four distinct sets, with the size of each representing the total market demand: markets with trade disputes underway, markets with domestic requirements, markets with domestic content incentives, and markets with none of the domestic or trade issues yet.

Taken together, these four sets represent the top 30 global markets and account for approximately 215 GW of cumulative demand over the 5-year period from 2013 to 2017. When taken together, these 30 markets account for over 90 per cent of global cumulative demand over the 5-year forecast period.

In total, 80 per cent of future demand from the top 30 countries is now at risk from a trade dispute or has some form of domestic restriction/bonus policy in place. The trade disputes underway today are affect both the upstream manufacturers (primarily in the form of anti-dumping and countervailing duty investigations) as well as the downstream supply channels (in the form of complaints against domestic content or domestic bonus policies).

While the majority of the upstream-focused investigations are being conducted by national – or in the case of the European Union supranational – bodies, many of the downstream-centric investigations (especially domestic bonus and content policies) are being investigated by the World Trade Organization.

In terms of expansion of trade disputes, it is more likely that the scope of current trade disputes will expand within these top 30 countries rather than more countries being involved. For example, countries that are already involved in an upstream-centric trade investigation will likely see the scope expanded to include a downstream-specific action, again most likely via the WTO.

Countries that currently do not have any of the specified trade barriers could continue to avoid entanglement, because many of them remain open to foreign products as they do not have strong PV incentive policies and market demand is being generated without undue expense to local taxpayers.

However, these markets represent a minority, both in terms of the total number of countries as well as total capacity share. Therefore, it is likely that supply and demand micro-environments could begin to emerge as domestic protectionism will continue, through incentive policies, content restrictions, or import duties.

Until now, end-market demand has not been directly affected by any of the trade cases, other than affecting possible investor confidence and changing market-shares among module suppliers. However, as the cases expand across the top-30 PV regions with more vigour, then there is a strong possibility that end-market demand will have to factor in these issues moving forward.

This article was originally published by SolarBuzz. Republished with permssion.