Why you owe power companies a living

Regular readers of Climate Spectator will be very familiar with how the profitability of major power generators in Europe has been hammered by the growth of renewable energy and a drop off in electricity demand. This has been a particular issue in Germany, where rapid growth in solar has acted to depress prices in the wholesale electricity market, such that gas generators are losing money and coal generators are only barely covering their costs.

Curiously, the main lobby group for electricity suppliers, the Electricity Supply Association of Australia or ESAA, has taken the initiative of commissioning a report examining the possible lessons for Australia from this energy demand drop and renewables-induced profit squeeze. It is written by Mark Lewis, former head of commodity trading for Deutsche Bank in Europe and a leading expert on Europe’s carbon and power markets.

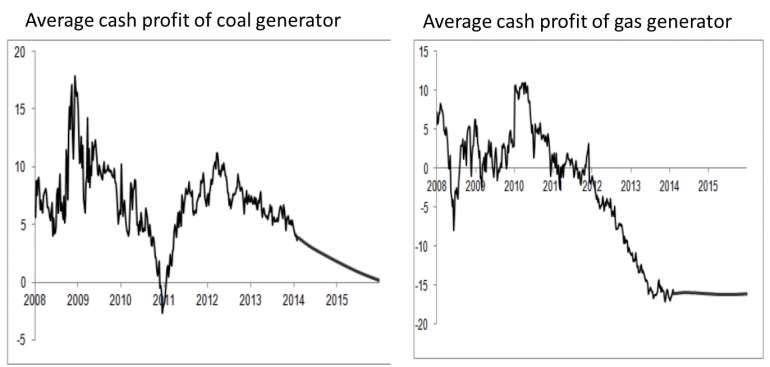

The report provides two charts which help to illustrate the pickle confronting fossil fuel generators in Germany. The chart on the right in particular shows that since about 2012, gas generators have received insufficient prices from the wholesale electricity market to cover their fuel and other operating costs, let alone a return on capital. Coal generators have done better, partly because US shale gas has pushed US coal overseas reducing coal prices, and also because of the collapse in the EU carbon price. Nonetheless, looking forward their profitability also appears grim.

Source: Bloomberg cited by Mark Lewis (2014)

Essentially these generators have found that in spite of a plan to phase out nuclear in Germany, a drop away in demand plus the surge in renewables (almost entirely solar PV) has created a large oversupply of electricity generation. And of course, when there’s an oversupply, prices in a market go down.

Why would Australian energy suppliers commission such a report?

Well, it’s all a bit confusing. The report makes a range of points, some of which would be extremely uncomfortable and inconvenient for many electricity generators and the government itself. But it seems to be part of an attempt to weave a narrative around winding back the Renewable Energy Target, because bad things will happen through exacerbating an oversupply of electricity in Australian electricity markets.

In support of such a claim the report notes that a range of recently built, efficient combined cycle gas fired generators (CCGT) are getting squeezed out of the European market while coal manages to hang on. Yet if you wanted to decarbonise your power supply, Lewis observes, then you’d actually want the gas generators to stay in place and instead close the coal generators. That’s because CCGT is half the emissions of coal and its output can be ramped up and down faster and therefore better accommodate the variation in output from an increasing amount of sun and wind power.

The spin you might place on such a report is that Australia needs to pull back on the Renewable Energy Target because it’s going to undermine investments in low emission gas generators. This is a problem for emissions and it’s a potential problem for security of supply.

This seems a bit weird. How can too much electricity generating capacity result in not enough supply?

Apparently because investors will be scared off investing in new plant because of past experience with the RET pushing down wholesale electricity prices. So some time down the track -- possibly in a decade or two when we need new conventional generation -- no one will be willing to finance it. Also, generators will cut back on maintenance so that they might...break down when demand is high and electricity prices are for once actually really good (sound like a good strategy?).

Besides this security of supply problem requiring a stretch of the imagination, if you read the report in detail it throws up a range of issues and suggestions which run counter to policy positions of major generators. This suggests this not as simple as just blaming government subsidies for renewables.

Firstly Lewis notes that one of the reasons for utilities difficult predicament in Europe is in fact their own poor strategic decision-making,

“..given that many [power utilities] were slow to recognize the disruptive threat presented by renewable technologies in general, and by the potential for self-finance for distributed generation in particular (the bulk of the solar PV capacity has been funded by private households rather than incumbent utilities), it would undoubtedly be fair to say that some of the consequences of the power crisis could have been avoided with more adaptable corporate strategies on the part of the incumbent utilities.”

The same goes for Australian power companies which have elected to buy several thousands of megawatts of coal and gas power generation after 2007, when the expanded Renewable Energy Target became government policy. How these companies could cry 'woe is me' when they knew the policy before buying power plants (and even paid bargain basement prices because of the generation oversupply) seems a bit like they reckon the government owes them a living.

Also, Lewis notes that it is a combination of an inadequate carbon price and the declining competitiveness of gas relative to coal (due to US shale pushing US coal into Europe) that has played an instrumental role in gas being pushed aside in Europe. Indeed, Lewis has suggested that the European ETS should have features characteristic of a price floor -- something Australian electricity suppliers have actively undermined.

In Australia, we have similar issues. Even if you scaled back the RET considerably, it’s not gas that will grow but rather coal over the next decade. With the carbon price axed, wholesale gas prices tripling and coal prices steady, and a very large overhang of excess coal fired generating capacity sitting idle, there will be nothing to stop coal output from growing considerably at the expense of gas once the RET is rolled back. It's also worth noting that in the past three years, it has been coal (rather than gas) that has experienced a major decline in Australia at the hands of gains in energy efficiency and renewable energy.

There are a range of differences in Australia’s east coast electricity market and renewables sector to those in Europe, which suggest Lewis’ observations simply don’t apply here. Most importantly is that our wind and solar resources are vastly better than those in Germany and so the cost of government support for renewables is vastly smaller for consumers.