Why our dollar may keep rising

| Summary: There are multiple scenarios for the future direction of the Australian dollar, and the factors driving its course will be key. A higher dollar will be a buy signal for stocks, while a falling $A will be a signal to sell. That our dollar is rising again in the face of a US Federal Reserve economic tapering may provide Australian investors with great investing opportunities. |

| Key take-out: If all the bearish news of a US taper has already been priced, then the $A could push even higher as the Fed actually tapers. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

The Australian dollar is hovering around a key area of support /resistance and has been doing so for the better part of six months – just range trading.

It’s unlikely that, as we head into 2014, the unit is going to stay at that point – there is simply too much going on. What is less clear to me is in what direction it will break. The truth is, it could go either way.

In particular, I think investors need to be prepared for what would be one of the biggest surprises of 2014, and that is that the Aussie dollar pushes higher as the Fed tapers. Today the Australian dollar was trading back above US91 cents following the release of United States jobs data and surprisingly strong Chinese trade data.

The current consensus, as dictated by the Reserve Bank of Australia, is that a higher Australian dollar would be bad for the country and, by implication, our equity market. Australia’s saving grace, according to this view, would be a much weaker Aussie dollar. It’s expected this would rebalance the economy, lift national incomes, corporate earnings and our equity market. As you’ll see below, I don’t think this is right. It is inconsistent with economic theory and historical experience.

Consider that an Aussie dollar appreciation generally comes about from four mains influences – either independently or through some combination.

- The Chinese economy accelerates.

- Commodity prices surge.

- The Australian economy proves to be much stronger than expected.

- The $US weakens further because the Fed announces a taper isn’t imminent.

Similarly, there are five main influences that would see the Aussie dollar depreciate.

- As the Chinese economy slows.

- As commodity prices slump.

- The Australian economy does turn down.

- As the RBA tries to force the $A down through further rate cuts or direct foreign exchange intervention.

- As the Fed tapers.

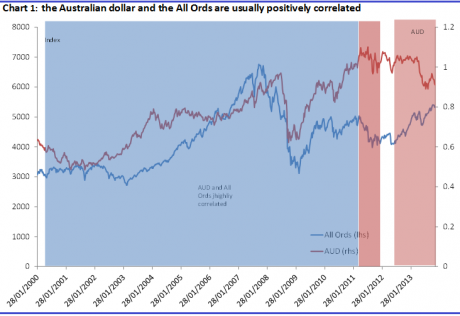

Dealing with an appreciation first, the investment implications of (a), (b) and (c) are good for investors. In each instance, economic growth will be stronger and earnings will be stronger – notwithstanding the higher Australian dollar. That means our equity market will be stronger and valuations more compelling. This is the traditional relationship between the Australian dollar, our equity market and the economy. What’s good for one is good for the other, normally, and so there is a positive correlation as you can see in chart 1 below. I don’t think the RBA has got things quite right here.

In the above chart the area shaded in blue is where you can see the positive correlation – the $A and stocks move up together! The area shaded in red is where that relationship has generally not held and, as you can see, we are in one of those periods now.

Conversely, it makes sense that if a stronger China, higher commodity prices or domestic economic growth outperformance see a stronger currency, then the opposite is also true. Simple enough. In that circumstance – driven by any of (a), (b), (c) and (d) listed above as factors driving an $A fall – a weaker Aussie dollar would signal that Aussie stocks are a sell. That’s because it would mean valuations are rich – earnings won’t be able to match expectations (as given by price growth). The truth is that a weaker $A cannot provide growth in a weak environment – it can only help cushion the fall.

What about the Fed taper? Well, it’s complicated.

The issue of the Fed’s taper (i.e. the reduction in the US Federal Reserve's 'money printing program') is much more complicated. Up to now, the market has viewed any delay in tapering as a net positive, despite the implication that any delay would signal growth is too slow. Longer-term, however, and if the growth story behind it was true, the taper delay would signal weaker earnings growth and imply an overvalued equity market – notwithstanding any short-term sugar hit.

The truth is whether or not a taper delay is actually good for long-term investors boils down to the actual economic conditions of the time.

Perhaps an even more complicated picture will emerge if the Fed actually does taper. Up until this point, the general expectation, and this was mine as well, is that the Aussie dollar would head lower and this would in fact be a virtuous depreciation. Virtuous, because it would be accompanied by stronger US and global growth. That is, the weaker Aussie dollar would be caused by stronger growth – rather than weaker growth as in some of the examples provided above. Obviously a good thing for our investments.

Why the $A could push higher

But let's look again at what we saw on Friday night (December 6), though, after the strong payrolls figures. The Aussie dollar actually ended up over 1 cent higher, most of that after the better-than-expected US payrolls data and rising taper expectations (although there was an another leg-up from the stronger Chinese export figures). That’s left me wondering if all the bearish news on the currency has already been priced in. The Fed has been talking about a taper for a very long time, after all, and the $A is down about 13 cents as a result. Indeed, all that fall occurred in the two months after expectations of a tapering rose (the RBA’s influence has actually been very modest).

If that is right, and all the bearish news has been priced in, then the $A could push even higher as the Fed actually tapers. It’s a case of buy the rumour sell the fact. Well, in this case, sell the rumour and buy the fact. Why would that happen? Well, think about it, and it’s probably the same factors that drove the Aussie higher on Friday night.

Remember that as the Fed’s taper talk heated up, our central bank was out and about talking our currency down, highlighting its concerns on growth – China, commodity prices and the global economy. It may have shot itself in the foot doing this, because as it becomes clear that the world’s greatest consumer – the US – is once again on the march, people may then become more bullish on the world’s greatest producer nation – China. If that’s the case, sentiment on commodities may lift further, and that of course is bullish for the $A. (Indeed I am not alone here, Clifford Bennett has been warning of the distinct risk of a higher dollar regularly in Eureka Report).

I’m not highlighting this as my base case, but I think it’s a risk that has risen from the short-sightedness of policy makers in linking a weak Aussie dollar to weak growth prospects here. In so doing, they’ve set out an economic pretext for the Australian dollar to lift on US economic strength – and a tapering.

From an investor’s perspective that isn’t necessarily a disaster though, as I outlined above. From where we are now – an $A in the low 90s – I think the direction it takes is less important than the why. It’s the why that will impact your investment and dictate the correct course of action. That’s not always the case, but from here I think it is: Don’t forget that.

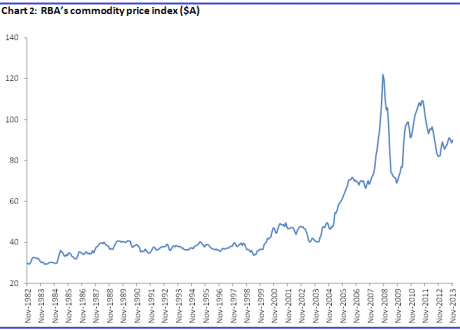

1. Commodity prices and in particular the price of iron ore remain elevated.

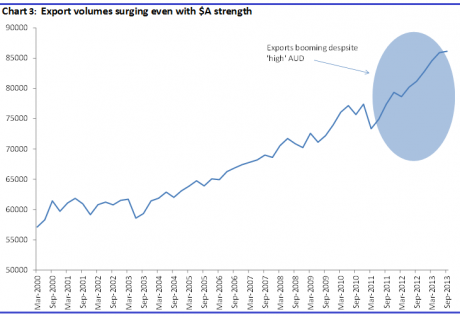

2. Similarly, exports are already booming and were even booming when the exchange rate was higher.

That exports were booming while the exchange rate was high shows that the currency has not been damaging the country.

The fact is that the case that the Aussie dollar is too high simply doesn’t exist. Too high for what? So that’s why I’m not too bothered by the actual direction it goes.

Just be prepared for the prospect that a Fed taper may not be the cure-all the market and policy makers expect. As always though, mismatches between sentiment and fundamentals provide great investing opportunities. The way things are shaping up, the Fed’s taper may provide just that.