Why negative gearing is Australia's biggest policy failure

It is difficult to find a government policy that has been less successful at meeting its objectives than negative gearing on residential property. But unfortunately that is the nature of housing policy in Australia, where sound policies are ignored in favour of policies that encourage speculation, reduce home ownership and redistribute wealth towards the already affluent.

Of all the short-sighted housing policies plaguing Australia, negative gearing receives the greatest criticism. Its original purpose was to boost the housing supply by encouraging greater investment into housing construction. By that metric, it has been an unmitigated disaster.

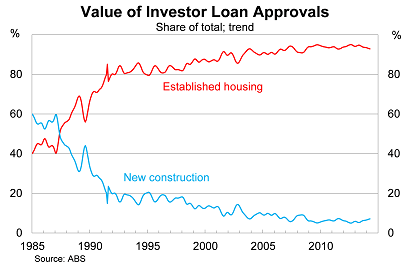

Based on the latest data, new construction accounted for just 7.1 per cent of the total value of investor loan approvals. The trend has ticked up modestly recently but the long-term trend could not be clearer: Australian investors have little interest in newly constructed properties.

Rather than supporting the housing supply and boosting construction-related employment, negative gearing has effectively encouraged speculation and boosted house prices. Statistics from the Australian Tax Office paint a clear picture: property investment is popular in Australia but few of those investments generate sufficient rental returns to cover their costs.

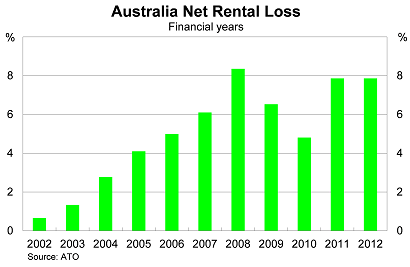

According to the ATO, Australia had 1.9 million property investors in the 2011-12 financial year. Most of those investors failed to cover their costs, suffering a collective $6.8 billion net rental loss. Losses of this magnitude have become exceedingly common in Australia over the past decade.

The only reasonable conclusion is that most Australian property investors don’t really care about rental yields. They are in it for the capital gains, which is the very definition of speculative activity.

But despite the fact that negative gearing has failed to meet its objectives and distorted our housing market it remains a popular policy. Given our housing market is worth over $5 trillion that is hardly a surprise; a number of investors would be left vulnerable if negative gearing was wound back.

One such supporter is The Australian’s economic editor Judith Sloan, who wrote an article yesterday in support of negative gearing. Sloan notes that “It is a fundamental principle that taxpayers should be able to deduct the associated costs incurred in earning income from investments, including the cost of borrowing.”

I tend to agree with that assertion but what Sloan has overlooked is that Australia’s approach to negative gearing differs from normal practice in one simple but important way: we allow losses made on property to offset any form of income.

By comparison, most countries only allow losses made on assets, such as property, to be offset against profits generated by the same asset class.

The difference might appear minor but Australian property investors face very different incentives compared to investors in other countries. These incentives encourage speculation, elevated housing prices and increasing indebtedness.

If property losses can only offset rental profits, then negative gearing only has value if you have a profitable investment property. By comparison, in Australia, negative gearing has value as long as you earn an income sufficient to exceed the tax-free threshold.

Most Australian property investors would fail to benefit under the more narrow application of negative gearing, since most property investors do not hold positively geared properties. For most investors, limiting negative gearing on residential property would be the same as eliminating it.

Sloan goes on to say that “the net effect of negative gearing is to make market rents for these properties lower than they would be otherwise, something which assists those on low incomes”.

This is a common argument trotted out by the pro-negative gearing crowd but it is incorrect. Removing or narrowing the scope of negative gearing would increase rental yields but that doesn’t necessarily imply that rents will be higher. Furthermore, when the Bob Hawke government limited negative gearing in 1985, growth in real rents was relatively benign.

Removing or limiting negative gearing would also boost home ownership by making housing more affordable. The number of new investors would decline, and many would sell their homes, with those properties purchased by owner-occupiers instead. This would partially offset the sharp decline in home ownership rates among those under the age of 45.

Obviously, adjusting the rules surrounding negative gearing would be difficult. Our politicians clearly lack the political courage to tackle our housing problem, while many investors would be left vulnerable to any change in our tax code. In practice, any change would have to be grandfathered in, which would limit the exposure of current investors and allow prices to adjust gradually.

Negative gearing is obviously not alone in creating housing market distortions but it is a key reason why investor activity continues to skyrocket. Australian policymakers need to determine what housing policy should be trying to achieve and tailor policy towards those goals.

I believe housing policy should be designed to improve housing affordability, stability and home ownership -- goals to which negative gearing is poorly suited. Unfortunately the government, through inaction, is supporting speculation and rising indebtedness, and in the process has left household increasingly vulnerable to economic shocks.