Why most SMSFs have underperformed

The Week in Review (by Shane Oliver, AMP Capital)

Investor Signposts (by Craig James, CommSec)

Readings & Viewings

During the week I ran into a person who is becoming really successful with his small enterprise operation, and because he had some spare cash coming forward he thought it was time to start a self-managed super fund.

His super savings were housed in an industry fund. The first thing he told me was that he found it incredibly difficult to get the money out of the industry fund. Every time he filled out the form there was something wrong, and then he had to go through the bureaucracy once again. It took weeks to take the money out. Strangely, many decades ago I did the same thing and had the same problem.

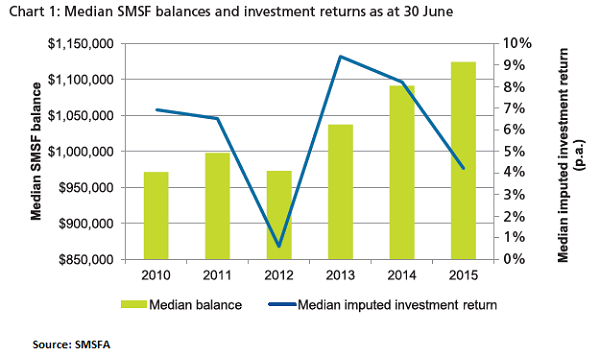

I start my commentary with this story for a particular reason. The Self Managed Superannuation Fund Association (SMSFA) announced this week that the median imputed investment return for self-managed super funds in 2015-16 was only 1 per cent, compared to 4.2 per cent in 2014-15 and 8.2 per cent 2013-14.

The average returns on industry funds were higher than self-managed funds so, not unexpectedly, there has been a volley of press reports instigated by the big funds denigrating the performance of the self-managed fund operators. They are alarmed at the growth of SMSFs.

We need to understand why there was a difference in performance and how this relates to my friend. Industry funds have made enormous investments in property and infrastructure. They are actually very good investments for superannuation funds, but they have one drawback – they are not liquid. The industry funds believe their arrangement with the Government means that they are not likely to have a run on their funds, so they can invest more in property and infrastructure than a self-managed fund or a retail fund like MLC or BT.

The retail funds have to restrict their infrastructure investments, because they are always in danger of a run on their funds. SMSFs, by definition, do not have that problem, but the amount of property and infrastructure available for self-managed funds is more restricted and often comes in pooled funds with large management charges.

In recent years the fall in interest rates has been a bonanza for industry funds and their property and infrastructure investments.

They have been in the right place at the right time, but they are not happy to see money leave their funds because they are well aware of the danger. Hence, some make it hard to withdraw money. It's a foolish strategy, but we see it reflected in another area.

The Government is trying to remove the so called ‘default status' of industry funds, which would make them more vulnerable. The measure is opposed by the ALP, because the industry funds are a part of the union movement.

Meanwhile, when we look at the SMSF movement, the SMSFA says that the average fund had 38 per cent in Australian shares and 12 per cent in overseas shares – a total of 50 per cent. Next to this category is fixed interest which comprises 19 per cent of funds. Cash is not far behind at 16 per cent, while property is well back at 12 per cent.

The overall share market has not performed as well as the infrastructure assets, so this has held back SMSF investment returns. In addition, many of the fixed interest securities that SMSFs invested in have matured and the replacement securities are now yielding far lower interest returns. Cash has gone the same way.

Over a period these things will change and the share market will have its time and, if interest rates rise, infrastructure and property will not do as well.

How much do you need?

Now we get to the difficult question of how much money do you require for retirement?

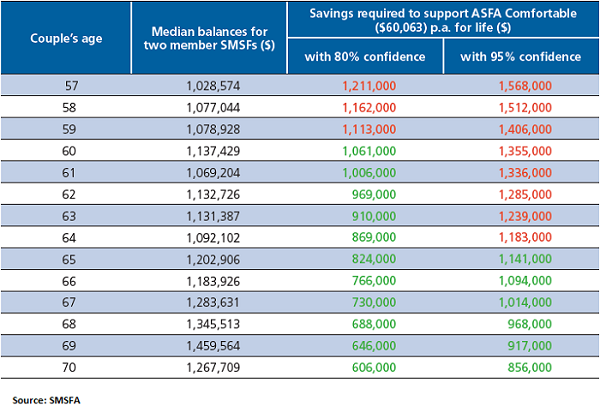

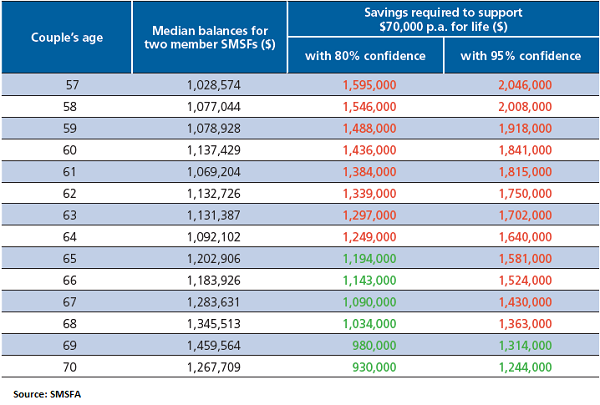

The SMSFA survey shows that the median balance for a two-member SMSF whose members are aged 60 is $1,137,429, and at that level the fund has an 80 per cent confidence level of being able to pay a $60,063 pension for life. But, if the retired people aged 60 wanted a $70,000 per annum pension, then on SMSFA figures the couple needs $1,460,000 and then the median figure of $1.1 million carries a clear shortfall.

Of course, if the couple wants a $100,000 pension for life then they need $2.4 million, which is well above the amount the ‘median couple' has at aged 60. As the couple ages, the amount of money they need on SMSFA calculations declines. And so, a 70-year-old couple wanting a $60,000 pension only needs $606,000 in their fund and in fact has enough money to pay $70,000 a year. One of the great problems all of us face with our superannuation funds is we don't know how long we are going to live, and actuaries make these calculations on probabilities.

Very often a couple will live a lot longer than the actuaries expect, have very good health for longer than expected, and therefore require more money. In Australian society the great leveller is the aged pension, and if you have assets at or near retirement that are in the $400,000 and $800,000 vicinity (it varies greatly between couples and single persons and those with houses or without houses) then if your assets fall you get a 7.8 per cent return on the asset reduction. I am grossly over simplifying the sums in this exercise, but anyone whose total savings are around the pension trigger point needs good advice on how they handle their spending.

One of the great furphies the Government announced when it increased superannuation taxes was that they didn't want superannuation to be a major estate planning vehicle. The SMSFA survey shows that only 7 per cent of trustees have any plans to pass their superannuation balances onto their children, and there is good reason because older people need that money in case they live a long time. My friend does not have a large amount of money in superannuation, but I made the point to him that he and his wife are each allowed to have $1.6 million in superannuation and that the pension generated from that $1.6 million is tax free. Accordingly, if his business goes well he should put the maximum amount of money he is allowed to put into his superannuation fund, and that includes the $100,000 a year in tax-paid contributions.

If he and his wife can bring their superannuation balance to a combined total of between $2.5 and $3.2 million they will be in a very strong position, and their income will be tax free. It is important to regard the $1.6 million as a dual entitlement which if at all possible should be used by your spouse as well as yourself.

Implications of the Fed's unwinding

In the last week or so the market has been preparing for the beginning of the great buyback of securities that the US Federal Reserve purchased as part of quantitative easing (QE). Accordingly, we are seeing American bond prices decline as people sell their bonds in anticipation that there will be more bonds on the market. So far this has not caused any great convulsions, because for the most part the banks that sold the bonds and corporate securities to the Federal Reserve did not use the cash to lend to their clients. This is partly because the clients didn't want to go deeply into debt and partly because the banks were nervous. As a result, a large amount of the money is “in the bank vaults”. The US banks will use the money they have sitting in the vaults to buy back the securities they sold to the Federal Reserve all those years ago. That's why QE did not generate the expected stimulus.

If everything goes to plan it will be a very neat exercise, but almost certainly along the way the markets will get out of kilter and there will be surprises.

The Week in Review

Investment markets and key developments over the past week

- Share markets were mixed over the last week with Japanese shares up sharply as the Yen fell further, European shares up slightly, US and Chinese shares pretty flat and Australian shares down on rate hike fears and falls in the iron ore price. Bond yields rose as global data remained solid and the Fed continued its process of monetary tightening. Oil prices rose but iron ore fell. The $A fell after RBA Governor Lowe pushed back against talk of an early rate hike in Australia.

- Bonds resuming their upswing as the Fed provides a jolt to investor complacency. A big surprise this year has been the extent of the pull back in bond yields in the US and to a lesser extent elsewhere. A big driver of this was low US inflation and expectations that this will see less tightening from the Fed. However, the Fed clearly sees things differently. Not only is it moving to start letting its holdings of bonds and mortgage backed securities start to rundown from next month but it has also maintained its expectation for another rate hike in December. This is all understandable given the strength of US economic data and the likelihood that at some point this will start to push inflation up. So after hitting a low around 20 per cent early this month the US money market's probability of a December Fed rate hike has rebounded to 67 per cent. And it's hard to see a reduction in the Fed's bond holdings not imparting some upward pressure on bond yields.

- The bottom line is that while the Fed remains benign and gradual in undertaking monetary tightening, it's not quite as benign and gradual as many had been assuming. This is likely to see further upwards pressure on bond yields and the US dollar – after both sagged this year partly in response to lower than expected US inflation and expectations that the Fed may not raise rates as much as had been flagged. Equities should be able to withstand ongoing Fed tightening (short-term gyrations aside) because they are still cheap versus bonds. The Fed is only tightening because growth is stronger and US monetary policy is a long way from tight.

- Of course, what Yellen and others at the Fed say comes with a bit less authority at present with Trump set to select the chair, vice chair and up to five governors (if Yellen also resigns her governorship if she does not remain as chairperson) in the next few months. But this is unlikely to slow the quantitative tightening process and could go either way on interest rates, so for now Fed commentary and the dots remain the best guide to its thinking.

- Trump is still Trump - threatening to wipe out North Korea in the last week (but don't forget to take him seriously not literally!) - and I am not a political analyst (although economists like to pretend they are). But it does seem that Trump may have hit a low inflection point a few weeks ago in the aftermath of Spicer, Priebus, the Mooch and Bannon leaving the White House team and after Trump's Charlottesville comments. Trump the pragmatist seems to be in control of Trump the populist, his White House team seems a lot more disciplined now and he is cutting pragmatic deals with Democrats and moderate Republicans to get things done. Some of this may be aimed at upping the pressure on the Republicans in Congress to get tax reform done (where progress is continuing). The hurricanes may also have helped but the sense of crisis around Trump looks to have receded a bit. Along with the Fed reasserting itself this adds to the positives for the US dollar.

- The German election (Sunday 24) is of limited relevance for investors. Polling has Angela Merkel on track to easily “win” with the issue being who she forms a coalition with: the Social Democrats again in which case the outcome is more pro-Europe, or the Free Democratic Party which is less pro-Europe. It's probably irrelevant as Merkel has migrated to a more pro-Europe stance anyway. Post-election coalition negotiations usually take several months to be resolved. The nationalist anti-Euro Alternative for Deutschland has seen support perk up a bit after the terrorist attack in Barcelona rekindled worries about immigration. It may get a seat in parliament but its support is still pretty low at around 11 per cent.

Major global economic events and implications

- US data remains strong, abstracting from the impact of hurricanes. While August readings for home builders' conditions, housing starts and existing home sales were all dampened by the hurricanes, permits to build new homes are up and initial jobless claims are already falling again. What's more, manufacturing conditions remained strong in the Philadelphia region this month and the US leading index is strong. Based on past experience the hurricane impact will be temporary and is best looked through.

- The Bank of Japan made no changes to monetary policy and remains on auto pilot with quantitative easing and its zero target for the 10-year bond yield continuing until it gets inflation above 2 per cent and right now we are a long way from that. With the Fed on track with tightening and the BoJ firmly on hold the Yen is in decline again which has helped Japanese shares rebound to their highest since 2015.

- While China's credit rating was downgraded to A from AA- by Standard and Poors on the back of a long run of strong credit growth my view is that Chinese credit risks have actually declined a bit over the last year or so with stronger corporate earnings, reduced capital outflows and regulatory moves to slow credit growth. The S&P downgrade just follows a similar Moody's downgrade in May. More broadly it's odd to think that China is a huge creditor nation with a current account surplus, borrows from itself, saves too much (46 per cent of GDP), consumes too little and has a weaker credit rating than Australia.

Australian economic events and implications

- In Australia, the minutes from the RBA's last Board meeting didn't add anything new and nor did RBA speeches – but the latter still caused a few gyrations. While some may have been confused by the seemingly more upbeat comments of Assistant Governor Lucy Ellis and the more balanced comments of Governor Philip Lowe, it's worth noting Ellis was mainly focussed on the global economy where it's easier to sound more upbeat whereas Lowe was focussing on Australia where it's more mixed. Lowe is upbeat about growth consistent with the RBA's own forecasts but is well aware of the risks around wages and household debt, and repeated that “a rise in global rates has no automatic implications for Australian rates.” We agree with Lowe that the next move in rates will likely be up but it's still likely to be some time away.

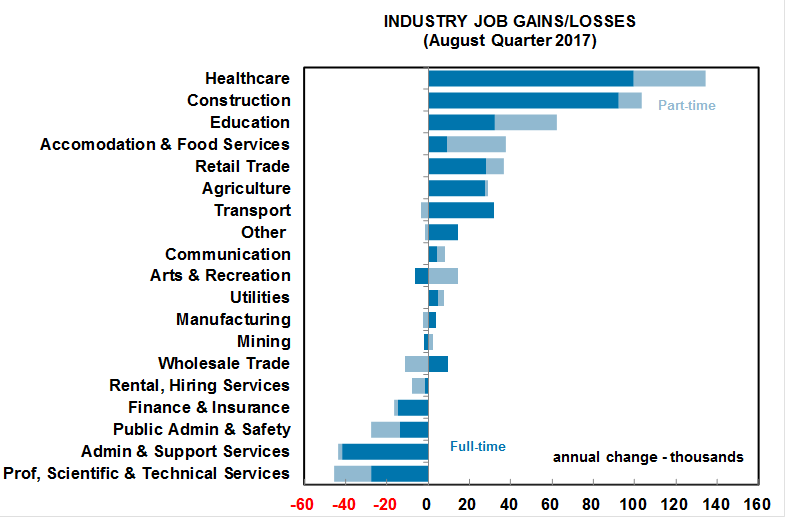

- For those who want to know “where the increase in jobs is coming from” the chart below shows a breakdown for the twelve months to August. Healthcare, construction and education are the big drivers.

Source: ABS, AMP Capital

Shane Oliver is the chief economist at AMP Capital.

Investor Signposts

A week devoid of highlights

- There is a healthy spattering of data releases as well as speeches from Reserve Bank officials in the coming week. But it is hard to identify highlights.

- The week kicks off on Tuesday with the weekly data on consumer confidence. Consumer sentiment is not far from the average level that divides optimism from pessimism. A firm Aussie dollar is supporting consumer sentiment. And spending is still normal with car sales at record highs.

- Also on Tuesday the Reserve Bank Assistant Governor (Financial Stability) Michele Bullock speaks at the ‘Where to from here?' briefing hosted by Lander & Rogers and Westpac in Sydney.

- On Wednesday, the Australian Bureau of Statistics (ABS) releases the March quarter population figures. NSW, Victoria and ACT are the stand-outs economies currently because the three economies are experiencing solid population growth, which in turn is driving housing and broader economic activity and creating jobs. It's a simple equation but it works. But still lost on ‘bush economists'.

- On Thursday the ABS releases the quarterly data on job vacancies – a key leading indicator for employment. Both job vacancies and job advertisements are holding near the best levels in over six years.

- And also on Thursday the ABS releases the June quarter “Finance and Wealth” publication. There are an array of results and ratios that can are produced from the raw data including foreign ownership of our listed bonds and equities and household wealth. Wealth would have hit fresh record highs at the end of June.

- The Reserve Bank Deputy Governor, Guy Debelle, also delivers a speech on Thursday at the Bank of England conference, London.

- And on Friday the Reserve Bank releases the Financial Aggregates for August including the private sector credit or loans outstanding data. Credit is running at a 5.3 per cent annual pace, still short of the nominal growth of the economy of 6.3 per cent. Consumers and businesses are still hesitant about taking on debt.

- Also on Friday the Australian Construction Insights “Construction Monitor” report is released – a quarterly report that examines conditions in the non-residential (commercial) sector.

Overseas: eclectic mix of economic data

- There is a raft of statistics for release in the US covering a range of topics. In contrast the only data in China are the official purchasing manager indexes covering manufacturing and services sectors to be released on Saturday September 30.

- In the US, the week kicks off on Monday when the Chicago Federal Reserve releases its national activity index – a measure “designed to gauge overall economic activity and related inflationary pressure.” The Dallas Federal Reserve releases a manufacturing survey the same day.

- On Tuesday, the US Federal Reserve chair, Janet Yellen, delivers a speech. Case Shiller releases July data on home prices while consumer confidence, new home sales and the Richmond Fed index are issued.

- Home prices most likely rose by 5.8 per cent on the year while consumer confidence may have eased in September with new home sales up by just 0.7 per cent in August.

- The usual weekly data on chain store sales is also issued on Tuesday together with indexes out of Texas covering the outlook for the services sector.

- On Wednesday a gauge of business investment – durable goods orders – is issued with the pending home sales index. Durable goods orders are effectively orders for goods that last three years or longer, like cars and aircraft. Economists expect that orders bounced back in August, lifting 1.5 per cent, after falling 6.8 per cent the previous month. The weekly data on housing finance is also issued on Wednesday.

- On Thursday the final economic growth (GDP) estimate for the June quarter is released. Economists expect that the data will confirm annualised growth of 3 per cent. Using the same format Australian annualised economic growth was 3.3 per cent in the quarter.

- The usual weekly data on claims for unemployment insurance is also issued on Thursday.

- And on Friday, the personal income and spending figures for August are released together with the Chicago purchasing managers index – a precursor to the national index released early the following week.

- Incomes may have lifted 0.2 per cent in August with spending up 0.1 per cent. But most investors will be interested in the core personal consumption deflator – that is, the Federal Reserve's preferred inflation measure. Prices may have only risen 0.2 per cent in August, keeping annual inflation well below the Fed's 2 per cent inflation goal at 1.4 per cent.

- And on Saturday China's National Bureau of Statistics releases the purchasing manager indexes.

Craig James is the chief economist at CommSec.

Readings & Viewings

Central banks took centre stage this week with the pinnacle performance delivered by the Fed mid-week. Hawks and doves alike were closely watching, some like their lives depended on it, to hear just how the USA planned to unwind its massive balance sheet. How did we all get so hooked on central banks?

It looks like Bank of England will be among the first majors to raise rates and economists are quite concerned at the thought of this. Meanwhile, Bank of England Governor, Mark Carney, keeps going on about Brexit and claims it's a “prime example of de-globalisation”. And the UK Treasury select committee is now warning British expatriates could be left without a pension because of Brexit.

But it's not exactly a hard knock life for everyone in old London town. The British financial and insurance sector handed out the most bonuses last year, paying out a record £15 billion to staff.

The British Prime Minister, Theresa May, is fast pursuing a post-Brexit trade deal with Canada.

Owing to frothy regional housing markets and high household debt levels, a global body says Canada's debt threat remains “critical”.

But one of Hollywood's biggest directors, James Cameron, is certainly bullish on Canada. He's claiming it's more pro-business than California, and in an Avatar-esque move, has just opened an organic pea protein facility.

Some Canadian investors are too busy trading the Toronto Stock Exchange to notice any of this. And apparently, the hottest stock on the TSX isn't even a stock yet.

Over to the Nasdaq, and Facebook's biggest problem may just be Facebook itself. A Russian election ad campaign explains it all.

Singapore is trying to steal some market share from its tech savvy neighbours, aiming to invest around $21 billion in electronics manufacturing by 2020. The plan is already proving to be promising.

Think of an electric vehicle and you often don't picture a rickshaw. But India is moving with the times and rolling out 100,000 electric buses and rickshaws in the coming weeks as part of an ambitious strategy.

Surely the Malaysian people wouldn't praise it in the same way, but the nation's Treasury Secretary-General says the implementation of GST is a “blessing” for his crumbling economy.

The Securities and Exchanges Commission in the US has been hacked – here's what investors need to know.

When credit reporting agency Equifax announced this month 143 million of its customers had been hacked, people probably thought it would respond a little differently to this. A little dodgy?

Next to call the Bitcoin bubble is Ray Dalio, the founder of the world's largest hedge fund, Bridgewater Associates. After China, now Mexican legislators are going through cryptocurrencies with a fine-tooth comb.

But even after CEO Jamie Dimon called it last week, and said he would fire his staff on the spot for making bitcoin trades, the bubble continues to grow at JPMorgan Chase.

Was it talent or timing that made fellow billionaire Bill Gates who he is today? Apparently if he could go back in time, he would ctrl-alt-delete one thing.

Tiny houses are going missing in Australia.

Any ideas why anyone would flush tens of thousands of euros down a toilet?

The world's richest woman, whose been trying to live down the stains of Nazi associations for years, has passed away at the age of 94.