Why investors should discount the policymakers

| Summary: Stocks are still cheap, and the key risk at this point is very much skewed towards another bout of strong growth. |

| Key take-out: Cash investment levels remain high, indicating investors are still cautious. But when this money is switched into the market, stocks and property are likely to drive further into record territory. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

Risk has become a big topic of late, with global policymakers issuing a number of warnings to investors against complacency.

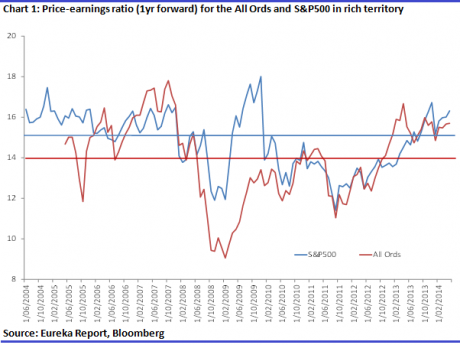

They are concerned that, in many cases, investors just aren’t taking the concept seriously enough after having been lulled into a false sense of confidence. Mirroring this is the idea expressed by many market analysts and commentators that equities, both here and in the US, are expensive. The S&P500 is at new records, and price-earnings ratios (P/Es) are high relative to history.

In my view there is a slight problem with this analysis – well two problems to be exact. Firstly, value as concept has become much harder to define. It’s less meaningful in a world characterised by ultra-low rates, ample liquidity and quantitative easing. In one way or another, the world’s major central banks print money. Now, in a fiat world (where currency is not backed by gold or silver or anything at all) debasing the currency must lift the value of other financial assets, as money is the benchmark against which we value all financial assets – and money now has less worth. This renders as much less useful charts like the one above. What is value when money, in many jurisdictions, is nearly worthless – and is worthless adjusting for inflation?

Chart 1 may show price-earnings ratios for US and Australian indices well above average levels. Yet the chart also shows that valuations don’t appear to be so stretched relative to pre-GFC levels. So, for instance, from 2004-2007 the average one-year forward P/E for the S&P500 was nearly 16. For the All Ords it was 15.6. That means the current S&P500 P/E is now only just above its pre-GFC average Similarly, the All Ords, is pretty much smack bang on average. Combine that fact with the significant debasement of currency underway – well, the reality is stocks are still very cheap – and cheaper than bonds and other assets. Which, of course, is why central banks are increasingly diversifying out of cash and bonds and into equities. They know the game.

To my mind, this is merely one reason why policymakers are being highly disingenuous in stating that investors are too complacent. Stocks are cheap and the key risk at this point – the skew – is very much toward another bout of explosive growth over the next couple of years.

In any case it’s simply untrue to suggest that investors are complacent – because the fact is, and notwithstanding new records being set in some markets, investors are still cautious. Extremely so, noting that returns to cash are not too different from zero.

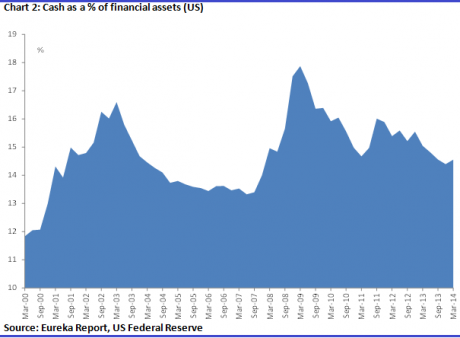

At this point recall the hunt for yield. We’ve all heard a lot about it and to listen to policymakers and their lament about complacency, you’d think that investors had become a bunch of cowboys throwing caution to the wind. Yet, the data shows that nothing could be further from the truth. Despite the hunt for yield, investors are still comparatively cautious. Take a look at chart 2 below. It shows the proportion of cash as a percentage of total financial assets.

As the chart shows, investors in the US have been trimming there holdings of cash as a proportion of total financial assets. At the moment this sits just above average – 14.5% against about 14%. Yet holdings are still higher than the pre-GFC period, odd considering returns to cash were much better then. Note that at its recent low in 2006-07 investors cut this proportion to 13.5%. In 2000 we saw rates around 11-12%. Admittedly we are only talking about 1 or 2% here or there. And that doesn’t sound like a lot, except that these small percentage variations can unleash huge sums into the market. So for instance if US households brought cash holdings down to pre-GFC rates, that would free up another trillion dollars or so, just below, to flow into the market.

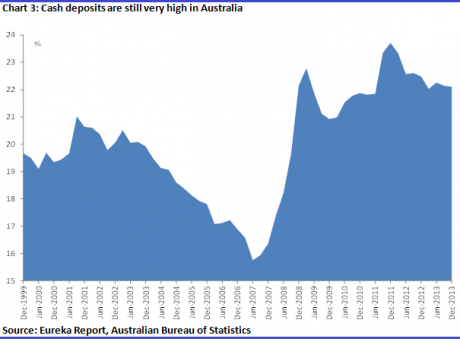

For Australia, the situation is much worse. Chart 3 shows the proportion of cash as percentage of total financial assets for Australian households. The chart is pretty clear, Australian households still hold cash at elevated levels. At 21.7%, the amount held in cash is only just off the post GFC peak of 23.7% and well above what we saw prior to the GFC (average for the three years to December 2007 is just over 17%).

That suggests investors are still quite cautious with regards to their investments – in contrast to the picture being painted by global policymakers. I suppose that in some respects it could be said that investors are too complacent. That they are indeed not taking risk and uncertainty seriously enough. Yet I don’t think it’s in a way that policymakers intend – at least publically.

There are risks, certainly. There always are. But the single biggest risk at this point is that cash level highlighted above. This is the elephant in the room, as it were, and it’s my belief policymakers are in fact terrified of this prospect. Already the International Monetary Fund and Organisation for Economic Co-operation and Development are warning about housing booms developing in various economies – again, so soon after the GFC! Despite the hunt for yield to date and record prices here and there for, well, everything, the flood of money has yet to hit – it’s still sitting on the sidelines. That it will hit I don’t doubt; we are still in the early stage of this broad-based asset price boom. When that cash hits, we will see stocks and property drive further into record territory – and further still as credit growth accelerates. That’s why I think it really is different this time.

Sure, in the long term, it will all come tumbling down – policymakers are blindly taking us down that path, they always do. Perhaps knowingly – or it could be the case they simply don’t know what else to do. Either way though, I think we are many years away from any disaster. While investors will need to make sure they protect themselves at the time, in the interim there is plenty of money to be made and it’s a long road ahead.