Why I Bought and Believe in Bitcoin

I first bought Bitcoin in mid-2017, seven years after Laszlo Hanyecz purchased two Papa John’s pizzas for 10,000 BTC, or Bitcoin. I was just in time for Bitcoin’s wild bull run, which would take the price to around $A27,000 in December 2017 and down to $A7,000 a few months later.

I bought Bitcoin on the way up, held on the way down and continued to hold through the Bitcoin bear market that has so far followed every bull run.

My conviction that Bitcoin will continue its growth trajectory in years to come remains strong. I am in the same company as legendary macro investors like Paul Tudor Jones and Stanley Druckenmiller and, despite Elon Musk’s antics, Tesla still holds over $AU1 billion in Bitcoin as of writing.

2017 was a watershed year for Bitcoin. Bitcoin had already lodged in my peripheral consciousness as an emerging payments technology but it took until 2017 before my curiosity had piqued sufficiently to buy some.

I read the white paper published by Bitcoin’s anonymous creator Satoshi Nakamoto and learned that Bitcoin was an evolution of earlier initiatives to create electronic money. “A peer-to-peer electronic cash system” spells out the Bitcoin vision: “an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party”.

A key element here is the third party. I had spent my professional career working on payment systems involving multiple gatekeepers and intermediaries, all adding friction and cost to any transaction.

A simple payment using a credit card at a merchant often involves a payment “gateway”, the merchant’s bank, a card scheme network (such as Visa or MasterCard), possibly another payment gateway and then the cardholder’s bank.

Settlement of such payments typically occur over 24 to 48 hours, despite the fact that these payments are electronic. I immediately saw the potential for Bitcoin to disrupt established payment networks if it could overcome technical issues with transaction throughput.

Nakamoto also provided another important clue about Bitcoin’s purpose by encoding into the starting block on Bitcoin’s distributed ledger blockchain "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" – the headline of the Times newspaper signalling the UK was facing another banking crisis.

Some believe this demonstrates Nakamoto’s distrust of the banking system and a belief that Bitcoin could become a kind of monetary standard to replace traditional fiat currency.

So Bitcoin’s original core value proposition was to be a decentralised, trust-less, permission-less network for payments.

But Satoshi Nakamoto also introduced the concept of an “incentive”, using a “proof-or-work” algorithm, requiring “miners” to spend energy to earn Bitcoin by performing complex calculations that secure the network.

“This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue them,” Nakamoto wrote. He also predetermined the supply of new Bitcoins according to a predictable and fixed schedule, and incorporated transaction fees to incentivise miners once the total supply had exhausted (currently estimated to occur in 2140).

Reading the white paper and other information in the Bitcoin community led me to conclude that Bitcoin was an extremely elegant innovation combining payments technology, cryptography, libertarianism, sound money and network effects.

The block reward incentive, and predictable and fixed supply schedule, acts as both a price driver with increased network use and a built-in consensus mechanism to prevent centralised control.

Bitcoin has survived contentious “forks” of the Bitcoin code by disgruntled developers unhappy with the consensus direction. (Bitcoin core maximalists saw this as a kind of attack on the Bitcoin network, but Bitcoin core’s survival and growth since then, and the comparative fall in value of the forked Bitcoin networks, only proved Bitcoin core’s robustness to attack.)

I learned about the effect of the four-year halving cycle on the Bitcoin price due to ”stock-to-flow” dynamics, the development of second layer enhancements to speed up transactions (eg. Lightning Network), the awareness of on-chain analytics as a kind of fundamental analysis and the relative merits of Bitcoin versus myriad other crypto coins, tokens and emerging digital assets.

With greater conviction about Bitcoin’s unique attributes, I decided to purchase Bitcoin inside my Self-Managed Super Fund as a long-term holding, after ensuring that my trust deed and the Australian Tax Office accommodated this. My rationale was that if I believed it held strong prospects for price appreciation compared to other assets over time, then I had a fiduciary duty to hold some as a trustee, even allowing for volatility.

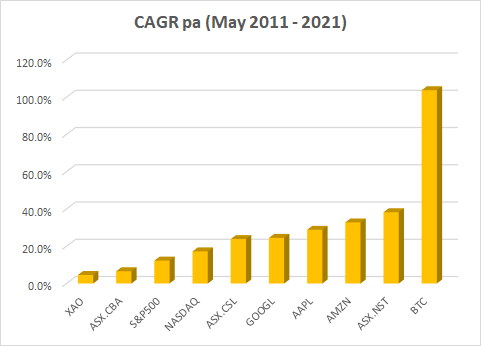

As of writing, Bitcoin has seen recent dramatic falls in price after reaching an all-time high of $A85,000 in mid-April 2021, but it has never yet failed to exceed the previous all-time high. Bitcoin’s long-term price trajectory since 2011 has dwarfed other assets.

Bitcoin is still a nascent technology and asset, prone to significant volatility as price discovery occurs, and occasional manipulation.

But 2020 saw the arrival of institutional investors, family offices, endowments, hedge funds and other professionals, so volatility may moderate as Bitcoin’s market cap grows and professional investors smooth the gyrations previously driven by more temperamental retail speculators.

After 12 years, Bitcoin has arguably already won the battle to be the premier digital money technology and digital store-of-value. If investors also believe that central banks will continue to debase fiat currency by continuing to print money then Bitcoin may continue to see inflows as an inflationary hedge that is technologically much better than gold.

Whether Bitcoin will survive another 12 years remains to be seen, but I am certainly backing my personal conviction with real money to find out. The journey should be interesting.

Frequently Asked Questions about this Article…

The author invested in Bitcoin for the long term because they believe in its strong growth potential, unique technological innovation, and its fixed supply schedule. After researching Bitcoin’s underlying technology and reading the white paper, the author saw it as an elegant combination of payments technology, cryptography, and sound money principles, making it a promising asset compared to traditional investments.

Bitcoin’s payment system is peer-to-peer, meaning it allows two parties to transact directly without intermediaries like banks or payment gateways. Unlike traditional payments, which involve multiple middlemen and slow settlement times (24-48 hours), Bitcoin transactions can be faster and operate on a decentralized, trust-less network secured by miners using cryptographic proof.

Bitcoin’s fixed supply (capped at 21 million coins) and scheduled 'halving' events (occurring roughly every four years) create scarcity and influence its price dynamics. Halving reduces the amount of new Bitcoin entering circulation, which historically has driven price appreciation via stock-to-flow economics, strengthening Bitcoin as a deflationary asset over time.

Institutional investors, such as hedge funds, family offices, and pension funds, started entering the Bitcoin market around 2020. Their participation is expected to moderate Bitcoin’s price volatility compared to earlier retail-driven swings, as larger, professional investors tend to smooth out extreme price gyrations while increasing overall market liquidity and legitimacy.

Yes, Bitcoin is often viewed as a modern inflation hedge because of its limited supply and decentralized nature. Unlike fiat currencies, which central banks can print indefinitely, Bitcoin’s supply is fixed, making it resistant to currency debasement. Many investors see it as a technologically superior alternative to traditional inflation hedges like gold.