Why Gonski is wrong about house prices

David Gonski made a ridiculous comment last week when he stated, "The fact is, anyone who believes [house] prices always go up is, I think, a fool". It’s vacuous, because no one actually believes that as literal fact. I've not heard nor read anyone ever suggest house prices always rise -- not even the most aggressive spruiker -- and comments like that make no contribution to the broader policy discussion.

The issue isn't whether house prices fall; we know they do at times. The issue is whether purchasing property makes sense, whether it’s an intelligent decision and enhances wealth (for either owner-occupiers or investors) over a reasonable time period. The answer is an unequivocal yes and it’s foolish -- not to mention extremely misleading -- for Gonski and others to imply otherwise.

For those with the capacity, the decision on property involves a simple choice as to which side of the wealth divide they want to sit on. Rob Burgess highlighted the importance of this issue (in regards to retirees who maybe didn't have that capacity) in his piece (A house-price curse for retirees, August 29). The fact is, people are already worse off for not having owned property and it is naïve to suggest this is going to change.

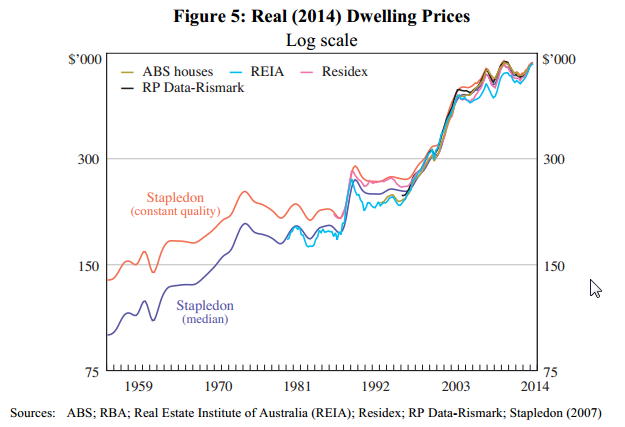

With that in mind, anyone who follows the tripe sprouted by those who would try to talk down the property market are, quite simply, doing themselves and their children a grave disservice because on any reasonable time frame, prices do only go up. This is an undeniable truism and you only have to look at a chart provided by the Reserve Bank of Australia to see this.

As you can see from the chart, the trend is up! It’s pointless to dispute that. Indeed there has really only been two periods of stasis in the past 60 years: the mid-1970s to the late '80s and then again from the early-to-late '90s. But go back to the macro settings we saw back then: annual inflation rates of 10 per cent or more (up to the early '90s) and mortgage rates from about 9 per cent to 17 per cent. Over that 20-year period, the lowest interest rate was 8.4 per cent. The average was closer to 12 per cent and at the peak, you were paying 17 per cent.

Those double-digit inflation rates are important as well by the way, as the chart above shows real inflation-adjusted house prices. Double-digit inflation through the '70s and '80s hides the fact that nominal house prices were still probably going up by about 7 or 8 per cent per year. It’s not so much that house prices were falling, it’s just they couldn't keep pace with rampant out-of-control consumer inflation.

Against that backdrop, cherry picking short periods where house prices have fallen or have flatlined, such as in Sydney from 2004 to 2009, are disingenuous. Sure, if you bought at the peak in 2003 and sold at the trough three years later, you lost money.

Then again if you still hold that property you are up more than 50 per cent in capital gains alone and your total returns are more like 80 per cent or 7 to 8 per cent per annum. Those periods don’t prove that property is a bad investment, just that you probably shouldn’t be in it for the short term. The holding period is important, but then again that’s the case with all investments.

Now think about the macro settings we have today. Lending rates sub-5 per cent -- you can fix sub-5 per cent for five years! Inflation is comparatively low (2.75 per cent on average). It’s a different world, and according to consensus that world isn’t going to change too much. Inflation is dead. There is deflation in Japan, Europe and if the US doesn’t flirt with outright deflation, then it oscillates between mild inflation and disinflation.

Similarly, the RBA isn’t about to start hiking rates and indeed we have very vocal calls to cut rates further. Should a miracle occur and the RBA does decide to set rates more appropriately, well, we already have it from them that rates aren’t going up by much. Interest rates will remain low, even after they’ve been tightened, even if inflation rises. This we know as fact since central banks simply look through bouts of inflation and forecast lower inflation. This is what the Bank of England and the Federal Reserve have both done.

In the meantime, land and property are a finite resource, the scarcity of which is exacerbated by deliberate policy decisions to lift population density rather provide adequate infrastructure into satellite towns and regions. Population growth is strong, and outside of a surge in inner city apartments we’re still not building -- and nor is there any sign that we’re about to start building -- adequate stock of detached housing or any dwelling stock, outside of inner-city areas.

Buying property is, quite simply, a no-brainier with the policy settings and the supply demand dynamics we have in place now. I can’t really see that changing in the foreseeable future. People can and will still lose money if they throw caution to the wind and don’t do their research.

But, I don’t think anyone should be concerned about a sustained or broad-based price fall. In those periods where we have seen real prices go down, this has been associated with extremely high inflation and interest rates. We are nowhere near that world now. Neither do we have the conditions that saw house price slumps in the US and other countries.

As a final point, macroprudential regulation, when it is inevitably put in place, won’t prevent house prices rising either. It will do nothing other than exacerbate the already growing wealth divide by making it harder for lower income earners and first home buyers -- who typically have higher loan-to-value ratios by necessity -- to take advantage of the lowest interest rates in a generation.