Why Clive Palmer speaks budget sense

It was an interesting experience to be part of the budget lock-up last week, but as I warned in my article, I could make mistakes under that time pressure -- and I did. I’ll correct them below, but I want to open with a declaration that I never expected to make: that the best sense I heard spoken about the budget was uttered by neither Liberal nor Labor nor Green, but by Clive Palmer.

Speaking in the face of quite hostile questioning on ABC AM, he observed that Australia’s government debt level of 12 per cent of GDP was far below the OECD average of 73 per cent, rejected the hysteria that Australia’s anticipated deficits would lead to a debt ratio of 70 per cent, defended running deficits if they were needed to stimulate the economy or provide infrastructure or social benefits, and noted that our current government debt level is far below the personal debt level that most Australians currently carry.

Our debt at the moment is probably around about $300 billion so that's… about two months of our activity. Is your personal debt less than two months of your activity? That's what we are as a nation. You know, we've got debts which are less than one year of our total activity. I mean that's not difficult. (“Budget based on a con: Clive Palmer”)

Spot on, Clive. Most of his points were made equally well by Penny Wong for the ALP in the Guardian, but this observation -- that Australia’s private debts are far greater than our public --was unique to Palmer.

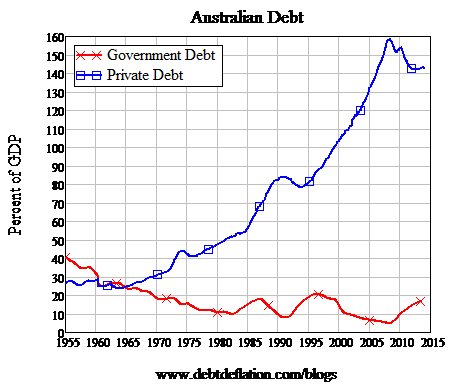

Using the figures from the Commission of Audit and the RBA, Australia’s private debts are over seven times government debt (see Figure 1; the ratio is over eight times if you use the Bank of International Settlement’s figures).

Figure 1: Government and Private Debt in Australia

Which brings me to my incorrect arithmetic last week, and an argument which supports Palmer’s confidence that budget deficits of the scale Australia has historically run are no big deal -- and they may be beneficial in the current economic circumstance.

Last week I made the mistake of trying to develop a new argument on the fly under the time pressure of the lock-up. The argument was correct, but I stuffed up the arithmetic. So I’ll redo the argument from the top, along with the correct arithmetic. But first I need to discuss a discredited concept in economics, the “velocity of money”.

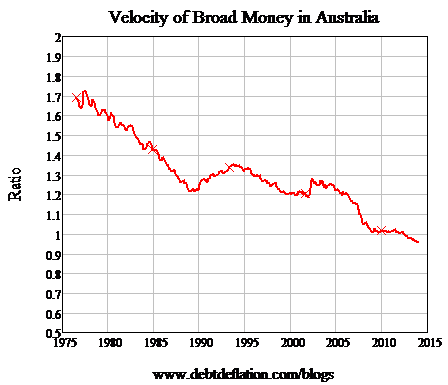

The velocity of money is simply the ratio of nominal GDP to the money stock. Using the RBA’s figures for the broad money supply, this ratio has fallen from 1.7 in the 1970s to under 1 today (see Figure 2).

Figure 2: Velocity has fallen by almost 50% over the last 40 years

The concept of the velocity of money has fallen into disuse in economics because of how it was abused by Milton Friedman in the Monetarist days of the 1970s. Basically, Friedman asserted that the velocity of money was a constant, and that changes in the money stock caused permanent changes in prices, but only temporary changes in output -- so that monetary policy could be used to control the rate of inflation without particularly affecting real output.

One look at Figure 2 should convince you that Friedman’s opening gambit (that velocity is a constant) was bunkum, and the rest of his argument was no better. In practice, Monetarist “tight money” policies succeeded in driving inflation down, but by causing serious recessions, which the theory argued wouldn’t happen. The concept of the velocity of money became collateral damage as Friedman’s ideas were discredited, and it became harder to measure too as more and more financial instruments were classified as money.

But the idea that there is a relationship between output and the amount of money is still a reasonable one when stripped of Milton’s baggage, including his belief that the only way the money supply could be increased was by government spending.

There are basically three independent methods to increase the money supply:

- The government can run a deficit;

- The country can run a current account surplus; or

- Banks can lend money to households and businesses.

Using the velocity of money simply as a ratio between the money supply and the dollar value of output, this leads to the truism that nominal GDP equals the velocity of money times the money stock. That in turn means that part -- but not all -- of the change in change in GDP will equal the velocity of money times the sum of the government deficit, the current account surplus, and new lending by banks.

We can use this rule of thumb to analyse what will be required for Hockey’s intended budget outcomes to occur.

Hockey’s budget had the target of achieving sustained growth of nominal GDP of 5 per cent per annum, and a sustained government surplus (or a negative deficit) of 1 per cent of GDP. That’s not the immediate objective of course, but to get a quick handle on what Hockey’s budget requires I’ll ignore the transition and just consider the 1 per cent target in the context of a current account deficit (or a negative surplus) of 3.5 per cent of GDP.

Taking the value of the velocity of money as roughly one (see Figure 2), that results in the following arithmetic equation:

Five per cent of GDP = Minus 1 per cent of GDP, minus 3.5 per cent of GDP, plus bank lending

Or

Bank lending = 9.5 per cent of GDP

So for Hockey’s economic ambition to be fulfilled, bank lending must equal 9.5 per cent of GDP. Since total bank lending to households and businesses is about 1.5 times GDP, that means that bank lending has to grow at about 6.6 per cent per year -- or about 1.6 per cent a year faster than the desired rate of growth of GDP itself (and the required rate of growth of private debt will rise if the velocity of money continues to fall). So rising private sector debt is a pre-requisite for the success of Hockey’s budget.

What if, in place of the hoo-hah we’ve had over the government deficit, we simply had the current government deficit of 2.8 per cent of GDP continue? Then private sector debt could grow by 4 per cent per year, 1 per cent less than the hoped-for level of GDP growth. The private sector could manage to gradually delever while government debt remained relatively constant as a share of GDP.

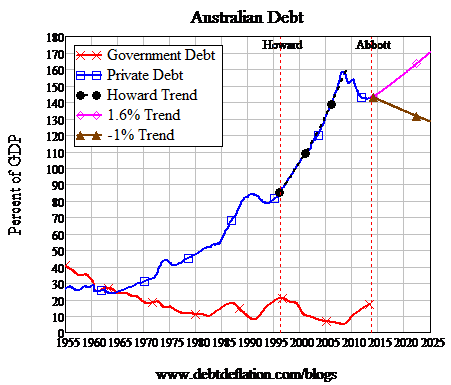

The two alternative paths for private debt are shown in Figure 3.

Figure 3: Hypothetical trends in private debt

So the success of Hockey’s budget strategy is dependent on a rising level of private sector indebtedness, whereas a “no panic”, business-as-usual policy would have allowed the private sector to delever slightly without causing a recession.

This brings me back to Palmer and his point about private debt being much greater burden than public debt. He also noted that Obama’s policies had minimised the pain in the US, and that’s largely because the US budget deficits enabled the private sector to delever, without causing a Depression-level economic downturn. On the other hand, the Europeans, who have followed much the same “the government deficit must be reduced at all costs” policy as the Liberals are touting now, have thrown the economies of southern Europe into a full-blown Depression.

Australia could avoid this fate with Hockey’s budget, but only if the private sector -- and primarily households -- continues to borrow. If they don’t, then the monetary equation will be balanced by either a lower rate of economic growth, or a higher budget deficit than planned, or both.

Rather than setting Australia up for future growth, the Coalition budget policy puts the Australian economy in danger of contraction, and for no good reason.