Why Australia's pension ranking slipped

Summary: Australia's retirement income system scores a 'B', losing our spot on the podium to Finland.

Key take-out: The 2018 Melbourne Mercer Global Pension Index (MMGPI) has shown up Australia's retirement system – here's where we now stand against 34 peers.

Ballooning household debt and tougher testing for government pensions have seen Australia's retirement incomes system marked down in an international survey.

Australia gave up the third spot on the podium this year to Finland, after our rating tumbled nearly 5 per cent in Mercer's critique of global pension systems.

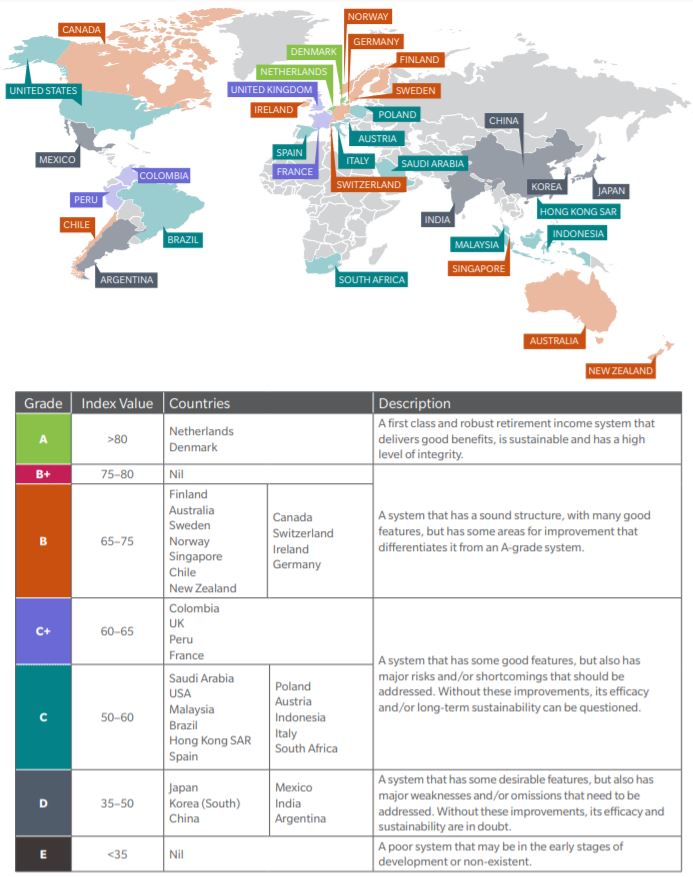

The Netherlands and Denmark were the only countries surveyed to score an "A" for achieving a score of higher than 80 in the 10th year of the Melbourne Mercer Global Pension Index (MMGPI).

The MMGPI survey this year ranked 34 countries on a comprehensive test of their overall health and quality of national retirement incomes system.

Australia has ranked as high as second in recent years. But the fall down the rankings this year was caused by some measurements being tweaked, including those that related to household debt and the assets test for the government age pension.

This year, Australia's score slipped from 77.1 to 72.6, sinking our nation to the fourth spot or a ‘B’ grading. Also graded as a ‘B’ were Sweden, Norway, Singapore, Chile, New Zealand, Canada, Switzerland, Ireland and Germany.

The six worst countries, scoring a ‘D’, from the bottom were Argentina, India, Mexico, China, South Korea and Japan.

A further 15 countries scored Cs and C-pluses, including the UK, France, US, Hong Kong, Austria and Italy.

The survey ranks countries across three broad areas – adequacy, sustainability and integrity – off the various limbs of their retirement incomes systems.

Adequacy is given a 40 per cent weighting, with sustainability getting 35 per cent, and integrity 25 per cent.

Australia's score was virtually unchanged in the last two categories, but it tumbled from 75.3 to 63.4 on the basis of adequacy. While related to Australia's high debt levels, the question that cost us the most was around our levels of saving (which is inversely proportional). The second element related to changes to the assets test in 2017 for the government age pension.

The survey's authors said Australia's retirement income system could be improved in five key areas:

- Changing the asset test for government pensions to improve incomes for average income earners.

- Improving household savings and reducing household debt.

- Forcing those who are moving into pension phase with their super into taking a portion of their lump sum as an annuity.

- Increasing participation for older workers, particularly as life expectancies rise.

- Increasing the pension age as life expectancies rise.

On the last issue, plans to take Australia's age pension age to 70 have been scrapped, in one of the first decisions made by new Prime Minister Scott Morrison.

But on the first four … there does not seem to be much in the way of official consideration of the topics from government at present.

Table 1: Ranking 34 leading nations on retirement income systems

Source: 2018 Melbourne Mercer Global Pension Index

The MMGPI survey outlines that it considers there are roughly five pillars to a retirement income system.

The first (called "Pillar 0") is a basic public pension that provides a minimal level of protection.

Pillar 1 is a public mandatory and contributory system linked to earnings, while Pillar 2 is a private mandatory and fully funded system. Pillar 3 is a voluntary and fully funded system, and Pillar 4 is a "financial and non-financial support outside formal pension arrangements".

There is one element of the survey that concerns me, probably more than most.

Australia scores very highly for "integrity". Integrity measures "regulation and governance; protection and communication for members; and costs".

On this, Australia scores 85.7, the fourth highest of the 34 countries surveyed.

Anyone who has followed superannuation in Australia in recent years, particularly this year with the Royal Commission, would struggle to think that we score an "A" for "integrity".

But there we are.