Why Australian aluminium was doomed

Alcoa's announcement that it is to close its Point Henry smelter came as no surprise to most observers. While the Australian dollar and the high cost of labour played a part, the global impediments to a viable industry proved impenetrable.

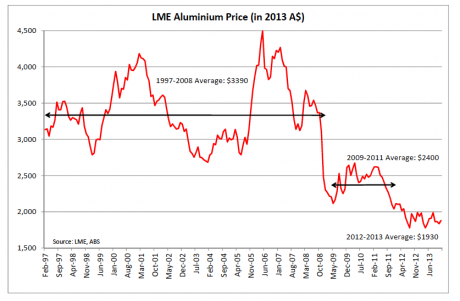

Since 2008, the price of aluminium has tumbled on the London metal exchange. In the 1990s, aluminium sold north of $US3000 per tonne, now it’s struggling to fetch $1700.

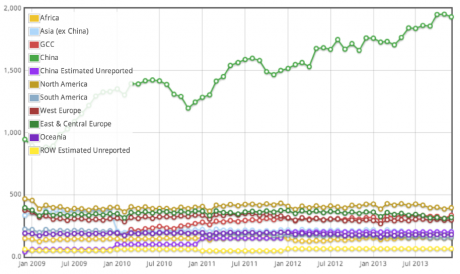

China accounted for the overwhelming majority of the world’s demand for aluminium, and production around the world ramped up to accommodate the country’s growth. What many global aluminium manufacturers didn’t count on however, was China's disposition towards self-sufficiency with resources. The country began to manufacture its own aluminium, which over time outpaced production around the world.

In a 2013 report, Boston Consulting Group described the inevitable ramp down of aluminium manufacturing as a “game of chicken”. As production slows and plants around the world begin to close, the last companies standing will be in a prime position to capitalise on aluminium trade when supply and demand eventually level out.

Australia’s high dollar and costs put Alcoa’s smelter high up on the list of plants for closure, but the story is one that has echoed throughout modern economic history – when developing countries want to create a domestic industry by subsidising state-owned companies, free market economies will suffer.