What's really going on with the corporate tax cut

The US is talking about it. Japan is talking about it. And now we look to be doing it too.

What am I talking about? Cutting the corporate tax rate.

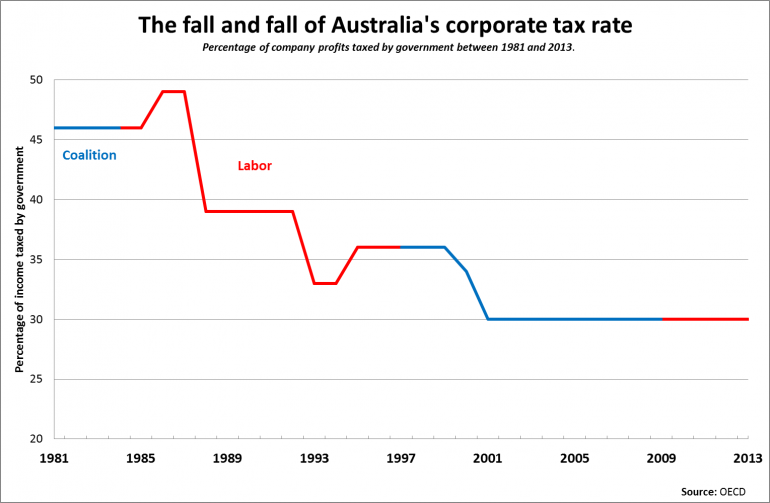

As the graph above shows, it’s been sitting at 30 per cent of company profits since 2001. By lowering the rate down from 30 per cent to 28.5 per cent, the Abbott government will be effectively cutting this wide-ranging tax for the first time in a decade.

Designed to offset the levy the government is charging big business to fund its paid parental leave scheme, it’s actually quite a momentous (and complex) reform.

It’s also a means of rewarding small business with a much-needed tax break, though it's an expensive reward for a budget in ‘crisis’: The Australian has previously estimated the government will sacrifice $4 billion in extra tax revenue in 2016-17 if the tax rate falls to 28.5 per cent.

A cut in the corporate tax rate will reignite a trend that began back in the 1980s as a result of recommendations from a document known as the Asprey Report.

You can read more about this report in the government’s latest corporate tax issues paper, but basically it found that Australia’s corporate tax system would be fairer (and possibly reap more tax) if the government lowered the base rate of the tax, and applied it more broadly (in other words, eliminate loopholes and taxation exemptions).

It’s strange that this corporate tax break is set to cost the government, when the last tax cut actually paid dividends for the then Howard government. As you can see from the graph below, broadening the tax base had a significant impact on corporate tax revenue.

As for why the government may not broaden the tax base this time round, Merrill Lynch chief economist Saul Eslake reasons that: "Business can’t agree among itself as to which if any deductions, concessions or exemptions should be reduced or abolished, so the government is unlikely to want to spend political capital making that decision for them”.

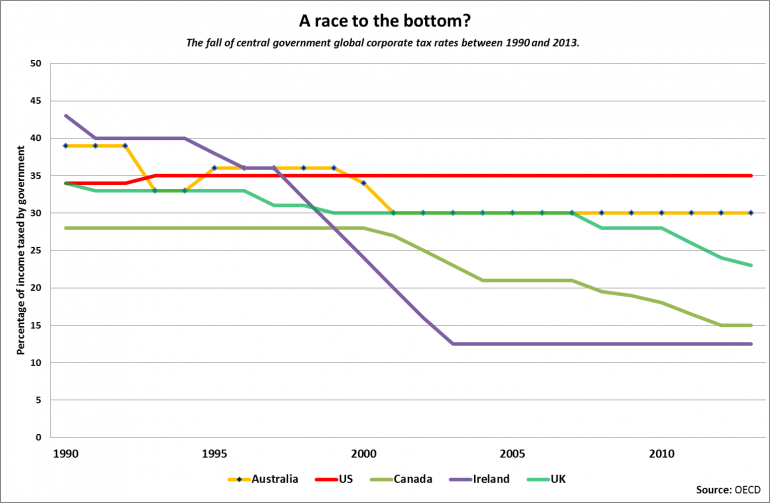

But don’t expect the cut on Tuesday to be the end of it: All around the world countries are slashing at corporate tax rates. As the IMF explains in its 2012 report on the matter:

“It is quite striking that the median corporate tax rate in the largest 19 OECD countries fell from 50 percent in 1982 to 34 per cent by 2003.”

Given this latest response is more of a reshuffle than a cut, it’s likely that business will continue lobbying for a lower corporate tax rate. And don’t take heart from the fact that Australia still sits below the US corporate tax rate -- it’s riddled with exemptions and deductions.

With this in mind, we may not have to wait another decade for further alteration to the income tax rate.

Australia doesn’t exist in an economic bubble. Aggressive cuts from other OECD nations (and our increasingly globalised world) may force the rate down sooner than expected.

The real trick for the government is to balance the books so that Australia remains competitive, but the government doesn’t lose out on all of its corporate tax income. After all, it corporate tax makes up around 20 per cent of Australia’s total tax take and nobody wants to see a hike in income tax to compensate for any mishandlings of it.

Got a question? Ask the reporter @HarrisonPolites on Twitter or leave a comment below.