What we learned from the RBA this year

The Reserve Bank of Australia has been busy this year. Sure, it didn't get to play with its interest rate lever, but it did publish 14 research discussion papers and travelled the country giving speeches to anyone who would listen.

But most readers don't have the time to read everything that comes out of the RBA. Sometimes you see the words ‘dynamic stochastic general equilibrium model' and your eyes glaze over, while vector autoregressive models give a good reason to do something, anything, else.

So as my Christmas gift to my valued readers, I thought I'd provide a brief list of the not-to-be-missed publications and speeches from the RBA this year.

Its analysis of the mining sector and the housing market was particularly thought-provoking and, while I didn't agree with everything discussed, it is great that these issues are being discussed in public.

On housing

Is Housing Overvalued? by economists Ryan Fox and Peter Tulip

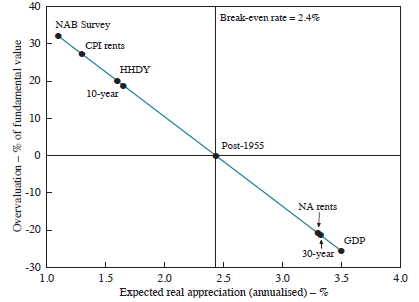

Fox and Tulip take an interesting approach to the topic that has dominated macroeconomic discussion this year. They show that real house prices have to continue to grow by at least 2.4 per cent annually -- its long-run average post-1955 -- for buying a house to remain preferable to renting.

The most interesting insight is that if house prices grow at the same rate as household disposable income -- as has been the case for the past decade -- house prices are overvalued by around 20 per cent (The great Australian housing rip-off, July 15).

Expected Real House Price Appreciation and Overvaluation

April 2014

On the mining boom

The Effect of the Mining Boom on the Australian Economy by economists Peter Downes, Kevin Hanslow and Peter Tulip

Everyone except for RBA board member John Edwards accepts that the mining boom contributed significantly to Australia's recent economic prosperity. Nevertheless, it was good to see it quantified in this interesting research paper.

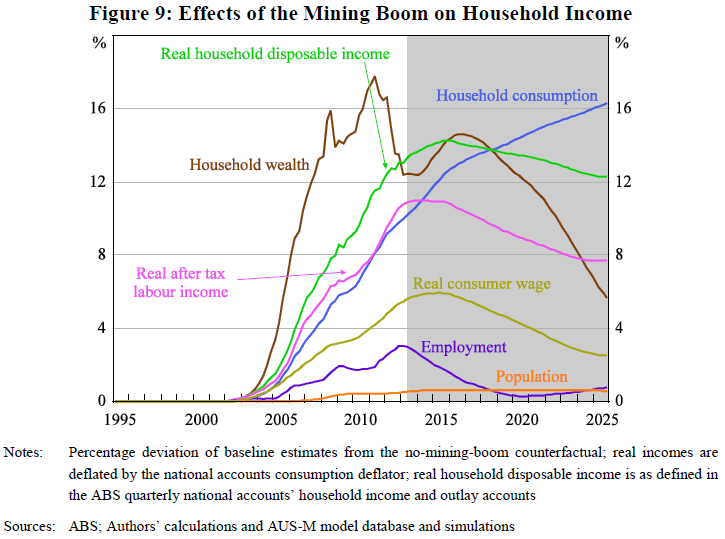

Downes, Hanslow and Tulip create a counterfactual: an alternative history in which the mining boom did not occur. They estimate that the mining boom increased real per capita household disposable income by 13 per cent; real wages by 6 per cent; and lowered the unemployment rate by 1.25 percentage points.

Now we find ourselves in the aftermath of this once-in-a-lifetime terms-of-trade event, their outlook for the next decade makes for more sobering reading and indicates that conditions will be tough for a number of households and businesses for the foreseeable future (The mining boom's final days may come quicker than expected, August 25).

On financial markets

Volatility and Market Pricing by RBA assistant governor Guy Debelle

This was not the type of speech that RBA-watchers had come to expect. Full of interesting insights, Debelle didn't pull any punches in what is, in my opinion, the best RBA speech delivered in years.

Debelle notes that “there are a number of investors buying assets on the presumption of a level of liquidity, which is not there”. The implication is obvious: when investors rush for the exits, they'll find the market does not have the liquidity to get the deals done.

On the topic of forward guidance, Debelle said that he found it surprising that “the market is willing to accept the central banks at their word and not think so much for themselves.” Given the forecasting performance of central banks post-crisis it's hard to disagree with him (The market stillness before the storm, October 14).

On big picture issues

Demographics, Productivity and Innovation by RBA deputy governor Philip Lowe

Ageing and Australia's Economic Outlook by RBA assistant governor Christopher Kent

Lowe's our governor-in-waiting and has done a great job discussing the longer-term issues that will drive the Australian economy when he finally becomes top dog. Kent is also making a lot of sense on many of these long-term challenges.

For decades the Australian economy benefited from favourable demographics but the positive impact of demographics has slowly diminished and now appears to be firmly in reverse. An ageing population continues to weigh on the labour force participation rate and appears all but certain to push it lower over the next decade (Coming to terms with Australia's stark economic reality, March 13).

The implications for the Australian economy are many and varied. An older Australia will have different spending patterns -- more services consumption and less spending on goods -- and less tolerance for risk (Will Australia's economy age gracefully?, October 20).

Increasingly the Australian economy will come to rely on a smaller share of the population to pay taxes and create prosperity.

The answer to the problem lies with productivity growth. Lowe recognises the need for greater investment in infrastructure as a way forward. Productivity growth is the silver bullet for a number of economic problems but unfortunately it doesn't appear to be high on the agenda for federal or state governments.

It's been a mixed year for the Reserve Bank. The rebalancing of the Australian economy hasn't quite gone to plan but at the very least the bank has released some quality research that deserves to reach a broader audience.

This list is obviously far from exhaustive -- there were 14 research papers and 53 speeches given this year -- but hopefully it offers some insight into the current state of the Australian economy, where we've been and where we will arrive soon.