WEEKEND ECONOMIST: June jitters

Markets are giving us little encouragement for our view that there is a decent case for the Reserve Bank board to cut rates at the June meeting.

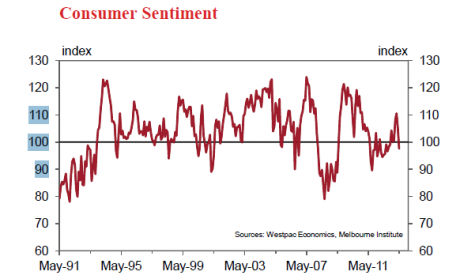

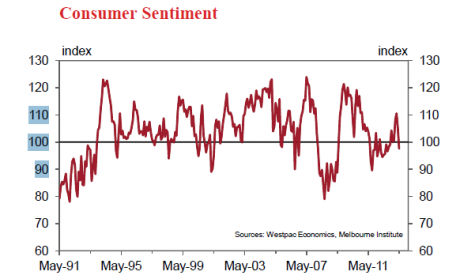

Market pricing points to a meagre 20 per cent probability of a cut. That is despite what we consider to be quite a shock with the Westpac-Melbourne Institute Consumer Sentiment Index dropping by a significant 7 per cent in May to 97.6.

The print pushed the index back into a range where pessimists outnumber optimists for the first time since October 2012. It is the lowest read since August 2012.

Over the last two months the index has fallen by 11.7 per cent to fully reverse the promising 9 per cent increase we saw in February and March. Of course, the remarkable aspect of this result is that it is the first read of the index since the Reserve Bank cut the cash rate by 0.25 per cent on May 7.

Absent any other major influences, we would have expected a solid boost to the index following that rate cut. However, since the rate cut we have seen the announcement of the federal budget.

We expect that the dissatisfaction is not only due to concerns around some of the savings measures in the budget but also the sharp deterioration in the fiscal position, indicating renewed fears about the overall state of the economy.

These concerns are also likely to have been fuelled by the surprise fall in the Australian dollar before and during the survey period. Further undermining the assessment of the state of confidence amongst households was the 5.4 per cent increase in the Westpac-Melbourne Institute Index of Unemployment Expectations, following a 1.3 per cent increase last month.

This change has partially redressed the promising 9.6 per cent fall in the index between December and March.

It is back to levels indicating that households expect the unemployment rate to start rising.

The key issue for the economic outlook is whether this response represents a short term reaction to a budget that will be forgotten in a couple of months or whether the 'budget blues' will linger for some time.

The take out for us from this surprisingly shar Presponse is to emphasise the fragility of the confidence of the household sector, particularly at a time of near record low mortgage rates.

Furthermore, because we expect that the negative response was fuelled not only by dissatisfaction with some savings measures in the budget but also the deterioration in the fiscal position and the direct implication for the state of the economy this weakness is likely to persist for some time.

Further evidence on the economic outlook will be available with the print of the Capital Expenditure Survey on May 30. We rate this survey very highly as a key influence in the policy debate.

Recall that we expected a soft survey result on February 28 which would have prompted the Reserve Bank to cut rates at its March board meeting. Instead the decision was subsequently delayed until May.

The February survey painted a bleak picture for the investment outlook in 2012-13 but a more positive result for 2013-14.

From our perspective the February survey indicated that manufacturing investment was likely to be reduced by 29 per cent in 2012-13; services investment by 4 per cent while mining investment growth would slow from 73 per cent in 2011-12 to 19 per cent in 2012-13.

The picture for 2013-14 provided a couple of 'welcome' surprises. Mining investment was not expected to contract, slowing to a 2 per cent pace. More importantly, services investment was expected to be boosted by 12 per cent.

Manufacturing was expected to contract by a further 3 per cent.

The result for services investment encouraged the Reserve Bank to conclude that their key plan to transition business investment away from the inevitably slowing mining investment to non mining investment was starting to work.

The 'realisation' ratio (the proportion to which the raw estimate is grossed up to to reach the overall estimate) in February for services is 45 per cent (10 year average). This ratio falls to 34 per cent in the second estimate and 18 per cent in the third estimate that will print in August.

While the realisation ratio is still high it is lower and therefore implyies a higher degree of accuracy than in February.

A sharp correction to the 12 per cent implied increase in services investment in 2013-14 would be a very disappointing result for the Reserve Bankin its objective to transition growth from mining to the non mining sectors.

The second issue will be around mining investment in 2013-14.

The February estimate implied a modest 2 per cent increase in mining investment. Any result from this survey which indicated a shar Prevised fall in mining investment in 2013-14 would also be disturbing for the Bank.

We have noted elsewhere that the path of the Australian dollar will also impact our call for a June rate cut. In the wake of the testimony to Congress by the Fed chairman, the Australian dollar dropped from $US0.98 to $US0.96.

The testimony to Congress by the chairman of the US Federal Reserve was interpreted by the markets as indicating that the Fed was close to tapering its bond buying policy of $85 billion per month.

We give much greater weighting to the chairman's written speech than his "off the cuff" answers in the Q&A session.

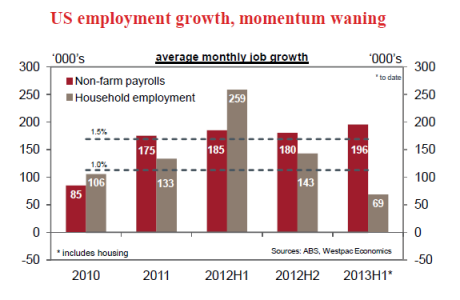

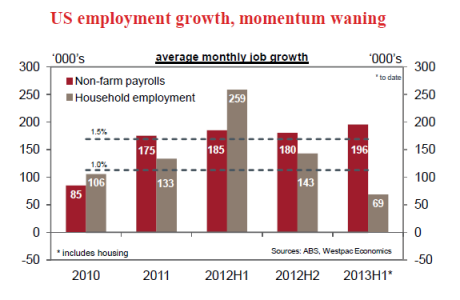

The written speech is the vehicle that is carefully crafted to give the message which the Fed wants to deliver. In that regard the key sentences are: "the job market remains weak overall"; "the committee will continue its securities purchases until the outlook for the labour market has improved substantially in the context of price stability"; "in considering whether a recalibration of the pace of its purchases is warranted, the Committee will continue to assess the degree of progress made toward its objectives in light of incoming information".

The most significant Q&A response was: "If the outlook for the labour market improves and we are convinced that this is sustainable we will respond to that. If the recovery were to falter, if inflation were to fall further, and we felt that the current level of monetary accommodation was still appropriate, then we would delay that process."

Our take on the issue is that the chairman is yet to be convinced that the labour market has even started to improve. Note that the fall in the unemployment rate is entirely due to the fall in the participation rate; the employment to population ratio has not increased since the GFC; and average jobs numbers for payrolls have been steady over the last year while numbers from the household survey have recently been falling.

The fall in the Australian dollar will be warmly welcomed by the Reserve Bank since a lower Australian dollar is an effective policy easing.

That will raise the bar for a rate cut. With time, a more rational assessment by markets of the chairman's statement is likely to push the Australian dollar back nearer to parity.

That expected move will be very important for the Reserve Bank decision. We currently maintain our call for a rate cut as early as June while recognising that the path of the Australian dollar and the outcome from the Capital Expenditure survey will be critical to that decision.

Bill Evans is Westpac's chief economist.