Week in Review: August 31, 2018

Trade war, Australian profits and rate hikes.

Investment markets and key developments over the past week

- The past week saw most share markets rise helped by US shares pushing further into record territory, but gains were capped by ongoing turmoil in the emerging world (notably Argentina and Turkey) and nervousness ahead of the next round of US tariffs on imports from China. Australian shares also rebounded after being hit by the previous week's political turmoil. Bond yields rose in the US, but were flat in Germany, Japan and Australia. Commodity prices were mixed with oil up but iron ore flat and metal prices down. While the $US fell the Australian dollar also fell thanks to trade fears, soft data and the likelihood that out of cycle bank mortgage rate increases will keep the RBA on hold for longer.

- Good news regarding US trade with Mexico and maybe Canada, but the global trade threat from the US remains and looks like ramping up further soon with more tariffs on China coming soon. News that the US and Mexico have reached agreement on a revised trade agreement and that Canada may join too leading to a revamped and renamed NAFTA is a good sign and coming on the back of the US/Korean trade deal and the start of negotiations with Europe signals that Trump is not anti-trade per se but just wants what he regards as fairer trade for the US. But it's clear that with Trump still threatening to pull out of the World Trade Organisation, saying that the EU offer to remove auto tariffs “is not good enough” and with indications that the threatened next bigger round of tariffs on China will soon be implemented it's clear that the trade war risk is continuing to rise. The public comment period on threatened tariffs of up to 25 per cent on $US200bn of imports from China ends on September 6 and it's likely they will start to be implemented soon thereafter. This will mean that around half of imports from China are now affected, albeit it's only 10 per cent of total US imports – so we are still a long way from 1930. Negotiations between the US and China are unlikely until after the mid-terms and a possible Trump/Xi summit in November so trade will be a continuing source of market volatility for a while yet. A lack of progress in US/North Korean negotiations are adding to US tensions with China again.

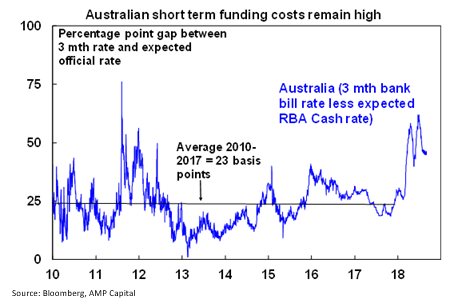

- Australian mortgage rates on the rise with Westpac and some smaller banks moving and other big banks likely to follow. This was no real surprise given the rise in money market borrowing rates this year which has seen the gap between bank bill rates and the RBA's cash rate blow out well beyond normal levels - see the next chart. While bank bill rates have fallen back a bit in the last month or so the gap remains over 20 basis points higher than it has averaged over the last decade or so. Since banks get around 35 per cent of their funding from this or related sources it cuts into their margins unless they pass it on in the form of higher lending rates. Small banks had already moved and now it looks like the big banks are starting to follow – having delayed moving in the hope that the money market will settle down which it hasn't (and probably won't given slowing growth in bank deposits meaning more competition for money market funds). While the rise in mortgage rates on average is small at around 15 basis points, it's still another dampener on consumer spending and home buyer demand, particularly given many borrowers will fear that more rate hikes will follow. It will hit the home buyer market particularly in Sydney and Melbourne at a time when it's already down. As such it's a de-facto monetary tightening and is yet another reason for the RBA to remain on hold for longer.

Major global economic events and implications

- US data remains mostly solid. While the past week saw pending home sales fall continuing the run of softer housing conditions, home prices continue to rise, consumer confidence is at a new 18-year high, personal spending is rising strongly with strong income growth keeping the savings rate high, jobless claims remain ultra-low and the goods trade deficit widened in July as imports picked up. Meanwhile core inflation rose back to the Fed's 2 per cent inflation target. All of which is consistent with ongoing but gradual Fed rate hikes.

- Eurozone economic sentiment fell a bit further in August but remains at levels consistent with solid growth. Against this the German IFO business conditions index rose strongly and growth in bank lending is continuing to trend higher.

- Japanese data was mixed with a continuing very tight labour market (helped by a falling population) but another slight fall in industrial production. Core inflation rose in Tokyo to 0.6 per cent year on year but this was due to higher hotel rates which are volatile.

- Just when it seemed Chinese growth is slowing, its PMIs surprisingly rose in August. Not a lot but they remain at levels consistent with good growth and suggest that the deleveraging campaign and trade war fears are not having a huge negative impact.

Australian economic events and implications

- Soft capex, soft building approvals and soft credit. June quarter business investment was disappointing with an unexpected decline in the June quarter and investment plans for the current financial year still pointing to falling mining investment and soft growth in non-mining investment. At least the big drag on growth from slumping mining investment is largely behind us. Meanwhile, soft building approvals add to evidence the housing construction cycle has peaked and credit growth remains soft as investor lending continues to fade and personal and business credit remain weak. Notwithstanding solid economic growth in the first half of the year our view remains that growth going forward will be weaker than the RBA is expecting.

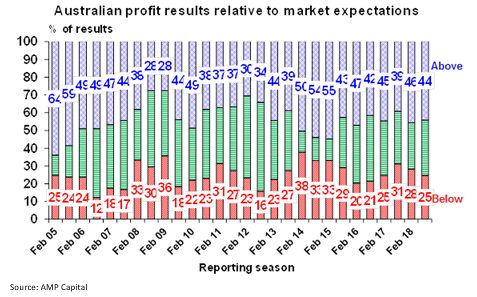

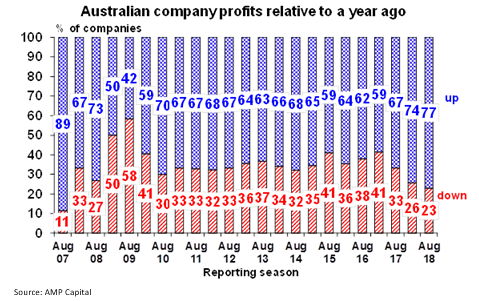

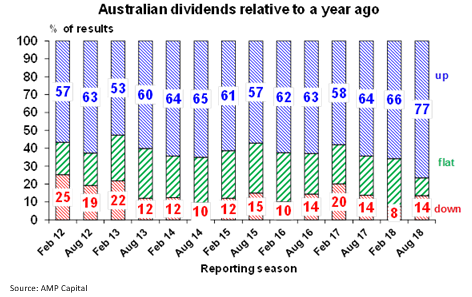

- The June half Australian earnings reporting season is now wrapped up and results have been solid. 44 per cent of results have surprised on the upside which is in line with the long term norm, the breadth of profit increases was impressive with 77 per cent reporting higher profits than a year ago which is the strongest since before the GFC and compares to a norm of 66 per cent, 86 per cent have increased their dividends or held them constant and 62 per cent of companies have seen their share price outperform the market on the day results were released. 2017-18 earnings growth have come in around expectations at about 8 per cent, with resources earnings up 25 per cent thanks to solid commodity prices and rising volumes and the rest of the market seeing profit growth of around 5 per cent. It's not the 28 per cent earnings growth being seen in the US but it's still solid.

Share this article and show your support