Wealthy pickings

| Summary: Australia’s high-net worth individuals, including the ultra-rich, are on the hunt for better returns. It seems they like a good mix of assets, but their favourite investment is closer to home – real estate. They are also taking a keen interest in offshore assets, primarily in the US and Europe. |

| Key take-out: While Australia’s super-rich are increasing their equity holdings, they look to be taking a more cautious approach than before. |

| Key beneficiaries: General investors. Category: Asset allocation. |

Australia’s super-rich like to spend. They spend on art, cars and lavish holidays, but above all else, they spend on property.

Post-GFC, the savvy super-rich have been able to snap up many a bargain, and not just in real estate.

“It’s been a very constructive market for them,” says Chris Selby, head of private wealth at Deutsche Bank.

“High-net worth individuals (HNWIs) have been the beneficiaries of a lot of asset disposals”.

A new report by UK wealth consultants WealthInsight details the investment trends of Australia’s wealthy, and gives a unique look into where they plan on putting their money in the next few years.

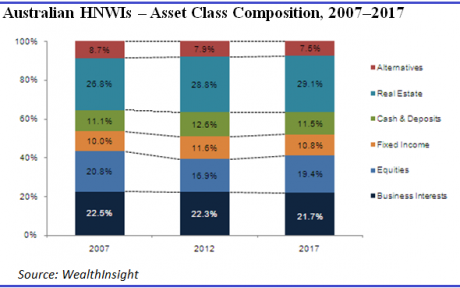

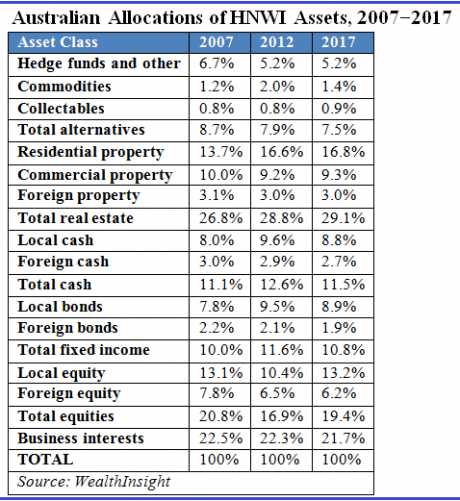

As you can see from the charts below, property was the largest asset class for Australian HNWIs (those with $1 million or more of investible funds) in both 2007 and 2012, accounting for 26.8% and 28.8% of total assets for HNWIs respectively.

This national obsession is expected to retain its position as the largest investment asset class in the coming years, accounting for 29.1% of total HNWI assets by 2017.

Selby says he’s seen renewed enthusiasm for real estate investments among clients, and not just at home.

“Australians are moving into new jurisdictions which had been quite punished, notably in the US and to Europe to some degree.”

Australia’s super-rich are also beefing up equity holdings, but look to be taking a more cautious approach than before.

By 2017 local equities are expected to have recovered to their 2007 levels, but foreign equity holdings are tipped to decline to 6.2% of total assets. Foreign debt is also expected to fall as a percentage of total assets by 2017.

But that doesn’t mean Australia’s super rich are turning their backs on overseas investing. Selby says Australia’s ultra-wealthy (those with $30 million or more of investible funds) continue to have a keen interest in foreign investments, particularly in the US and Europe.

“It’s clear that there are opportunities abroad and that there has been much activity in the US market recently. There’s been a general willingness to move out of Aussie dollar investments and take other currencies,” he says.

While Europe has been a lagging in investment terms compared to the US, it’s still on the radar of this niche group.

“There’s definitely interest in Europe from our upper client base, but they’re buying equity rather than debt.”

The key for the ultra-wealthy is to buy businesses with a global footprint.

“It’s really about looking for companies that have very strong global businesses but just happen to be resident in Europe or the US,” he says.

Hugh MacNally, director of Private Portfolio Managers, is of a similar view. “There’s been an increased focus on global equities,” he says. “The focus is not so much the location of the head office, or the listing, but rather the range of countries [in which] the business is operating. For instance, Rolls Royce is a UK company but the revenue is very much global.”

MacNally says investors are spoiled for choice in this regard.

“The valuation multiples are quite low and by comparison to the yields on fixed interest and cash, the gap is as large as it’s been since World War II.

“There’s been a trend toward the major growth industries; areas that Australia has no major global operators.”

It’s a strategy that makes sense. It gives investors exposure to a wide range of markets, including emerging markets in a lot of cases, with the surety of good governance and compliance. Coca-Cola and Johnson & Johnson are two such examples.

Back at home, companies that would be affected by global developments include CSL, News Corp and QBE; companies that Selby says are in part seen as based offshore while priced onshore.

Tracking alternatives

There’s also been renewed interest in alternative assets.

“It’s really about moving out the duration curve and the life of the investment. That’s where private equity and hedge funds become interesting again,” he says.

“We’re particularly seeing interest in the private equity side because it’s a longer-term investment.

“In Australia, investors are quite limited in what they can buy. The tendency is to buy fairly short-dated exposures, whether it’s equity or fixed income or hybrids. With private equity, it’s a five or 10-year horizon.

“The higher the investor’s net worth, the more they can afford to take a longer-term investment.”

Commodities were the stand-out performer in this class between 2007-2012. The price of gold rocketed 142% over the period, while other commodities such as coal and iron ore also experienced strong gains.

But the outlook for commodities isn’t as favourable going forward, and WealthInsight estimates that allocations to this asset class will fall to 1.4% of total HNWI assets by 2017.

Meanwhile, collectables such as art, wine and classic cars are becoming an increasingly popular means of storing wealth and increasing portfolio diversification.

WealthInsight estimates that collectables could account for 12% of alternative assets within a few years.