Warnings signs from earnings season

| Summary: The latest reporting season shows many companies are finding it difficult to increase their revenues, but they are improving their margins. It is also clear that the golden days for the banks are over, and there is a warning sign for investors in some listed property trusts. |

| Key take-out: We are in the advanced stages of the yield boom. That boom may still go for some time, but the beginning of the end starts when the US lifts interest rates. |

| Key beneficiaries: General investors. Category: Economics and Investment Strategy. |

The 2014 profit season is almost completed, and we have seen some remarkable trends amongst our leading companies. Indeed, for those who have been watching the performance of Australian companies over a longer period, this financial year was rare and has considerable ramifications for the future.

The first stand-out feature of the season was that revenue increases were hard to achieve. You can use a range of different measures, but the tough economic conditions have made it very difficult for Australian companies to achieve the revenue growth rates they have enjoyed over previous years. And in those previous years, the “lucky country’s” revenue growth enabled them to achieve profit growth rates without attending to their productivity. But this year company after company lifted its margins as a result of becoming more efficient using all the techniques that were available, and they also concentrated on producing more cash. And, as a result, there has been a string of increased dividend payments.

New technologies improve margins

There is no doubt that companies are responding to the pressure from shareholders, particularly those nearing retirement or in retirement gaining greater income from shares, given the cash rate interest rates are so low. As you know, I have reported longer term many companies are not investing sufficiently in their growth and this may affect results in future years. But that is down the track, and in many cases the new technologies are enabling big improvements in margins. In many ways BHP typifies what is happening in so many companies. In past years the company has not been nearly attentive enough to its production efficiencies and cost structures, partly because it was desperate to increase production.

But chief executive Andrew Mackenzie has adopted measures to save $10 billion over three years, and my guess is that he will do much better than that. We have already reported Rio Tinto’s Sam Walsh has a similar program. The Commonwealth Bank group has some 53,000 staff at the moment, but is gradually embracing an entirely new bank branch structure which will be rolled out over the next five years and will substantially lower that staff number and lower their operating costs.

I picked our two largest companies merely as an illustration of what is happening right across the board. Australian corporations are going to be a lot more efficient. But a large slab of the Australian workforce are going to feel the jitters because, in most situations, the higher efficiency involves less labour and/or very low wage and salary increases. That, in turn, will curb consumer spending growth. But, at least for the moment, dramatic events are restricted, which has helped consumer confidence. However, the end of the mining investment boom and automotive manufacturing will boost unemployment late in 2015.

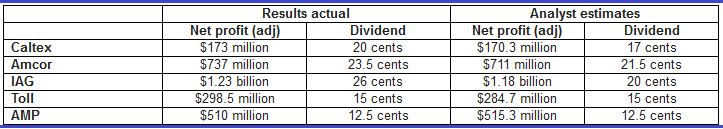

Overall, with notable exceptions, industrial companies have performed better than expected, led by Caltex, Amcor, IAG, Toll and AMP. But mining service companies, small miners and groups like Breville have disappointed.

Golden days over for banks

The results of the banks overall were comforting to those who were looking for dividends, but they are not increasing their base business and their loan impairments are at historical low levels, which is likely to change in the future. I think banks are an area of the investment community where greater investment is needed in their businesses, but they are having difficulty with their management capacity to adapt to this changing environment and there is some risk their impairments will rise in the years ahead.

But for those that are relying on bank dividends, those trends will have to be much greater than is currently anticipated before incomes will be affected. My message is that the golden days of banking, where growth seems never ending, have ended for the time being.

A caution on listed property trusts

The area that I found most disturbing is listed property trusts. But I must confess that, as I saw the results coming through, I didn’t notice anything amiss. However some research from Macquarie came across my desk (or more accurately my computer), which showed that a large number of the listed property trusts have weakening operating cash flows. As a result, free cash flow after all necessary outgoings such as dividends and maintenance has become a substantial negative in 2013-14. According to Macquarie, dividends in excess of cash earnings plus higher working capital and maintenance expenditure is draining cash. Too many have not raised capital equity as they should have. Amongst the list of property trusts that Macquarie isolates as making dividend distributions in excess of free cash flow are General Property Trust, Dexus, Stockland, Investa Office, Charter Hall retail, and CFS Retail.

Macquarie says that there has been a deterioration in the second half of 2013-14. Worse still, that half year represents the fourth consecutive half year where a number of these property trusts have been making distributions higher than their free cash flow. They can continue for a while, but over the medium term this is not sustainable. So, if you have invested in listed property trusts I am afraid you need to look more closely at what is taking place. A good listed property trust distributes only its current operating income, and not all of that. In certain circumstances it is permissible to borrow or use asset sales, but only to smooth out short-term fluctuations.

As I have described many times, we are in the advanced stages of the yield boom. That boom may still go for some time, but the beginning of the end starts when the US lifts interest rates. They are nervous about doing this because of the effect on their own unemployment but also the possible effect on Europe.

Productivity gains to fuel growth

The analysts believe that there will be another strong year of Australian earnings, once again given by better productivity. The general forecast is for another rise of around 10% in earnings per share and that dividends will follow. Once again, this will be a result of better productivity. I suspect that the low iron ore and coal prices will make it very tough for many of our mining companies to achieve an overall rise in profits, but many will benefit from further big rises in productivity and if the Australian dollar falls that will offset some of the impact of lower prices.

But, in many of our companies, our shares have been priced on the basis that nothing will go wrong and risk is downplayed. I am certainly not forecasting a disaster, but it is necessary to warn people that we have a high market which is dependent on management’s ability to keep lifting productivity. Longer term the rise in the Asian middle class is going to open a lot of opportunities for Australia, but that is down the track.