Warning signs on A-REITs

| Summary: Listed property investors have been enjoying good returns, but is the door about the close? Some sector warning signals include low dividend yields in an environment where bond yields are rising; the potential return of poor-quality property deals; and overly-high market expectations for earnings growth. |

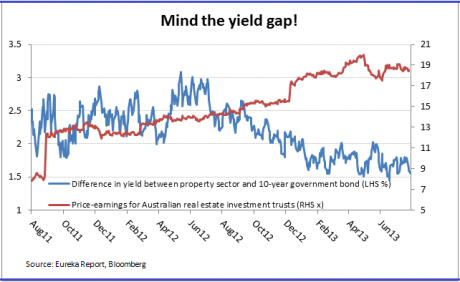

| Key take-out: The narrowing yield gap with bonds makes property stocks look less attractive, especially with the A-REIT sector currently trading at a steep premium. |

| Key beneficiaries: General investors. Category: Shares. |

Who would have thought that the "tapering tantrum" in the US would have profound implications for Australian listed property stocks?

But investors beware. Speculation that the US Federal Reserve is about to "taper", or curtail, its purchase of US government bonds is causing a fracas in bond and equity markets around the world.

This has led to a sharp rise in yields in the US and Australia, and the yield movement heralds challenging times ahead for property stocks. This is but one of three warning signals flashing for the sector.

The yield on the 10-year Australian government bond has rallied close to 100 basis points (or one percentage point) since May to hit a 16-month high of 4.07% on Thursday evening, and is expected to rise even further.

This is troubling for property sector investors for two reasons. The first is that dividends on property stocks look less appealing to income investors, with the yield difference between property stocks and bonds hovering close to their lowest point in two years at 1.55% when the appropriate premium should be around 2.5% (if benchmarked off corporate bonds).

One of two things must happen to restore so-called equilibrium. Either the bond yield needs to fall (not likely in this environment) or property stocks have to fall in value to lift dividend yields, since price and yields move in opposite directions.

The other reason is that rising bond yields will drive up the cost of debt, even though the Reserve Bank of Australia (RBA) continues to have an easing bias on interest rates.

The disconnect between the cash rate and bond yields is driven by the US government bond market as the Australian market takes its cue from that country.

Talk of tapering is the key reason why Australia's two-year government bond yields have jumped 25 basis points (or 0.25 of a percentage point) to 2.53% since the RBA lowered interest rates two weeks ago. The rise in the two-year yield comes in spite of its historical correlation with the RBA cash rate.

The narrowing yield gap not only makes property stocks look less attractive, but it comes at a time when the Australian real estate investment trust (A-REIT) sector is trading at a fairly steep premium on a 12-month trailing price-earnings (P/E) basis, as shown in the chart above.

The stretch in valuation has been driven by the strong run in property stocks over the past two years as yield obsessed investors flocked back into the sector that has been the poster child of the global financial crisis due in large part to its addiction to debt to fund an over-expansion of their businesses.

While the S&P/ASX 300 A-REIT Index has corrected by 11% since hitting a near five-year high of 1116.7 back in May, the index has still delivered an enviable 54% compared with the broader market's 36% total return.

A return to bad habits

The second warning sign investors should watch for are hints that A-REIT managers are returning to their bad habits to maintain the upward momentum.

The investment manager from Aberdeen Asset Management, Natalie Tam, notes there is a danger of this due to a good supply of properties for sale in the market currently.

"[This] can create a deal frenzy," she says. "The better quality the property asset, the more likely there is to be competition for that asset. With more competition comes a higher likelihood of over-paying."

Aberdeen has $6 billion in funds under management (FUM) for Australian equities and is underweight on property stocks.

High earnings expectations

The pressure on managers to strike a deal could come from high market expectations for earnings growth, and this is the third flashing warning sign investors should be wary of.

Data compiled from Bloomberg shows that the average 2013-14 consensus earnings per share (EPS) growth forecast for A-REITs is close to 8%, and that sounds too high.

While the profit results from listed property companies like shopping centre owner Federation Centres (FDC) and diversified property company Dexus Property Group (DXS) have been pleasing, their growth guidance for the current financial year is between 4% and 6%.

These property companies are better placed to grow earnings than A-REITs because they have more growth levers to pull, such as funds management and property development. A-REITs, on the other hand, are typically passive property owners that collect and distribute rents.

Rental growth is also unlikely to surprise materially on the upside this year given the weak retail environment and high office vacancy rates (see David Gilmour's recent article).

The good news is that there are no signs of an outbreak of deal frenzy in the sector. If anything, property managers are showing strong deal discipline, according to Stuart Cartledge from Phoenix Portfolios, which is a property investment fund with around $500 million in FUM.

"I have not seen any signs of ill-discipline," he says. "Look at the discussions over Australand, which resulted in no deal being done. To me it demonstrates a degree of caution and sensible attitude with respect to doing deals for the sake of doing deals."

GPT Group (GPT) was looking at acquiring some of Australand Property Group's (ALZ) assets but walked away because it wouldn't pay what Australand wanted for the assets.

While investors should look closely at any deals announced in the sector for signs of deal desperation, the head of property for Australian Unity Investments, Peter Lambden, doesn't think the sector will return to its old ways.

"Boards and directors have got greater accountability, and there are greater regulatory requirements [since the global financial crisis] that are all designed to ensure activities of the past don't happen again," he says.

Australian Unity Investments has $7.1 billion in FUM.

Stable returns

While A-REITs are at risk of suffering some earnings downgrades, it isn't necessarily bad news as it could help reset unrealistic investor expectations. Cartledge believes property investment is about stable returns, not fast returns, and that earnings growth should track around the 3% mark.

Based on data from Bloomberg, the A-REIT sector attracts fewer "buy" recommendations than the broader market, but one A-REIT that RBS Morgans believes is worth considering is 360 Capital Industrial Fund (TIX).

This is the only A-REIT that is focused on industrial properties in this country and the outlook for the industrial property sector is stronger than other parts of the property market. (Note: Industrial property company Goodman Group is not a trust).

The broker is forecasting a dividend of 18.6 cents a share for 2013-14, which would put the stock on a very attractive yield of 9%.

Its above sector average yield isn't the only attractive feature of the A-REIT that listed in December last year. RBS Morgans also likes the fact that the trust holds 20 quality assets worth $340 million with a weighted average lease expiry of 5.1 years.

RBS Morgans has an "outperform" recommendation on the stock with a $2.20 price target compared with its Thursday closing price of $2.07.