Value Investor: Three stocks to watch as the Aussie dollar drops

Earlier this week, the Australian dollar fell to a four-year low, dropping to below US87c. As the currency has slumped 6.5 per cent in the last month alone, speculation about the dollar’s future movements has intensified.

John Abernethy, chief investment officer at our fund partner Clime Asset Management, has consistently forecast the depreciation of the Australian dollar against the greenback. Abernethy’s thesis is that the recent strength of the Aussie dollar was driven by overseas quantitative easing and resulting capital flows into higher-yielding Australian dollar-denominated assets and that the underlying fundamentals -- the sliding terms of trade, a slowing China and the end of the commodity price boom -- point to a weaker dollar.

The Australian dollar has previously managed to bounce back after falling below US90c, however, we have turned our minds to stocks which might benefit should the dollar depreciate further.

There are three quality companies trading close to valuation which should benefit from a lower trading range for the Australian currency.

Some of these stocks might have already partly priced in the benefits of a lower exchange rate, so investors should form their own view on whether the current depreciation has further to go and if this is also priced in.

CSL, a global provider of plasma therapeutics, sources 90 per cent of its revenue from outside Australia. With robust global demand for its core products, immunoglobulin (IG) and albumin, along with CSL’s historical investment in capacity, it remains well-positioned to benefit from growing demand.

CSL is a high-quality defensive business. Last month, we increased our ROE forecast to 51 per cent, up from 45 per cent, given increasing profitability from solid growth in the core business and the competitive advantage of the R&D pipeline, which is likely to deliver new revenue streams.

Our adopted required return of 11 per cent is low, reflecting large market capitalisation, offshore earnings and the defensive nature of the revenue stream.

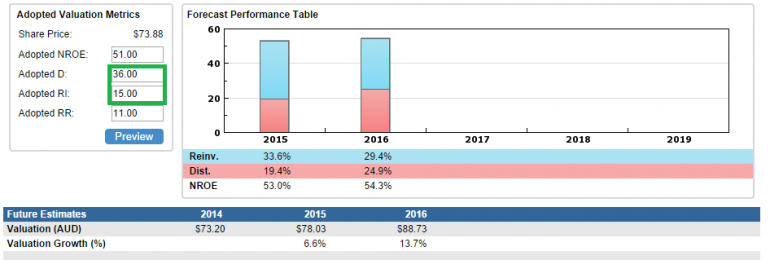

We derive a fiscal 2014 valuation of $73.20, rising to $78.03 in fiscal 2015. CSL is currently trading 1 per cent above value.

Figure 1 – CSL Future Valuation

Source: StocksInValue

CSL has a reinvestment to dividends (RI:D) ratio of 15 to 36 (green above), reflecting its reinvestment in research and development. The reinvestment at high rates of return contributes to CSL’s significant intrinsic value growth of 6.6 per cent in the next financial year.

Platinum Asset Management, a fund manager with investments in global equities, reports in Aussie dollars so the value of its funds under management, investment management fees, performance fees and earnings are inflated by any depreciation of the local currency.

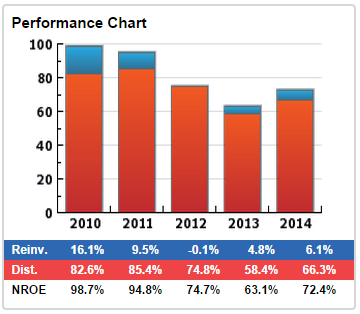

Platinum’s continued ability to outperform and deliver high returns is a key driver for the business. It also has a low cost base, which provides significant operating leverage, and is “capital-light”, meaning only a modest equity base is needed to operate the business. This has seen the company achieve extremely high rates of profitability, with return on equity (ROE) above 70 per cent.

Figure 2 – PTM historical profitability

Source: StocksInValue

Platinum is also positioned to benefit from the legislated growth in funds under management and shift towards a greater exposure to international equities.

With an adopted ROE of 75 per cent and a required return of 12 per cent, we derive a fiscal 2014 valuation for PTM of $5.79. Platinum is currently trading slightly above valuation.

A similar company to benefit from the same currency tailwinds is global equities manager Magellan Financial Group.

Finally, Navitas is a global education provider specialising in providing pre-university and university pathway programs. Around a quarter of domestic tertiary students come from abroad. Therefore student numbers and profitability are sensitive to the exchange rate. If we see further depreciation of the local currency, Australia’s attractiveness as an education location is bound to increase, which bodes well for Navitas.

We derive a fiscal 2014 valuation for Navitas of $5.74.

Clearly, we have three stocks of interest to monitor and be considered for portfolio inclusion should suitable margins of safety emerge.

By Brian Soh and Jonathan Wilson are equities Analysts at StocksInValue. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.