Value Investor: The tailwind underpinning Leighton's future

Leighton Holdings is under new management and in the middle of restructuring, but remains well positioned as the largest, most experienced contractor in Australia and will benefit from increased government spending on infrastructure expected in the coming years.

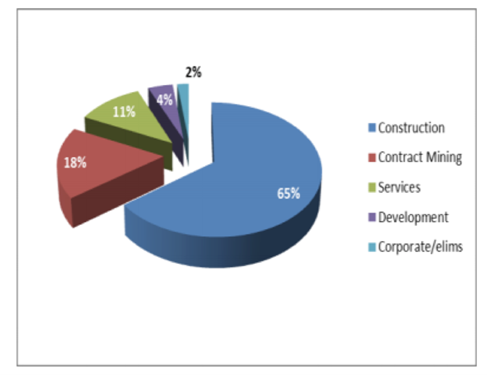

In the first half of 2014, construction revenue increased 5 per cent to $7.7 billion, primarily due to major liquid natural gas projects in Australia and the Wynn Cotai resort in Macau. Construction remains Leighton’s dominant segment, comprising 65 per cent of all revenues.

Figure 1 – Revenue by segment

Source: Leighton Holdings, first half 2014 result

Profit after tax increased 25 per cent to $319 million. Performance across its businesses was mixed, with Leighton contractors John Holland and Leighton Asia, India and offshore segment results decreasing on the previous corresponding period.

Trade and other receivables increased $500m to $5.5bn. The elevated level of receivables is largely due to domestic LNG projects. Leighton has experienced lengthy payment cycles, extensive scope growth, and complex and time-consuming valuation and negotiation processes to agree variations to existing contracts.

Gearing reduced slightly to 37.1 per cent, but remains slightly above the targeted range of 20-35 per cent. Leighton’s gearing is volatile due to working capital movements. The company expects it to be within the target range by December 31, which assumes collection from receivables and possibly proceeds from asset sales. However, there is concern that some of the Middle East and gas receivables may not be recoverable.

The current restructure of Leighton may address some of these concerns. Majority shareholder Hochtief lifted its stake in Leighton to nearly 70 per cent earlier this year and replaced former board members and management with their own executives -- Leighton boss Hamish Tyrwhitt lost his place to Hochtief chief executive Marcelino Fernandez Verdes in March.

Verdes announced an update on Leighton’s strategic review in June outlining an aggressive timetable to divest non-core assets and implement a new operating structure by March 2015. The focus will be to strengthen the balance sheet, streamline the operating model and improve project delivery.

To strengthen the balance sheet, Leighton stated it is focused on recovering existing receivables, improving working capital management on new projects and potentially divesting the services, property and John Holland businesses subject to market conditions.

At the end of June, it was formally announced Leighton is seeking to sell its 50 per cent stake in Devine Limited. This decision to offload these shares and its property development business makes sense given the robust property market.

Cash from receivables and divestments will be used to reduce gearing and expenses on the balance sheet. Verdes says this “is crucial to improving the group’s competitive position. Perspective businesses need to be backed by a strong balance sheet … both our contract mining and PPP [Public Private Partnerships] business are capital intensive”.

Streamlining the operating model will include grouping similar business units under activity lines, such as construction, mining and engineering. The aim is to reduce overhead duplication and bureaucracy and generate other identifiable cost savings. This blueprint is a more transparent structure and should meaningfully and sustainably reduce the cost base.

A strong future tailwind is the substantial infrastructure funding programs announced by federal and certain state governments during the half. The federal government’s objective is to begin new infrastructure projects worth more than $125 billion by the end of the decade.

Over time, infrastructure spending in the economy should outweigh the rundown in mining investment. Leighton should benefit with its scale, proven track record and long standing client relationships, which places the company in a strong position to win work.

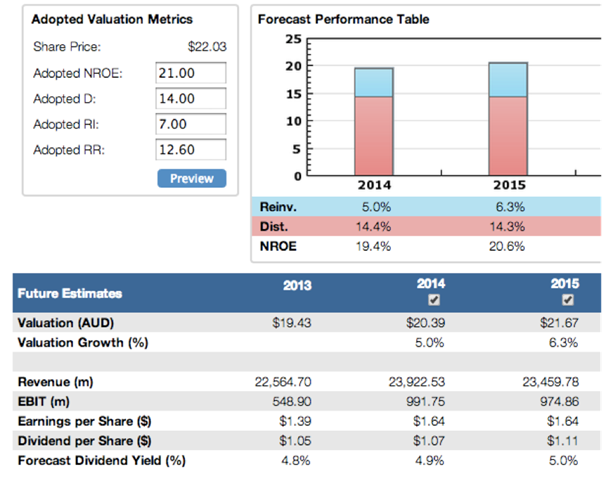

We adopt a return on equity of 21 per cent, broadly in line with consensus and marginally below the five year average of 22.7 per cent to reflect the tapering off in resources related activity. Earnings in the near term is expected to decline moderately due to the hiatus in construction spending between the resources roll-off and infrastructure ramp-up.

Figure 2 – Future value and adopted metrics, Leighton Holdings

Source: StocksInValue

The required return of 12.6 per cent is low, reflecting Leighton’s position as the largest contracting business in Australia and the company’s diversification across different industries and markets.

Our fiscal 2014 valuation of Leighton is $20.39. It is trading above value with the share price containing a premium for a possible takeover bid by Hochtief, rationalisation from asset sales and an upturn in infrastructure spending in Australia.

There is an inherent lack of earnings visibility for contractors, given low transparency on individual contracts and project execution risks. We would require a 10-15 per cent margin of safety.

By Brian Soh, with insights from Stephen Wood of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.